Here is my evening summary of dealer positioning $SPX, $SPY & $QQQ. The data is provided by Vol.land, created by @WizOfOps, and will help us identify key areas tomorrow to inform our #optionstrading and #futurestrading. Show thread to see it all! 🧵👇

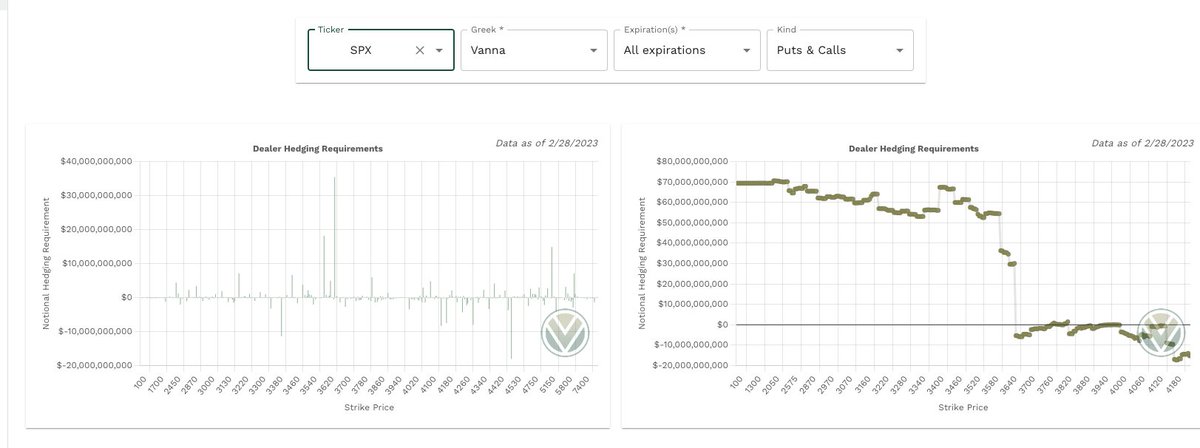

Lets start with #Vanna on $SPX & $SPY. $SPX cumulative Vanna picture is neutral in this range with positive vanna favoring downside and negative vanna hurting moves higher. $SPY is similar but with much more positive vanna favoring downside should $VIX/IV continue to rise.

Aggregate #Charm up next on $SPX & $SPY. $SPX charm is pretty neutral as well, but slightly more negative which is slightly bullish. However, $SPY is very positive which favors downside.

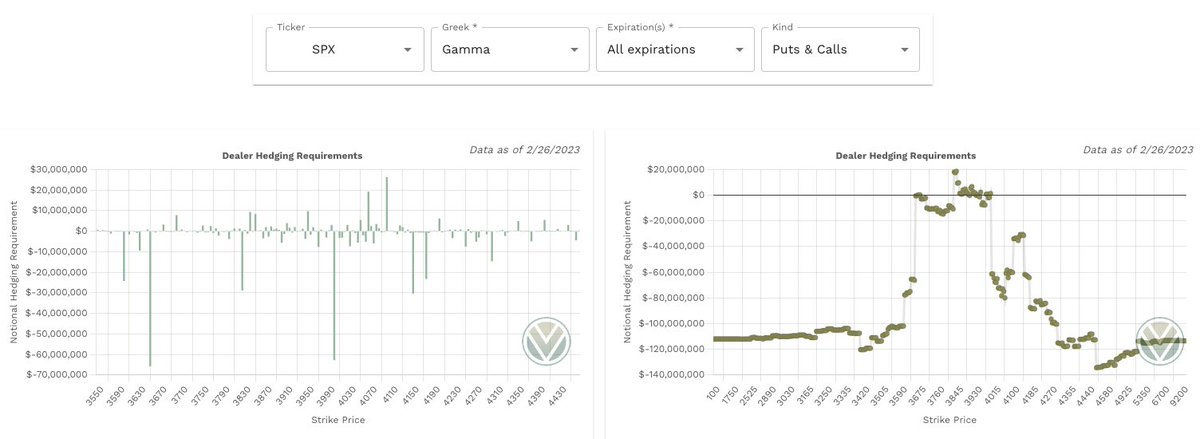

Largest #Gamma levels on $SPX to put on your charts.

+GEX Levels (dealers resist moves into it):

3840, 3850, 3950, 4065, 4100

-GEX Levels (dealers assist moves into it):

3825, 4000, 4150, 4175

Screen shots of chart attached, note 3950 is now light support due to positive GEX.

+GEX Levels (dealers resist moves into it):

3840, 3850, 3950, 4065, 4100

-GEX Levels (dealers assist moves into it):

3825, 4000, 4150, 4175

Screen shots of chart attached, note 3950 is now light support due to positive GEX.

Largest #Gamma levels on $SPY to put on your charts.

+GEX Levels (dealers resist moves into it):

386, 387, 389, 398

-GEX Levels (dealers assist moves into it):

391, 392, 393-397, 399-402, 403-405

Worth noting this range is still very volatile due to negative GEX.

+GEX Levels (dealers resist moves into it):

386, 387, 389, 398

-GEX Levels (dealers assist moves into it):

391, 392, 393-397, 399-402, 403-405

Worth noting this range is still very volatile due to negative GEX.

While $SPX is looking less bearish than last week with support showing up around 3950, $SPY still remains in a very volatile region that still favors downside. I'd expect as to see resistance if we climb to 398 and will be watching to see how we react to the 392.50 area.

The impact $VIX will have is still very important. Due to the Vanna structure, IV rising will cause $SPY to sell off more easily than IV dropping would help it rise. The same applies to $SPX, despite this zone we are in being pretty neutral from a cumulative picture.

That's all for the dealer positioning side of $SPX & $SPY. Make sure to have your charts marked & keep an eye on $VIX for Vanna impact. If you are interested in viewing & using this data plus more with hundreds of other assets, use coupon code “FattyTrades” for 10% off!

• • •

Missing some Tweet in this thread? You can try to

force a refresh