Curious what's going on with #cannabis stocks?

Here are 5 charts you need to see🧵

$VRNO $TRUL $CURA $CCHW $AYR $CL $GTII

Here are 5 charts you need to see🧵

$VRNO $TRUL $CURA $CCHW $AYR $CL $GTII

Current Ratio: Measures if they can pay current liabilities if due today. Below 1 is bad.

If you exclude inventories which can't all be sold at once only 3 of 7 can pay current liabilities.

If you exclude inventories which can't all be sold at once only 3 of 7 can pay current liabilities.

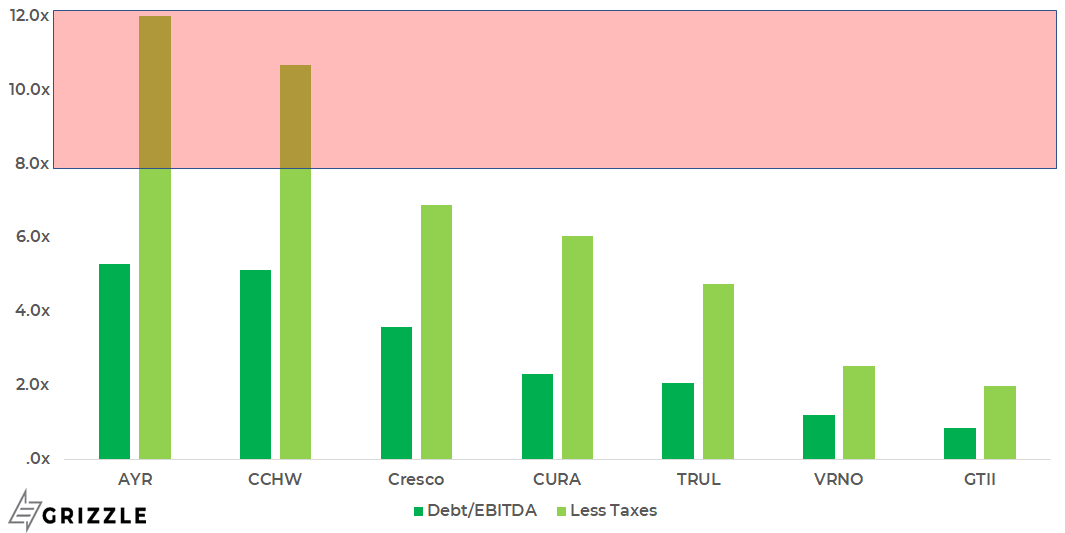

All companies getting up there on debt levels. If we take off tax payments which they have been paying even with operating "losses" not a lot of borrowing room left except for the bottom 4.

EBITDA = cash available to pay debt

EBITDA = cash available to pay debt

This chart shows if they can afford interest on debt. Below 1 means you can't afford your interest from internally generated cashflow. 2x is probably the bare minimum I would want to see, 6 out of 7 look ok.

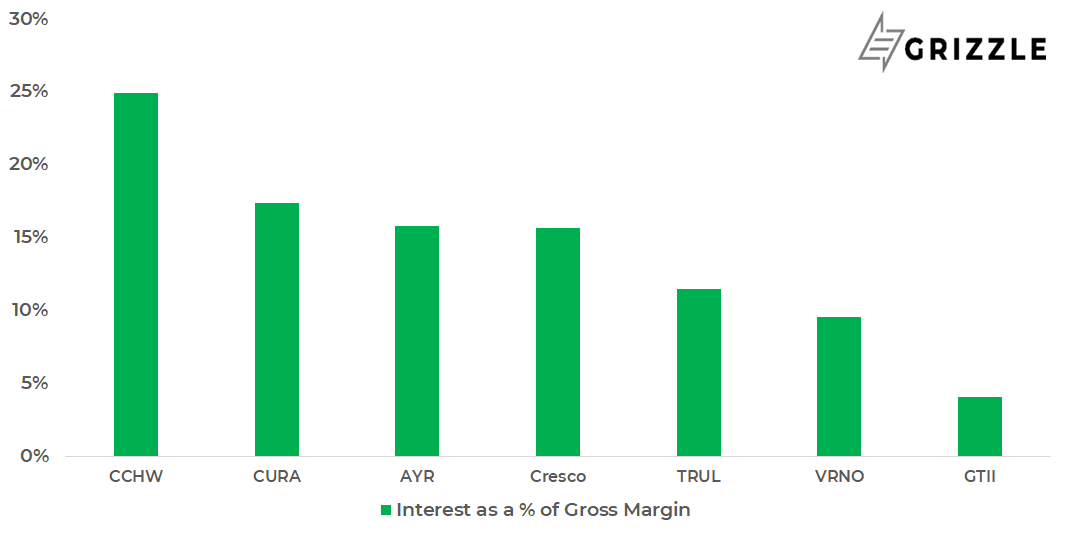

This chart looks at the cost of interest to the business (Gross Margin). $CCHW loses 25% of every $1 they make to interest before they even think of paying employees, marketing etc..

Borrowing as a cannabis business isn't cheap

Borrowing as a cannabis business isn't cheap

And the last chart: 1 year change in gross margin (underlying business profitability).

Everyone saw a 7%-30% fall in gross margins over the last year.

Only $VRNO increased margins

Everyone saw a 7%-30% fall in gross margins over the last year.

Only $VRNO increased margins

Bottom Line: #potstocks are facing borrowing and profit headwinds. They need to cut costs as prices fall to maintain profitability.

With most debt not due until 2024/2025 bankruptcy is unlikely for now, but without legal change, its hard to see things getting better soon.

With most debt not due until 2024/2025 bankruptcy is unlikely for now, but without legal change, its hard to see things getting better soon.

If you liked this thread, you can find my latest research on the cannabis industry here:

grizzleresearch.substack.com

grizzleresearch.substack.com

Also you may be wondering why Canadian stocks aren't in this analysis? Its because none of the big canadian potstocks are profitable. 😭

• • •

Missing some Tweet in this thread? You can try to

force a refresh