Stock Market Manipulation.

All you should know about- How it works?

A THREAD 🧵

(1/25)

#StockMarketindia #trading #StockMarket

@sunilgurjar01 @kuttrapali26 #investing

All you should know about- How it works?

A THREAD 🧵

(1/25)

#StockMarketindia #trading #StockMarket

@sunilgurjar01 @kuttrapali26 #investing

Market manipulation is when someone interferes with the normal course of stock trading or pricing to further their own gain. (2/25)

The idea behind investing in the stock market is simple: you buy shares at a lower price and sell them at a higher price. However, numerous entities in the stock market are capable of manipulation in the stock market. (3/25)

Market manipulation is when someone artificially affects the supply or demand for a security (for example, causing stock prices to rise or to fall dramatically). (4/25)

These entities deceive the uninformed investors and use their investment to increase or decrease the price of securities. The process is called market manipulation. For an investor, it is vital to understand the topic in detail to ensure utmost investment protection. (5/25)

✅Methods Manipulators Use to Manipulate Prices :

✔Wash Trades

Offsetting trades that are placed for the purpose of misleading the market rather than actually acquiring or liquidating stock are called "wash trades".

(6/25)

✔Wash Trades

Offsetting trades that are placed for the purpose of misleading the market rather than actually acquiring or liquidating stock are called "wash trades".

(6/25)

Wash trades can occur by the same player through two different brokers or as a collusion between a trader and a broker. (7/25)

✔Spoofing

"Spoofing" is the act of placing fake orders and then cancelling them before they execute.

Investors at large often assess pending buy and sell orders to gauge whether the market is bullish or bearish on a stock for the near term. (8/25)

"Spoofing" is the act of placing fake orders and then cancelling them before they execute.

Investors at large often assess pending buy and sell orders to gauge whether the market is bullish or bearish on a stock for the near term. (8/25)

Spoofing can therefore give these investors the false appearance of a large amount of interest on one side of the market or the other when it isn’t really there. (9/25)

✔Pump and Dumps

This scheme involves a player accumulating a stock position and then issuing unrealistically optimistic comments about the company to attract buyers who will further bid up the price.

The player then sells into the rising stock price to make a profit. (10/25)

This scheme involves a player accumulating a stock position and then issuing unrealistically optimistic comments about the company to attract buyers who will further bid up the price.

The player then sells into the rising stock price to make a profit. (10/25)

Pump and dump schemes are typically implemented on small or microcap stocks, where there is a better chance of impacting the price of the stock with false news and a better chance of attracting retail investors who are more susceptible to that message.(11/25)

✔Painting the Tape

It is a form of market manipulation whereby market players attempt to influence the price of a security by buying and selling it among themselves to create the appearance of substantial trading activity. (12/25)

It is a form of market manipulation whereby market players attempt to influence the price of a security by buying and selling it among themselves to create the appearance of substantial trading activity. (12/25)

The goal of painting the tape is to create the illusion of an increased interest in a stock to trick investors into buying shares, which would drive the price higher. (13/25)

✔Brokers and Pledged Shares

It is common industry practice for promoters to pledge their holding to raise loans.

Market manipulators influence the market to reduce the share price, resulting in decreasing the total price of pledged shares. (14/25)

It is common industry practice for promoters to pledge their holding to raise loans.

Market manipulators influence the market to reduce the share price, resulting in decreasing the total price of pledged shares. (14/25)

With the shares losing their value, promoters are forced to make up for lost collateral.

Since it is an indication that the lender may dumb the shares if the margin is not met, the investors start to dump shares in a panic, further lowering the share price. (15/25)

Since it is an indication that the lender may dumb the shares if the margin is not met, the investors start to dump shares in a panic, further lowering the share price. (15/25)

✔Short and Distort:

In this type of market manipulation, the bears (who make profits by short selling) target a stock that has been increasing its price steadily. (16/25)

In this type of market manipulation, the bears (who make profits by short selling) target a stock that has been increasing its price steadily. (16/25)

They take short positions in the stock to increase the share price artificially and follow it by spreading negative news about the company.

This creates an unfavourable perspective for investors who dump the shares to cut their losses. (17/25)

This creates an unfavourable perspective for investors who dump the shares to cut their losses. (17/25)

It rapidly decreases the share price, allowing the short-selling manipulators to make huge profits.(18/25)

✔Bear Raids

A player takes a short position in a stock and then issues negative or alarming comments on the stock which are meant to induce shareholders to panic out of their positions, thereby lowering the price of the stock. (19/25)

A player takes a short position in a stock and then issues negative or alarming comments on the stock which are meant to induce shareholders to panic out of their positions, thereby lowering the price of the stock. (19/25)

✅Example of Market Manipulation

➡In 2019, the Securities and Exchange Board of India barred 12 entities for 4 years from trading in the securities market as they were found guilty of manipulating the share price of Ram Minerals and Chemicals Ltd.(20/25)

➡In 2019, the Securities and Exchange Board of India barred 12 entities for 4 years from trading in the securities market as they were found guilty of manipulating the share price of Ram Minerals and Chemicals Ltd.(20/25)

According to SEBI, the entities executed a large number of trades to match the price of the prevailing buy orders.

The buy orders were placed at a price higher than the previous traded price. (21/25)

The buy orders were placed at a price higher than the previous traded price. (21/25)

Therefore, the manipulated orders increased the company's share price and resulted in misleading the investors. (22/25)

➡ 02-March-2023 : SEBI barred 55 entities, including actors Arshad Warsi and his wife Maria Goretti, from the securities market for alleged price manipulation through YouTube, and subsequently, offloading the inflated shares of Sadhna Broadcast and Sharpline Broadcast.(23/25)

✅At the end

Stock market manipulation is illegal, and the entities are charged with civil lawsuits and bans.

However, as they are difficult to detect, it is important for every investor to not fall for such market manipulation techniques. (24/25)

Stock market manipulation is illegal, and the entities are charged with civil lawsuits and bans.

However, as they are difficult to detect, it is important for every investor to not fall for such market manipulation techniques. (24/25)

With the knowledge of what market manipulation is, you can better analyse your trades and ensure that you are not being manipulated by market manipulators.(25/25)

♥If you found this thread useful, please RT the first tweet & follow @itsprekshaBaid for more useful threads.🔁

A Thread to knowthe difference : Mutual Fund vs. ETFs👇

https://twitter.com/itsprekshaBaid/status/1629364217185980418

A Thread to: learn About a Bull Flag Pattern.👇

https://twitter.com/itsprekshaBaid/status/1626827071182995457

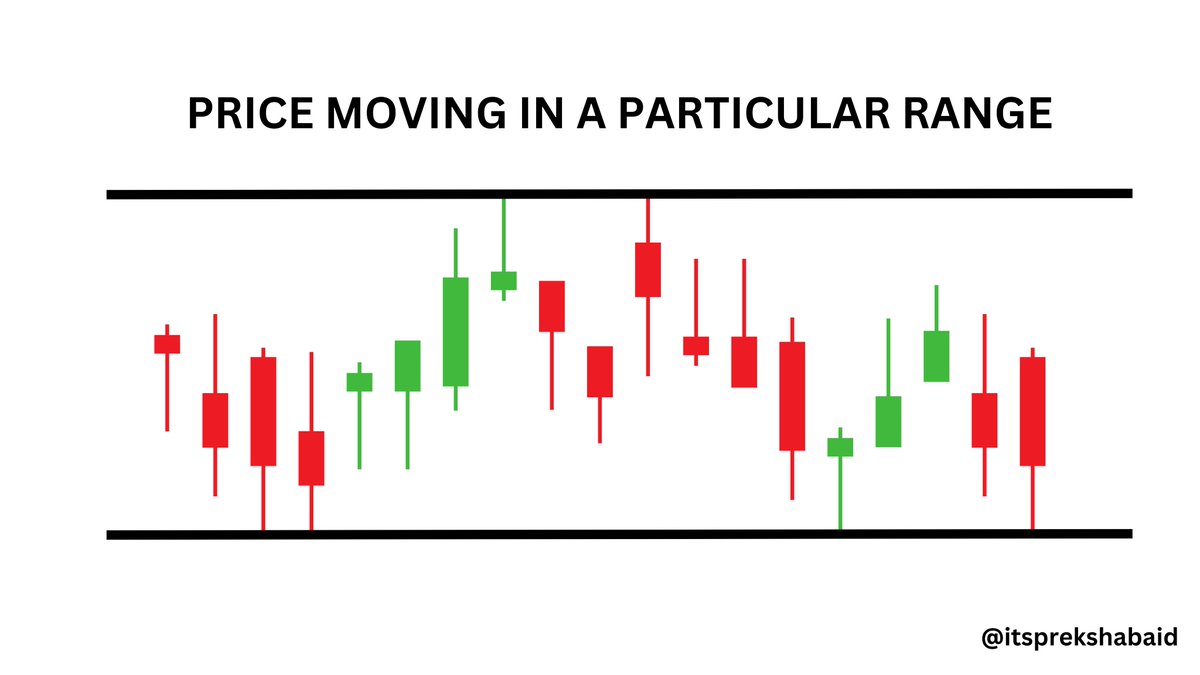

A Thread to learn : Simple range breakout strategy 👇

https://twitter.com/itsprekshaBaid/status/1618246899760533504

A Thread to learn : Fibonacci Retracement and how I use this tool in with Supply & Demand levels? 👇

https://twitter.com/itsprekshaBaid/status/1624345560827445249

• • •

Missing some Tweet in this thread? You can try to

force a refresh