Liquity basics in 4 short tweets 👇

1️⃣ Values of Liquity

2️⃣ Liquity Protocol

3️⃣ LUSD stablecoin

4️⃣ LQTY token

A quick refresher for the new community members that joined recently.

👉 Learn more about #Liquity in 4 tweets in <1min. A🧵

1️⃣ Values of Liquity

2️⃣ Liquity Protocol

3️⃣ LUSD stablecoin

4️⃣ LQTY token

A quick refresher for the new community members that joined recently.

👉 Learn more about #Liquity in 4 tweets in <1min. A🧵

1/ Liquity embodies the true ethos of crypto from day one:

✅ Decentralized (Liquity is credibly neutral)

✅ Immutable (no multi-sig, no upgrades)

✅ Governance-minimized (no DAO & governance drama)

Why is it important? This means less risk for you.

✅ Decentralized (Liquity is credibly neutral)

✅ Immutable (no multi-sig, no upgrades)

✅ Governance-minimized (no DAO & governance drama)

Why is it important? This means less risk for you.

2/ Liquity

👉 Borrow with 0% interest against your $ETH.

👉 One of the cheapest ways to get a loan or leverage up your $ETH.

👉 Liquity issued 4b+ in loans and generated more than $30m in revenue since its inception.

📽 See an explainer video:

👉 Borrow with 0% interest against your $ETH.

👉 One of the cheapest ways to get a loan or leverage up your $ETH.

👉 Liquity issued 4b+ in loans and generated more than $30m in revenue since its inception.

📽 See an explainer video:

3/ LUSD

👉 Liquity also issues the most decentralized and resilient #stablecoin on Ethereum.

👉 Use $LUSD as a treasury asset, DCA into $ETH at favorable terms or use it to generate yield: dune.com/murathan/liqui…

👉 Liquity also issues the most decentralized and resilient #stablecoin on Ethereum.

👉 Use $LUSD as a treasury asset, DCA into $ETH at favorable terms or use it to generate yield: dune.com/murathan/liqui…

4/ LQTY

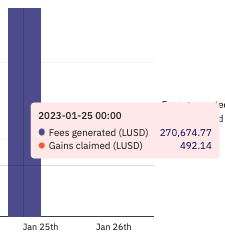

👉 $LQTY is the protocol's secondary token that captures the generated revenue. $LQTY stakers get rewarded 100% of that!

👉 Earn hard assets: $LUSD from the borrowing and $ETH from the redemption fees.

👉 Read LQTY 101 from the User Docs: docs.liquity.org/faq/lqty-distr…

👉 $LQTY is the protocol's secondary token that captures the generated revenue. $LQTY stakers get rewarded 100% of that!

👉 Earn hard assets: $LUSD from the borrowing and $ETH from the redemption fees.

👉 Read LQTY 101 from the User Docs: docs.liquity.org/faq/lqty-distr…

• • •

Missing some Tweet in this thread? You can try to

force a refresh