🧵(1/33)

Did you know @ConvexFinance $cvxCRV has been depegged for 3 months?

Read this thread and you will know it.

Likes/ Retweet/ Comment, please🫡

@CurveFinance @iearnfinance @ConvexFinance @StakeDAOHQ

#Curve #Curvewar #defi

Did you know @ConvexFinance $cvxCRV has been depegged for 3 months?

Read this thread and you will know it.

Likes/ Retweet/ Comment, please🫡

@CurveFinance @iearnfinance @ConvexFinance @StakeDAOHQ

#Curve #Curvewar #defi

(2/33)

$cvxCRV has been depegged for three months.

Why did that happen, and what will occur in the future?

In this thread, I will mainly cover four topics

1️⃣ Curve Eco brief

2️⃣ Depeg Event

3️⃣ Market Equilibrium

4️⃣ Mike's Memo

$cvxCRV has been depegged for three months.

Why did that happen, and what will occur in the future?

In this thread, I will mainly cover four topics

1️⃣ Curve Eco brief

2️⃣ Depeg Event

3️⃣ Market Equilibrium

4️⃣ Mike's Memo

(3/33)

1️⃣ Curve Eco brief

Before discussing depeg, we need to understand the following:

🌬The emission of $CRV

🪙Curve Tokenomics - $CRV and $veCRV

Curve is a very complex protocol, I don't think I can fully cover it in a thread, I will only do the brief in this thread

1️⃣ Curve Eco brief

Before discussing depeg, we need to understand the following:

🌬The emission of $CRV

🪙Curve Tokenomics - $CRV and $veCRV

Curve is a very complex protocol, I don't think I can fully cover it in a thread, I will only do the brief in this thread

(4/33)

🌬The emission of $CRV

🔸Max supply: 3.03 billion $CRV.

🔸Community LP: 1.1 billion $CRV, which is 57% of total supply.

Community incentive tokens are allocated for liquidity incentives a.k.a. emissions🌬

🌬The emission of $CRV

🔸Max supply: 3.03 billion $CRV.

🔸Community LP: 1.1 billion $CRV, which is 57% of total supply.

Community incentive tokens are allocated for liquidity incentives a.k.a. emissions🌬

(5/33)

Every year, $CRV emissions decrease by -15.9%, see the gray part of the diagram.

🌬Emissions can bring a positive impact:

Emissions → More LPs come in → Deeper liquidity →more fees for LPs

Every year, $CRV emissions decrease by -15.9%, see the gray part of the diagram.

🌬Emissions can bring a positive impact:

Emissions → More LPs come in → Deeper liquidity →more fees for LPs

(6/33)

We are currently in 2022/08/14-2023/08/14 (3 of 6)

During this period, 532,394 $CRV will be given to liquidity providers on Curve as an incentive, which is approximately

$596,281 USD per day or $17,888,430 USD per month

More details please check on @Token_Unlocks

We are currently in 2022/08/14-2023/08/14 (3 of 6)

During this period, 532,394 $CRV will be given to liquidity providers on Curve as an incentive, which is approximately

$596,281 USD per day or $17,888,430 USD per month

More details please check on @Token_Unlocks

(7/33)

🪙Curve Tokenomic - $CRV & $veCRV

Despite $CRV being a gov token, users cannot use it to vote on proposals, share revenue, etc.

To gain utility from $CRV, users must #LOCK their tokens into Curve to get $veCRV.

This action is irreversible, and $veCRV is untradeable🥶

🪙Curve Tokenomic - $CRV & $veCRV

Despite $CRV being a gov token, users cannot use it to vote on proposals, share revenue, etc.

To gain utility from $CRV, users must #LOCK their tokens into Curve to get $veCRV.

This action is irreversible, and $veCRV is untradeable🥶

(8/33)

We won't go into all the details about Curve tokenomics.

All we need to know is that $veCRV holders have

🚜Yield right

🏃♂️Boost right

👨⚖️Governance right

But they don't have

💦Liquidity

$veCRV holders can‘t transfer their $veCRV or take back their $CRV from smart contract.

We won't go into all the details about Curve tokenomics.

All we need to know is that $veCRV holders have

🚜Yield right

🏃♂️Boost right

👨⚖️Governance right

But they don't have

💦Liquidity

$veCRV holders can‘t transfer their $veCRV or take back their $CRV from smart contract.

(9/33)

However, lacking liquidity is a significant pain point in the crypto industry.

Convex has created a delicate Convex flywheel, which is not detailed in this article

I made a mindmap to help understand Convex flywheel

However, lacking liquidity is a significant pain point in the crypto industry.

Convex has created a delicate Convex flywheel, which is not detailed in this article

I made a mindmap to help understand Convex flywheel

(10/33)

I will be happy to write another thread to intro @ConvexFinance

If you want to see this thread, plz leave comments to let me know!

I will be happy to write another thread to intro @ConvexFinance

If you want to see this thread, plz leave comments to let me know!

(11/33)

The Convex flywheel includes wrapped token $cvxCRV

$cvxCRV holders have

🔥🚜Higher Yield

💦Liquidity

But they don't have

🏃♂️Boost right

👨⚖️Governance right

The Convex flywheel includes wrapped token $cvxCRV

$cvxCRV holders have

🔥🚜Higher Yield

💦Liquidity

But they don't have

🏃♂️Boost right

👨⚖️Governance right

(12/33)

This innovation has enabled Convex to acquire users very quickly

Currently

# of Circ $CRV: 1.2b

# of $veCRV: 567m

Convex holds 288m $veCRV = 50% of the $veCRV supply

Giving them the power to decide the allocation of emissions of $8.9m per month (half of $17,888,430)

This innovation has enabled Convex to acquire users very quickly

Currently

# of Circ $CRV: 1.2b

# of $veCRV: 567m

Convex holds 288m $veCRV = 50% of the $veCRV supply

Giving them the power to decide the allocation of emissions of $8.9m per month (half of $17,888,430)

(13/33)

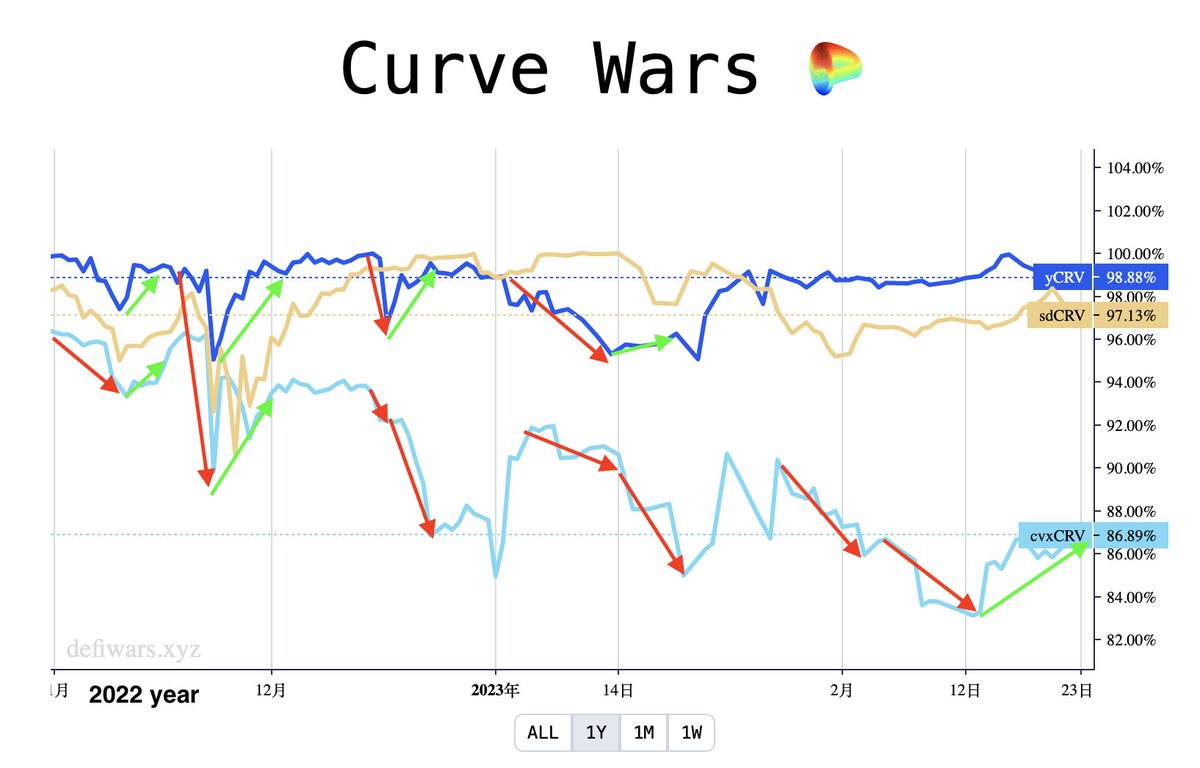

2️⃣ Depeg Event

Let's take a look at the players and their:

🔸Market share

🔸Depeg situation

Data from @defiwars_

Why would the largest player Convex remain depegged for a ridiculous three months?

@iearnfinance is the most important part

Deeper dig👇

2️⃣ Depeg Event

Let's take a look at the players and their:

🔸Market share

🔸Depeg situation

Data from @defiwars_

Why would the largest player Convex remain depegged for a ridiculous three months?

@iearnfinance is the most important part

Deeper dig👇

(14/33)

Yearn provides aggregator services for Defi investors.

Although Yearn used to be the first and largest player in this field, their automatic magic is less attractive compared to Convex's liquidity incentives.

Yearn provides aggregator services for Defi investors.

Although Yearn used to be the first and largest player in this field, their automatic magic is less attractive compared to Convex's liquidity incentives.

(15/33)

In the past, Yearn’s wrapped token $yveCRV has depeged for a long time.

Last year, Yearn decided to improve:

🔸$YFI tokenomic

🔸Redesign $yveCRV tokenomic

In the past, Yearn’s wrapped token $yveCRV has depeged for a long time.

Last year, Yearn decided to improve:

🔸$YFI tokenomic

🔸Redesign $yveCRV tokenomic

(16/33)

In 2022/10, Yearn improved its $YFI tokenomics.

The market reflected confidence in the new design, resulting in a convergence of the gap.

For more details, please refer to Ashu Pareek's report on @MessariCrypto

In 2022/10, Yearn improved its $YFI tokenomics.

The market reflected confidence in the new design, resulting in a convergence of the gap.

For more details, please refer to Ashu Pareek's report on @MessariCrypto

(17/33)

Yearn also redesign the tokenomic of $yveCRV to $yCRV, this is why we see the break in the diagram.

When $yCRV launched, it was priced at 1 $CRV.

Yearn also redesign the tokenomic of $yveCRV to $yCRV, this is why we see the break in the diagram.

When $yCRV launched, it was priced at 1 $CRV.

(18/33)

$yCRV differs from $cvxCRV in that it provides additional governance rights to gain bribery benefits, resulting in higher yields for $yCRV holders compared to $cvxCRV holders.

As you can see, the APY of $yCRV is 37.25% while the APY of $cvxCRV is 20.53%

$yCRV differs from $cvxCRV in that it provides additional governance rights to gain bribery benefits, resulting in higher yields for $yCRV holders compared to $cvxCRV holders.

As you can see, the APY of $yCRV is 37.25% while the APY of $cvxCRV is 20.53%

(19/33)

👀Why depeg?

Because people want to cash out in BEAR market📉

When users want to cash out, they swap their wrapped token to $CRV, and then to stablecoin, which causes a depeg situation as shown by the red arrow below.

Deeper dig👇

👀Why depeg?

Because people want to cash out in BEAR market📉

When users want to cash out, they swap their wrapped token to $CRV, and then to stablecoin, which causes a depeg situation as shown by the red arrow below.

Deeper dig👇

(20/33)

But there still have true Curve believers who looking for long-term benefits, swapping their $CRV into wrapped $CRV.

Therefore the depeg converged as shown by the green arrow below.

But there still have true Curve believers who looking for long-term benefits, swapping their $CRV into wrapped $CRV.

Therefore the depeg converged as shown by the green arrow below.

(21/33)

Typically, they are presented with three options and prefer the one with a better condition, like a higher APY.

Therefore, $yCRV is more #attempting.

Typically, they are presented with three options and prefer the one with a better condition, like a higher APY.

Therefore, $yCRV is more #attempting.

(22/33)

3️⃣ Market Equilibrium

Although the depegging of $cvxCRV has persisted for more than three months, I believe this reflects market equilibrium.

3️⃣ Market Equilibrium

Although the depegging of $cvxCRV has persisted for more than three months, I believe this reflects market equilibrium.

(23/33)

Below is my calculation as of 2023/02/28

(numbers may differ, but the concept is the same🔮)

🔸Three largest protocols

🔸Assuming an investment of 100 $CRV

🔸As depegging continues, the number of wTokens obtained after swapping increases.

Below is my calculation as of 2023/02/28

(numbers may differ, but the concept is the same🔮)

🔸Three largest protocols

🔸Assuming an investment of 100 $CRV

🔸As depegging continues, the number of wTokens obtained after swapping increases.

(24/33)

Although each protocol has its tokenomic design, we still get a number, with #varying quality and barriers.

wToken amount times APY, we have the real APY, which Convex and Yearn would receive #equally

Currently, this represents the market equilibrium in my opinon.

Although each protocol has its tokenomic design, we still get a number, with #varying quality and barriers.

wToken amount times APY, we have the real APY, which Convex and Yearn would receive #equally

Currently, this represents the market equilibrium in my opinon.

(25/33)

4️⃣ Mike's Memo

Effect to stakeholders

👑$CRV stakers

👑$cvxCRV holders

👑$cvxCRV/$CRV liquidity providers

4️⃣ Mike's Memo

Effect to stakeholders

👑$CRV stakers

👑$cvxCRV holders

👑$cvxCRV/$CRV liquidity providers

(26/33)

👑$CRV stakers

They are more willing to swap their $CRV to $cvxCRV than stake $CRV into Convex smart contract.

Because in the depeg situation, they swap more $cvxCRV rather than directly stake $CRV into Convex smart contract.

👑$CRV stakers

They are more willing to swap their $CRV to $cvxCRV than stake $CRV into Convex smart contract.

Because in the depeg situation, they swap more $cvxCRV rather than directly stake $CRV into Convex smart contract.

(27/33)

👑$cvxCRV holders

Holders who want to cash out need to take a loss.

👑$cvxCRV/$CRV liquidity providers

LP undertakes an IL, because of the depeg.

Convex provides more bribery to ensure this pool has enough liquidity.

👑$cvxCRV holders

Holders who want to cash out need to take a loss.

👑$cvxCRV/$CRV liquidity providers

LP undertakes an IL, because of the depeg.

Convex provides more bribery to ensure this pool has enough liquidity.

(28/33)

I believe Yearn will not able to catch up with Convex’s market share.

🔸The difference in the market share is too significant.

🔸Convex has enough time to make improvements.

I believe Yearn will not able to catch up with Convex’s market share.

🔸The difference in the market share is too significant.

🔸Convex has enough time to make improvements.

(29/33)

$crvUSD could be a game changer.

🔸New stablecoin could be a new incentive in the Curve ecosystem.

🔸$crvUSD in expected launch at 2023 Q2.

$crvUSD could be a game changer.

🔸New stablecoin could be a new incentive in the Curve ecosystem.

🔸$crvUSD in expected launch at 2023 Q2.

(30/33)

In my opinion, the value of wrapped tokens should be slightly higher than $CRV itself.

🔸Wrapped token has better token designs than $CRV.

In my opinion, the value of wrapped tokens should be slightly higher than $CRV itself.

🔸Wrapped token has better token designs than $CRV.

(31/33)

The real problem could be with the #emissions, and we should reconsider whether the number is too high to pump the whole system😬

The real problem could be with the #emissions, and we should reconsider whether the number is too high to pump the whole system😬

(32/33)

Votium bribery is another interesting metric we could examine.

The bribery cost per $vlCVX has recently been recovering, which could be a leading indicator of market recovery and, of course, an alpha😎

Votium bribery is another interesting metric we could examine.

The bribery cost per $vlCVX has recently been recovering, which could be a leading indicator of market recovery and, of course, an alpha😎

(33/33)

Is this thread useful?

Like/RT if you can😀

Tell me your opinion, friends :)

@SherifDefi

@cyrilXBT

@thedefiedge

@DeFi_Made_Here

@DefiIgnas

@jake_pahor

@Dynamo_Patrick

@DeFiMinty

@DefiMoon

@thedefiedge

@Flowslikeosmo

@crypto_linn

Is this thread useful?

Like/RT if you can😀

Tell me your opinion, friends :)

@SherifDefi

@cyrilXBT

@thedefiedge

@DeFi_Made_Here

@DefiIgnas

@jake_pahor

@Dynamo_Patrick

@DeFiMinty

@DefiMoon

@thedefiedge

@Flowslikeosmo

@crypto_linn

• • •

Missing some Tweet in this thread? You can try to

force a refresh