1 THREAD on LIC and its investments in the Adani Group - why #LIC has been imprudent, reckless and irresponsible in squandering money belonging to its policyholders. Why even now, it may not be too late for it to cut its losses and run from the fire. indianexpress.com/article/busine…

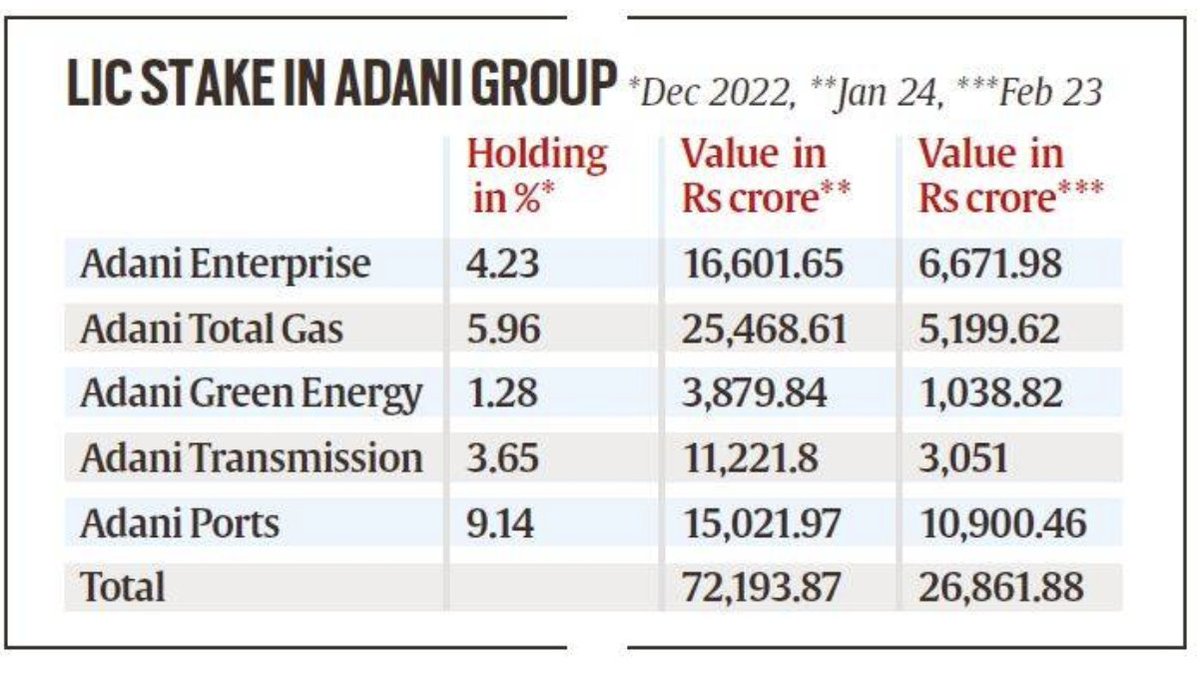

2 LIC has stakes in 5 Adani Group companies of which its earliest substantive acquisition was in Adani Ports in Sept 2000. LIC management has defended itself by saying that the acquisitions in Group cos were made “over a period”. <3 years does not suggest long term!

3 Significantly Adani Port, which has been a major source of revenue, is the only co to have somewhat avoided the free fall in the month after the #Hindenburg revelations. LIC’s stake, thankfully for now, were more in this venture. LIC will do well not to bet on this for long

4 Notice that in effect #LIC appears to have invested most of its “initial investment” of Rs 30127 crores since Sept 2022 - just 30 months before the crash. Not very long term, you would think!

5 By any reckoning, especially for a longterm institutional investor like #LIC, this is rather sudden. Before the current crash these investments were 5 per cent of its equity investments; now they are just about 1 %.

6 The LIC management is being just too clever by half by claiming that this is only a tiny portion of its overall portfolio that is about Rs. 42 LAKH CRORES.

7 It just takes basic elementary school arithmetic to figure out that the value of the Adani portfolio in #LIC’s overall portfolio would become smaller and smaller as the value of the Adani stock has dropped >60 % in a month.

8 The LIC’s participation in the Adani party is a contrast to the conduct of a comparable class of investors, mutual funds. In Sept 2020, which is about the time when LIC started investing in the Adani Group, its holdings were sig in only 2 Adani cos - AEL and Adani Transmission

9 But by late 2022 LIC’s investments in the Adani Group cos had increased significantly (its highest stake was in the Ports co, although its %age stake remained stagnant). Meanwhile, barring SAEL, MF stakes in the group cos were far smaller than LIC’s.

10 We know that MFs are wary of investing in closely held companies because of the possibility of greater volatility (you may call this manipulation in the light of Hindenburg effect). Also,for MFs they offer inferior opportunities for price discovery becos of the low free float

11 Now, let us see how the #LIC, which is supposedly the custodian of the interests of millions of policyholders, has acted in the last month. Its action of participating in the FPO as an actor investor was surely reckless, in effect it was playing games with other peoples’ money

12 This is because it took the anchor position AFTER the Hindenburg report.

13 Significantly, all mutual funds stayed away, as did most Indian institutional investors (although SBI’s pension fund did participate). The fact that the Adani FPO bombed and that LIC waas returned the cash it paid, does ot change the fact that it acted recklessly.

14 Now see the contrast b/w the holdings of LIC and the MFs as a class (as of Sept 2022): while LIC’s holdings in the Adani Group cos was 3.91% the MFs held just 0.83% in ALL Adani Group cos. LIC held 3.91%, MFs held 0.83%

15 While #LIC held 3.98% of shares in companies of the Tata Group, MFs held almost 5 %. Adani acolytes (incl those in the NaMo regime) may retort that LIC’s investments were in effect a bet on the Indian Infra story, for which Adani cos were a proxy.

16 Sadly for these sidekicks that very Infra story is now in tatters. For the #LIC to have bet so heavily on the Adani Group as a proxy was a cardinal sin, for which it needs to, for the sake of millions who have put their life savings, seek immediate atonement.

17 It appears there are few options for the LIC. The only sane course it now has is to unwind its holdings in ALL the Adabi cos before they slide lower and lower into the abyss. Most of the stocks, barring perhaps Adani Ports are hitting the circuit breaker every day.

18 LIC would do well to cut its losses and not pretend to have a “long view” of the Adani stock when even the promoters are finding it difficult to see the horizon.

19 For the sake of your policyholders and as a unique institution that is supposed to function like a cooperative (one of a kind in the world of finance) LIC owes the country at least this.

Source: charts from Indian Express and BusinessLine, Feb 24, 2023) LAST

Source: charts from Indian Express and BusinessLine, Feb 24, 2023) LAST

@threadreaderapp Pl unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh