Be $BOLD • The best way to borrow with (staked) ETH

Join us: https://t.co/nFzKCPYkkR

How to get URL link on X (Twitter) App

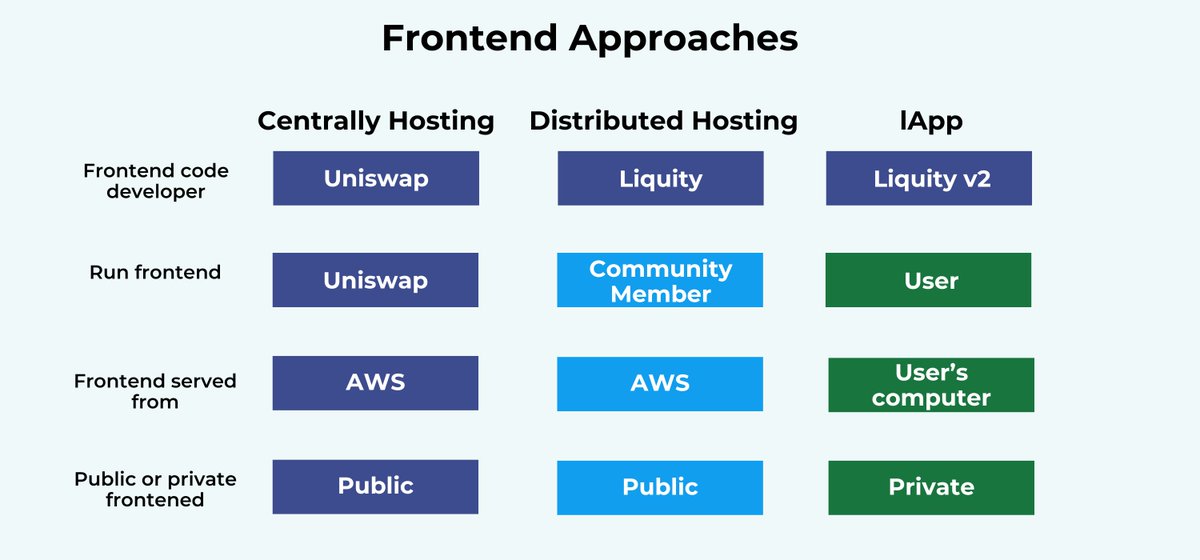

Currently, they require users to install third-party software like browser extensions or desktop applications.

Currently, they require users to install third-party software like browser extensions or desktop applications.

Today, we'd like to go back on some Liquity folklore & share the stories of our Chads who, despite their Chadness, sometimes made mistakes

Today, we'd like to go back on some Liquity folklore & share the stories of our Chads who, despite their Chadness, sometimes made mistakes

1/ Liquity embodies the true ethos of crypto from day one:

1/ Liquity embodies the true ethos of crypto from day one:

1/ Earning LQTY

1/ Earning LQTY

Before jumping into things, a brief reminder of what LiquiFrens is:

Before jumping into things, a brief reminder of what LiquiFrens is:

Stakers of LQTY can earn fees generated on two fronts:

Stakers of LQTY can earn fees generated on two fronts:

When LUSD is at $1.00 Liquity's maximum leverage ratio for users longing ETH is 11x (110% min LTV).

When LUSD is at $1.00 Liquity's maximum leverage ratio for users longing ETH is 11x (110% min LTV).

1/ @StargateFinance now supports LUSD transfers between selected chains (@optimismFND and Ethereum). They also have STG rewards up for grabs for LPs 👀

1/ @StargateFinance now supports LUSD transfers between selected chains (@optimismFND and Ethereum). They also have STG rewards up for grabs for LPs 👀https://twitter.com/StargateFinance/status/1592953795352629248?s=20&t=dY771gZNmppoB180-5wyoA

Chicken Bonds introduce a new, innovative form of bonding, while offering amplified yield and trading opportunities for LUSD holders while stabilizing the LUSD price

Chicken Bonds introduce a new, innovative form of bonding, while offering amplified yield and trading opportunities for LUSD holders while stabilizing the LUSD price

First things first.

First things first.

https://twitter.com/LUSDBULL1/status/1563220450196369408

2/

2/

Let's start with the situation on the ETH2 (PoS) chain

Let's start with the situation on the ETH2 (PoS) chain

First, let's start with the easy stuff: the PoW chain will not implement any change at the network level compared to the current #Ethereum mainnet, unlike the PoS chain.

First, let's start with the easy stuff: the PoW chain will not implement any change at the network level compared to the current #Ethereum mainnet, unlike the PoS chain.

In this thread we’ll show you offramp options directly from your wallet using $LUSD and @viaMover.

In this thread we’ll show you offramp options directly from your wallet using $LUSD and @viaMover.

https://twitter.com/justinsuntron/status/1558397647165091840

Chicken Bonds explore a novel principal-protected bonding mechanism that boosts the yield opportunities for end-users, enabling them to acquire newly issued bTokens in return for their bonded tokens

Chicken Bonds explore a novel principal-protected bonding mechanism that boosts the yield opportunities for end-users, enabling them to acquire newly issued bTokens in return for their bonded tokens