Mutual Fund vs. ETFs

What is the difference?

Which one to choose?

A THREAD 🧵

(1/20)

#StockMarketindia #trading #StockMarket

@sunilgurjar01 @kuttrapali26

What is the difference?

Which one to choose?

A THREAD 🧵

(1/20)

#StockMarketindia #trading #StockMarket

@sunilgurjar01 @kuttrapali26

There are various ways of investing, and two of the most popular are mutual funds and Exchange-Traded Funds (ETFs).

Both are pooled funds that allow investors to access professionally managed funds that offer diversification in a wide variety of asset classes and industries.2/20

Both are pooled funds that allow investors to access professionally managed funds that offer diversification in a wide variety of asset classes and industries.2/20

MFs includes stocks, bonds, and money market funds that are bundled together in a single mutual fund. They offer investors a way to own a diversified portfolio of investments at a lower price which is not possible if they own each instrument separately. (3/20)

They are managed by professional money managers who allocate the funds intending to produce income or capital gains for investors.

For example : Parag parikh flexi cap fund,

Axis small cap fund,

ICICI prudential S&P BSE Index fund...etc (4/20)

For example : Parag parikh flexi cap fund,

Axis small cap fund,

ICICI prudential S&P BSE Index fund...etc (4/20)

ETFs are pooled investments of stocks, bonds, or other commodities similar to mutual funds, except they can be bought and sold on the stock exchange much like stocks. (5/20)

EFTs may track a specific index or sector by a single investment or an assortment depending on investment strategy.

For example : Niftybees, Bankbees, MOM100, MON100, Psubnkbees, Goldbees, Silverbees…etc (6/20)

For example : Niftybees, Bankbees, MOM100, MON100, Psubnkbees, Goldbees, Silverbees…etc (6/20)

One of the most notable similarities when considering mutual funds vs. ETFs is they are both professionally managed baskets of funds.

Since they are managed by experts, they do the research, oversee the funds, and make sure they stay on track with the target indexes. (7/20)

Since they are managed by experts, they do the research, oversee the funds, and make sure they stay on track with the target indexes. (7/20)

Due to the diversification, many investors consider them to be less risky because when one stock or bond isn’t performing well, others can offer a more balanced portfolio and reduce risk. (8/20)

ETFs offer greater flexibility in trading and allow investors to choose smaller niche stocks, while mutual funds are better suited for investors who don’t want to manage their own fund(s). (9/20)

ETFs be traded throughout the trading day, just like stocks with pricing based on supply and demand. However, mutual funds are traded differently. The price is set, and they can be traded only at the end of each trading day, not during it.(10/20)

ETFs is less expensive way to buy and enjoy a diversified portfolio, there is no such minimum requirement to buy any ETF while Mutual funds can routinely have a minimum investment requirement to enter into that particular fund.(11/20)

Mutual funds – as discussed, mutual funds are made up of stocks, bonds, and money market funds.

They are typically actively managed by professional fund managers who hand-pick the investments and buy and sell them time to time.(12/20)

They are typically actively managed by professional fund managers who hand-pick the investments and buy and sell them time to time.(12/20)

ETFs – include multiple investment types such as stocks, commodity, bonds, and others that can be made up of hundreds of stocks in various industries. They’re listed on the exchange and bought and sold, much like stocks with prices that vary during the trading day.(13/20)

Index funds – are a type of mutual fund or ETF that employ a different strategy. Instead of the money manager choosing individual stocks, they buy all the shares that make up an index, such as the Nifty50, Sensex, to attempt to reproduce the performance of the market.(14/20)

Both ETFs and mutual funds offer a variety of benefits for investing as well as diversification, it’s important to consider your investment style.(15/20)

Since they have similarities, determining your choice can come down to the types of stocks and bonds in the fund, whether you want an actively or passively managed fund, the fees and commissions you’re willing to pay, and the returns you’re looking for.(16/20)

For investors that enjoy simplicity, ETFs offer a low-cost, easy way to get started with options in various markets that can provide a well-balanced and diversified portfolio geared to long-term investing.(17/20)

On the other hand, mutual funds offer the opportunity to invest in smaller markets and specific niches that may be suited for investors looking for even greater diversification.(18/20)

♥If you found this thread useful, please RT the first tweet & follow @itsprekshaBaid for more useful threads.🔁 (20/20)

A Thread to: learn About a Bull Flag Pattern.👇

https://twitter.com/itsprekshaBaid/status/1626827071182995457

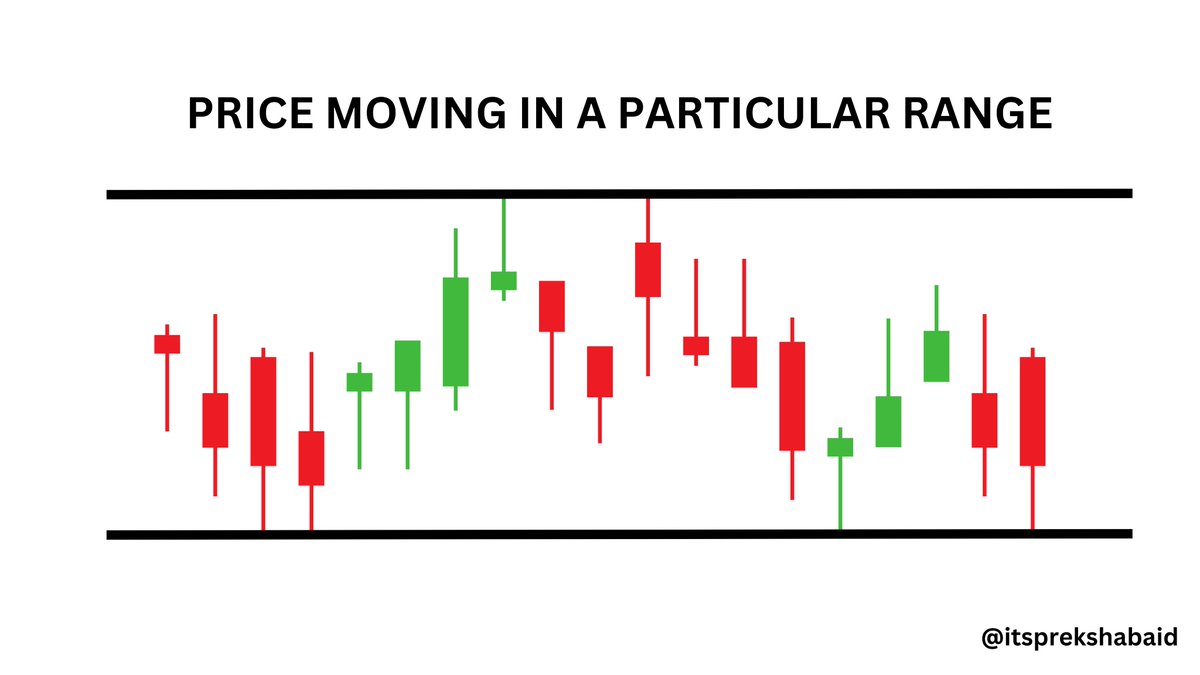

A Thread to learn : Simple range breakout strategy 👇

https://twitter.com/itsprekshaBaid/status/1618246899760533504

A Thread to learn : Fibonacci Retracement and how I use this tool in with Supply & Demand levels? 👇

https://twitter.com/itsprekshaBaid/status/1624345560827445249

A Thread to learn : Simple Price Action - Swing Trading Strategy. 👇

https://twitter.com/itsprekshaBaid/status/1622137391007031296

• • •

Missing some Tweet in this thread? You can try to

force a refresh