Too bored with these recent gem alpha? Let's go with the $sol-killer which is @Aleph__Zero - $azero

$azero is named as one of the future TOP-10 #Layer1 Protocols.

Below is why many are bullish on the future of this promising chain.

🧵 (0/9)

$azero is named as one of the future TOP-10 #Layer1 Protocols.

Below is why many are bullish on the future of this promising chain.

🧵 (0/9)

In this thread, we will go through the following parts of $azero

1️⃣ Overview

2️⃣ Key Features

3️⃣ Tokenomics

4️⃣ Team, Backer & Partners

5️⃣ Ecosystem

6️⃣ On-chain Analytics

7️⃣ Competitors

8️⃣ Bull case & Roadmap

9️⃣ Other info

1️⃣ Overview

2️⃣ Key Features

3️⃣ Tokenomics

4️⃣ Team, Backer & Partners

5️⃣ Ecosystem

6️⃣ On-chain Analytics

7️⃣ Competitors

8️⃣ Bull case & Roadmap

9️⃣ Other info

1️⃣ Overview

Aleph Zero - $azero is a privacy-enhancing public blockchain featuring integration with the Substrate stack.

It is powered by a custom algorithm that takes advantage of DAG (Directed Acyclic Graph) technology for efficient and decentralized transactions.

Aleph Zero - $azero is a privacy-enhancing public blockchain featuring integration with the Substrate stack.

It is powered by a custom algorithm that takes advantage of DAG (Directed Acyclic Graph) technology for efficient and decentralized transactions.

It solves the shortcomings of currently distributed ledger technology platforms by offering superior speed, validation time, scalability, and security.

In other words, $azero solves the blockchain trilemma with the optimal balance.

In other words, $azero solves the blockchain trilemma with the optimal balance.

2️⃣ Key Features

Traditional blockchain protocols can only create one block per time, which severely limits performance.

In contrast, AlephBFT, as a DAG consensus protocol, allows multiple users to create blocks simultaneously.

Traditional blockchain protocols can only create one block per time, which severely limits performance.

In contrast, AlephBFT, as a DAG consensus protocol, allows multiple users to create blocks simultaneously.

$AZERO uses two solutions

- Zero-Knowledge-Proofs (zkProofs)

- secure Multi-Party Computation (sMPC)

Zero-knowledge proofs are used for basic transfers, while sMPCs are used to interact with the shared private state.

- Zero-Knowledge-Proofs (zkProofs)

- secure Multi-Party Computation (sMPC)

Zero-knowledge proofs are used for basic transfers, while sMPCs are used to interact with the shared private state.

📌 Zero-Knowledge-Proofs (zkProofs)

A zkProof makes it possible to prove the truth of a statement without revealing details about the statement itself.

In blockchains, zkProofs are used to ensure that transactions are valid without disclosing transaction details.

A zkProof makes it possible to prove the truth of a statement without revealing details about the statement itself.

In blockchains, zkProofs are used to ensure that transactions are valid without disclosing transaction details.

📌 secure Multi-Party Computation (sMPC)

SMPC’s combination of encryption, distribution and distributed computation can have a profound impact on data privacy and security.

$AZERO uses zkProofs in conjunction with MPC to implement private smart contracts.

SMPC’s combination of encryption, distribution and distributed computation can have a profound impact on data privacy and security.

$AZERO uses zkProofs in conjunction with MPC to implement private smart contracts.

3️⃣ Tokenomics

📌 Token metrics

Total Supply: 300m $azero

Annual inflation rate: 30m $azero

Current Mcap: $350m

FDV: $480m

Currently, 70% of the circulating supply is staked.

📌 Token metrics

Total Supply: 300m $azero

Annual inflation rate: 30m $azero

Current Mcap: $350m

FDV: $480m

Currently, 70% of the circulating supply is staked.

📌 Inflation Notes

Inflation is essential for the ongoing expansion of the ecosystem.

While price appreciation is important and will come down the road, it can't get too steep too fast

It would only stunt its growth.

Inflation is essential for the ongoing expansion of the ecosystem.

While price appreciation is important and will come down the road, it can't get too steep too fast

It would only stunt its growth.

📌 Token allocation & Vesting

- Team 10%

- Foundation: 23%

- Pre-seed: 17%

- Seed: 17%

- Public Presale: 18%

- Early Community: 5%

- Public Sale: 10%

Already unlocked = 72% (20% of team, 20% of foundation, pre-seed, seed, public sale, pre-sale, early community).

- Team 10%

- Foundation: 23%

- Pre-seed: 17%

- Seed: 17%

- Public Presale: 18%

- Early Community: 5%

- Public Sale: 10%

Already unlocked = 72% (20% of team, 20% of foundation, pre-seed, seed, public sale, pre-sale, early community).

📌 Token Use Case

$azero is used for:

🧩 Transaction fees

🧩 Validator node staking

🧩 Governance voting processes

🧩 Collateral for wrapped assets on Liminal

🧩 Discounts on DEX fees and for asset wrapping/bridging on Liminal

$azero is used for:

🧩 Transaction fees

🧩 Validator node staking

🧩 Governance voting processes

🧩 Collateral for wrapped assets on Liminal

🧩 Discounts on DEX fees and for asset wrapping/bridging on Liminal

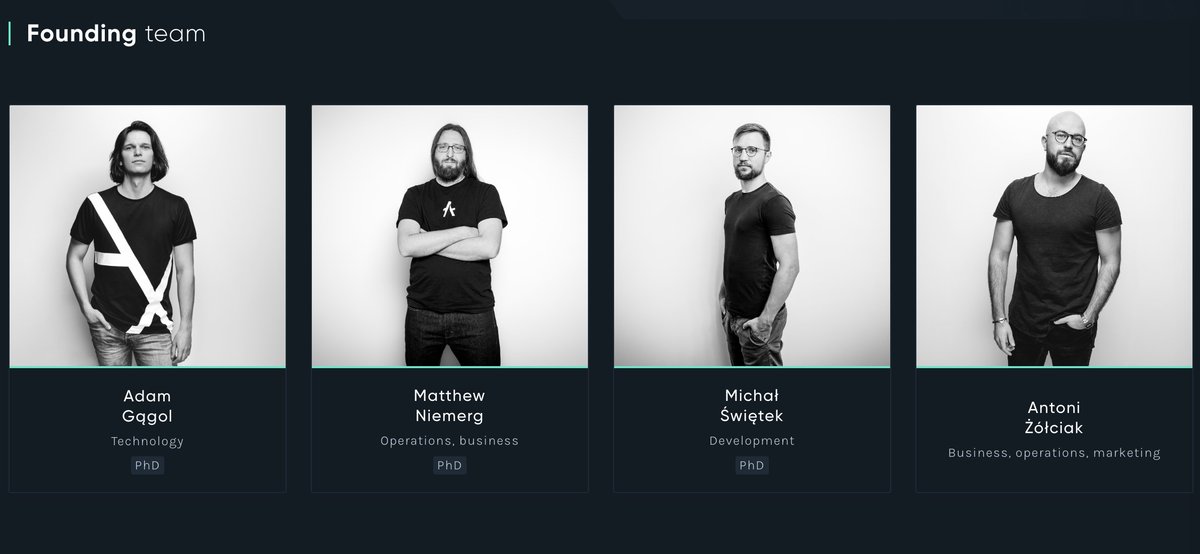

4️⃣ Team, Backer & Partners

📌 Core team: 37 members:

- 4 founders (3 PhDs)

- 20 in tech dep.

- 13 in marketing & business dep.

📌 Advisory board: 6 members

All team & advisory members are public. Significative experience in maths, blockchain & computer science.

📌 Core team: 37 members:

- 4 founders (3 PhDs)

- 20 in tech dep.

- 13 in marketing & business dep.

📌 Advisory board: 6 members

All team & advisory members are public. Significative experience in maths, blockchain & computer science.

📌 Others: @cardinal_hq VS is $azero's core developer & accelerator.

📌 Funding partners: $15m+ raised from 14 backers

=> Team is solid, public, and the project is technically & financially backed.

📌 Funding partners: $15m+ raised from 14 backers

=> Team is solid, public, and the project is technically & financially backed.

6️⃣ On-chain Analytics

📌 Active addresses: according to Subscan, activity increased significantly since Nov '22

📌 Revenue: $AZERO generates fees from transactions.

📌 Active addresses: according to Subscan, activity increased significantly since Nov '22

📌 Revenue: $AZERO generates fees from transactions.

📌 Volume: according to their Subscan, the volume of $azero increased significantly this Feb.

=> In 1-2 years from now, we will be able to evaluate their network effect capabilities by tracking TVL and holders increase.

=> In 1-2 years from now, we will be able to evaluate their network effect capabilities by tracking TVL and holders increase.

7️⃣ Competitors

$azero competitors are all infrastructure blockchain projects. i.e. L1 and L2s, as shown in the infographic.

The current FDV of @AZERO is only $480m

Compared to FDV of some other popular L1 protocols

$SOL: $12B

$DOT: $1.7B

$MATIC $12.5B

Any thoughts?

$azero competitors are all infrastructure blockchain projects. i.e. L1 and L2s, as shown in the infographic.

The current FDV of @AZERO is only $480m

Compared to FDV of some other popular L1 protocols

$SOL: $12B

$DOT: $1.7B

$MATIC $12.5B

Any thoughts?

9️⃣ Other info

$azero is listed on Kucoin, Huobi, MEXC, Gate, Bitrue, Uphold.

Has yet to be listed on major exchanges. Can be a price appreciation catalyst in a bull market environment.

Let's see!

$azero is listed on Kucoin, Huobi, MEXC, Gate, Bitrue, Uphold.

Has yet to be listed on major exchanges. Can be a price appreciation catalyst in a bull market environment.

Let's see!

My thread is inspired by @verumcapital deep research of $azero.

Thank you for reading!

Thank you for reading!

https://twitter.com/verumcapital/status/1623642412626198529

• • •

Missing some Tweet in this thread? You can try to

force a refresh