#GRINFRA Investor PPT

- Q3 - FY 23 Highlights

- Nine Months Total income in FY 22 > 57504M and 62787M in FY23

- EBIDTA > 15% and 16% for FY 22 and FY23 respectively

- Improvement in Debt to Equity Ratio & Net Debt to Equity Ratio in last 6 months till Dec

- Q3 - FY 23 Highlights

- Nine Months Total income in FY 22 > 57504M and 62787M in FY23

- EBIDTA > 15% and 16% for FY 22 and FY23 respectively

- Improvement in Debt to Equity Ratio & Net Debt to Equity Ratio in last 6 months till Dec

- PnL

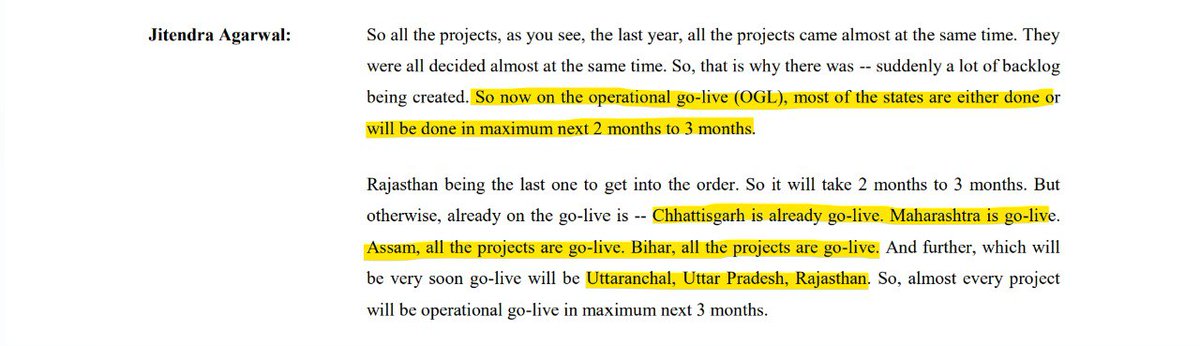

- Debt Breakup

- Development during the Year – Execution of Concession/ Share Purchase Agreements & Financial Closures

- Annuities received since FY 21 till FY 23

- Debt Breakup

- Development during the Year – Execution of Concession/ Share Purchase Agreements & Financial Closures

- Annuities received since FY 21 till FY 23

- Portfolio of Road / Transmission Projects (Operational and Under Construction)

- Robust Order Book (strong pipeline of upcoming projects)

- GRIL – Core Business

- Robust Order Book (strong pipeline of upcoming projects)

- GRIL – Core Business

- Key Milestones

- Company is committed to growth with a purpose

- Experienced and diversified Board of Directors

- Company is committed to growth with a purpose

- Experienced and diversified Board of Directors

- Emphasis on delivering high quality results with precision & efficiency

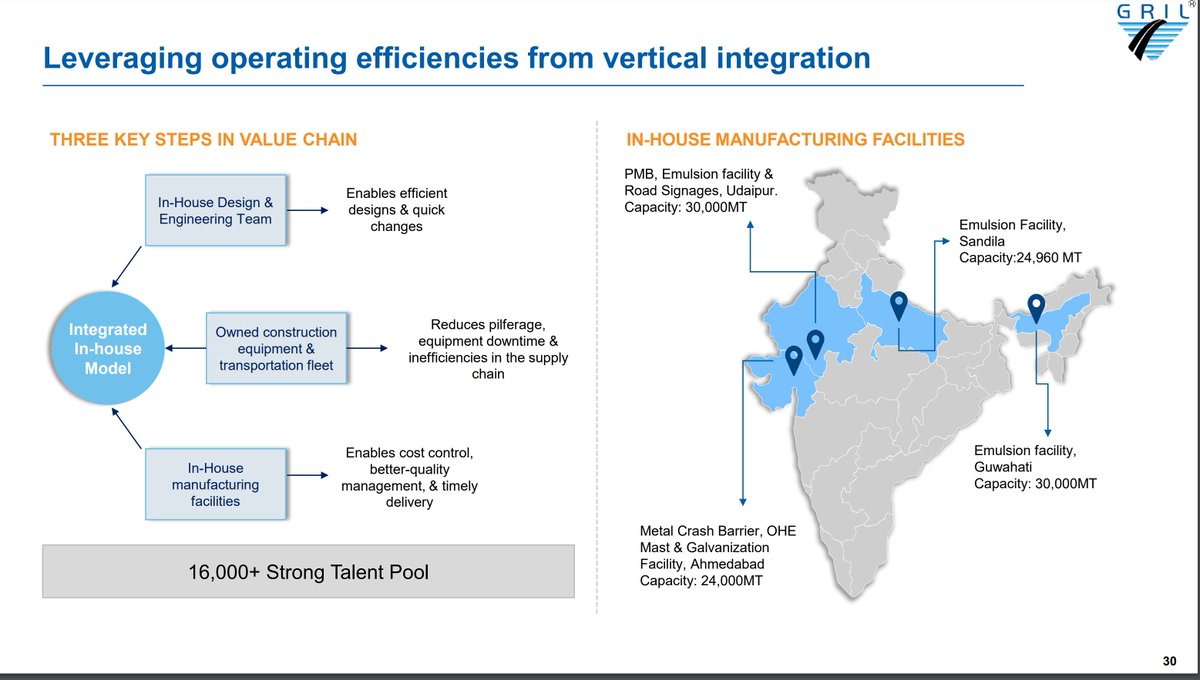

- Maximizing operational efficiencies through vertical integration

- Extensive reach across India & a strong nationwide presence

Recognized for excellence through numerous awards & accolades in the industry

- Maximizing operational efficiencies through vertical integration

- Extensive reach across India & a strong nationwide presence

Recognized for excellence through numerous awards & accolades in the industry

• • •

Missing some Tweet in this thread? You can try to

force a refresh