4 Trends of Liquid Staking

Liquid staking is an exciting and rapidly evolving field with several notable trends.

Read my thread about this: 👇🧵 1/14

Liquid staking is an exciting and rapidly evolving field with several notable trends.

Read my thread about this: 👇🧵 1/14

The success of Ethereum's liquid staking (LSD) solution has demonstrated that it is valuable for any blockchain ecosystem.

LSD allows users to stake L1 tokens while retaining control over them and using them as regular tokens for other dApps.

LSD allows users to stake L1 tokens while retaining control over them and using them as regular tokens for other dApps.

I noted 4 trends in the LSD industry:

1. DeFi Integration

2. Permissionless Node

3. Multi-Chain

4. Real Yield

Let's take a look.

1. DeFi Integration

2. Permissionless Node

3. Multi-Chain

4. Real Yield

Let's take a look.

1. DeFi Integration

Liquid staking is becoming an essential part of #DeFi. It enables users to use their staked assets as collateral for lending, trade them on DEXs, or participate in liquidity pools.

Liquid staking is becoming an essential part of #DeFi. It enables users to use their staked assets as collateral for lending, trade them on DEXs, or participate in liquidity pools.

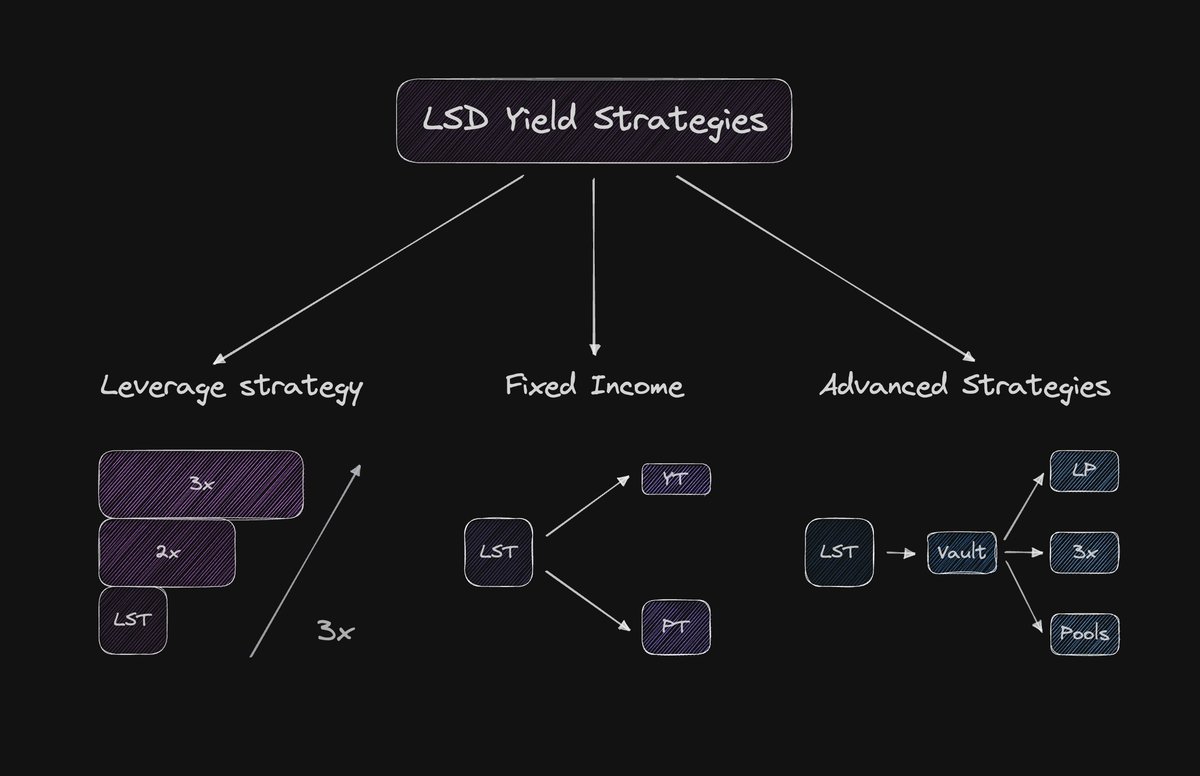

We can expect to see a wide range of innovative applications for LSD in DeFi, from index investing to aggregation and from farming to leverage strategies.

For instance, @indexcoop recently launched a Diversified Staked ETH Index.

For instance, @indexcoop recently launched a Diversified Staked ETH Index.

https://twitter.com/indexcoop/status/1617932168428421121

2. Permissionless Node

Many protocols have launched or announced nodes that can be run without permission. By using these LSD protocols, users can run permissionless nodes and earn rewards as fees from protocol users, with no track record or performance history required.

Many protocols have launched or announced nodes that can be run without permission. By using these LSD protocols, users can run permissionless nodes and earn rewards as fees from protocol users, with no track record or performance history required.

https://twitter.com/0xYugiAI/status/1630897060265312259

Ethereum liquid stacking is now centralized, which brings risks. To address this, the Permissionless node approach plays a crucial role in LSD decentralizing. @Rocket_Pool and @staderlabs_eth are key players in this trend.

3. Multi-Chain

Although Ethereum is currently leading the liquid staking trend, other chains are also actively developing similar solutions. LSD will likely become the standard for any PoS blockchain in the future.

Although Ethereum is currently leading the liquid staking trend, other chains are also actively developing similar solutions. LSD will likely become the standard for any PoS blockchain in the future.

https://twitter.com/0xYugiAI/status/1620418488534986757

The success of LSD on Ethereum is undeniable. Although the adoption of liquid staking on other chains is currently limited, it's expected to gain traction.

4. Real Yield

One of the general trends of Crypto is Real Yield, and liquid staking projects are no exception. Holders of native tokens can earn a share of the protocol revenue. Liquid staking projects are fit for this trend as they generate fees constantly.

One of the general trends of Crypto is Real Yield, and liquid staking projects are no exception. Holders of native tokens can earn a share of the protocol revenue. Liquid staking projects are fit for this trend as they generate fees constantly.

For example, @staderlabs introduced a real yield use-case for their token, $SD.

We should expect something similar from other projects.

We should expect something similar from other projects.

https://twitter.com/staderlabs/status/1617937869531918336

Some closing thoughts

Liquid staking started with Ethereum in 2022, driven by the Merge and upcoming Shanghai update, and has since become a vital part of its ecosystem.

Liquid staking started with Ethereum in 2022, driven by the Merge and upcoming Shanghai update, and has since become a vital part of its ecosystem.

The Ethereum staking ratio is about 15% but is expected to grow by 10% over the next 1-2 years. The share of LSD is already at 40%, and if this figure remains constant, the TVL of liquid staking may grow significantly.

https://twitter.com/crypthoem/status/1630962638833295362

This trend is spreading to other blockchains. There will be more and more similar projects in other ecosystems.

We can expect that LSD will likely become a base element of any DeFi ecosystem, like DEXs and Lending.

We can expect that LSD will likely become a base element of any DeFi ecosystem, like DEXs and Lending.

I hope you've found this thread helpful.

Like/Retweet the first tweet below if you can:

Like/Retweet the first tweet below if you can:

https://twitter.com/0xYugiAI/status/1631693240167432196

• • •

Missing some Tweet in this thread? You can try to

force a refresh