Shibarium's Massive Rising Power, $SHIB

Shibarium Websie is now live!

1)

The burn rate of $SHIB increased by 1700% in just one day on Feb 27 after Shibarium senior developer Shytoshi Kusama tweeted a link to the company's website.

#shibarium

Shibarium Websie is now live!

1)

The burn rate of $SHIB increased by 1700% in just one day on Feb 27 after Shibarium senior developer Shytoshi Kusama tweeted a link to the company's website.

#shibarium

2)

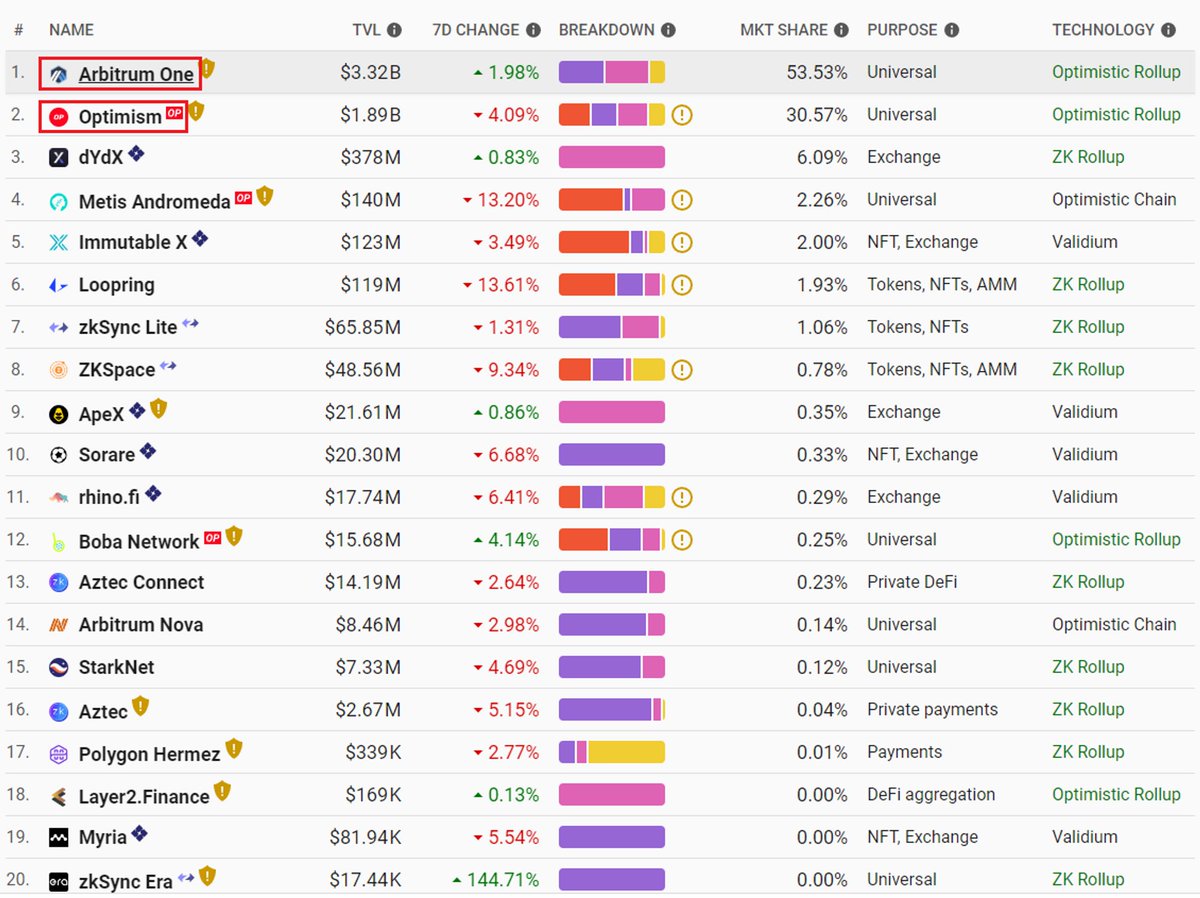

Shibarium is an L2 network that offers increased transaction speed and security at a lower cost for the $SHIB ecosystem ($SHIB, $LEASH & $BONE).

Players can own, purchase, and sell digital assets in games and the metaverse using Shibarium.

Shibarium is an L2 network that offers increased transaction speed and security at a lower cost for the $SHIB ecosystem ($SHIB, $LEASH & $BONE).

Players can own, purchase, and sell digital assets in games and the metaverse using Shibarium.

3) Shibarium’s GAS, $BONE

$BONE is a native token paid for Shibarium's network fees and rewarded to Validators and Delegators.

$BONE must be paid in proportion to the resources needed to run a particular task, and $BONE paid is rewarded to Validators and Delegators.

$BONE is a native token paid for Shibarium's network fees and rewarded to Validators and Delegators.

$BONE must be paid in proportion to the resources needed to run a particular task, and $BONE paid is rewarded to Validators and Delegators.

4)

Validators are limited to 100 and require a minimum stake of 10K $BONE.

Additionally, $TREAT is provided to Validators and Delegators. $TREAT incentivizes liquidity pools and provides low network fees.

Validators are limited to 100 and require a minimum stake of 10K $BONE.

Additionally, $TREAT is provided to Validators and Delegators. $TREAT incentivizes liquidity pools and provides low network fees.

5) Burn Portal

Every time a transaction is made on the Shibarium network, a specific amount of $SHIB will be burned through the Burn Portal as part of the transaction's basic GAS FEE.

This implies that $SHIB might eventually turn into a deflationary token.

Every time a transaction is made on the Shibarium network, a specific amount of $SHIB will be burned through the Burn Portal as part of the transaction's basic GAS FEE.

This implies that $SHIB might eventually turn into a deflationary token.

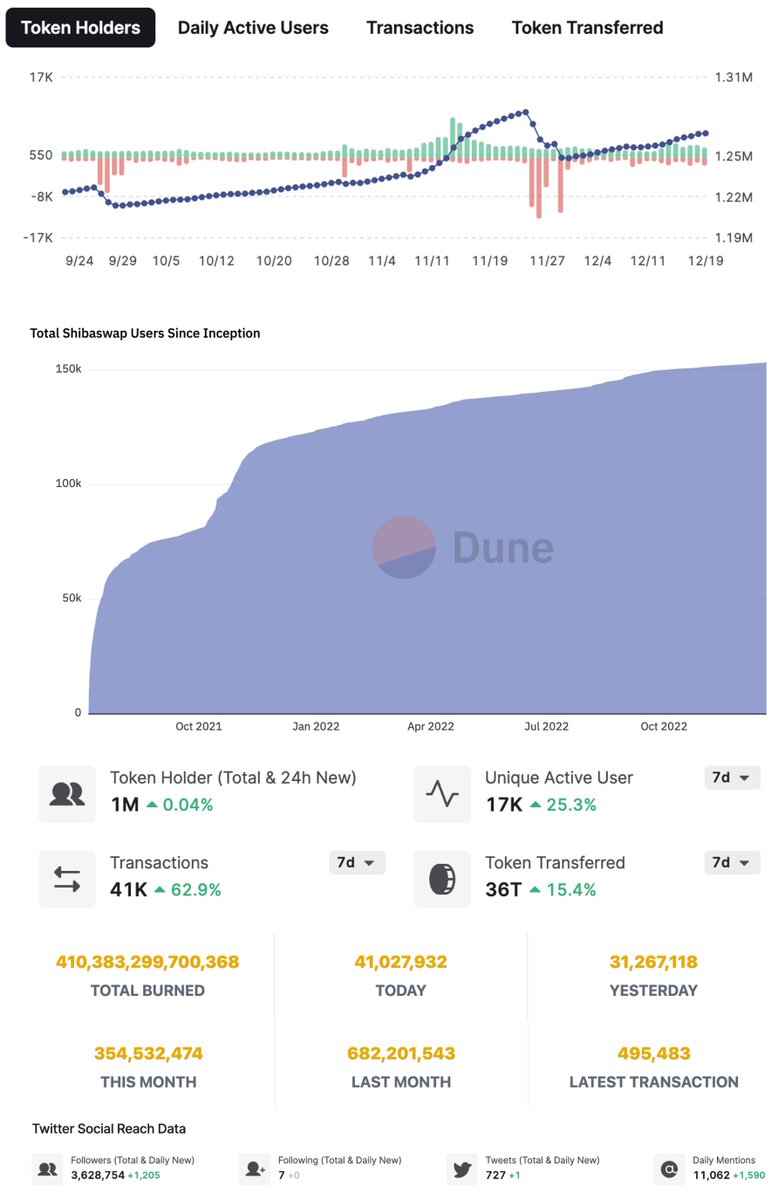

6) Integration with ShibaSwap, Shibarium

ShibaSwap will be integrated into the platform as part of Shibarium's mainnet, making tools and features more accessible and giving users and validators/delegators quick access to all staking and liquidity pools.

ShibaSwap will be integrated into the platform as part of Shibarium's mainnet, making tools and features more accessible and giving users and validators/delegators quick access to all staking and liquidity pools.

7)

ShibaSwap's daily transactions are steadily increasing, and the number of ShibaSwap's users is also constantly increasing.

ShibaSwap's daily transactions are steadily increasing, and the number of ShibaSwap's users is also constantly increasing.

8) Meme token meta driven by Shibarium

If Shibarium is successfully launched, other meme tokens will venture mark Shibarium to release games and metaverses, and are expected to expand to other chains as well.

If Shibarium is successfully launched, other meme tokens will venture mark Shibarium to release games and metaverses, and are expected to expand to other chains as well.

9)

It is very likely that $SHIB will drive the price increase of meme tokens now if $DOGE was the main axis and led the rise of meme tokens in the past.

*During Shibarium's beta period, all tokens and Dapps on Shibarium now will be used for testing purposes only. So do not buy!

It is very likely that $SHIB will drive the price increase of meme tokens now if $DOGE was the main axis and led the rise of meme tokens in the past.

*During Shibarium's beta period, all tokens and Dapps on Shibarium now will be used for testing purposes only. So do not buy!

• • •

Missing some Tweet in this thread? You can try to

force a refresh