#RealYield just got more real on Pendle!

Starting today, our new home in #Arbitrum will house everyone’s favourite jam - $GLP by @GMX_IO 🫐

With just a little Pendle magic, you can harness the full potential of this powerful asset 🧵

Starting today, our new home in #Arbitrum will house everyone’s favourite jam - $GLP by @GMX_IO 🫐

With just a little Pendle magic, you can harness the full potential of this powerful asset 🧵

What is $GLP?

$GLP is the liquidity provider (LP) token of #GMX.

$GLP holds a composition of assets which are used to facilitate the platform’s swaps and leverage trading.

$GLP is the liquidity provider (LP) token of #GMX.

$GLP holds a composition of assets which are used to facilitate the platform’s swaps and leverage trading.

Like other yield-bearing LP tokens, you can earn yield just from holding $GLP alone, including 70% of the platform fees.

As $GLP holders provide liquidity for trading, you will also make a profit when traders make a loss and vice versa.

As $GLP holders provide liquidity for trading, you will also make a profit when traders make a loss and vice versa.

The beauty of this yield is that most of it is generated through protocol revenue, not short-term, inflationary emissions.

This is what makes it #RealYield.

But what if you could make this #RealYield even more…real?

Enter Pendle.

This is what makes it #RealYield.

But what if you could make this #RealYield even more…real?

Enter Pendle.

As a $GLP holder, you’re already earning #RealYield consistently.

But like most things, there are good days, and there are bad days for yield, that's just the nature of this space.

But like most things, there are good days, and there are bad days for yield, that's just the nature of this space.

So what makes #RealYield more real? Consistency. Stability. Predictability.

Pendle lets you obtain a Fixed Yield on GLP and helps you take the win on the good days, for all days to come.

Pendle lets you obtain a Fixed Yield on GLP and helps you take the win on the good days, for all days to come.

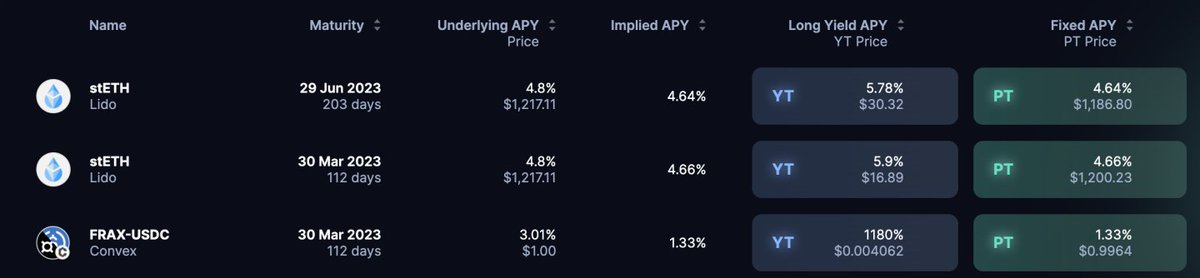

Currently, you can get a Fixed Yield of 18.2% APY on $GLP on Pendle.

This number can change depending on the yield market on Pendle, and opportunities are aplenty for the most attentive of users 👀

⚠️ Reminder to switch the network from Ethereum to Arbitrum in app

This number can change depending on the yield market on Pendle, and opportunities are aplenty for the most attentive of users 👀

⚠️ Reminder to switch the network from Ethereum to Arbitrum in app

For those who prefer the idea of stacking yield and fees on top of $GLP, you can provide liquidity on Pendle for up to 249% boosted APY - all while maintaining a fixed-yield exposure to $GLP.

As long as you hold the position to maturity, Pendle LPs will suffer from zero IL.

As long as you hold the position to maturity, Pendle LPs will suffer from zero IL.

The Pendle rabbithole goes deep, with many more ways to power up your $GLP position:

✨Buying at a discount

✨Advanced yield trading strategies

✨Fixed yield exposure through PT

✨Single-sided liquidity provision + zero IL

In the right hands, Pendle can be a very powerful tool.

✨Buying at a discount

✨Advanced yield trading strategies

✨Fixed yield exposure through PT

✨Single-sided liquidity provision + zero IL

In the right hands, Pendle can be a very powerful tool.

Like index funds, $GLP strives for consistent growth, with a natural hedge against volatility through diversification.

Pendle helps you kick things up a notch by locking in these returns. No matter what happens, the good days will still be here ☀️

trckr.com/4c7vzbg

Pendle helps you kick things up a notch by locking in these returns. No matter what happens, the good days will still be here ☀️

trckr.com/4c7vzbg

• • •

Missing some Tweet in this thread? You can try to

force a refresh