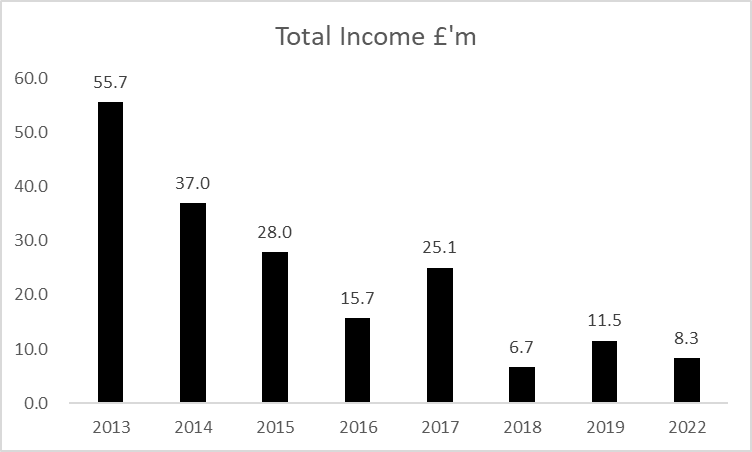

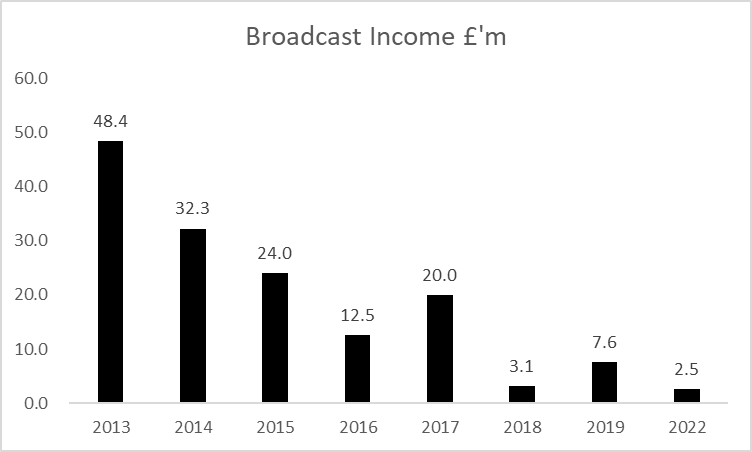

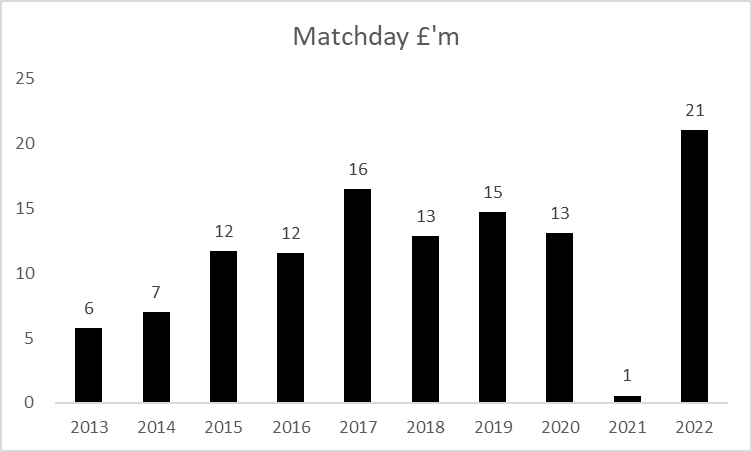

I was asked on @SkySportsNews why bidders not willing to match the Glazers' asking price of £6bn. This is one way how we crunch the numbers, the discounted cash flow model (DCF). First of all look at this historic performance of the club #MUFC

Then use those figures to work out historic relationships between income, costs, funding etc. Use those to create some working assumptions...and mine are fairly optimistic, 15% income growth pa and no major CAPEX investment for at least 5 years

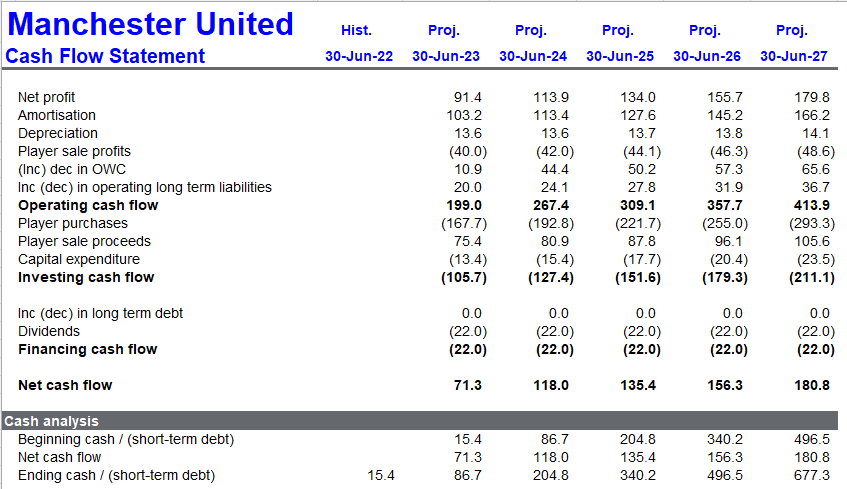

On the basis of the assumptions project future growth of income, costs and perhaps most importantly cash.

Under a DCF model, the value of the club/company is the total cash estimated to be generated in future years, taking into account we would rather have £1 today than in a year or two year's time.

Calculate what is known as a 'terminal value, which is the estimate of cash from 2028 onwards by using a bit of financial maths and assuming that investors want (a fairly low) 8% return on their investment. This values the whole business as £2.9bn.

Give the banks back what is owed to them first, and this means the shares come out at a figure of $17.35 a share...and the Glazers want about $30. Only reason to pay it is if there are cash flows that no one has at yet unlocked, so can understand why QSI might walk away

Difficult to see why anyone would think that #MUFC is worth 20x what PIF paid for #NUFC from Mike Ashley. Not disputing that Manchester United has a bigger global fanbase, but turning that into cash is the challenge.

• • •

Missing some Tweet in this thread? You can try to

force a refresh