1 THREAD on the SC’s order today constituting an expert committee to enquire into the #Hindenburg allegations. The supreme irony is that #SEBI gets away scot-free. Crucially, invoking the holy grail of “investor protection” is how #SEBI escapes court criticism/scrutiny

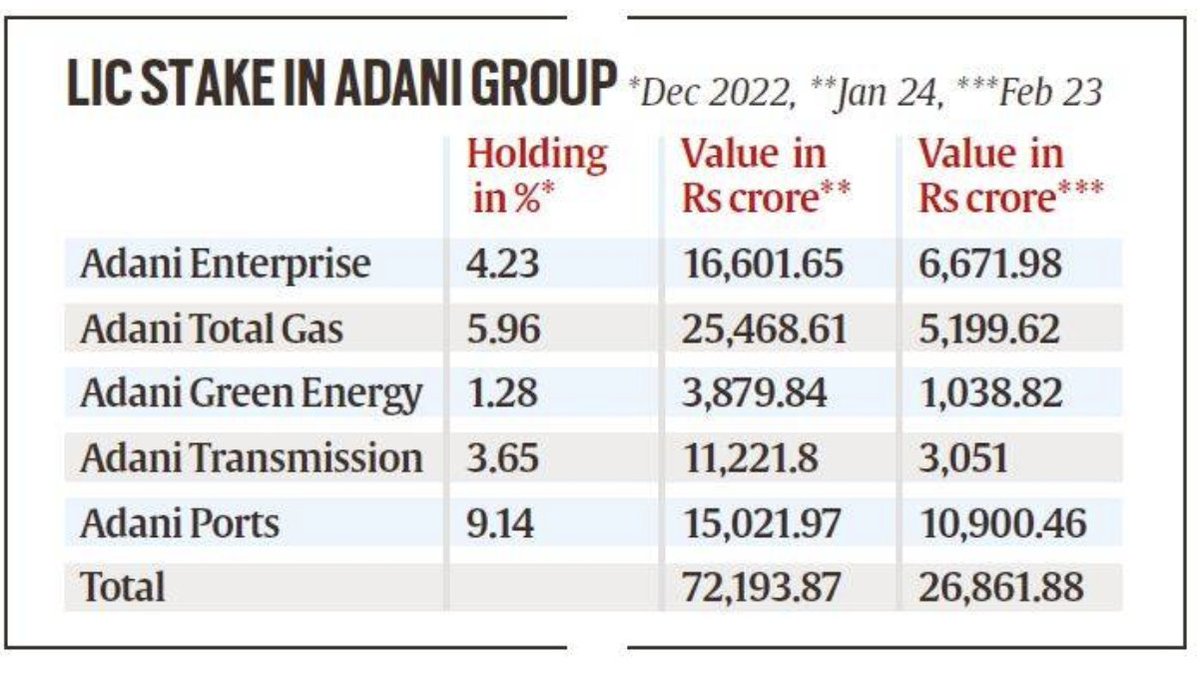

2 It is important to reiterate that crux of the Hindenburg allegations rest on the claim that the ownership of the #Adani Group Cos is concentrated above SEBI-set levels through entities not at arms length from the promoters. The rest of the allegations stem from this central one

3 The overvaluation of group company stocks and therefore of the companies is made possible because of the low “free float” - implying scope for manipulation - which then enables the #Adani Group to leverage even greater volumes of debt

4 The issue of volatility, which the court seems to be deeply concerned about, is actually a non-issue becos #SEBI as custodian is supposed to in a state of nirvana, unaffected by the worldly issues of stock prices movements - in effect a supreme believer that the mkt knows best

5 It is not #SEBIs remit to check volatility — UNLESS they arise from manifest violations of trading regulations (insider trading, etc). It is supposed to be agnostic to movements (up or down) of share prices, even violent ones.

6 The “investor protection” issue is the big big red herring, which the SC seems to latched on to with an innocence that is touching, but grossly misplaced.

7 First, it allows #SEBI to get away with utter failure to enquire long-pending allegations against #Adani of violations of SE listing rules.Recall @MahuaMoitra question from almost 18 months ago in Parliament revealing #SEBI was “enquiring” then. Still at it, Mr #SEBI?

8 The “investor protection” angst that the SC has shown has no place in a market-driven system. SEBI actually said as much in its affidavit. The Court’s concern when prices drop - not even of the wider market but only of a group - is curious.

9 The question to ask is why the SC expressed no concern when stock prices (that too in the wider market) has been on an upsurge that fundamentals do not warrant. This one-sided “concern” creates a deep incongruity in the market.

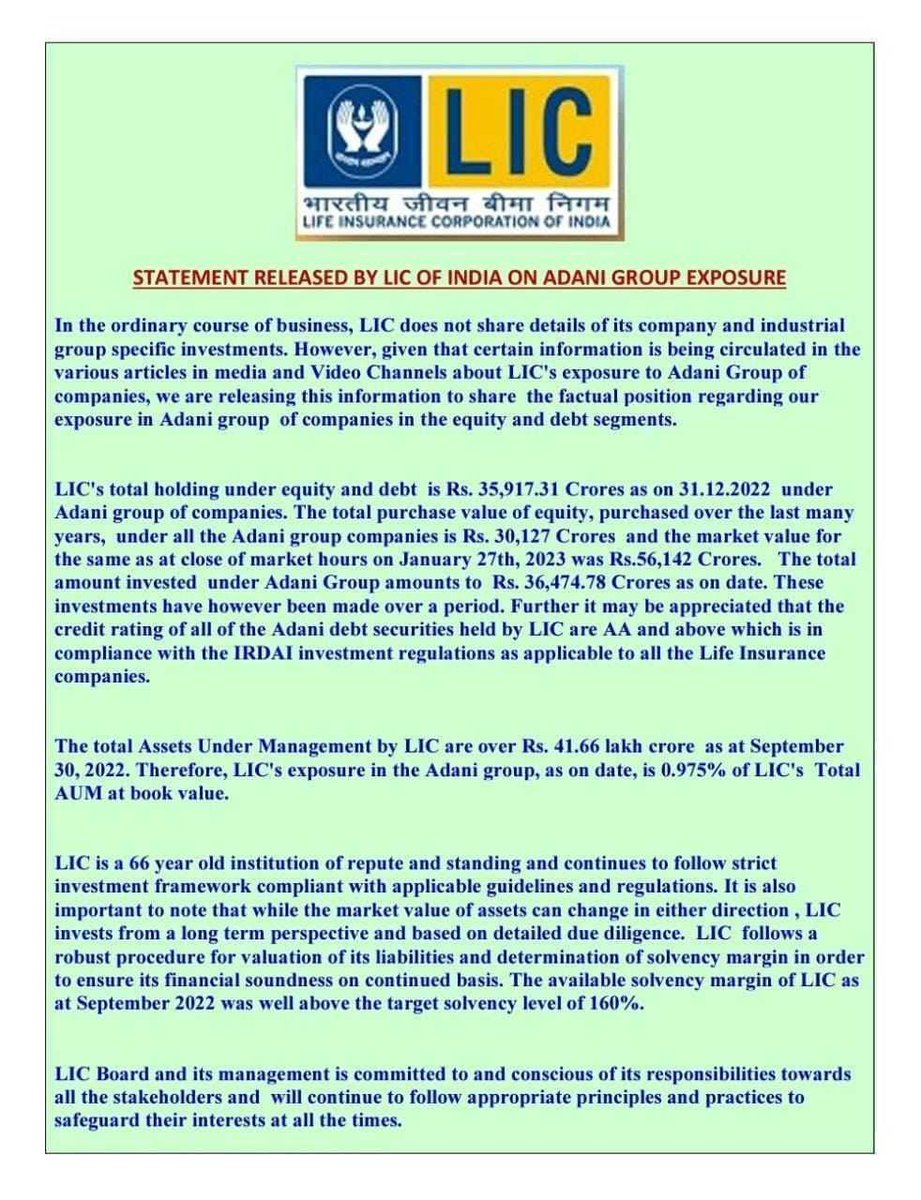

10 Second, by now #SEBI’s prolonged investigation into the allegations of holdings in #Adani Cos ought to have led it to rope in the services of the enforcement agencies that are meant to track economic offences - IT Dept, Customs, ED, RBI.

11 As a regulator of the capital markets in india it is #SEBI that ought to have triggered a wider investigation marshalling all the agencies. That is becos the cause of action would have emanated from the core allegations in the #Hindeburg report.

12 Instead, today’s SC observation that “SEBI is seized of the investigation” is laughable when the world knows that SEBI’s regulatory forbearance of the Adani Group has been excessive, suggestive of lethargy at best, or capture at worst.

13 The SC has asked SEBI to “investigate” whether #Adanis have failed to report “related part(ies)” transactions. But wasn’t this what SEBI has already been “investigating” for >18 months? And then the SC proceeds to provide the escape route for SEBI.

14 The SC does this by asking SEBI to “investigate” whether there have been “manipulations” of stock prices. This is a non-issue as elementary knowledge of trading in low-float stocks would testify.

15 When there is poor float, the amplitude of fluctuations - both ways - would be exaggerated simply because there are few stocks on offer. That is just simple logic, as the #Adanis themselves have learnt painfully in the last month and more.

16 IMO the SC has overloaded the agenda of the committee to the point that the core issues that need urgent scrutiny would be swamped by trivialities and “concerns” (about market movements) that have no valid legal scope of redressal.

17 The impression that one gets from today’s order is that the SC has treated #SEBI with kid gloves, especially after SEBI has failed disastrously to protect the credibility and integrity of Indian capital markets. That is what is really at stake. (END)

@threadreaderapp pl unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh