The big elephant in the room that hardly anyone is addressing: the cost of borrowing versus its availability. Up to this point, the Fed has only influenced the former, not the latter. And the former has not been enough to arrest end demand. 1/N

https://twitter.com/BobEUnlimited/status/1629468009906462721

People and businesses are still borrowing to fund current consumption and investment even if at a higher cost. Even if banks are pulling back loan books and tightening standards, the slack is being picked up in private lending (read shadow banking). 2/N

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

The Bbg article applies to LBOs funded by institutional investors via private credit and CLOs, but consumer lending also prevalent throughout #fintech such as BNPL. Asset securitization has played a huge role in expanding borrowing capacity. 3/N

FFR at 5% doesn't seem to impact the arb for securitized lending (so far) and QT only rolls back excess reserves for banks. As it stands now, the borrowing window remains open even if more expensive to tap into it. End. @CameronDawson @rhemrajani9 @JLinWins

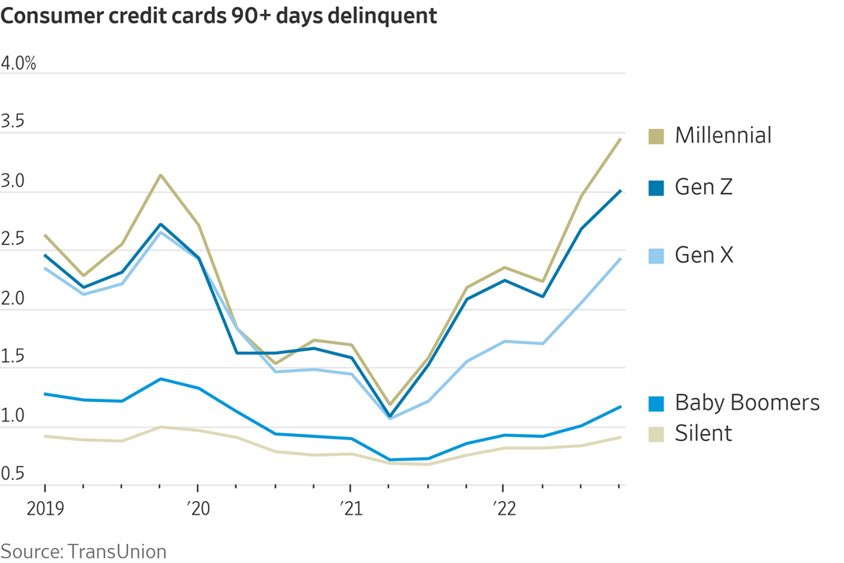

Addendum: case in point. This only becomes a problem if and when the cards are figuratively torn up. Or bank lines withdrawn, loan warehouses shut down, and CLO tranches downgraded, catalyzed by an actual economic contraction and rising unemployment.

And it looks like we’re about to cross the streams on non bank private lending (fintech + leveraged loans). This should end well. @JLinWins @rhemrajani9

https://twitter.com/business/status/1630530437155115010

• • •

Missing some Tweet in this thread? You can try to

force a refresh