Another condensed post tonight combining what I believe to be the most useful market data to help prepare for tomorrow. Show thread to see it all! 🧵👇

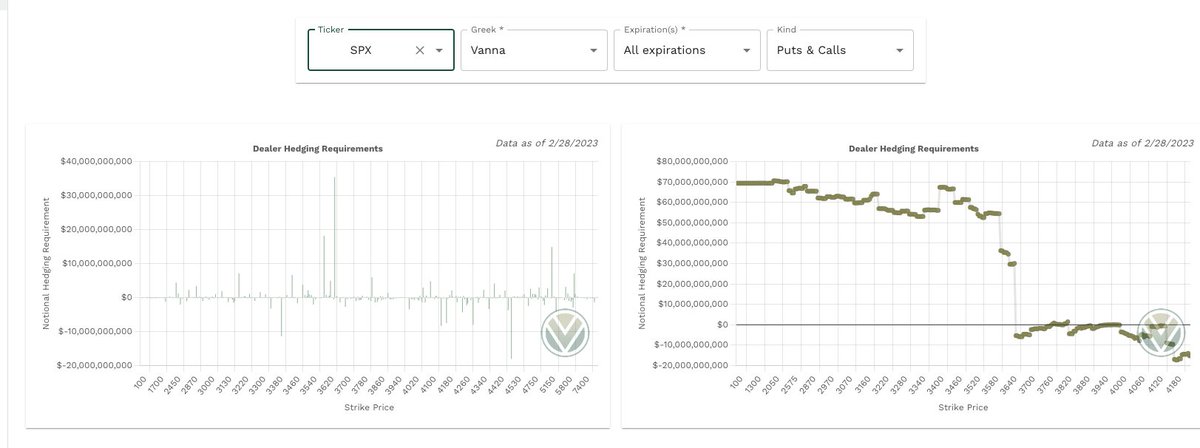

Lets start with #Vanna on $SPX & $SPY. $SPX cumulative Vanna picture still neutral in this range with positive vanna favoring downside and negative vanna hindering moves higher. $SPY is similar but with more positive vanna favoring downside should $VIX/IV rise.

Aggregate #Charm up next on $SPX & $SPY. $SPX charm is neutral as well, but slightly more negative which is slightly bullish. However, $SPY is still positive which favors downside. Combining the two has dealers doing slightly more selling as time decays.

Largest #Gamma levels on $SPX to put on your charts.

+GEX Levels (dealers resist moves into it):

3840, 3850, 3950, 4065, 4100

-GEX Levels (dealers assist moves into it):

3825, 4000, 4150, 4175

Screen shots of chart attached, 3950 still light support while above it.

+GEX Levels (dealers resist moves into it):

3840, 3850, 3950, 4065, 4100

-GEX Levels (dealers assist moves into it):

3825, 4000, 4150, 4175

Screen shots of chart attached, 3950 still light support while above it.

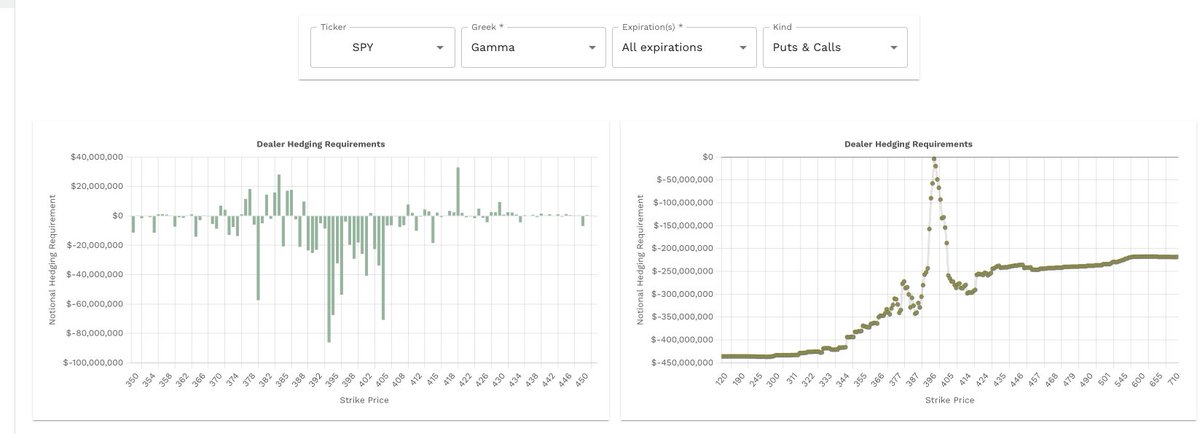

Largest #Gamma levels on $SPY to put on your charts.

+GEX Levels (dealers resist moves into it):

389

-GEX Levels (dealers assist moves into it):

390-397, 398-402, 403-405

398 flipped negative, volatile range, dealer assisted moves through due to all -GEX. See chart below.

+GEX Levels (dealers resist moves into it):

389

-GEX Levels (dealers assist moves into it):

390-397, 398-402, 403-405

398 flipped negative, volatile range, dealer assisted moves through due to all -GEX. See chart below.

The @Tradytics $SPY 3-day delta/price correlations show a 14% total chance of moving up to 0.9% higher and a 68% total chance of moving down as much as -3.7% over the next 3 days. Dealers are still long. Expected volatility slightly lower but still high.

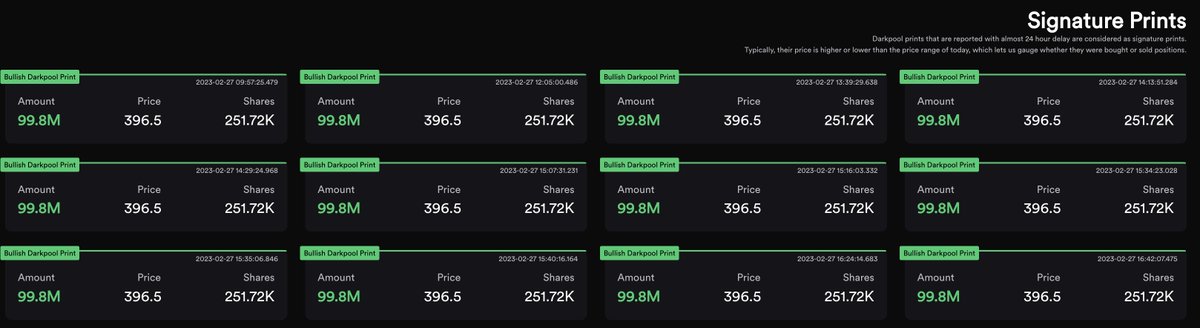

@Tradytics $SPY Dark Pools data shows various levels of support/resistance (see screen shots). Block trade sentiment is very bearish. Dark pool density map shows bearish prints in this area. Bullish signature prints @ 396.50 should we open above it.

We have some macro numbers hitting the pre market at 8:30AM and 9AM. Followed by more data at 9:45AM, 10AM and a Fed speaker (says AM but I think they mean 2:30pm).

It's pretty obvious what the market internals are showing here. The supportive +GEX on $SPY @ 398 has flipped negative. We do see signature prints @ 396.50 that will be supportive unless we gap under it, similar to how the sig print above price yesterday was the ceiling.

The Vanna outlook favors downside should $VIX/IV rise. The $SPX supportive +GEX @ 3950 isn't very significant and would be resistance if we open below. What really stands out to me is the Delta/Price correlations and the amount of -GEX on $SPY.

I can't recall ever seeing such a bearish picture on $SPY since I've been using this data. This means in the past, when deltas have been structured the way they are now, we've had significant downside. Outside of DP data, no GEX support until 389 and even that is light.

If we combine this with a basic trend line on $ES, we can see we simply retested the trend line that broke last week before dropping again when Jefferson spoke today. This was inline with the $SPY DP level I mentioned. If we are going off the data here, bearish moves ahead. 👀

The dealer data in this post is from vol.land and DP/Delta correlations from @Tradytics. Code FattyTrades will get you 10% off Vol.land. This link will do the same for @Tradytics.

tradytics.com/?ref_link=fatt…

tradytics.com/?ref_link=fatt…

• • •

Missing some Tweet in this thread? You can try to

force a refresh