Thread🧵

How to update in Aadhaar Proof of Identity and Proof of Address online free of cost up to 14th June 2023?

#Aadhaar

How to update in Aadhaar Proof of Identity and Proof of Address online free of cost up to 14th June 2023?

#Aadhaar

Login on myaadhaar.uidai.gov.in

Enter your Aadhaar Number, Captcha Code, and OTP sent on the Registered Mobile Number

Enter your Aadhaar Number, Captcha Code, and OTP sent on the Registered Mobile Number

This will help you to update your proof of identity and proof of address.

Note: It will not update demographic details i.e Name, Gender, and DOB

Note: It will not update demographic details i.e Name, Gender, and DOB

For updating proof of Identity - The option to upload PAN Card or e-PAN card is available

Note: This does not absolve you from linking your PAN with your Aadhaar. Not sure if this will make linking PAN with Aadhaar easy

Note: This does not absolve you from linking your PAN with your Aadhaar. Not sure if this will make linking PAN with Aadhaar easy

You have to mandatorily upload BOTH proofs of identity and address.

You have to click on the checkbox for giving consent for uploading the document and then click on "Next".

Note: The option to upload only one is not available

You have to click on the checkbox for giving consent for uploading the document and then click on "Next".

Note: The option to upload only one is not available

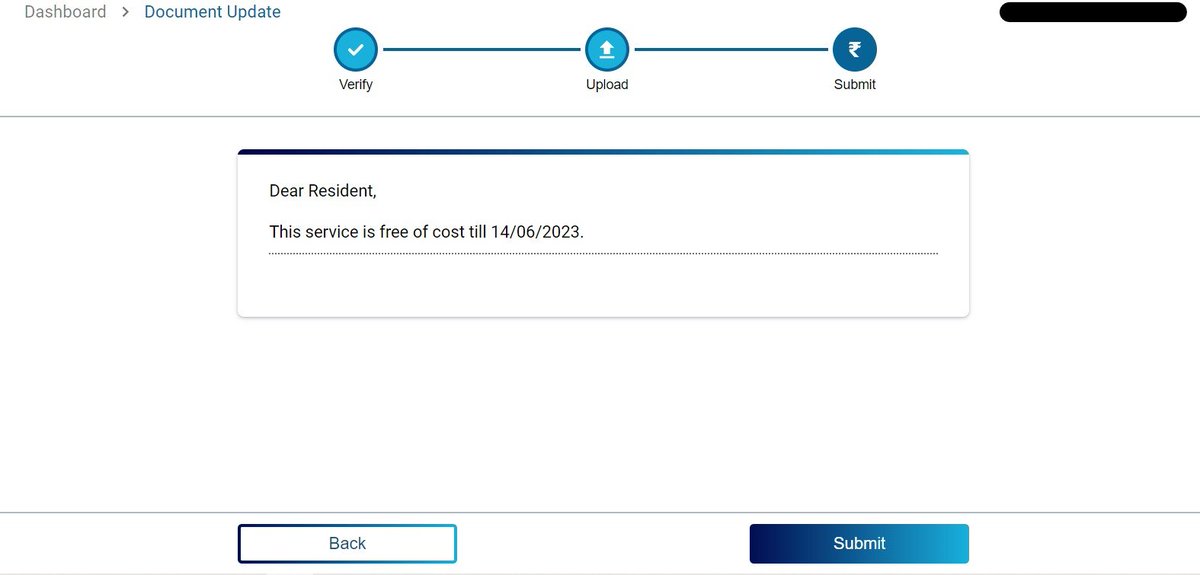

Upon clicking "SUBMIT". Your documents will be updated free of cost if the service is availed up to 14 June 2023.

• • •

Missing some Tweet in this thread? You can try to

force a refresh