Wanna understand DeFi transactions and trading strategies?

👉 https://t.co/5nyEdclEgF

🌐 https://t.co/1IKwOLYJYS

How to get URL link on X (Twitter) App

All the insights below are from these fantastic guests:

All the insights below are from these fantastic guests:

They are:

They are:

This crisis has impacted the oldest decentralized stablecoin: DAI. It was affected by this USDC bank run crisis and fell as low as $0.9.

This crisis has impacted the oldest decentralized stablecoin: DAI. It was affected by this USDC bank run crisis and fell as low as $0.9.

https://twitter.com/SummersThings/status/1607861933322952709In case you don't remember, let's take you back to November's @avi_eisen vs. Curve battle.

1/2 Do you know how much the #MEV has made from @Uniswap V3 since Jan 2022?

1/2 Do you know how much the #MEV has made from @Uniswap V3 since Jan 2022?

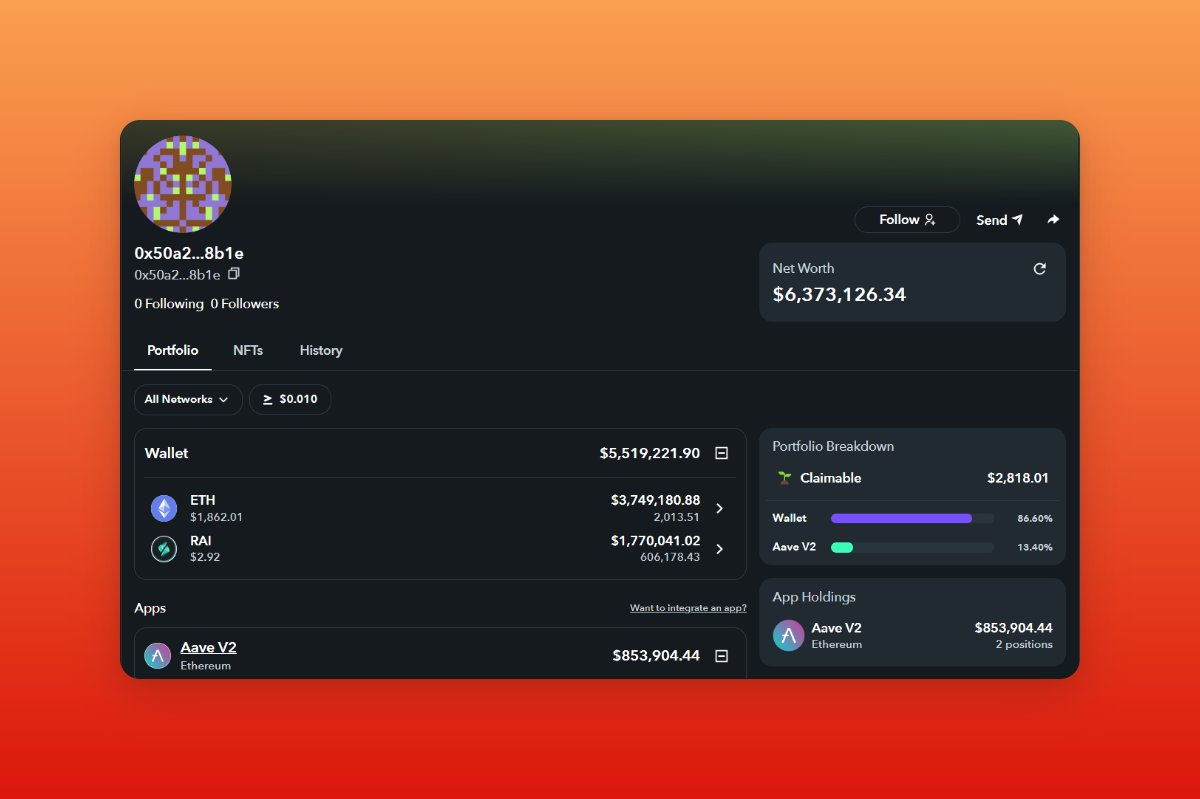

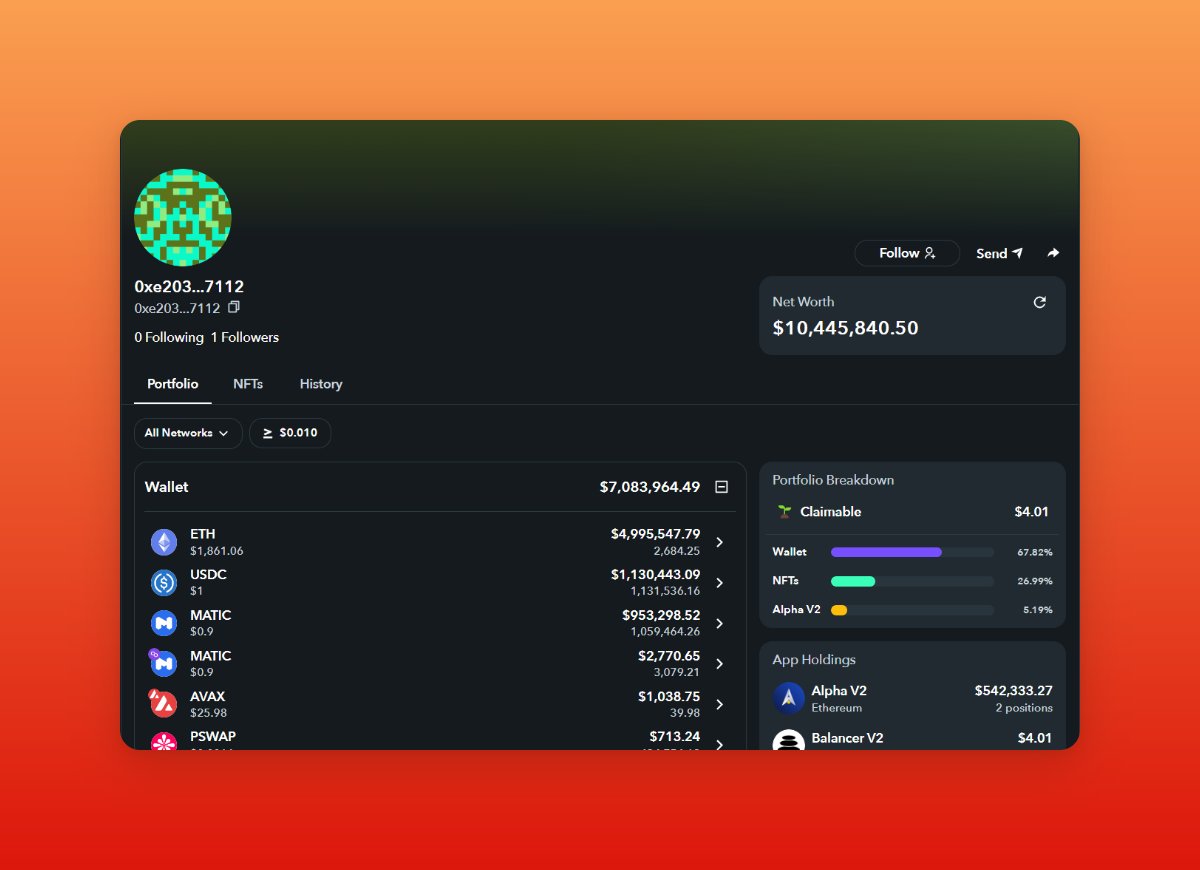

2/10 The Token Millionaire with $10M in holdings has suffered heavy loss in the last 7 days. It was squeezed for $399,46 in 16 🥪s while losing $18,789 in yesterday's 🥪.

2/10 The Token Millionaire with $10M in holdings has suffered heavy loss in the last 7 days. It was squeezed for $399,46 in 16 🥪s while losing $18,789 in yesterday's 🥪.

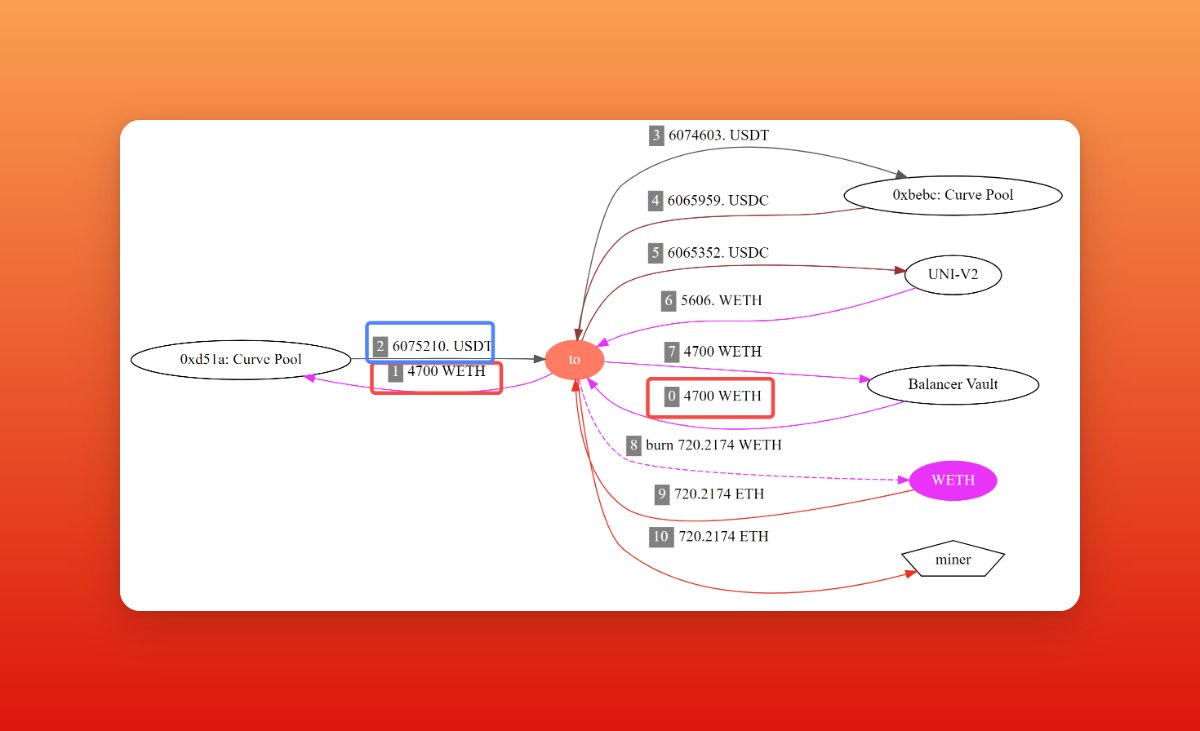

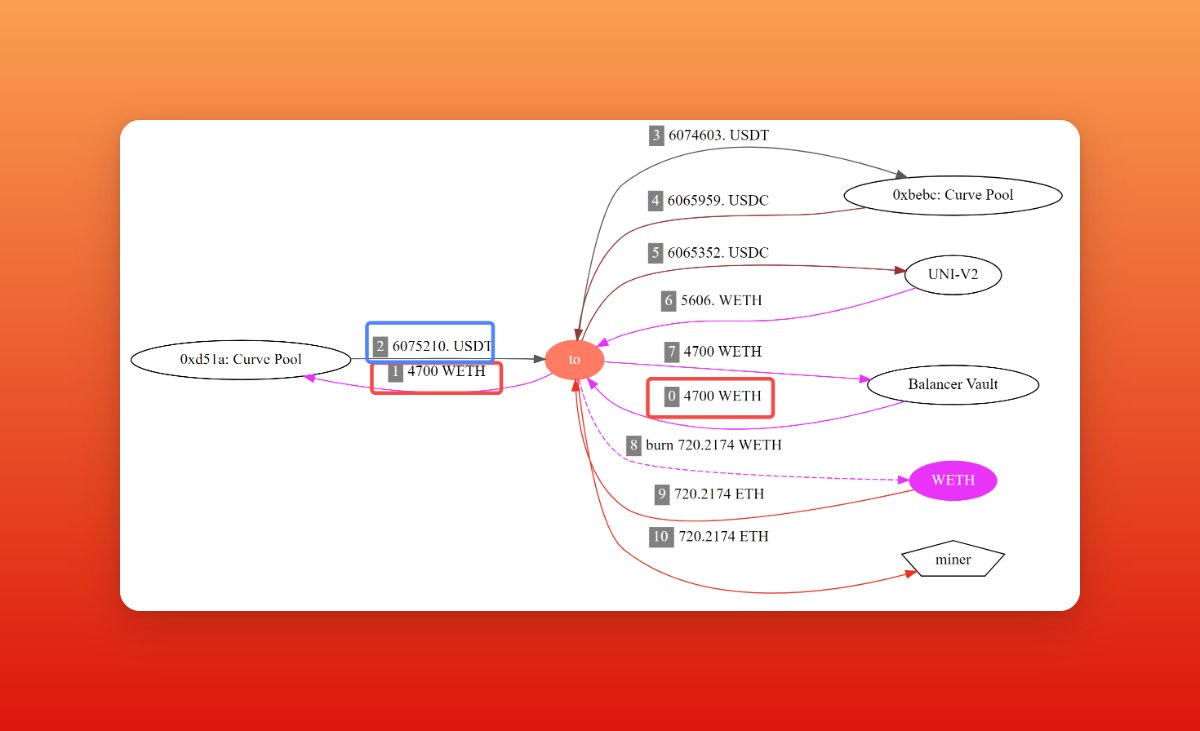

2/9 The 😢 of this 🥪, also the biggest victim of the day, was a Tornado Cash Withdrawer.

2/9 The 😢 of this 🥪, also the biggest victim of the day, was a Tornado Cash Withdrawer.

https://twitter.com/EigenPhi_Alert/status/1559649173246320640Here are some of the large amounts of deposits and borrows.

https://twitter.com/EigenPhi_Alert/status/1559687387986374657

Let's start with the roles involved in the transaction:

Let's start with the roles involved in the transaction: