The Committee for a Responsible Federal Budget is a nonpartisan group of budget experts concerned about this nation's fiscal future. https://t.co/e8R4vf8v9S

How to get URL link on X (Twitter) App

➡️The budget proposes an estimated $𝟯 𝘁𝗿𝗶𝗹𝗹𝗶𝗼𝗻 𝗼𝗳 𝗱𝗲𝗳𝗶𝗰𝗶𝘁 𝗿𝗲𝗱𝘂𝗰𝘁𝗶𝗼𝗻 through 2033 and projects 𝗱𝗲𝗯𝘁 𝘄𝗼𝘂𝗹𝗱 𝗴𝗿𝗼𝘄 from 98% of GDP at the end of this year to 110% by the end of 2033, compared to 117% of GDP under its baseline.

➡️The budget proposes an estimated $𝟯 𝘁𝗿𝗶𝗹𝗹𝗶𝗼𝗻 𝗼𝗳 𝗱𝗲𝗳𝗶𝗰𝗶𝘁 𝗿𝗲𝗱𝘂𝗰𝘁𝗶𝗼𝗻 through 2033 and projects 𝗱𝗲𝗯𝘁 𝘄𝗼𝘂𝗹𝗱 𝗴𝗿𝗼𝘄 from 98% of GDP at the end of this year to 110% by the end of 2033, compared to 117% of GDP under its baseline.

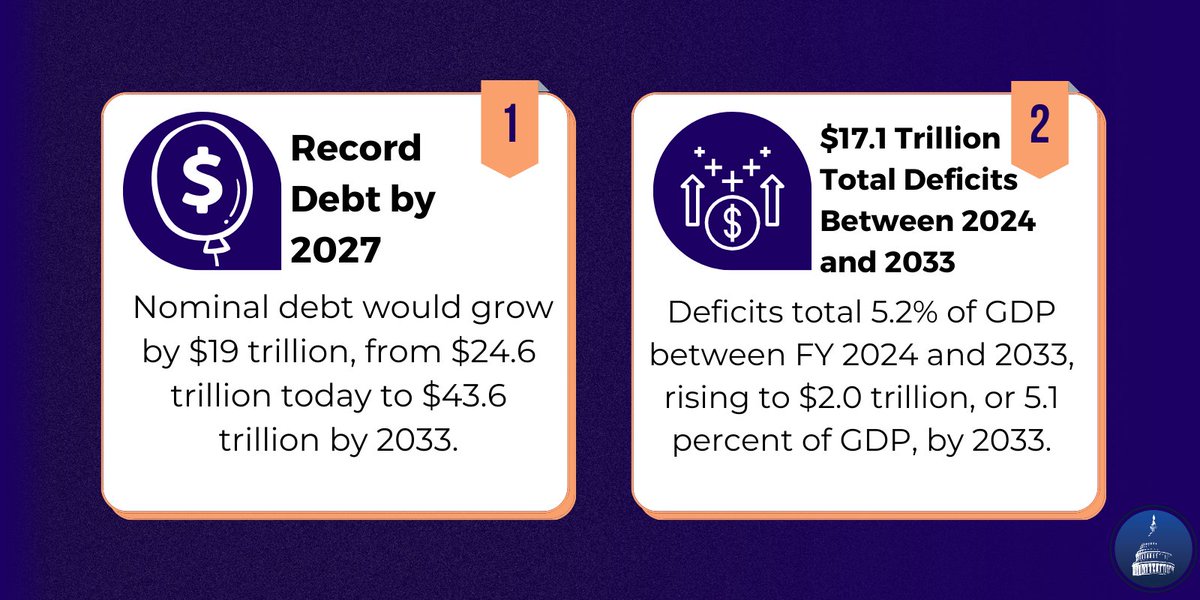

https://twitter.com/BudgetHawks/status/16338825322814832661️⃣First, #nationaldebt.

"Today’s budget briefing for Members of Congress is an encouraging step toward educating lawmakers with a shared set of facts on our fiscal outlook." crfb.org/press-releases…

"Today’s budget briefing for Members of Congress is an encouraging step toward educating lawmakers with a shared set of facts on our fiscal outlook." crfb.org/press-releases…

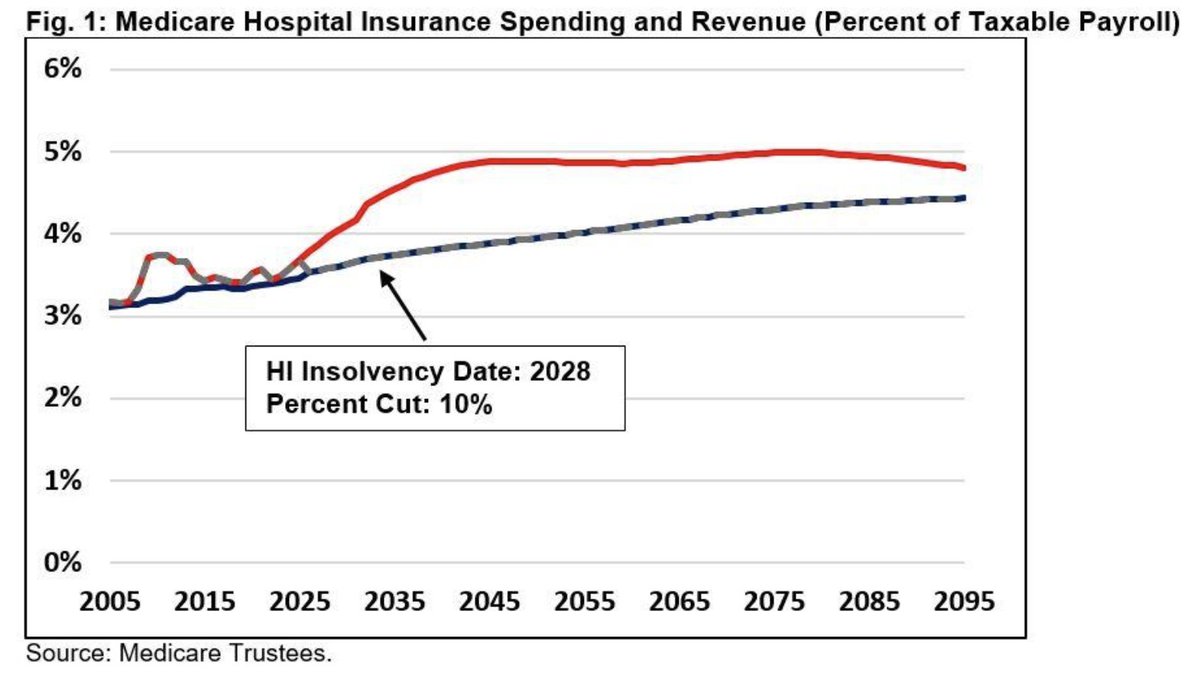

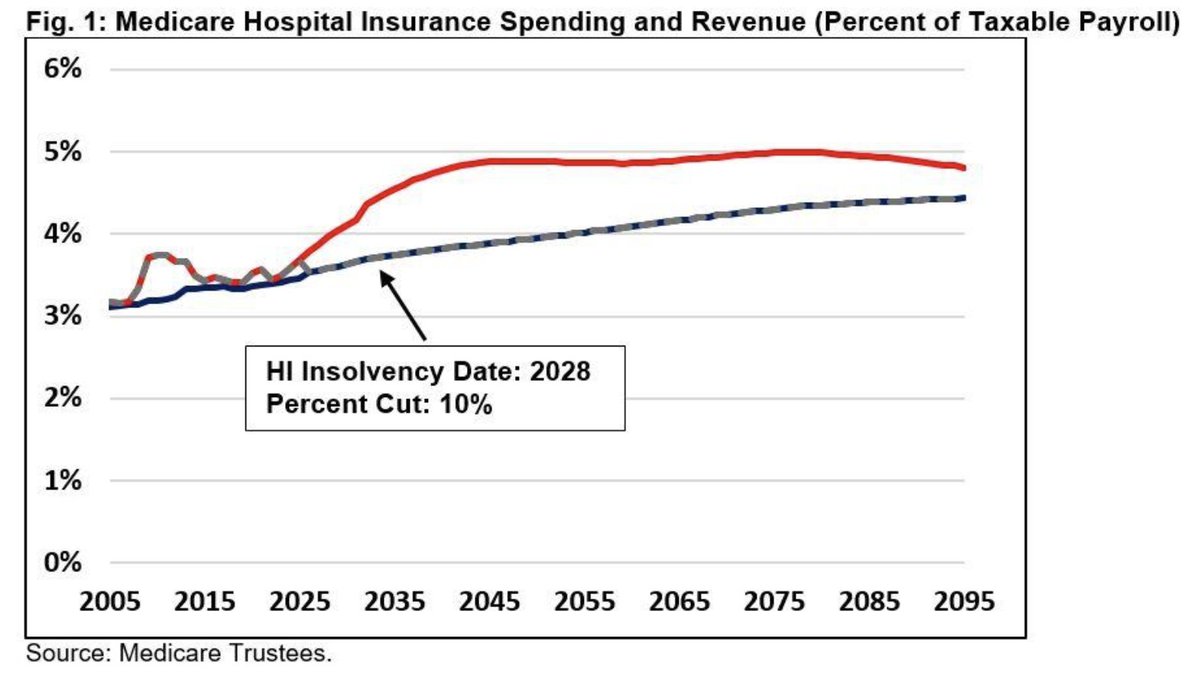

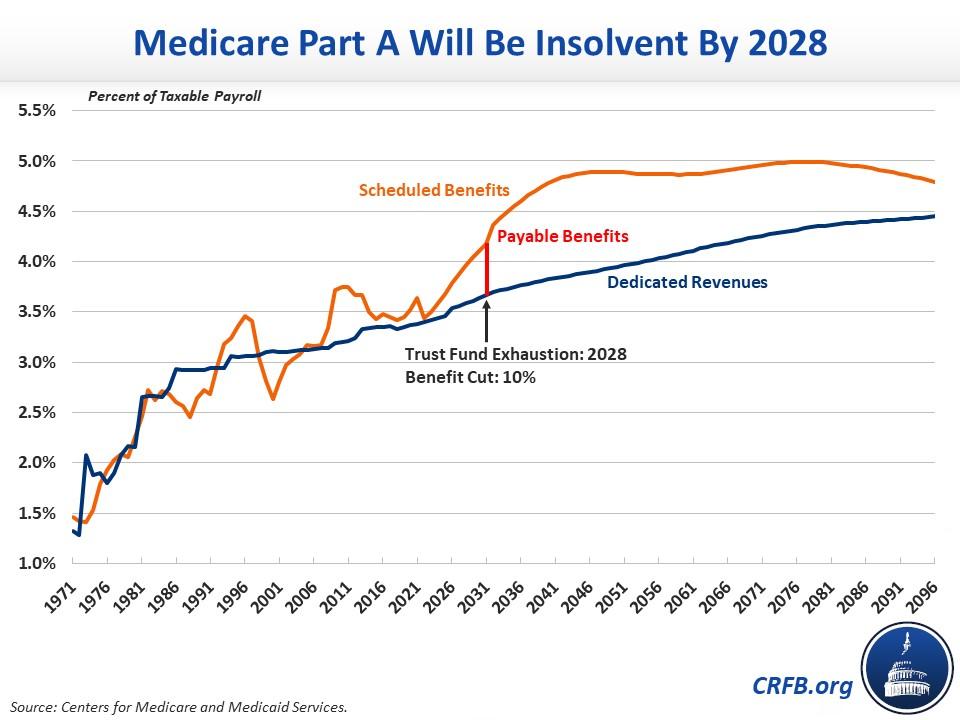

"We strongly support the Administration’s efforts to strengthen the Medicare trust fund. The HI trust fund is only 5 years from insolvency, and we are pleased that the President has put forward a plan to extend the life of this vital program." crfb.org/press-releases….

"We strongly support the Administration’s efforts to strengthen the Medicare trust fund. The HI trust fund is only 5 years from insolvency, and we are pleased that the President has put forward a plan to extend the life of this vital program." crfb.org/press-releases….

1️⃣ The repayment pause is highly regressive, benefitting high-degree, high-income borrowers.

1️⃣ The repayment pause is highly regressive, benefitting high-degree, high-income borrowers.

"This certainly could be one of the most expensive executive actions in history, and yet the White House can’t tell us what it will cost. Either the White House doesn’t know the cost of their debt cancellation proposal, or they know and won’t share it with the public..."

"This certainly could be one of the most expensive executive actions in history, and yet the White House can’t tell us what it will cost. Either the White House doesn’t know the cost of their debt cancellation proposal, or they know and won’t share it with the public..."

1️⃣ Among the proposed IDR plan changes:

1️⃣ Among the proposed IDR plan changes:

Today’s announcement consisted of:

Today’s announcement consisted of:

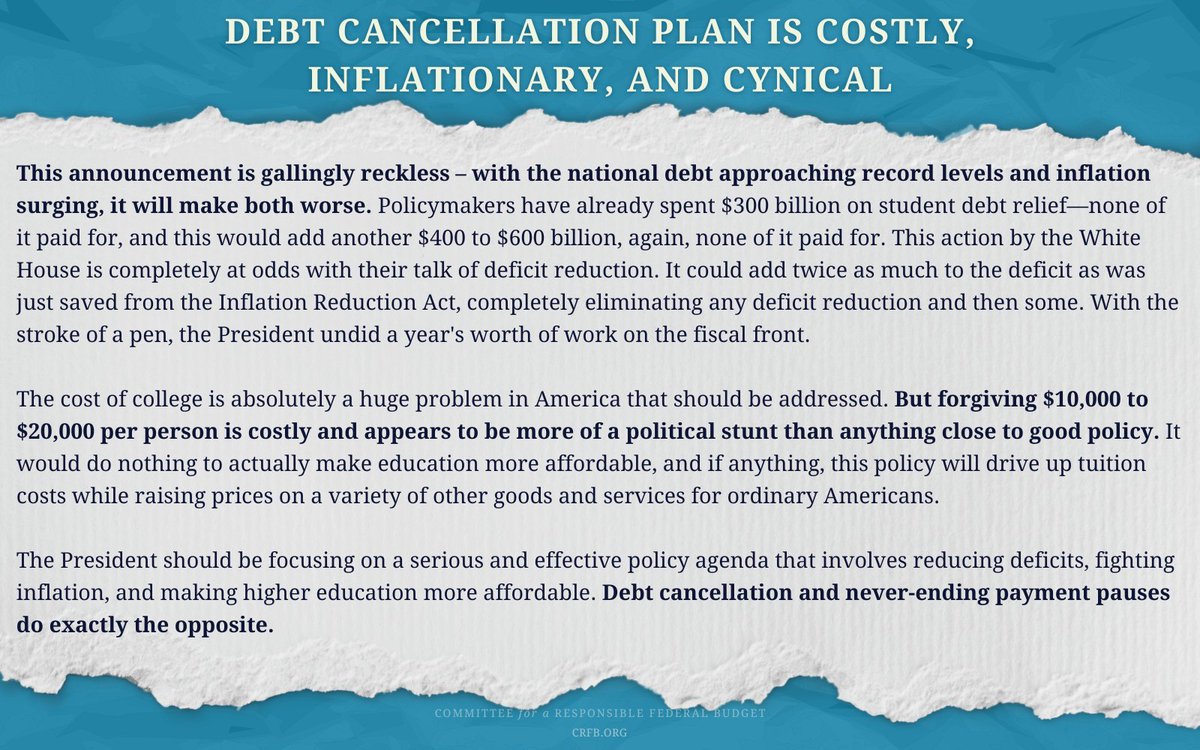

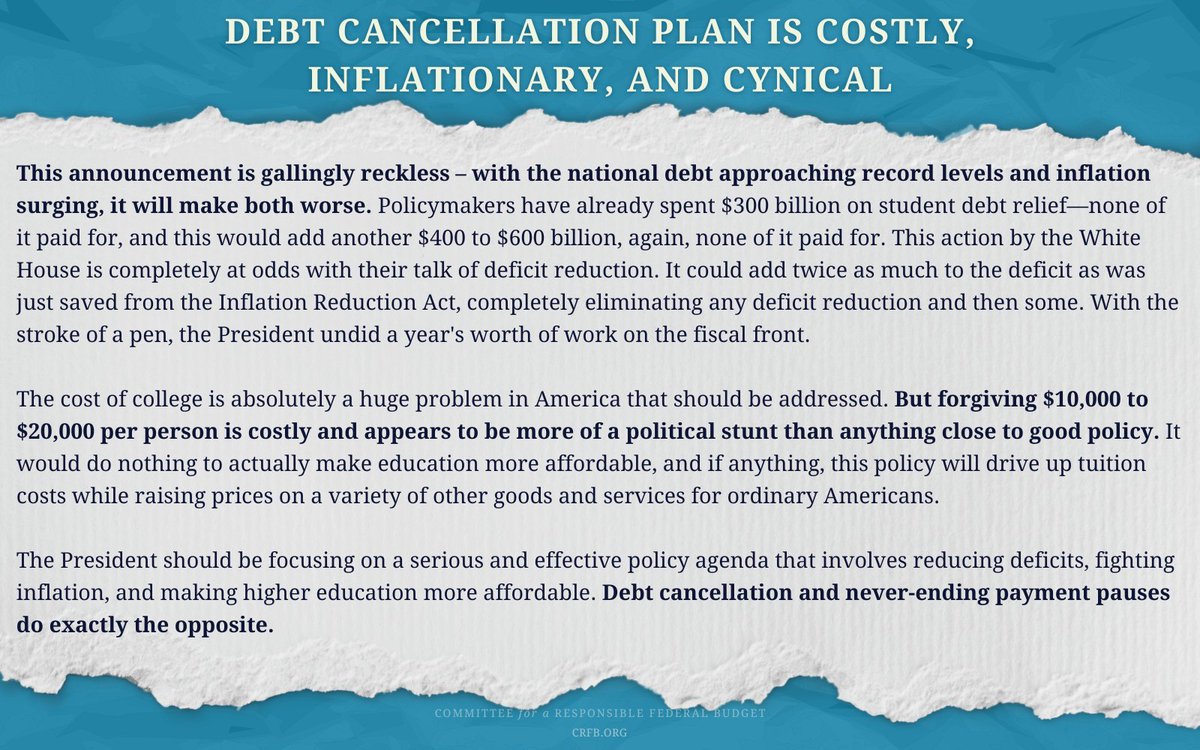

"This announcement is gallingly reckless – with the national debt approaching record levels and inflation surging, it will make both worse. Policymakers have already spent $300 billion on student debt relief—none of it paid for, and this would add another $400 to $600 billion..."

"This announcement is gallingly reckless – with the national debt approaching record levels and inflation surging, it will make both worse. Policymakers have already spent $300 billion on student debt relief—none of it paid for, and this would add another $400 to $600 billion..."

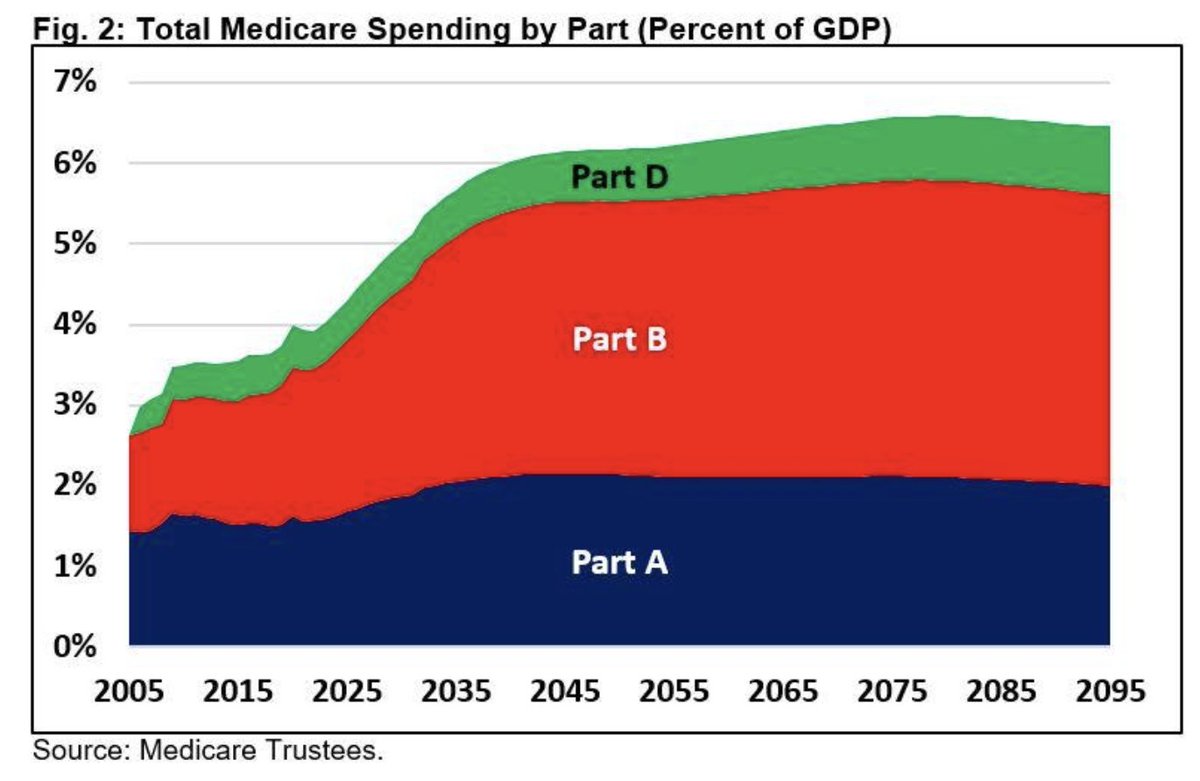

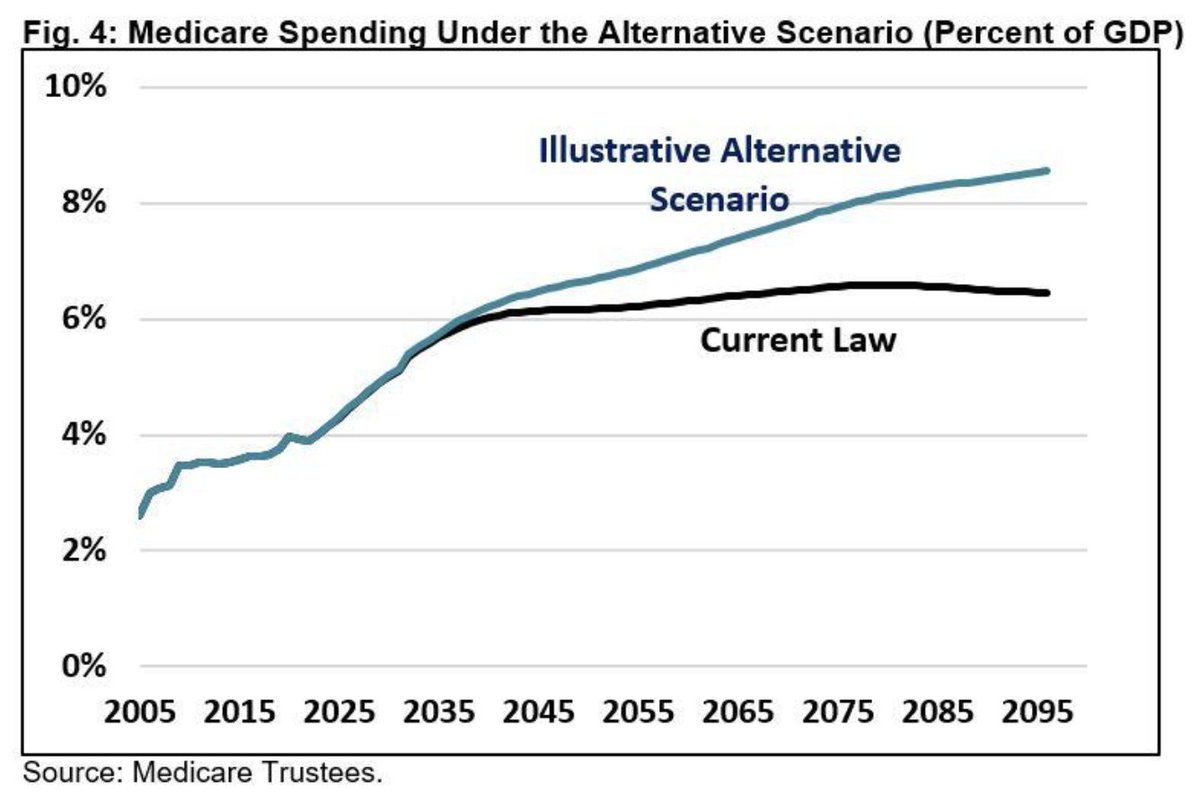

1️⃣ The HI trust fund is only 𝟲 𝘆𝗲𝗮𝗿𝘀 from insolvency.

1️⃣ The HI trust fund is only 𝟲 𝘆𝗲𝗮𝗿𝘀 from insolvency.

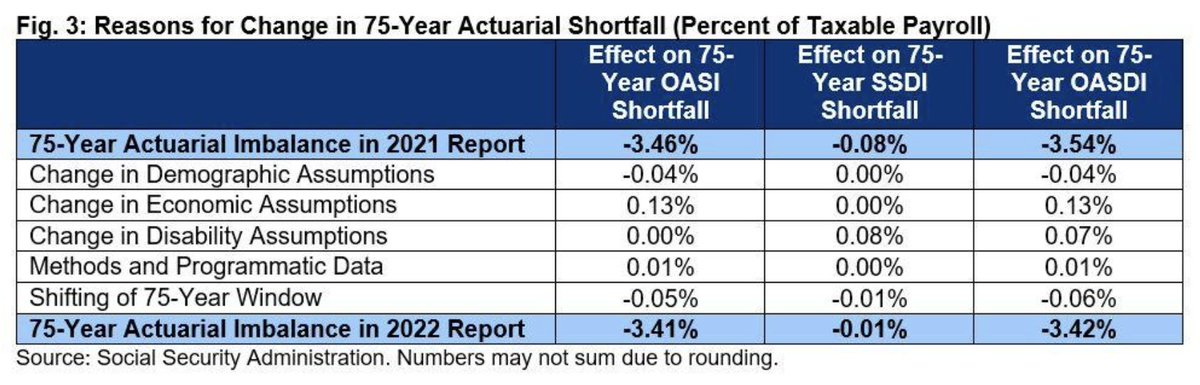

1️⃣ #SocialSecurity is only 𝟭𝟯 𝘆𝗲𝗮𝗿𝘀 from insolvency.

1️⃣ #SocialSecurity is only 𝟭𝟯 𝘆𝗲𝗮𝗿𝘀 from insolvency.

➡️OASI depletion will occur by 2034, while SSDI will not deplete within the projection window.

➡️OASI depletion will occur by 2034, while SSDI will not deplete within the projection window.

"#SocialSecurity is only 13 years from insolvency and #Medicare is only 6 years. Policymakers need to get their heads out of the sand and stop pretending these vital programs’ funding issues will fix themselves." crfb.org/press-releases….

"#SocialSecurity is only 13 years from insolvency and #Medicare is only 6 years. Policymakers need to get their heads out of the sand and stop pretending these vital programs’ funding issues will fix themselves." crfb.org/press-releases….

➡️Last week, @USCBO projected that debt will reach a record 110% of GDP and deficits will reach $2.3 trillion by 2032.⤵️

➡️Last week, @USCBO projected that debt will reach a record 110% of GDP and deficits will reach $2.3 trillion by 2032.⤵️https://twitter.com/BudgetHawks/status/1529536568926543872?s=20&t=-FqXEBvmO2AfiBPHuK_IcA

The House #COVIDrelief package includes about $312B of policies developed long before the #COVID crisis, not in response to it. Many of these policies are worthwhile but should be paid for and made permanent parts of the tax code or budget.

The House #COVIDrelief package includes about $312B of policies developed long before the #COVID crisis, not in response to it. Many of these policies are worthwhile but should be paid for and made permanent parts of the tax code or budget.