1/32

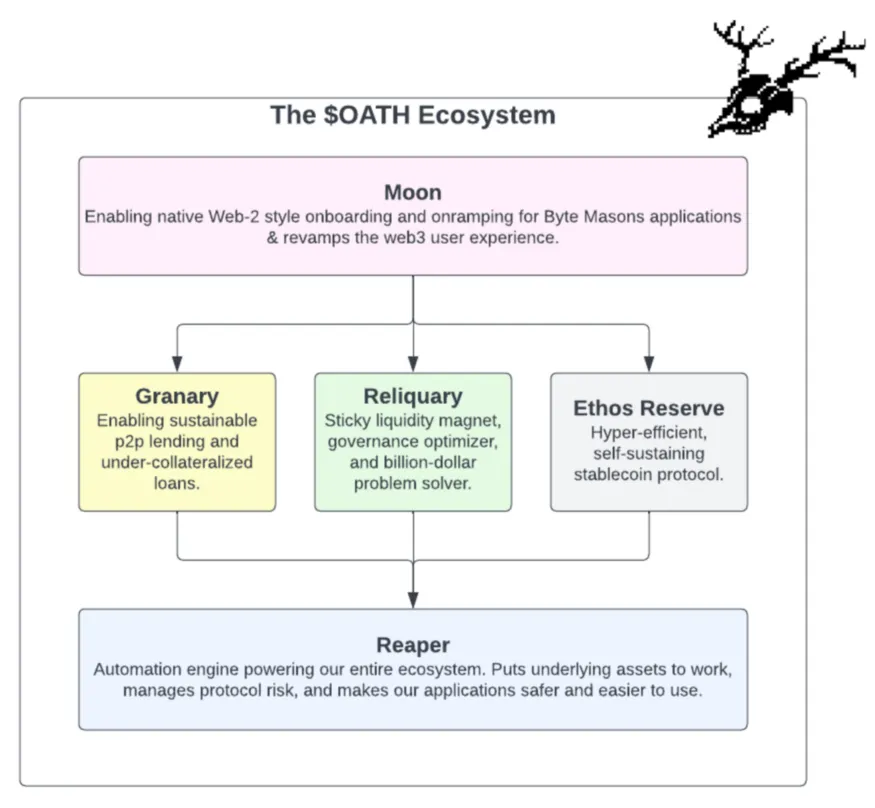

The @ByteMasons ecosystem flywheel will consist of

1️⃣ OATH

2️⃣ Reaper Farm

3️⃣ Granary Finance

4️⃣ Ethos Reserve

5️⃣ Digit (previously Reliquary)

6️⃣ Moon

The @ByteMasons ecosystem flywheel will consist of

1️⃣ OATH

2️⃣ Reaper Farm

3️⃣ Granary Finance

4️⃣ Ethos Reserve

5️⃣ Digit (previously Reliquary)

6️⃣ Moon

2/32

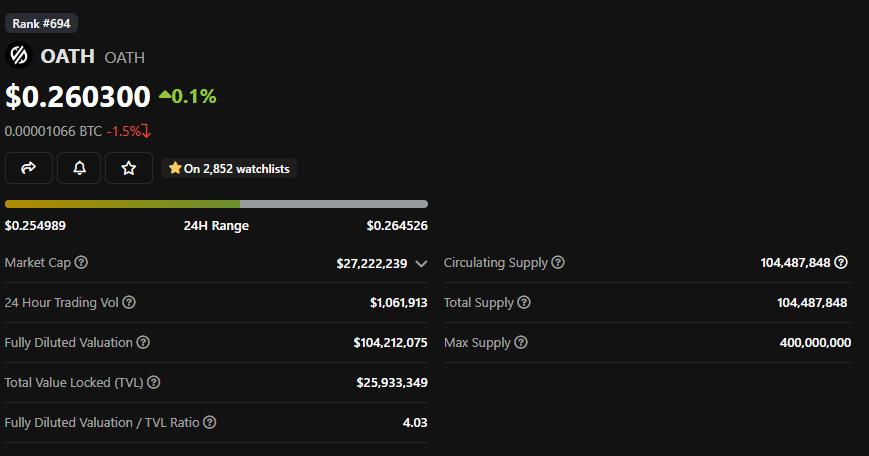

1️⃣ OATH

$OATH is the revenue sharing governance token of the ecosystem

As all roads lead to Rome, all revenue streams lead to $OATH

All dApps in Byte Mason ecosystem will drive revenue to $OATH

1️⃣ OATH

$OATH is the revenue sharing governance token of the ecosystem

As all roads lead to Rome, all revenue streams lead to $OATH

All dApps in Byte Mason ecosystem will drive revenue to $OATH

3/32

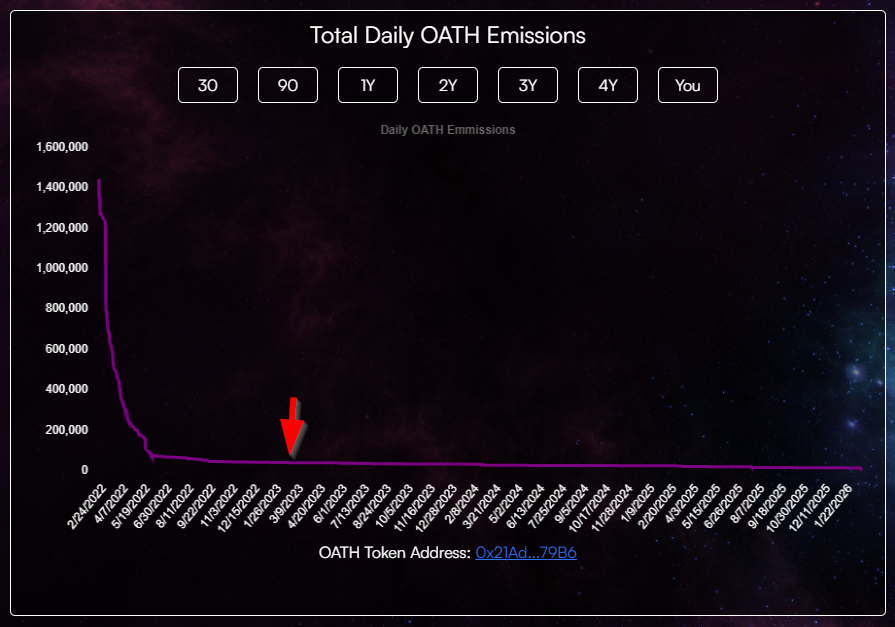

$OATH was launched on $FTM through a LGE

Almost all $OATH from LGE is already claimed

@ByteMasons have a lot of POL and little need for emissions to incentivize liquidity during bear, until recent months where they have started utilizing bribes heavily on ve(3,3) dexes

$OATH was launched on $FTM through a LGE

Almost all $OATH from LGE is already claimed

@ByteMasons have a lot of POL and little need for emissions to incentivize liquidity during bear, until recent months where they have started utilizing bribes heavily on ve(3,3) dexes

5/32

$OATH will be able to be staked for $bOATH (Bonded OATH) in a

80% OATH /20% ETH @Balancer LP

Using a 80/20 LP pool as the ecosystems governance token mitigates regulations for single side staking, and minimizes IL for stakers

$OATH will be able to be staked for $bOATH (Bonded OATH) in a

80% OATH /20% ETH @Balancer LP

Using a 80/20 LP pool as the ecosystems governance token mitigates regulations for single side staking, and minimizes IL for stakers

6/32

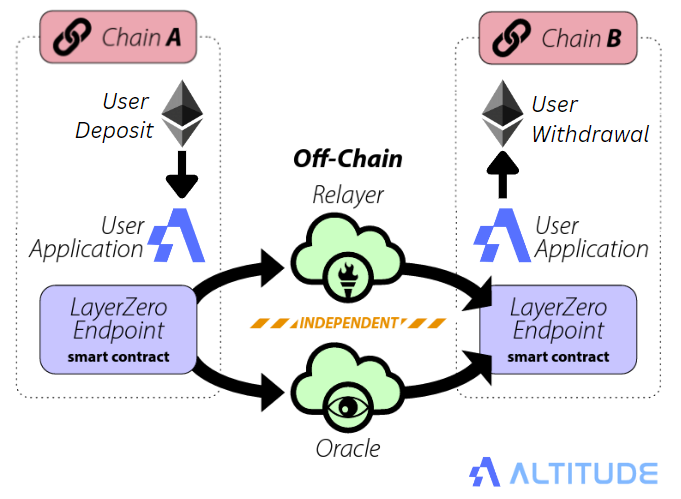

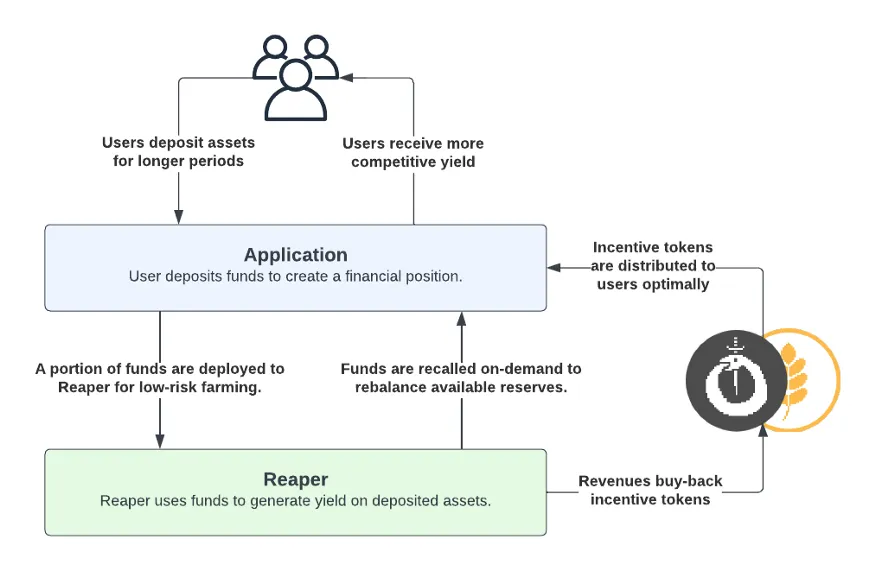

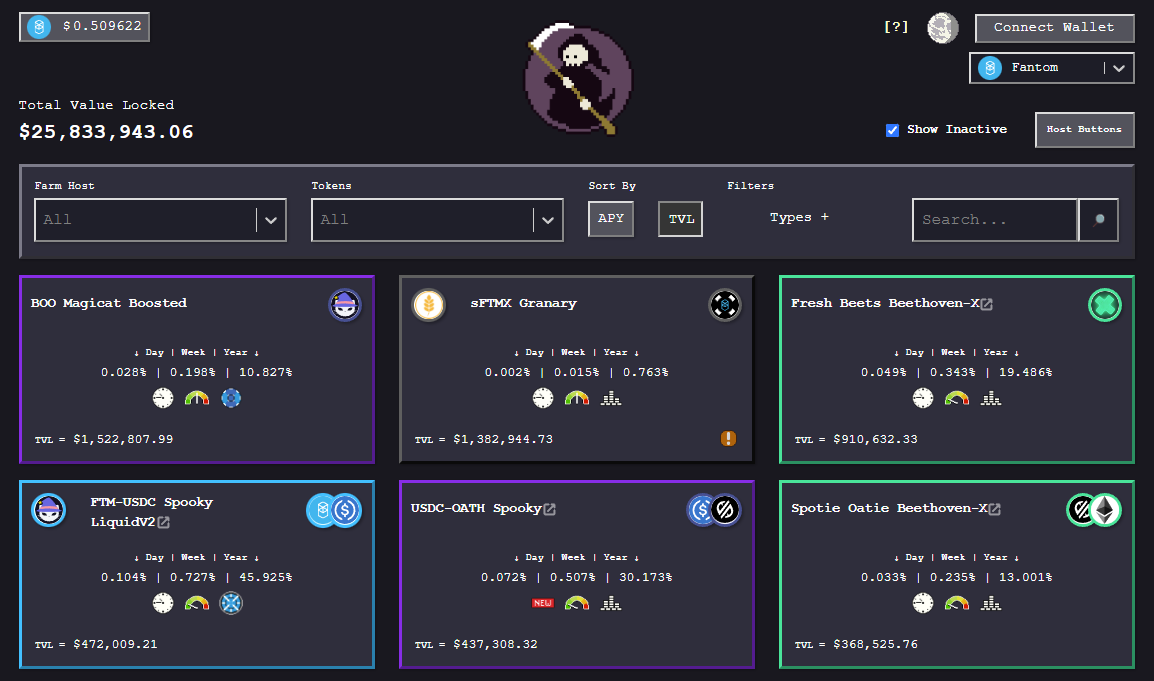

2️⃣ @Reaper_Farm

is a Yield Optimizer born on $FTM but have now expanded to multiple chains like $OP, #BSC and Arbitrum with more chains coming

The deposits of other protocols in the Byte Mason ecosystem will be deposited into Reaper to generate low risk yield

2️⃣ @Reaper_Farm

is a Yield Optimizer born on $FTM but have now expanded to multiple chains like $OP, #BSC and Arbitrum with more chains coming

The deposits of other protocols in the Byte Mason ecosystem will be deposited into Reaper to generate low risk yield

7/32

Reaper has multiple kinds of Yield Optimizer strategies

☑️ LP Farm autocompounder

☑️ Single side leveraged lending /borrowing (folding optional)

☑️ veVELO voter vault

Reaper has multiple kinds of Yield Optimizer strategies

☑️ LP Farm autocompounder

☑️ Single side leveraged lending /borrowing (folding optional)

☑️ veVELO voter vault

8/32

The goal is to make Reaper Farm into a Financial Automation Infrastructure powering all of the yield strategies.

Reaper Farm currently has $27m TVL, down from $300m in peak bull market

The goal is to make Reaper Farm into a Financial Automation Infrastructure powering all of the yield strategies.

Reaper Farm currently has $27m TVL, down from $300m in peak bull market

9/32

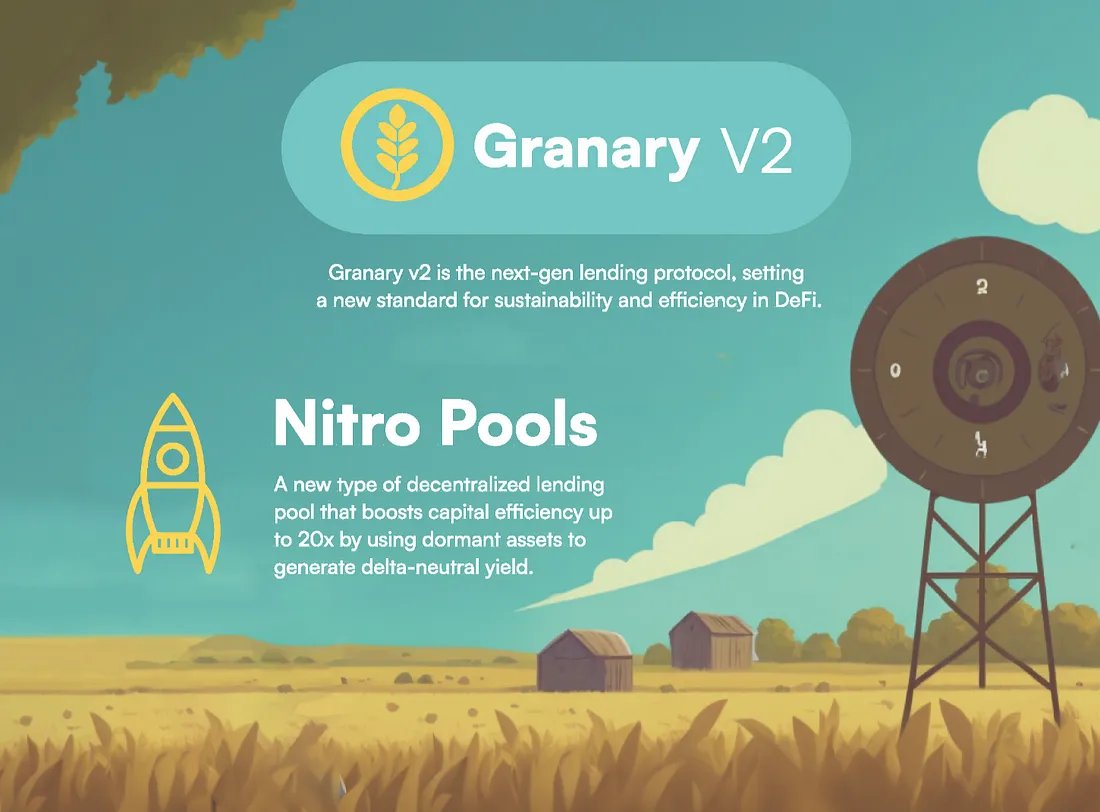

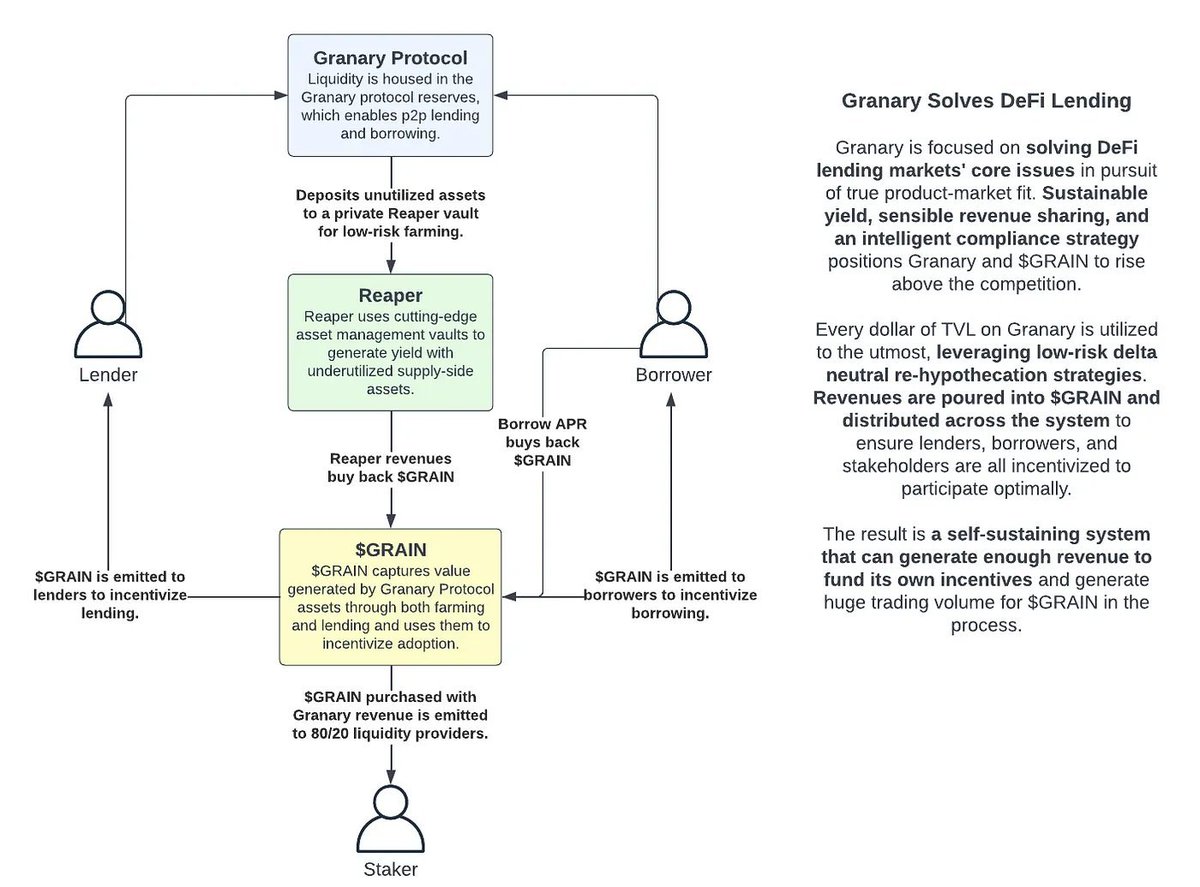

3️⃣ @GranaryFinance

Is a multichain lending/borrowing protocol forked of @AaveAave

It's currently deployed on multiple chains like $FTM $OP $METIS $ETH $ONE $AVAX and has $10m TVL without having launched its token

3️⃣ @GranaryFinance

Is a multichain lending/borrowing protocol forked of @AaveAave

It's currently deployed on multiple chains like $FTM $OP $METIS $ETH $ONE $AVAX and has $10m TVL without having launched its token

10/32

Multiple snapshots of early users have been taken during the last year and the $GRAIN token will be airdropped with the launch of @GranaryFinance v2

They will be hosting the first multichain LGE for the launch

Wen?

Multiple snapshots of early users have been taken during the last year and the $GRAIN token will be airdropped with the launch of @GranaryFinance v2

They will be hosting the first multichain LGE for the launch

Wen?

11/32

Granary v2 will generates its revenue by depositing the dormant deposits into Nitro Pools, which generates yields via @Reaper_Farm in low risk strategies, which is why it can charge 99% less protocol fees than its competitors

Granary v2 will generates its revenue by depositing the dormant deposits into Nitro Pools, which generates yields via @Reaper_Farm in low risk strategies, which is why it can charge 99% less protocol fees than its competitors

12/32

The revenue will be used to buyback $GRAIN from the market to distribute as incentivization to lenders and borrowers without the need for token emissions

The revenue will be used to buyback $GRAIN from the market to distribute as incentivization to lenders and borrowers without the need for token emissions

13/32

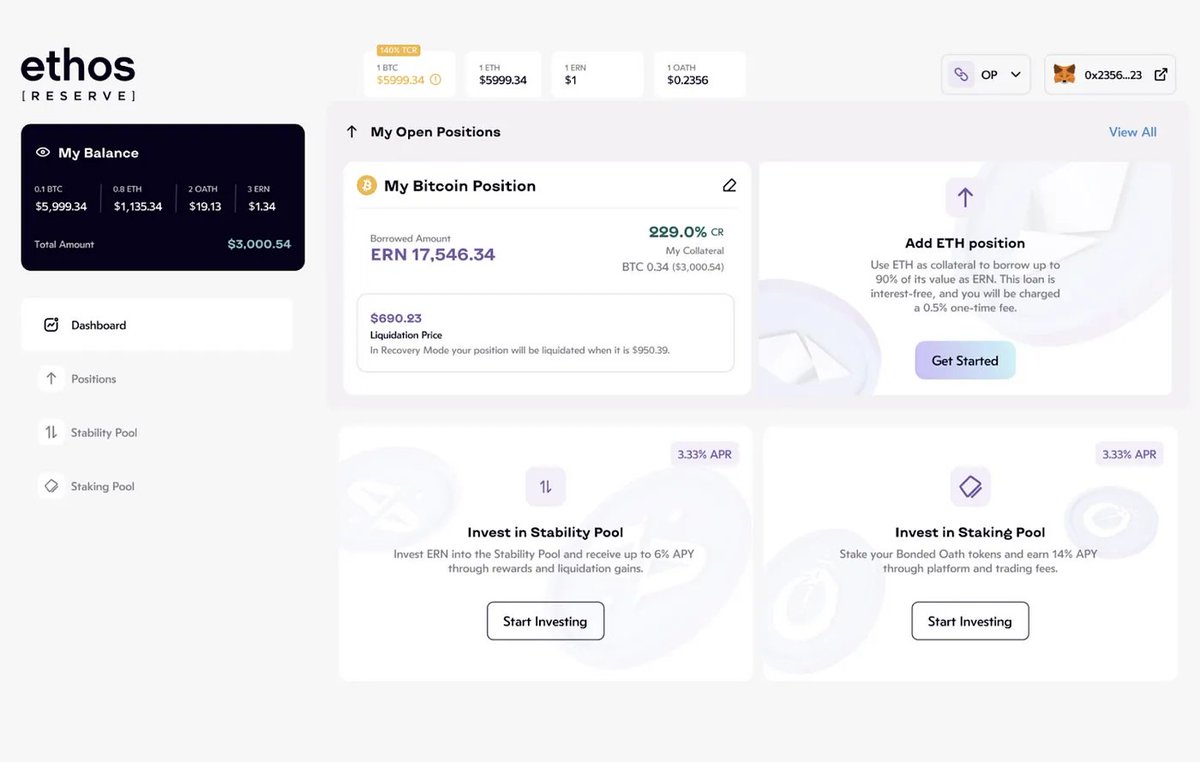

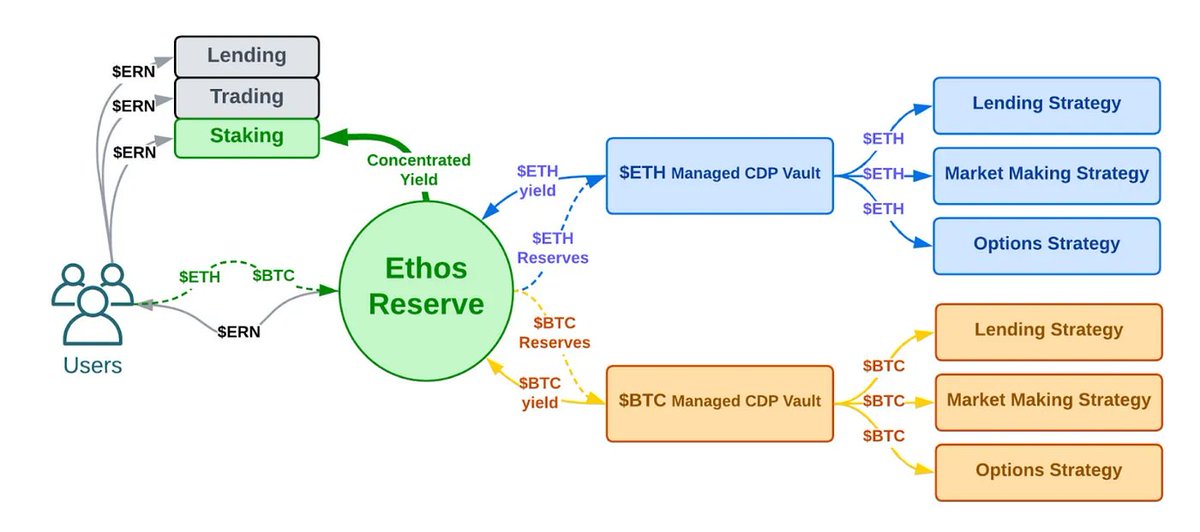

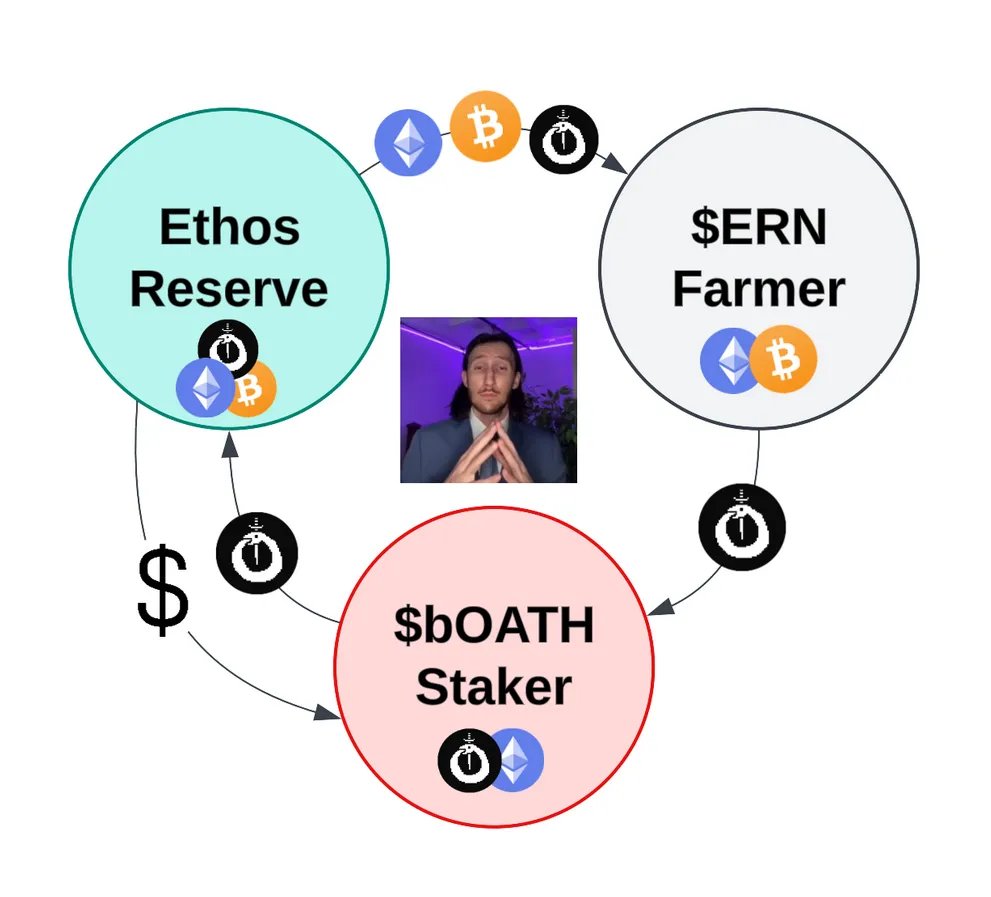

4️⃣ Ethos Reserve

@EthosReserve is the CDP stablecoin of the Byte Masons ecosystem $ERN.

It is not yet released.

Wen? February 2023

Ethos Reserve is based on @LiquityProtocol codebase but Byte Masons have upgraded it to allow ETH and wBTC as collateral

4️⃣ Ethos Reserve

@EthosReserve is the CDP stablecoin of the Byte Masons ecosystem $ERN.

It is not yet released.

Wen? February 2023

Ethos Reserve is based on @LiquityProtocol codebase but Byte Masons have upgraded it to allow ETH and wBTC as collateral

14/32

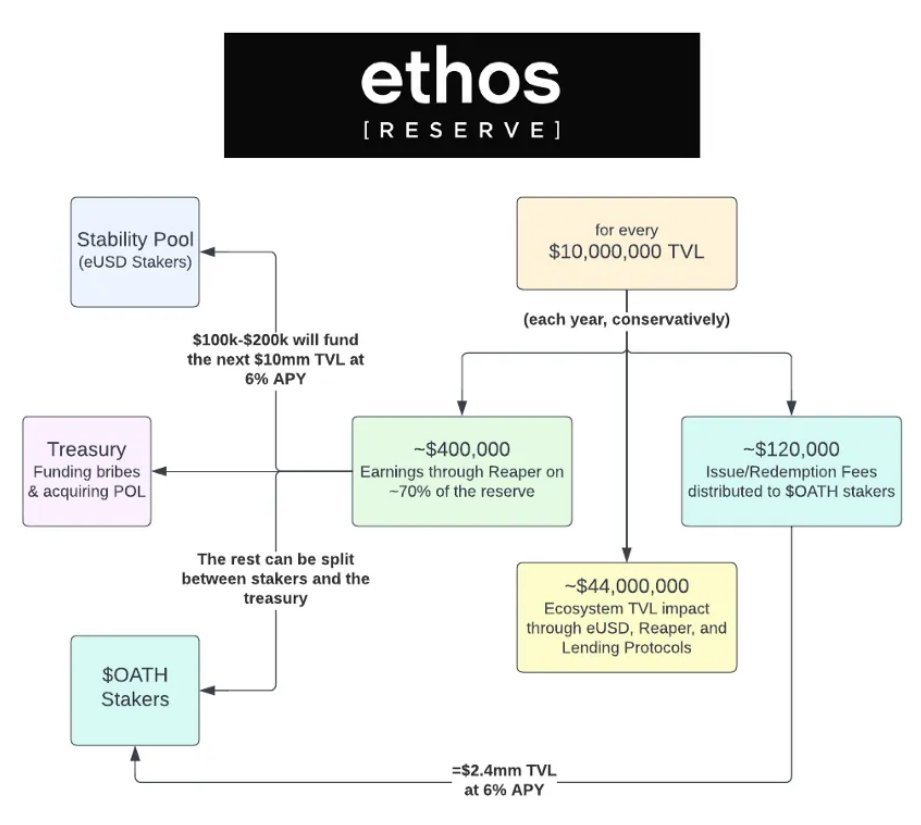

Ethos Reserve allows rehypothecation of the deposited assets

(can be deposited to Reaper Farm in the background to generate low risk yield)

With ETH and BTC as collateral the $ERN stablecoin will have low risks collateral, while having access to a lot of capital

Ethos Reserve allows rehypothecation of the deposited assets

(can be deposited to Reaper Farm in the background to generate low risk yield)

With ETH and BTC as collateral the $ERN stablecoin will have low risks collateral, while having access to a lot of capital

15/32

Imagine Liquity $LUSD but with yield generating assets.. But not the kind of risky assets that $MIM has

This yield will be used to buyback $OATH from the market and distribute to the $ERN stability module stakers

Imagine Liquity $LUSD but with yield generating assets.. But not the kind of risky assets that $MIM has

This yield will be used to buyback $OATH from the market and distribute to the $ERN stability module stakers

16/32

There will be a flat issue and redemption fee for minting/redeeming $ERN which is also distributed to $bOATH stakers

There will be a flat issue and redemption fee for minting/redeeming $ERN which is also distributed to $bOATH stakers

17/32

Byte Masons are looking to make Ethos Reserve evolve into treasury bonds of Defi, by allowing funds to be deposited to Reaper Farm earing yield that will be funneled to $bOATH and $ERN stakers

Byte Masons are looking to make Ethos Reserve evolve into treasury bonds of Defi, by allowing funds to be deposited to Reaper Farm earing yield that will be funneled to $bOATH and $ERN stakers

18/32

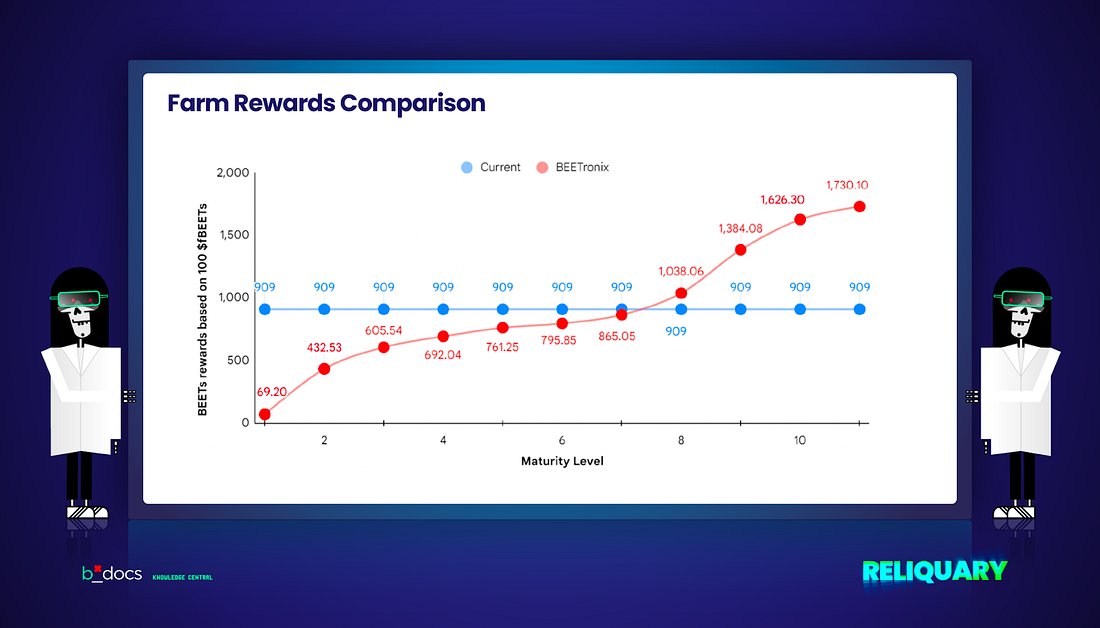

5️⃣ Digit

(previously Reliquary)

Is a new defi primitive made to attract and reward sticky liquidity.

To combat mercenary liquidity Digit will make it possible to deposit a LP token into a financial NFT that accrues maturity points over time.

5️⃣ Digit

(previously Reliquary)

Is a new defi primitive made to attract and reward sticky liquidity.

To combat mercenary liquidity Digit will make it possible to deposit a LP token into a financial NFT that accrues maturity points over time.

19/32

This means that a LP token wrapped in Digit will become more valuable over time compared to a LP token

This can be used by protocols giving liquidity incentives based on the maturity of the NFT

This means that a LP token wrapped in Digit will become more valuable over time compared to a LP token

This can be used by protocols giving liquidity incentives based on the maturity of the NFT

20/32

The NFTs will be tradeable on NFT marketplaces so you can sell your LP tokens at a premium with the accrued maturity

At any time you can withdraw your LP token from the Digit NFT but you would lose the accrued maturity.

You can also split, merge and shift LP tokens

The NFTs will be tradeable on NFT marketplaces so you can sell your LP tokens at a premium with the accrued maturity

At any time you can withdraw your LP token from the Digit NFT but you would lose the accrued maturity.

You can also split, merge and shift LP tokens

21/32

The NFT can also be used as collateral to take out a loan in the future

The underlying assets would be managed by Reaper Farm to generate yield for the holders.

Again fees will go towards $bOATH stakers

The NFT can also be used as collateral to take out a loan in the future

The underlying assets would be managed by Reaper Farm to generate yield for the holders.

Again fees will go towards $bOATH stakers

22/32

The first protocol to start using Digit will be @beethoven_x, a friendly fork of @Balancer on FTM and OP

I can't imagine anything other than that all Byte Masons product will be utilizing Digit

The first protocol to start using Digit will be @beethoven_x, a friendly fork of @Balancer on FTM and OP

I can't imagine anything other than that all Byte Masons product will be utilizing Digit

23/32

6️⃣ Moon

Is a onboarding platform aiming to make it as easy for users to get started with web3 as it is today for users of web2

It will include a wallet and solutions for socials, ads, app store and payments

6️⃣ Moon

Is a onboarding platform aiming to make it as easy for users to get started with web3 as it is today for users of web2

It will include a wallet and solutions for socials, ads, app store and payments

24/32

✅️Rebrand

There will be a rebrand of all of the Byte Mason products, with the aesthetic sitting somewhere between cypher punk (legacy) and polished/professional (future) @decodedeficrypto

✅️Rebrand

There will be a rebrand of all of the Byte Mason products, with the aesthetic sitting somewhere between cypher punk (legacy) and polished/professional (future) @decodedeficrypto

https://twitter.com/decodeficrypto/status/1628186346480349185

25/32

✅️ Concluding thoughts

This is exciting developments and i'm very excited to see them play out over the next couple of months?? weeks?? days??

The composability of defi never ceases to impress me with new novel flywheels being created

✅️ Concluding thoughts

This is exciting developments and i'm very excited to see them play out over the next couple of months?? weeks?? days??

The composability of defi never ceases to impress me with new novel flywheels being created

26/32

I've been an $OATH taker ever since the LPB, just waiting for the flywheel to unfold

...and now it looks like the time is near

I've been an $OATH taker ever since the LPB, just waiting for the flywheel to unfold

...and now it looks like the time is near

27/32

Is this all that the Byte Masons have planned?

I think not...

Wen Iceberg Protocol @0xBebis_?

Is this all that the Byte Masons have planned?

I think not...

Wen Iceberg Protocol @0xBebis_?

https://twitter.com/0xBebis_/status/1626632218859929600

28/32

🚨 This is definitely not financial advice, you are a big boy and have to make your own decisions to invest in risky crypto assets

Even though the protocols are audited and there are bug bounties in @code4rena there is always smart contract risk in defi protocols

🚨 This is definitely not financial advice, you are a big boy and have to make your own decisions to invest in risky crypto assets

Even though the protocols are audited and there are bug bounties in @code4rena there is always smart contract risk in defi protocols

29/32

This was a rewrite from my thread from November to add the latest updates from the $OATH ecosystem

This was a rewrite from my thread from November to add the latest updates from the $OATH ecosystem

https://twitter.com/Slappjakke/status/1597943078022574080

30/32

Tagging some OATH takers and frens

@BillyBobBaghold

@crypto_linn

@CryptoKaduna

@defi_naly

@crypthoem

@blockbytescom

@drakeondigital

@NickDrakon

@Route2FI

@blocmatesdotcom

@Louround_

@DAdvisoor

@thedailydegenhq

@TheDeFISaint

@Subli_Defi

@0xTindorr

@DeFiMinty

@0xKickflip

Tagging some OATH takers and frens

@BillyBobBaghold

@crypto_linn

@CryptoKaduna

@defi_naly

@crypthoem

@blockbytescom

@drakeondigital

@NickDrakon

@Route2FI

@blocmatesdotcom

@Louround_

@DAdvisoor

@thedailydegenhq

@TheDeFISaint

@Subli_Defi

@0xTindorr

@DeFiMinty

@0xKickflip

31/32

I hope you've found this thread helpful.

Follow me @Slappjakke for more alpha

Like/Comment/Retweet the first tweet below if you can to help spread the word

I hope you've found this thread helpful.

Follow me @Slappjakke for more alpha

Like/Comment/Retweet the first tweet below if you can to help spread the word

https://twitter.com/Slappjakke/status/1629140572115030017

32/32

@defi_naly also had a killer thread on the $OATH flywheel if you want to do some more reading

@defi_naly also had a killer thread on the $OATH flywheel if you want to do some more reading

https://twitter.com/defi_naly/status/1624313594014797824

• • •

Missing some Tweet in this thread? You can try to

force a refresh