Here is my evening rundown of $SPX and $SPY Dealer and Dark Pool data to prepare us for #optionstrading & #futurestrading tomorrow using data from @WizOfOps Vol.land and @Tradytics. Show thread to see it all! 🧵👇

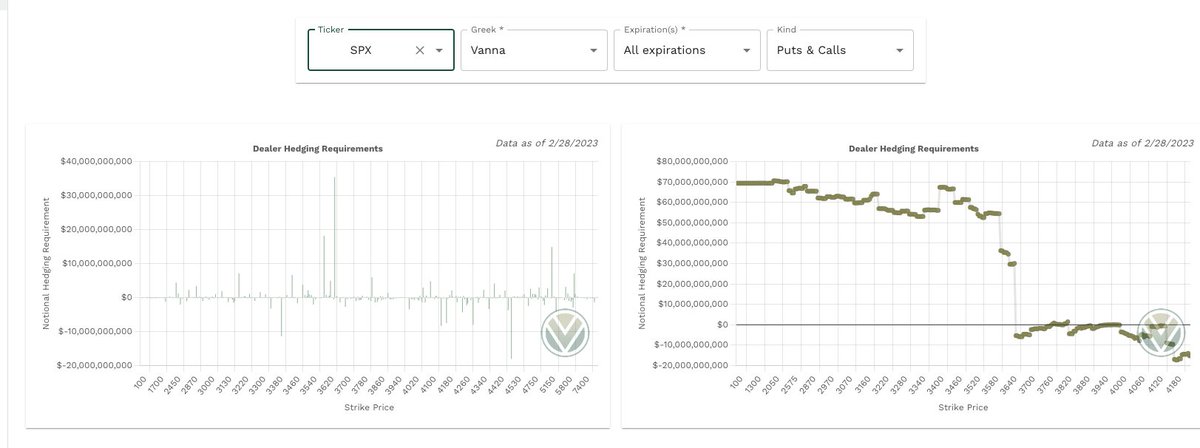

Lets start with #Vanna on $SPX & $SPY. $SPX cumulative Vanna picture still neutral in this range with positive vanna favoring downside and negative vanna hurting moves higher. $SPY is similar but with more positive vanna favoring downside should $VIX/IV continue to rise.

Aggregate #Charm up next on $SPX & $SPY. $SPX is now much more inline with $SPY with positive charm exceeding negative charm. This means dealer selling will take place as time passes on these contracts.

Largest #Gamma levels on $SPX to put on your charts.

+GEX Levels (dealers resist moves into it):

3925, 4065, 4100

-GEX Levels (dealers assist moves into it):

3825, 3900, 4000, 4150, 4175

Very light supportive positive GEX in the 3910 - 3950 region. Charts shared at the end.

+GEX Levels (dealers resist moves into it):

3925, 4065, 4100

-GEX Levels (dealers assist moves into it):

3825, 3900, 4000, 4150, 4175

Very light supportive positive GEX in the 3910 - 3950 region. Charts shared at the end.

Largest #Gamma levels on $SPY to put on your charts.

+GEX Levels (dealers resist moves into it):

386-387

-GEX Levels (dealers assist moves through it):

388, 390-399, 401-405

Large negative range for dealer assisted moves. Will share charts at the end.

+GEX Levels (dealers resist moves into it):

386-387

-GEX Levels (dealers assist moves through it):

388, 390-399, 401-405

Large negative range for dealer assisted moves. Will share charts at the end.

The @Tradytics $SPY 3-day dealer delta/price correlations show a 14% total chance of moving up to 0.9% higher and a 68% total chance of moving down as much as -3.7% over the next 3 days. Dealers are still long. Expected volatility still high.

@Tradytics $SPY Dark Pools data shows various levels of support/resistance (see screen shots). Block trade sentiment is very bullish. Dark pool density map showed bullish prints popping up as price dropped. Today, we clearly saw DP levels playing a big role in price movements.

We have a Fed speaker at 9AM pre market and macro numbers hitting at 9:45am and 10am. Be careful holding open positions during these number releases and during Fed speeches if trading futures pre market. Worth noting - China had good PMI numbers causing a rally in Asia session.

The dealer data across the market is still bearish. $SPX shifted more bearish from positive charm & with 3950 +GEX slipping away. $SPY lost some +GEX below as well. The one caveat is the DP block trade sentiment is bullish. Keep these levels in mind (chart link below).

Here is a link to a Tradingview chart that includes $VIX, $SPX w/ Gamma levels, $SPY with DP and Gamma levels & $DXY.

Red means negative GEX, green means positive GEX, white are dark pool levels. Thicker lines mean heavier dollar amount.

tradingview.com/chart/rjKQu0nV/

Red means negative GEX, green means positive GEX, white are dark pool levels. Thicker lines mean heavier dollar amount.

tradingview.com/chart/rjKQu0nV/

The dealer data in this post is from vol.land and DP/Delta correlations from @Tradytics. Code FattyTrades will get you 10% off Vol.land. This link will do the same for @Tradytics:

tradytics.com/?ref_link=fatt…

tradytics.com/?ref_link=fatt…

• • •

Missing some Tweet in this thread? You can try to

force a refresh