1/9 Riding the Wave of MEV Opportunities: In 2022, Arbitrage Dominates the Market, Promising Explosive Growth for Savvy Searchers! Let's See How It Happened!

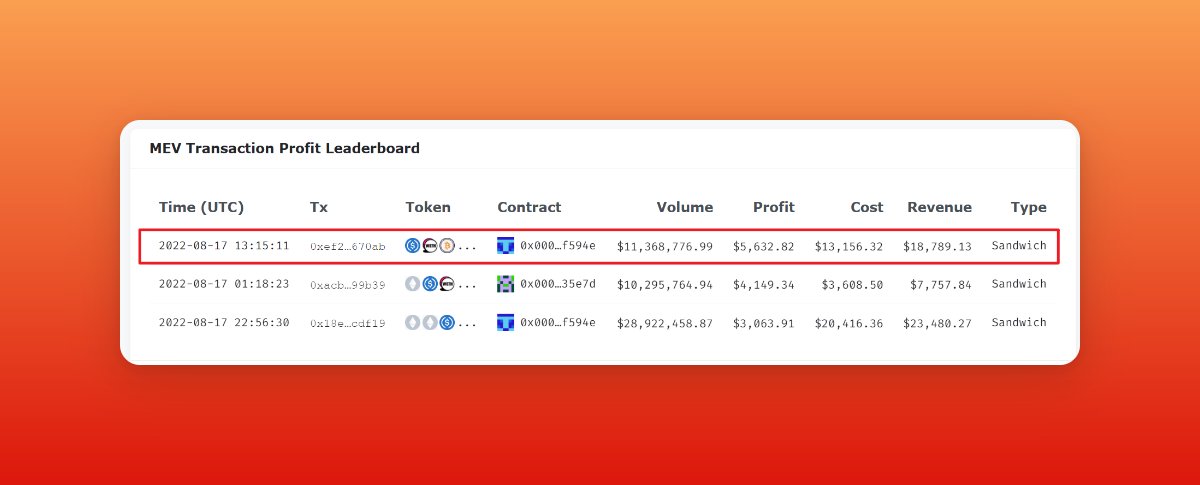

2/9 Our results show that arbitrage opportunities were the most frequent, accounting for 68.3% of the market. Sandwich opportunities are around 30.6%.

3/9 Opportunities for liquidation are far smaller than the other 2 MEVs, for it was more likely to depend on intense market fluctuation rather than conventional arbitrage ones. But the liquidation, the 1% of total MEVs, gained 11% of the total revenue.

4/9 Rising and rising, MEVs were getting more and more, regardless of the price of $ETH. Arbitrage bots traded more frequently than sandwich and liquidation bots in most months.

5/9 $LUNA crash, $stETH depeg, #FTX collapse; these crisis meant big time for MEVs. The chart below shows the monthly revenue change of MEV types.

👉 June was liquidation and arbitrage's best month.

👉 November belonged to 🥪 chefs.

👉 June was liquidation and arbitrage's best month.

👉 November belonged to 🥪 chefs.

6/9 Wonder about the impact of #theMerge? Combine these 2 charts, you can tell that the frequency of Sandwich front-running was definitely getting higher, not the revenue under usual conditions. It's no doubt that the Merge has increased the cost of making 🥪.

7/9 Based on our research, in 2022, sandwich transactions had a higher cost-revenue ratio each month when compared to arbitrage transactions, with an average of 0.78 for sandwich transactions and 0.49 for arbitrage transactions.

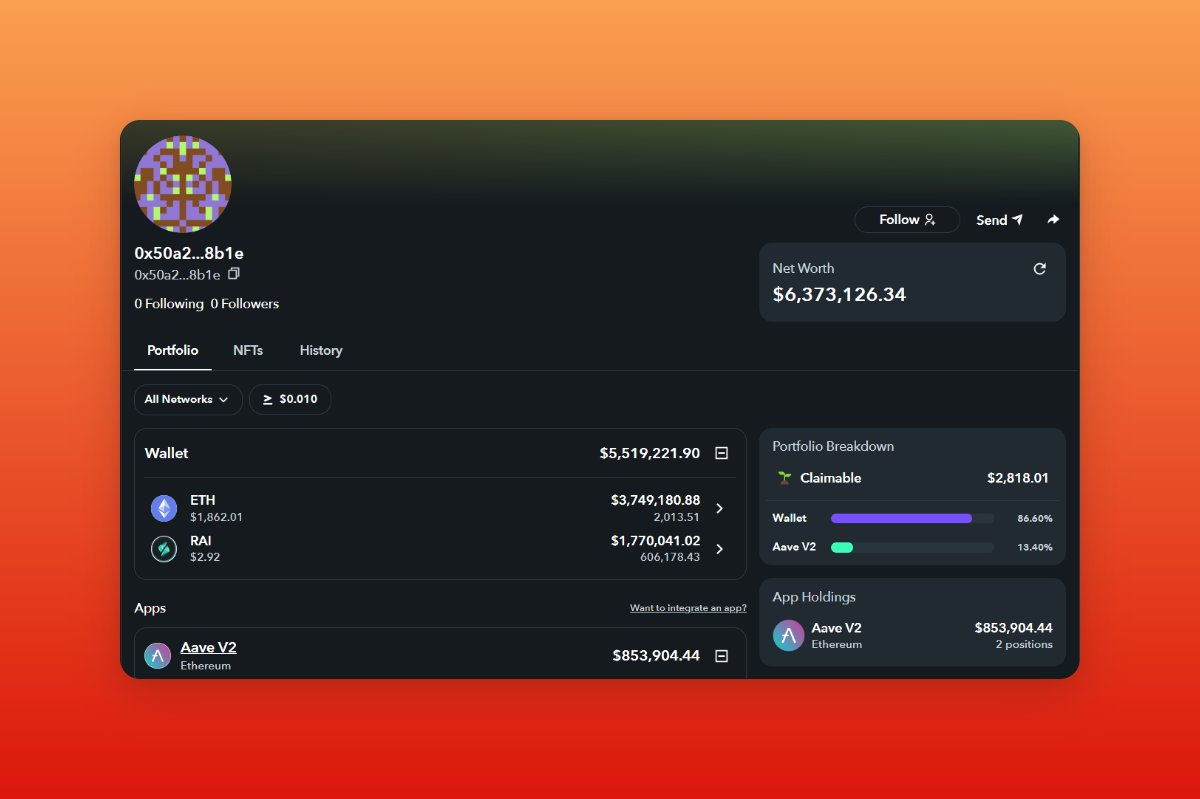

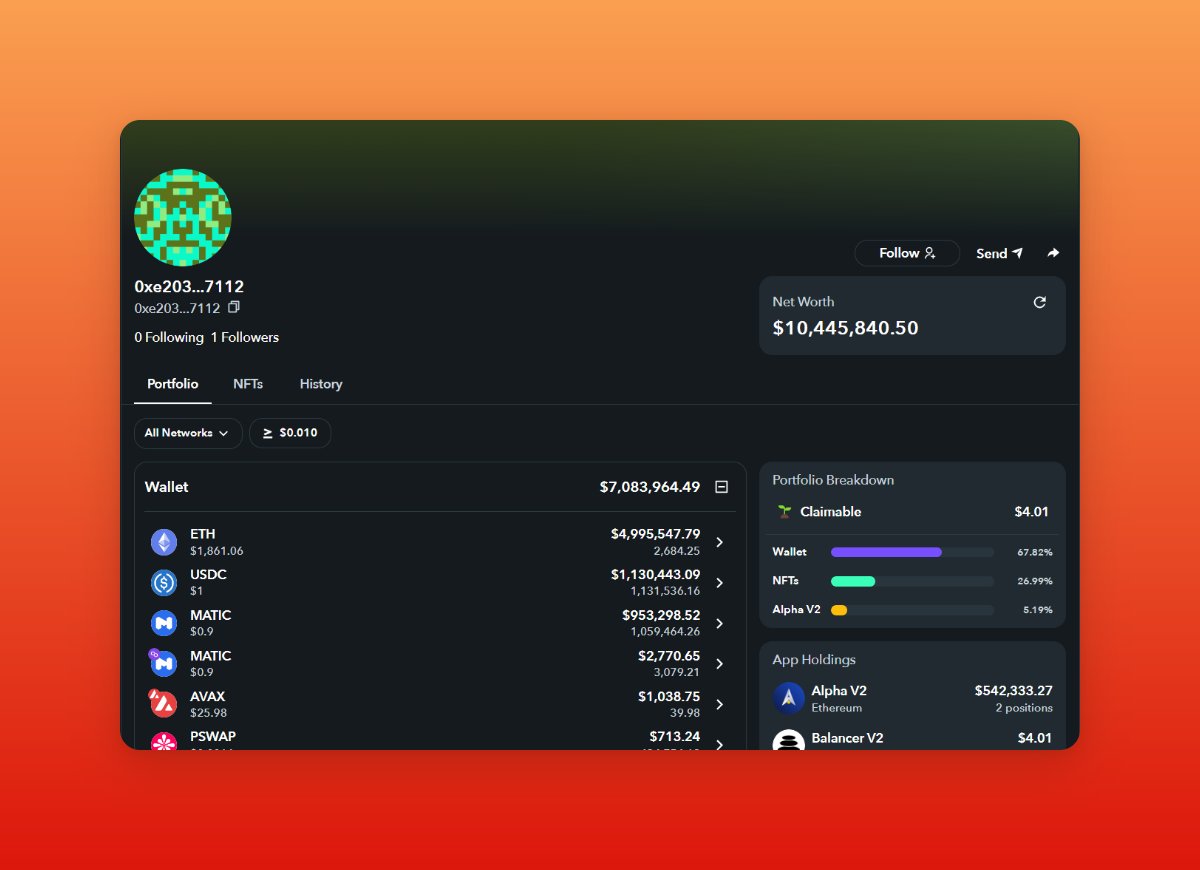

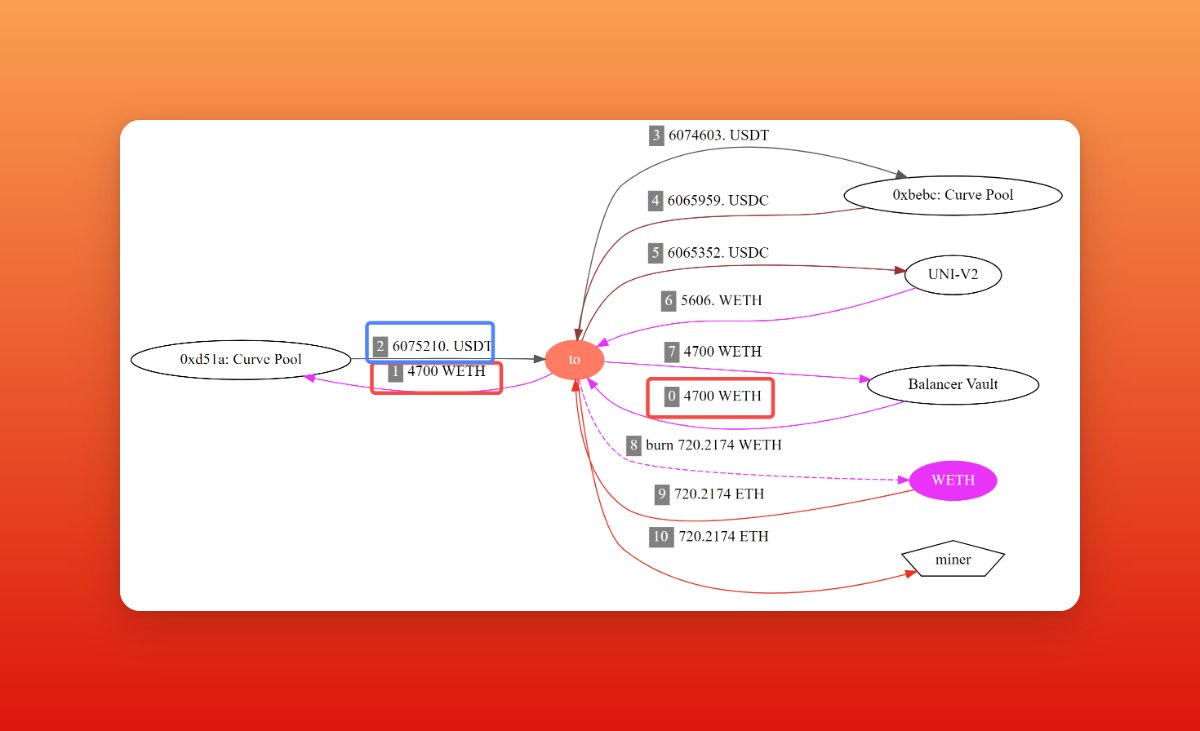

8/9 About November's liquidation revenue spike, it's because of the CRV short-squeeze event. For more detail, read our In-depth Analysis of How AAVE's $1.6 Million Bad Debt Was Created: eigenphi.io/report/aave-ba…

9/9 Let's wrap up today's thread exploring the rising tide of MEV. Visit the full report for more insightful advice: eigenphi.io/report/MEV-Out…. And HAPPY WEEKEND EVERYONE!

Like our daily #MEV analysis? Go visit eigenphi.substack.com

and typefully.com/Eigenphi for more!

Follow @Eigenphi_alert for real-time MEV 🚨

and typefully.com/Eigenphi for more!

Follow @Eigenphi_alert for real-time MEV 🚨

• • •

Missing some Tweet in this thread? You can try to

force a refresh