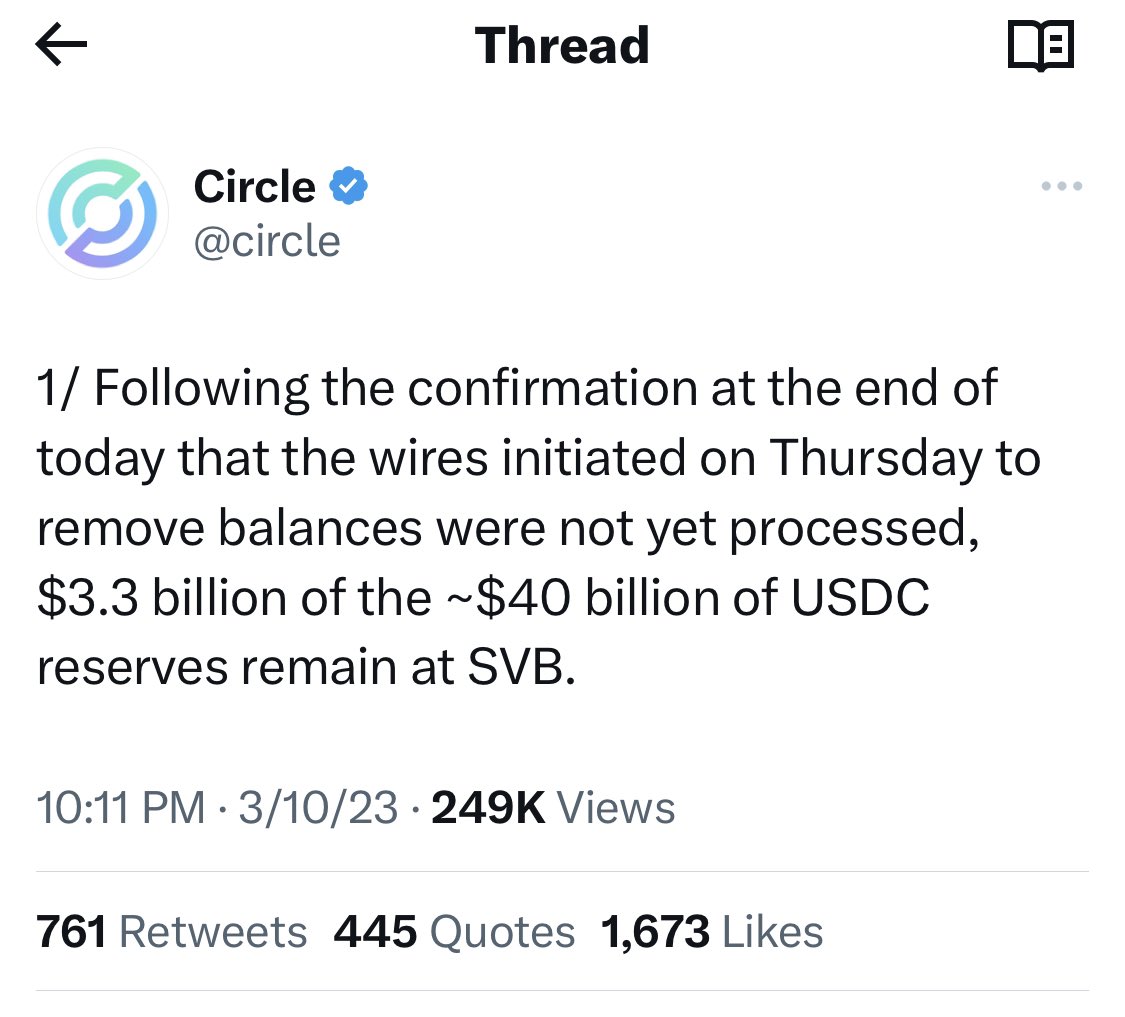

Uncle Gabor nailed it. #USDT

https://twitter.com/gaborgurbacs/status/1621842103637524481

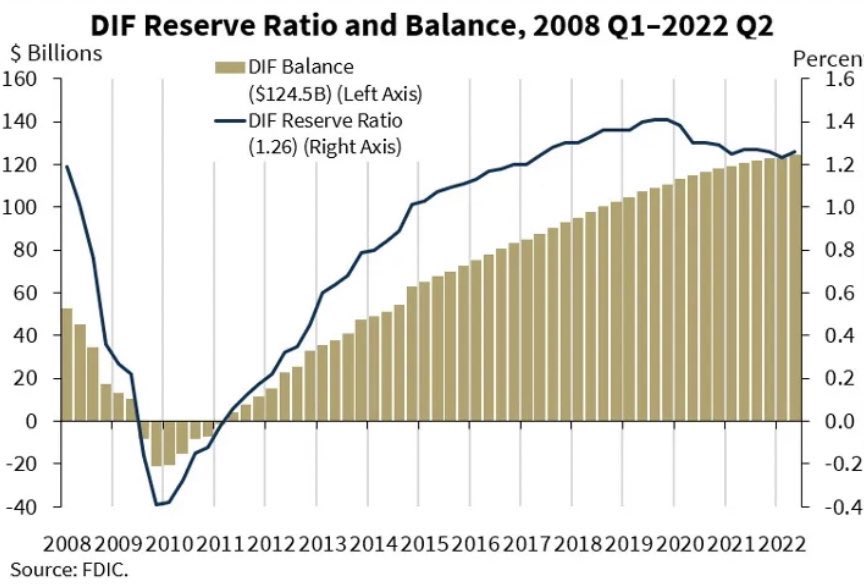

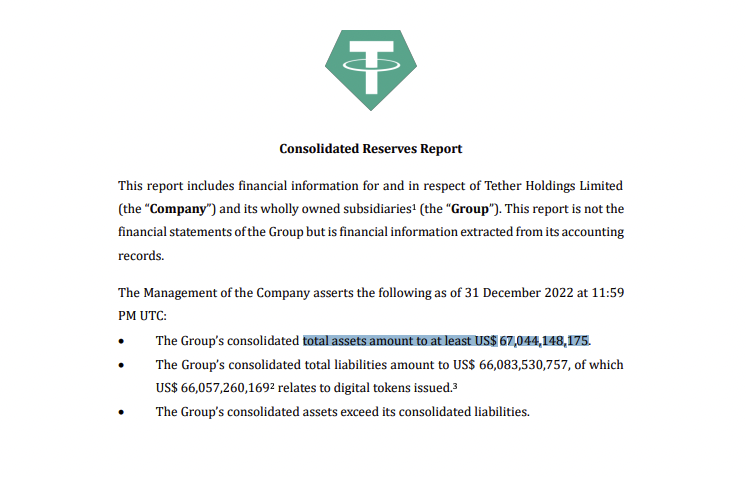

Tether demonstrated conservative and superior risk management during difficult market cycles over the past years allowing Tether to inspire confidence and grow leadership in Emerging Markets countries. I hope more people come to appreciate this given events in the past few days.

• • •

Missing some Tweet in this thread? You can try to

force a refresh