Founder + CEO: Pointsville & Hadron. CSA: Tether. Fmr: VanEck, MIT, Williams. Fine print reader. Builder of things. Views are my own. Not financial advice.

How to get URL link on X (Twitter) App

https://twitter.com/gaborgurbacs/status/1653003203531636737

2) In 1971, President Nixon ended the Bretton Woods agreement and un-tethered the Dollar from Gold, attacking gold once more. Yet gold is still around and went from $35/oz to $2,000+ today. Even states and central banks use gold as a hedge. Gold became what it is under pressure.

2) In 1971, President Nixon ended the Bretton Woods agreement and un-tethered the Dollar from Gold, attacking gold once more. Yet gold is still around and went from $35/oz to $2,000+ today. Even states and central banks use gold as a hedge. Gold became what it is under pressure.

Top U.S. Treasury Sellers in the Past 1 Year.

Top U.S. Treasury Sellers in the Past 1 Year.

The regional bank and crypto sectors are risks to centralized financial control and CBDC implementation. Since those elements won’t back down, their systematic elimination has commenced. Such financial pogrom is incongruent with everything that made America what it is today.

The regional bank and crypto sectors are risks to centralized financial control and CBDC implementation. Since those elements won’t back down, their systematic elimination has commenced. Such financial pogrom is incongruent with everything that made America what it is today.

2) The Hungarian economy could only be stabilized by the introduction of a new currency, and therefore, on 1 August 1946, the Forint was reintroduced at a rate of 400 000 000 000 000 000 000 000 000 000 (400 octillion) = 4×10^29 Pengo, dropping 29 zeros from the old currency. 👇

2) The Hungarian economy could only be stabilized by the introduction of a new currency, and therefore, on 1 August 1946, the Forint was reintroduced at a rate of 400 000 000 000 000 000 000 000 000 000 (400 octillion) = 4×10^29 Pengo, dropping 29 zeros from the old currency. 👇

Credit Suisse has a $39 Trillion off balance sheet derivatives exposure. We don't know: 1. whether it's all delta neutral. 2. What's getting picked up by UBS. 3. Which countries an unwind could impact. A chain reaction of bank unwinds could become potentially catastrophic.

Credit Suisse has a $39 Trillion off balance sheet derivatives exposure. We don't know: 1. whether it's all delta neutral. 2. What's getting picked up by UBS. 3. Which countries an unwind could impact. A chain reaction of bank unwinds could become potentially catastrophic.

Uncle Gabor nailed it. #USDT

Uncle Gabor nailed it. #USDT https://twitter.com/gaborgurbacs/status/1621842103637524481

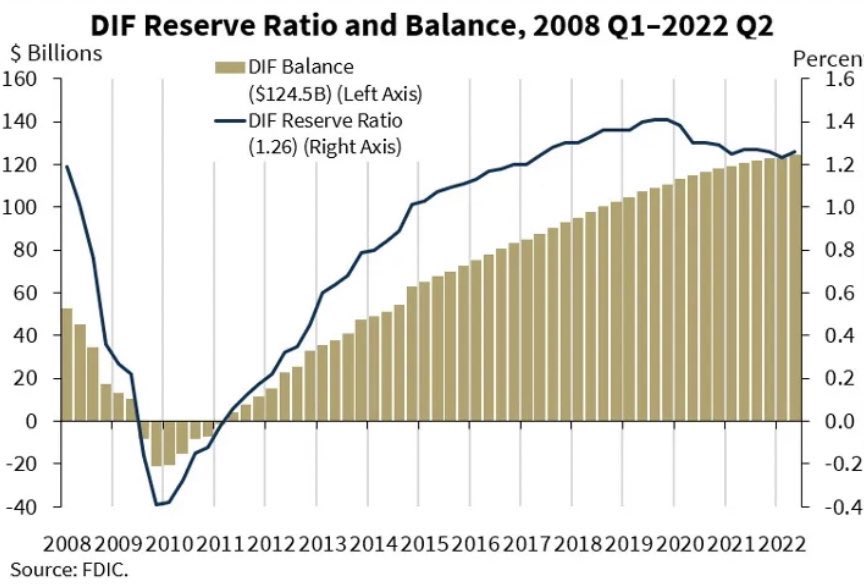

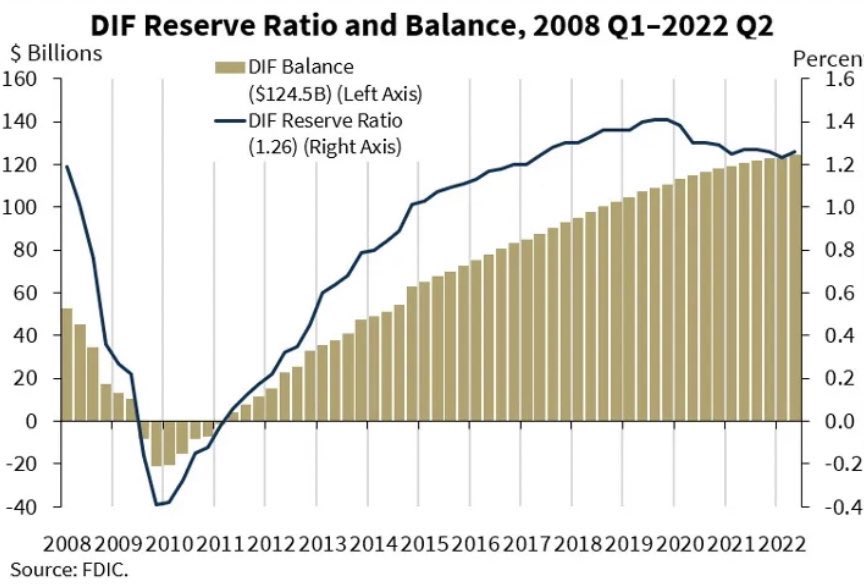

Of course, the FDIC doesn’t cover anything above $250k… so basically no businesses. It’s practically worthless. People trust banks more than what they should. Tier 1 leverage ratios (tier 1 capital/consolidated assets) show just how much more leveraged banks are vs stablecoins.

Of course, the FDIC doesn’t cover anything above $250k… so basically no businesses. It’s practically worthless. People trust banks more than what they should. Tier 1 leverage ratios (tier 1 capital/consolidated assets) show just how much more leveraged banks are vs stablecoins.

2) As a @PointsVilleApp partner, you can create and give-away Visa cards that is spendable anywhere that accepts a Visa. The card earns 5% back from 100+ big brands (see above). Cash just goes back onto your card after spending with our partners. Super simple. (T&C applies)

2) As a @PointsVilleApp partner, you can create and give-away Visa cards that is spendable anywhere that accepts a Visa. The card earns 5% back from 100+ big brands (see above). Cash just goes back onto your card after spending with our partners. Super simple. (T&C applies)

2) The perpetuals fututues track the MVIS CC DA 10 and MVIS CC DA 25 indices which are modified market cap-weighted indices that track the performance of the 10 and 25 largest & most liquid digital assets. To ensure investability the indices undergo rigorous liquidity screenings.

2) The perpetuals fututues track the MVIS CC DA 10 and MVIS CC DA 25 indices which are modified market cap-weighted indices that track the performance of the 10 and 25 largest & most liquid digital assets. To ensure investability the indices undergo rigorous liquidity screenings.

@vaneck_us 2/ Monetary value is value that exists in spite of an economic good not having intrinsic value or value that exists in excess of an economic good’s intrinsic value. Historically, most objects of monetary value have no relationship to a sovereign entity.(eg: gold, gemstones, etc.)

@vaneck_us 2/ Monetary value is value that exists in spite of an economic good not having intrinsic value or value that exists in excess of an economic good’s intrinsic value. Historically, most objects of monetary value have no relationship to a sovereign entity.(eg: gold, gemstones, etc.)