SaaS Metrics are more powerful when used together. In isolation, they offer less context.

Assess your CAC Profile to grasp the full picture of GTM efficiency.

🧵 Here’s a quick summary to help you analyze your CAC profile and grow. 📈 #saas

Assess your CAC Profile to grasp the full picture of GTM efficiency.

🧵 Here’s a quick summary to help you analyze your CAC profile and grow. 📈 #saas

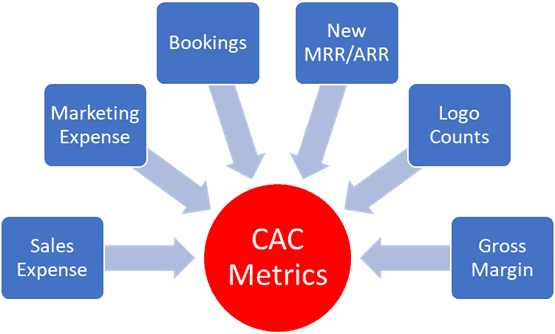

You will need the following inputs for CAC profile calculations:

1️⃣Sales expenses - wages, taxes, benefits, travel, commissions, CRM, training, etc.

2️⃣Marketing - marketing, paid ads, conferences, brand, swag, ESP, etc.

3️⃣Bookings - dollars and logo counts

1️⃣Sales expenses - wages, taxes, benefits, travel, commissions, CRM, training, etc.

2️⃣Marketing - marketing, paid ads, conferences, brand, swag, ESP, etc.

3️⃣Bookings - dollars and logo counts

4️⃣MRR/ARR - includes new, expansion, and maybe contraction

5️⃣Logo count - the number of new customers/users each month

6️⃣Gross Margin - recurring gross margin and maybe variable gross margin

5️⃣Logo count - the number of new customers/users each month

6️⃣Gross Margin - recurring gross margin and maybe variable gross margin

How to Assess Your CAC Performance?

To analyze your #SaaS CAC performance, use the following metrics:

✳️CAC: calculate CAC on a unit basis by dividing it by new customers acquired

✳️CAC Payback Period: after CAC, calculate the numbers required to pay back the upfront CAC

To analyze your #SaaS CAC performance, use the following metrics:

✳️CAC: calculate CAC on a unit basis by dividing it by new customers acquired

✳️CAC Payback Period: after CAC, calculate the numbers required to pay back the upfront CAC

✳️Cost of ARR (aka CAC Ratio): compare your sales and marketing expense against the new ARR or MRR that we are acquiring

✳️LTV to CAC: the customer lifetime value needs to be at least 3x your CAC. New data says 4x.

✳️LTV to CAC: the customer lifetime value needs to be at least 3x your CAC. New data says 4x.

✳️SaaS magic number: compare your annualized revenue growth to your previous quarter’s sales and marketing expense

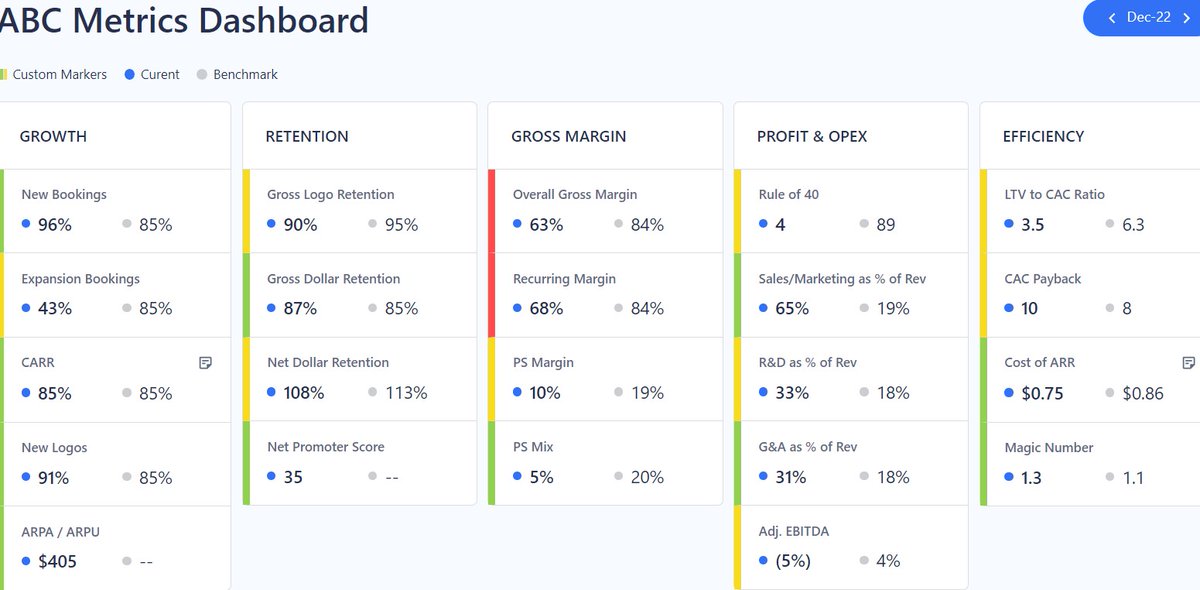

✳️Monthly metrics Dashboard: produce a monthly metrics dashboard like in the snippet below and compare against industry benchmarks

✳️Monthly metrics Dashboard: produce a monthly metrics dashboard like in the snippet below and compare against industry benchmarks

Want to explore CAC metrics or download my templates, check out my full article:

thesaascfo.com/how-to-assess-…

thesaascfo.com/how-to-assess-…

Need training on SaaS metrics? My April metrics course is open for enrollment! Learn more here: thesaasacademy.com/saas-metrics-f…

• • •

Missing some Tweet in this thread? You can try to

force a refresh