1/9 Rise to the Top: The Thrilling Journey of Best #MEV Bots - Exploring Lifespan, Profitability, and the Blood-Battling Secrets in the Quest for Financial Success!

This 🧵will give you an exclusive overview of MEV 🤖's performance in 2022, which you would never wanna miss:

This 🧵will give you an exclusive overview of MEV 🤖's performance in 2022, which you would never wanna miss:

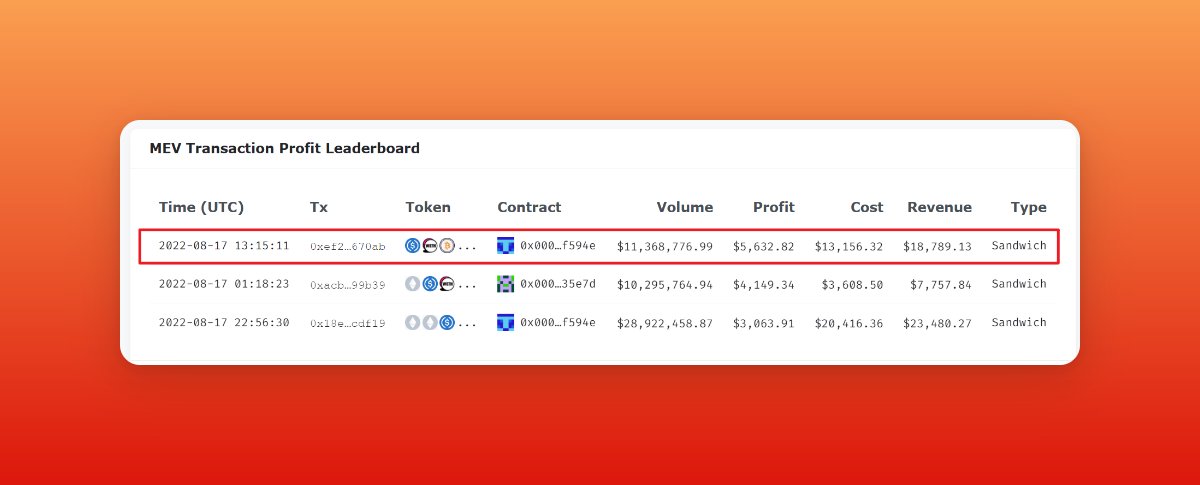

2/9 MEV is a fierce battlefield, with over 2.7K MEV 🤖s vying for profits. The arbitrage 🤖 are dominating the market, accounting for over 80% of total players.

3/9 In the cutthroat world of MEV, only the strongest may survive. See, the most profitable arbitrage 🤖 0xbad generates the highest profits of over $9.2M. One grabs 12.3% of the total profits from arbitrages! 🚀🚀

https://twitter.com/EigenPhi/status/1628658727611138049

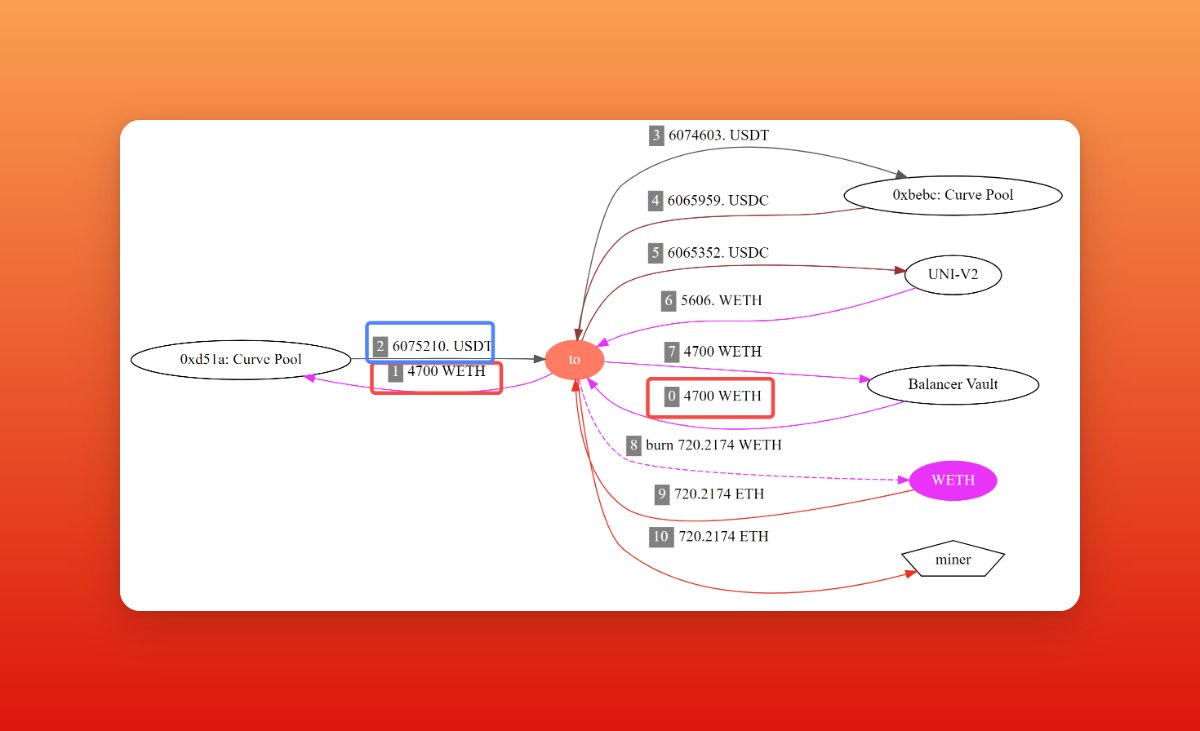

4/9 This arb 🤖 0xbad also created the most profitable single arbitrage transaction. It profited $3.197 million at the cost of $2,057 in one atomic transaction during the Nomad bridge exploit. Unfortunately, this bad guy is gone for good.

https://twitter.com/EigenPhi/status/1627980338042634240

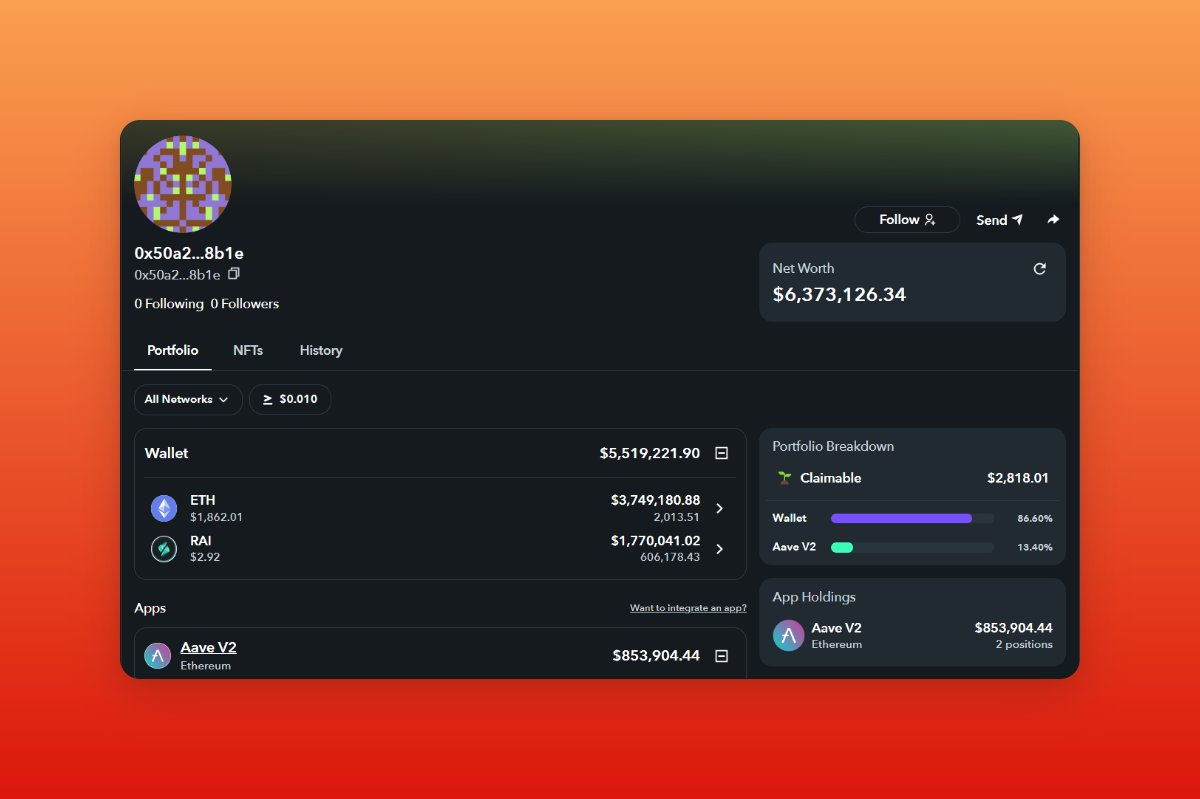

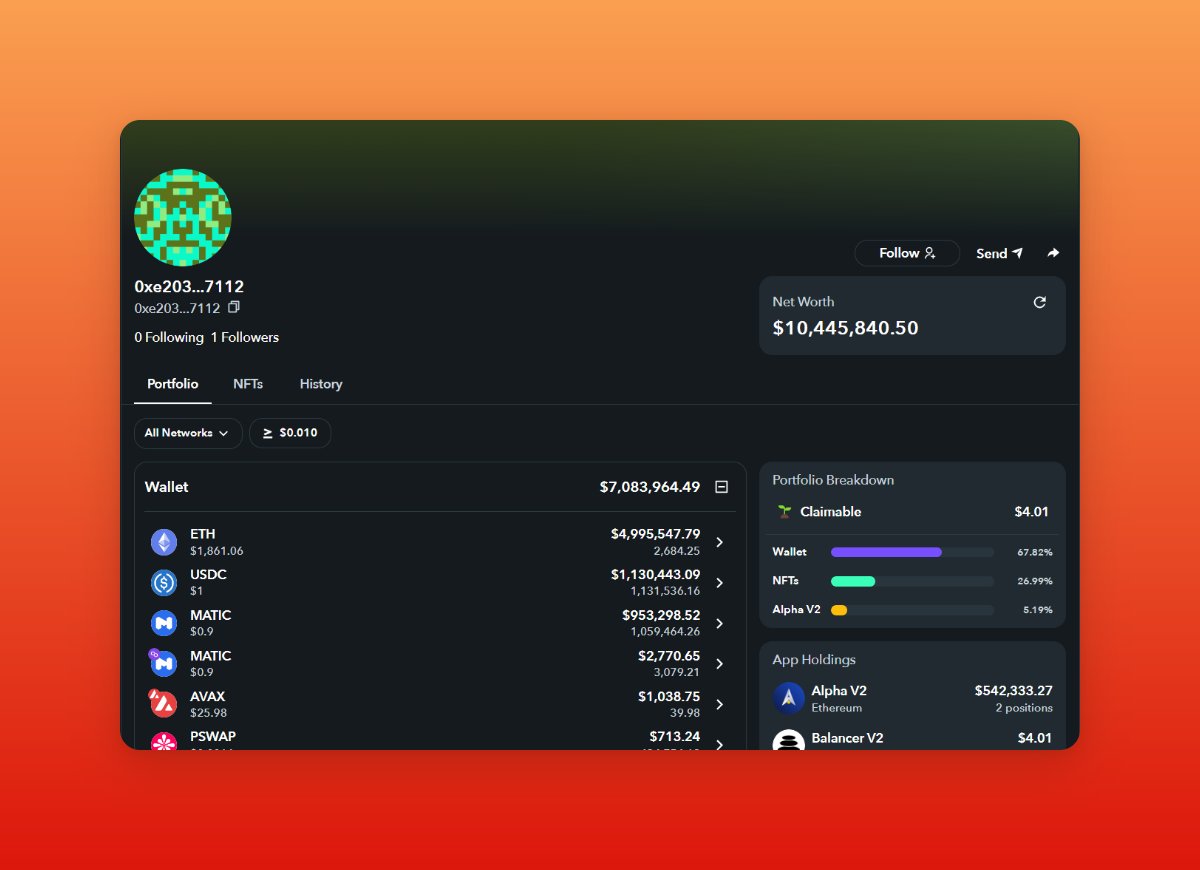

5/9 Liquidators may have a deeper understanding of the phrase "winners take the most." Looking at this profit leaderboard, the top alpha predator for liquidation has devoured 41.3% of total profits generated by liquidation 🤖!!

https://twitter.com/EigenPhi/status/1628664783192068097

6/9 The top 10 arbitrage bots collectively hold about 51.3% of the market value, while the top 10 sandwich bots hold 74.8%, and the top liquidation bots notably hold 90.2%.

You can also keep updated with the 🤖 profit leaderboard at eigenphi.io

You can also keep updated with the 🤖 profit leaderboard at eigenphi.io

https://twitter.com/EigenPhi/status/1628660983358181377

7/9 But others could not be so lucky. In 2022, over one-third of 🤖 reported negative profits, and nearly half of the liquidators suffered a loss. Only small amounts of 🤖 can make over $10K in profits.

8/9 Most of the bots could not last more than 1 day, mainly for testing purposes. In general, arbitrage 🤖 have a shorter lifetime compared to sandwich and liquidation ones, while 47.1% have lived for less than one day.

9/9 Wanna succeed like the bots above? Design effective algorithms and competing strategies for profitability calculations. Hope this 🧵 be an excellent starting point for investigation. Visit the full report for more insightful advice: eigenphi.io/report/MEV-Out…

Like our daily #MEV analysis? Go visit eigenphi.substack.com

and typefully.com/Eigenphi for more!

Follow @Eigenphi_alert for real-time MEV 🚨

and typefully.com/Eigenphi for more!

Follow @Eigenphi_alert for real-time MEV 🚨

• • •

Missing some Tweet in this thread? You can try to

force a refresh