🧪 How do you find the new #100x GEM?

Conduct DeFi token research easily with the research library I have created; @Blooomlabs

🧵 Thread. (Mad instructions)

Conduct DeFi token research easily with the research library I have created; @Blooomlabs

🧵 Thread. (Mad instructions)

1. Finding the hidden token.

You start by heading over to "🐳 Whales & Smart Money" section.

-- In this section, I have already added many high-IQ trader wallet addresses I have found through several strategies.

You go over to the bookmarked link and scan them.

You start by heading over to "🐳 Whales & Smart Money" section.

-- In this section, I have already added many high-IQ trader wallet addresses I have found through several strategies.

You go over to the bookmarked link and scan them.

High IQ traders are hard to find; I find them for you or teach you how to do so with Blooomlabs.

Using DeBankDeFi we can then see what the High IQ traders are doing.

- One token is interesting.

A trader has allocated over 56% of his portfolio to it.

Using DeBankDeFi we can then see what the High IQ traders are doing.

- One token is interesting.

A trader has allocated over 56% of his portfolio to it.

We found a potential token; now it's time to validate it.

Name: @vestafinance

Ticker: $VSTA

Ecosystem: @arbitrum

Name: @vestafinance

Ticker: $VSTA

Ecosystem: @arbitrum

Fast information overview.

You go to the exclusive @Blooomlabs telegram chat:

And using the @definedfi bot, you easily get a lot of information before even doing a google search about the token.

You go to the exclusive @Blooomlabs telegram chat:

And using the @definedfi bot, you easily get a lot of information before even doing a google search about the token.

What interests me is this info:

✦ Latest price action: Negative.

(This means I'm not late if the token is good).

✦ Current market cap: $3,5m (very low!)

✦ Liquidity: $7.7k ( 🚨 very low)

✦ Latest price action: Negative.

(This means I'm not late if the token is good).

✦ Current market cap: $3,5m (very low!)

✦ Liquidity: $7.7k ( 🚨 very low)

✦ Volume: $483 (very low).

Either it's very early or there is no trading at all. This can be a good or bad sign.

Back to Vesta finance. What do they do?

⬇️

Either it's very early or there is no trading at all. This can be a good or bad sign.

Back to Vesta finance. What do they do?

⬇️

Vesta Website:

They are creating a stablecoin for the Arbitrum ecosystem through collateral lending vaults.

Immediately a project comes to mind, #MakerDAO.

-- The biggest DeFi application on Ethereum with the most popular decentralized stablecoin $DAI.

They are creating a stablecoin for the Arbitrum ecosystem through collateral lending vaults.

Immediately a project comes to mind, #MakerDAO.

-- The biggest DeFi application on Ethereum with the most popular decentralized stablecoin $DAI.

This makes $VSTA more interesting.

Their website shows me that TVL is $21.47m

This means 6X the current market cap!

Their website shows me that TVL is $21.47m

This means 6X the current market cap!

I then head over to @GeckoTerminal, which I have embedded into @blooomlabs platform.

I see the price, individual pools and more information!

I see the price, individual pools and more information!

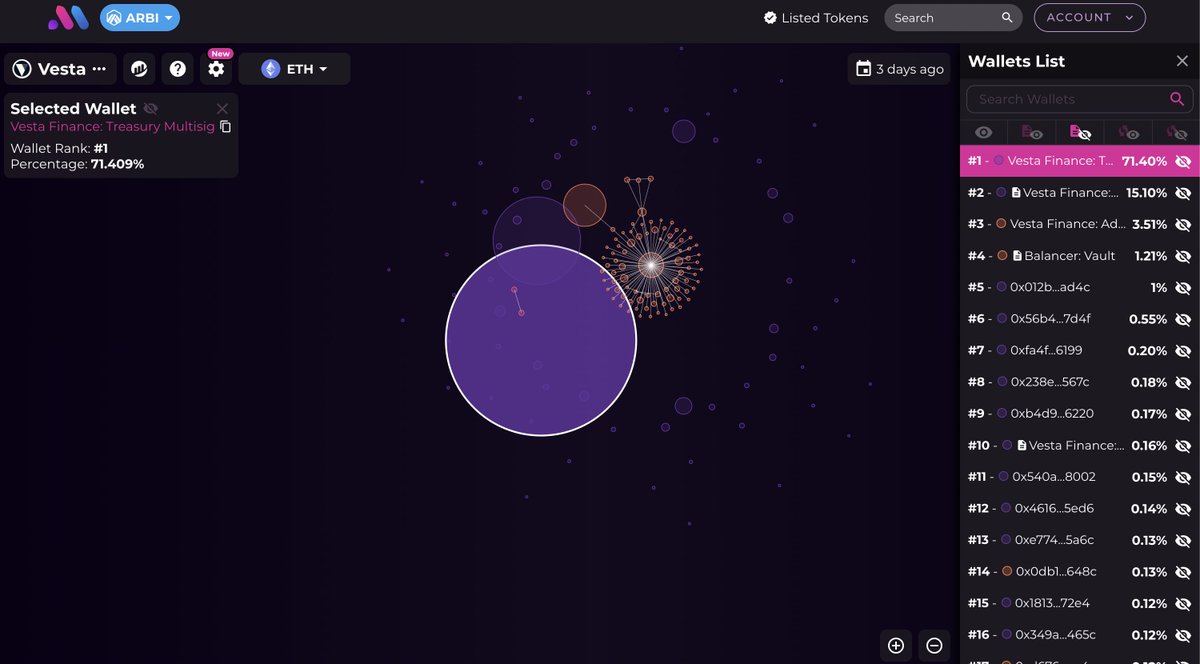

Now, we head over to Bubblemaps (outside of blooomlabs).

Here we see good and bad things. Vesta Finance team owns 71.4% of the entire token supply in their treasury.

However, Vesta finance has active user over at Balancer.

Here we see good and bad things. Vesta Finance team owns 71.4% of the entire token supply in their treasury.

However, Vesta finance has active user over at Balancer.

Centralized supply distribution.

We also know the circulating supply of $VSTA is under 10% of the total supply.

These factors together immediately make me reconsider buying $VSTA...

We also know the circulating supply of $VSTA is under 10% of the total supply.

These factors together immediately make me reconsider buying $VSTA...

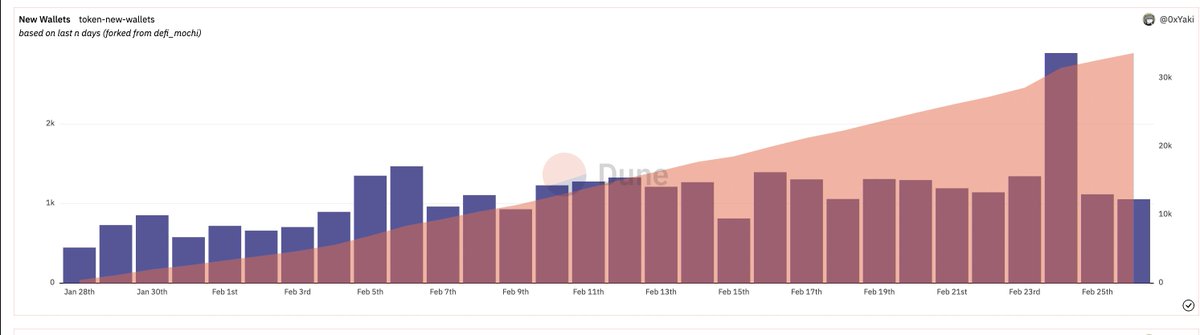

However, let's head over to Dune using the Token Dawg Mode🐶 by @0xYakitori. (Free tool)

This and many other tools are listed over at "Top Dune Dashboards".

This and many other tools are listed over at "Top Dune Dashboards".

In general @vestafinance is an interesting token.

The above research was conducted with @blooomlabs and other external resources.

An instruction on how to find and evaluate a token.

The above research was conducted with @blooomlabs and other external resources.

An instruction on how to find and evaluate a token.

Rumour has it @defi_mochi holds $VSTA

https://twitter.com/defi_mochi/status/1630237874452049920?s=20

This thread is not financial advice, but rather how you can use the tool to get a complete overview of the token in question.

In this case: $VSTA

In this case: $VSTA

Using the DeFi research library @blooomlabs;

- You found a token amongst a list of Smart Money traders

- Evaluated the potential catalyst token

- Cross-checked potential together with other sources

Now, I added this token to the list of "🔥 Upcoming Tokens"

- You found a token amongst a list of Smart Money traders

- Evaluated the potential catalyst token

- Cross-checked potential together with other sources

Now, I added this token to the list of "🔥 Upcoming Tokens"

DeFi research can be done for free, but it's sometimes a hassle and takes a lot of time.

That is why I advise @Blooomlabs for effectiveness and simplicity!

Recent overview thread:

That is why I advise @Blooomlabs for effectiveness and simplicity!

Recent overview thread:

https://twitter.com/CryptoBlooom/status/1630887491052904448

If you want to try it out, I have a special deal for the readers of this thread.

Get 30% off using the code: “Thread”

(Some geeks took advantage of the already 20% choosing the 3-month plan and got 3-month access for $32)

All the Alpha for 50% off

blooomlabs.gumroad.com/l/tzwk

Get 30% off using the code: “Thread”

(Some geeks took advantage of the already 20% choosing the 3-month plan and got 3-month access for $32)

All the Alpha for 50% off

blooomlabs.gumroad.com/l/tzwk

New link: blooomlabs.gumroad.com/l/tzwks

• • •

Missing some Tweet in this thread? You can try to

force a refresh