"Monetary actions affect economic conditions ONLY after a lag that is both long and variable" Milton Friedman, JPE, 1961

🚨New paper: we find that this statement is qualified: ❌ONLY

We find important short lags before monetary policy effects fully unravel at long lags 🧵

🚨New paper: we find that this statement is qualified: ❌ONLY

We find important short lags before monetary policy effects fully unravel at long lags 🧵

We use novel consumption (bank transactions), sales (VAT) and employment (social security) at very high-frequency (daily) in Spain, together with high-frequency monetary policy shock identification for the Euro Area, to revisit Friedman's dictum. 2/N

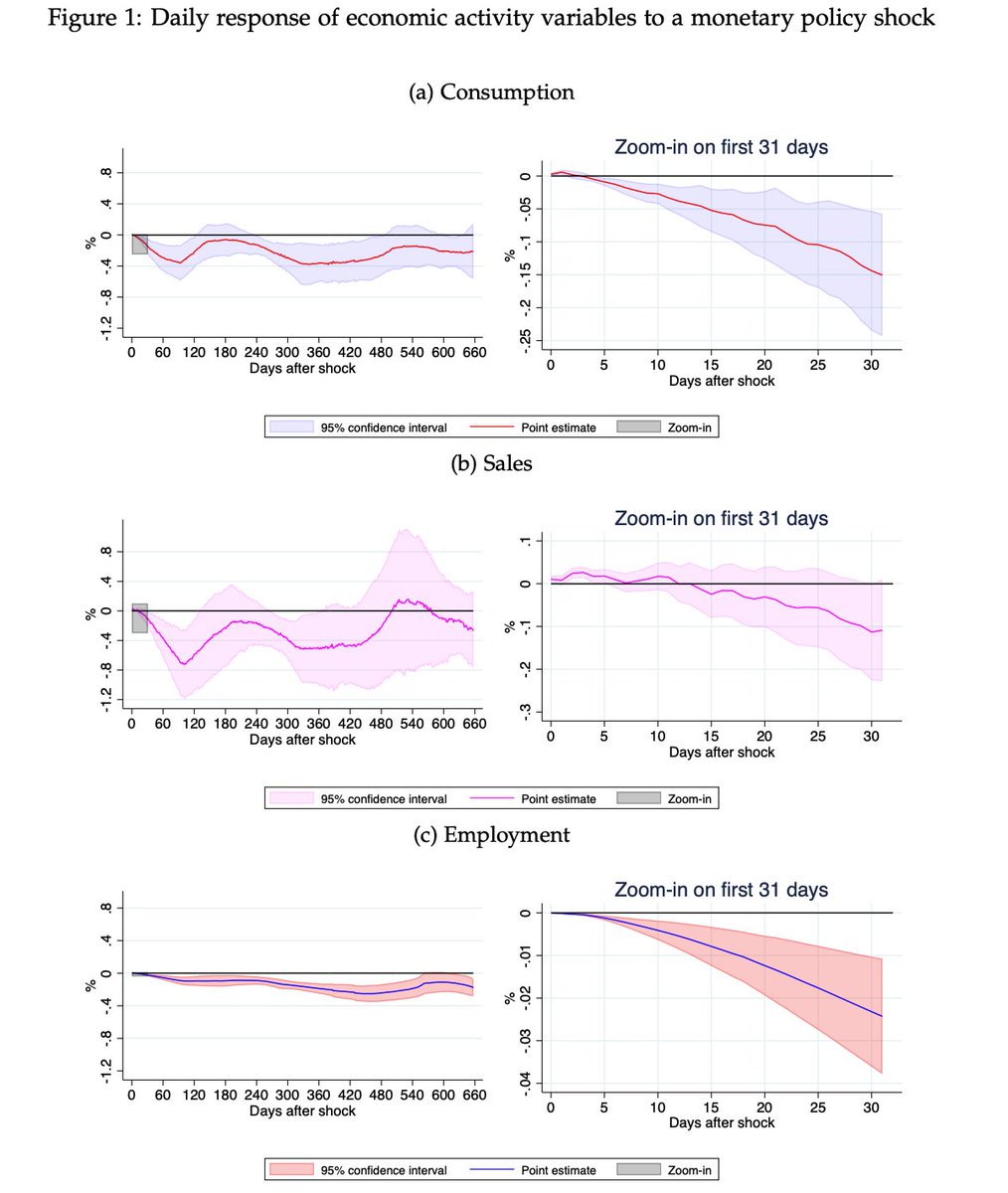

We find significant short lags in the transmission of monetary shocks that are variable in an economically significant way:

-consumption responds to MP shocks in 5 days

- sales in 30 days

- employment immediately but only strongly at long lags

3/N

janeway.econ.cam.ac.uk/working-paper-…

-consumption responds to MP shocks in 5 days

- sales in 30 days

- employment immediately but only strongly at long lags

3/N

janeway.econ.cam.ac.uk/working-paper-…

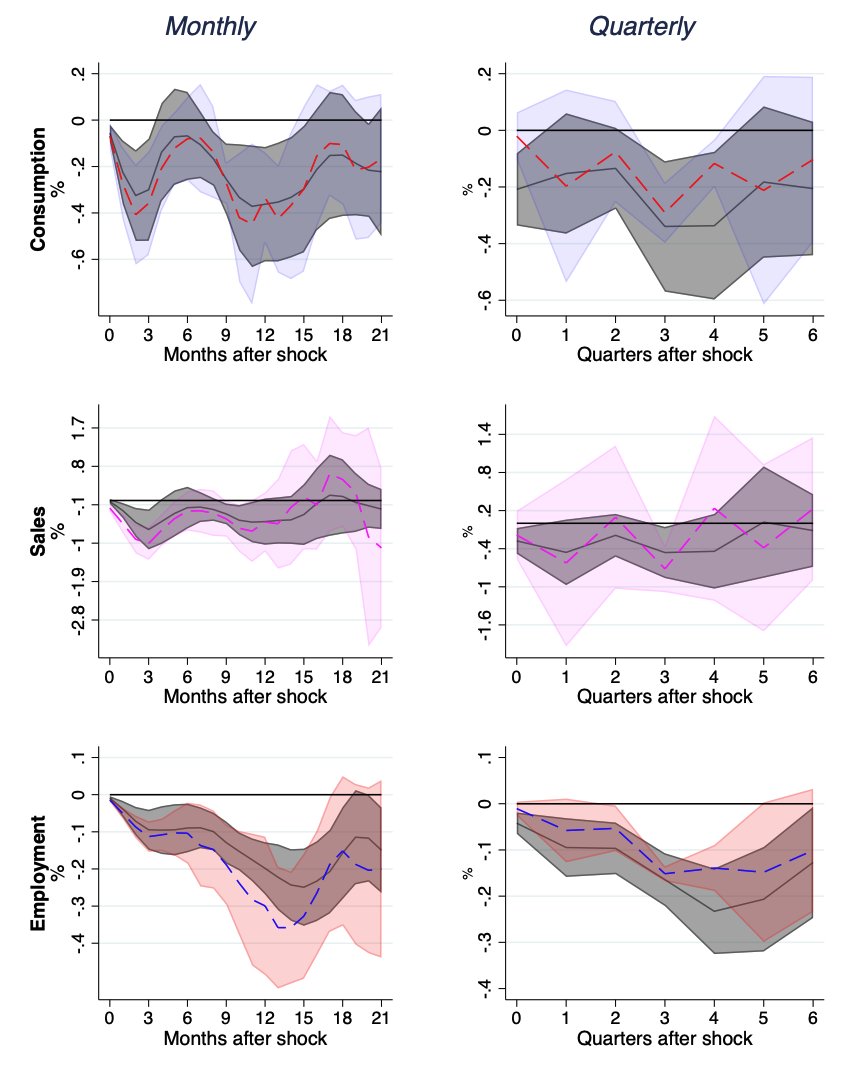

In addition, we show that time aggregation may explain why previous literature using lower frequency data only finds long lags: time aggregation hides short lags

Aggregating to weekly or monthly frequencies allows the researcher to still detect short lags, quarterly does not 4/N

Aggregating to weekly or monthly frequencies allows the researcher to still detect short lags, quarterly does not 4/N

The issues in time aggregation we document in our paper are relevant to a large body of literature that routinely aggregates identified monetary policy shocks around policy announcements to quarterly or yearly frequencies 5/N

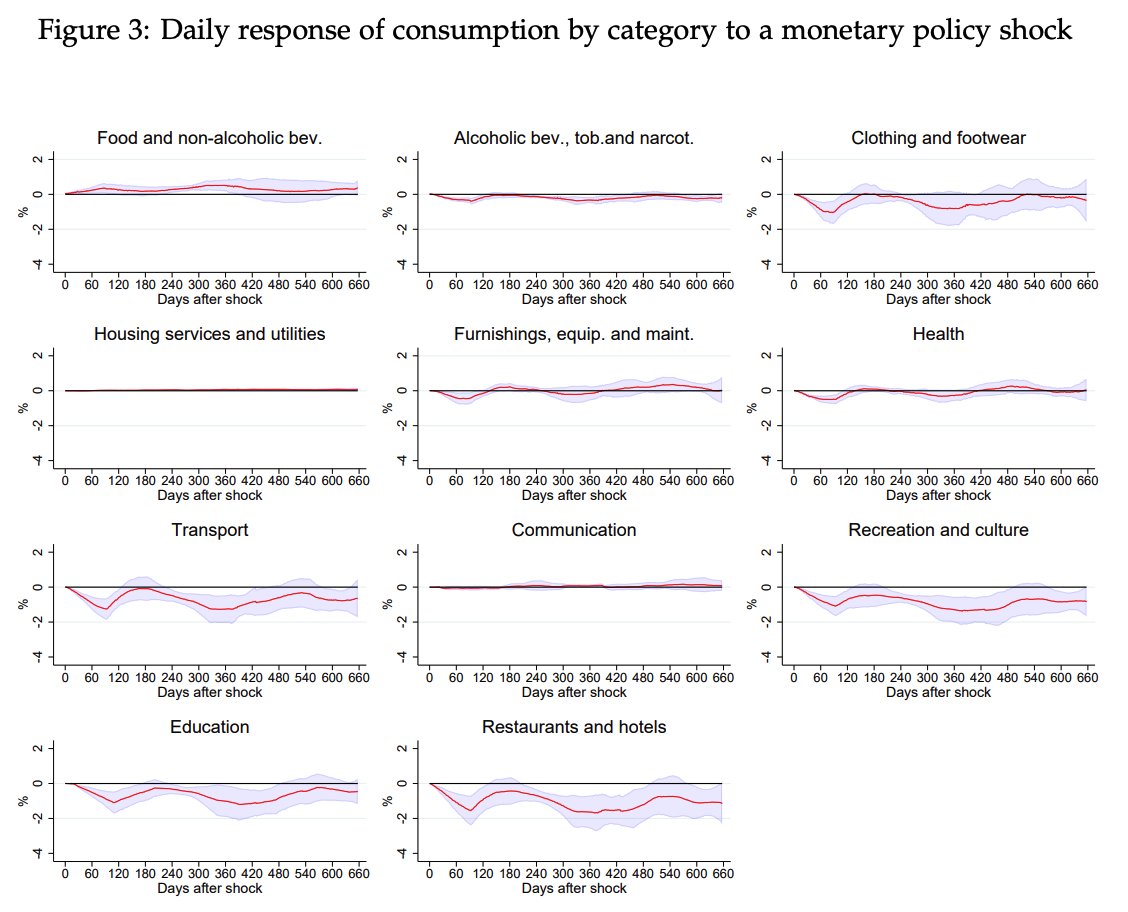

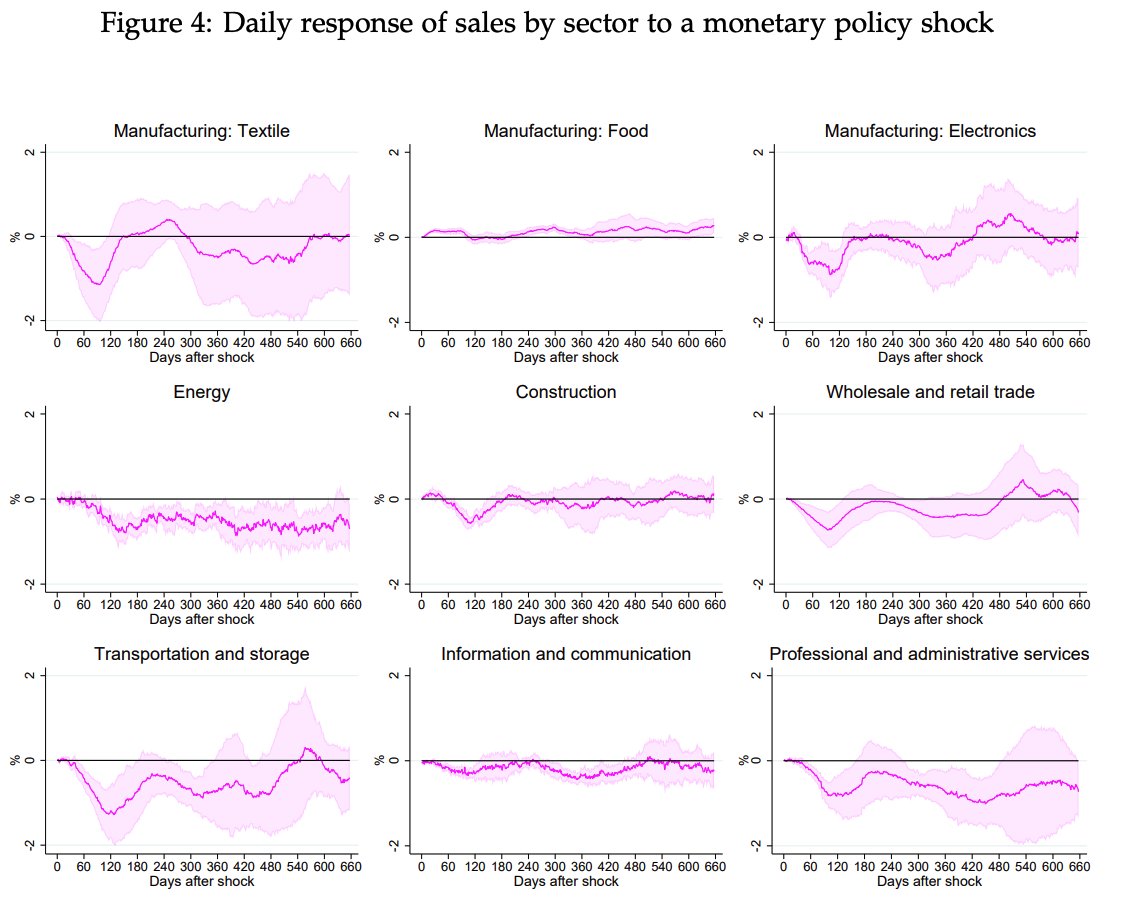

We also explore our rich data to show further that MP shocks affect more durable/luxury goods than essential goods and that downstream sectors react faster to MP than upstream sectors.

6/N

6/N

• • •

Missing some Tweet in this thread? You can try to

force a refresh