➡️Our team is working through the President's FY 2024 budget released a short while ago, and we will publish our full analysis of the spending and revenue plan later today.

In the meantime, we've published a top-line overview of the key findings.

Learn more 🧵⤵️

In the meantime, we've published a top-line overview of the key findings.

Learn more 🧵⤵️

https://twitter.com/BudgetHawks/status/1633882532281483266

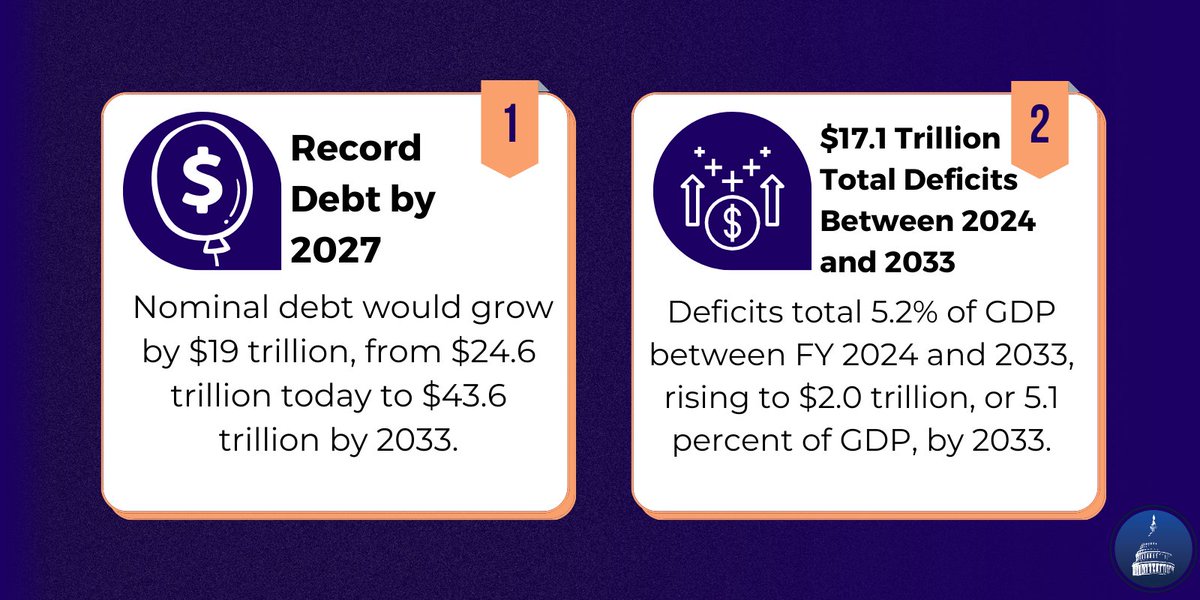

1️⃣First, #nationaldebt.

Under the President's budget, debt would rise at a slower rate than currently projected but still reach a new record share of the economy by 2027.

Debt will ⬆️ from 98% of GDP to a record 110% at the end of 20333 – compared to 117% under OMB's baseline.

Under the President's budget, debt would rise at a slower rate than currently projected but still reach a new record share of the economy by 2027.

Debt will ⬆️ from 98% of GDP to a record 110% at the end of 20333 – compared to 117% under OMB's baseline.

2️⃣Meanwhile, deficits will remain below their historic COVID-highs, but grow in the short- and long-terms.

Deficits will rise from $1.6 trillion in 2023 to $1.8 trillion in 2024, hitting a low of $1.5 trillion in 2027, and rise again to $2.0 trillion by 2033.

Deficits will rise from $1.6 trillion in 2023 to $1.8 trillion in 2024, hitting a low of $1.5 trillion in 2027, and rise again to $2.0 trillion by 2033.

3️⃣Looking next at spending and revenue, between 2024 and 2033:

➤Spending would total $82.2 trillion (24.8% of GDP), ➤Revenue would total $65.2 trillion (19.7% of GDP), ➤Budget deficits would total $17.1 trillion (5.2% of GDP).

➤Spending would total $82.2 trillion (24.8% of GDP), ➤Revenue would total $65.2 trillion (19.7% of GDP), ➤Budget deficits would total $17.1 trillion (5.2% of GDP).

4️⃣This nearly unprecedented borrowing is still ~$3 trillion lower than under OMB's baseline and would generate trillions in new revenue.

New initiatives in the budget are more than paid for, meaning $2.7 trillion in primary deficit reduction + $330 billion in interest savings.

New initiatives in the budget are more than paid for, meaning $2.7 trillion in primary deficit reduction + $330 billion in interest savings.

5️⃣Finally, the President's budget is built based off OMB's ten-year economic forecast, which is somewhat rosier than other forecasts including @USCBO.

Notably, projections differ somewhat on CPI inflation, real GDP, unemployment, and interest rates in coming years.

Notably, projections differ somewhat on CPI inflation, real GDP, unemployment, and interest rates in coming years.

Follow us here and on our website for our full analysis of President Biden's FY 2024 budget proposal.

In case you missed it, CRFB president @MayaMacGuineas issued the following statement reacting to the President's budget today:

In case you missed it, CRFB president @MayaMacGuineas issued the following statement reacting to the President's budget today:

https://twitter.com/BudgetHawks/status/1633888067063824392?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh