1/n Higher/rising rates $TLT & 2023/24 unit deliveries have weighed on #multifamily #REITs $AVB $CPT $EQR $ESS $MAA $UDR over the past year. I see the credit events $SIVB $FRC $SBNY $KBE of the past week being a positive for the sector as:

2/n Small/Med banks are a key lender to developers. Last week (prior to bank crisis), at Citi conf $MAA CEO said that new MF permitting had come to a halt due to rising rates/spreads/const costs. Bank crisis will further curtail development. LOWER SUPPLY

https://twitter.com/TheTranscript_/status/1636296322784411648

3/n 10y now below 3.5%. MF REITS are low leverage (sub 30% LTVs) and primarily access debt financing through corporate bond market. While banks will be reticent to lend, I see debt costs for the REITs heading lower

4/n YTM for long duration (7-25 year) MF REIT bonds is 4.6-5.1%. Strong balance sheet health/access to capital + low debt cost advantage puts REITs in prime position to capitalize on dislocation (distressed sales later this year should developers get crunched during leaseup).

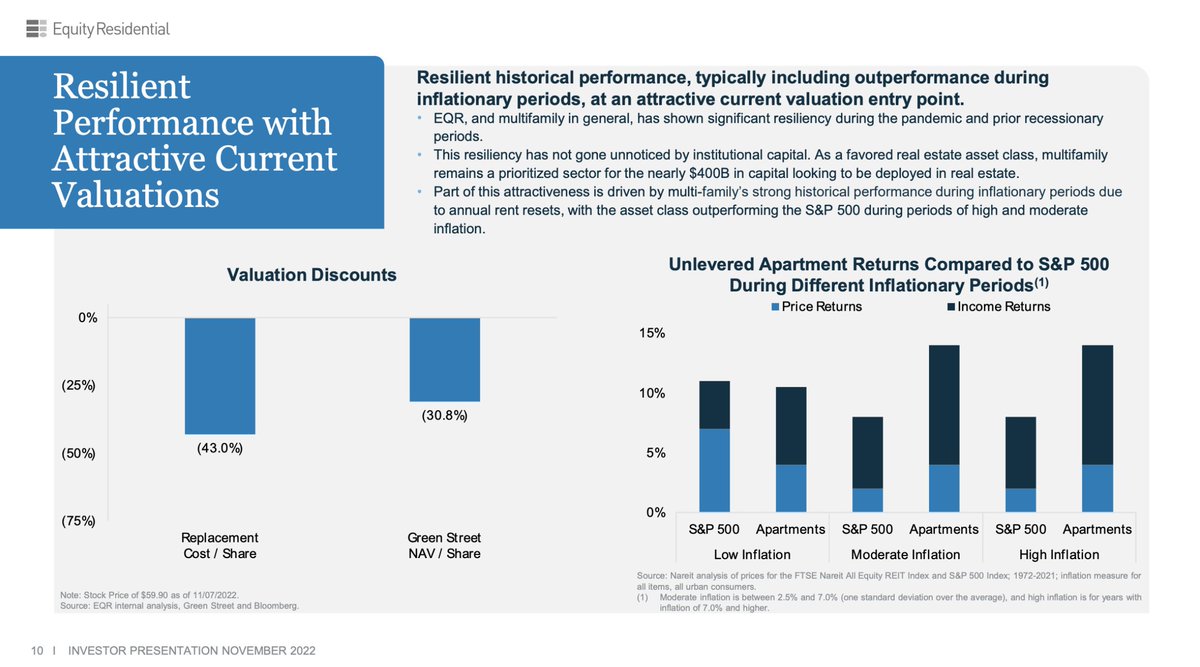

5/n Banking crisis puts fed in tough spot. End to fed tightening cycle could make it harder to curtail inflation->continued upward pressure on replacement cost. MF $REITS priced well below replacement cost. Another reason NOT to develop.

6/n I believe this sets up well for outsized rent/NOI growth looking out to 2025-26 (after we work through 2023/24 deliveries). Sector trading at implied cap rates of 5.7-6.3% (on 2023e NOI).

$EQR / $UDR boosting #dividends today

seekingalpha.com/news/3948314-e…

seekingalpha.com/news/3948319-u…

seekingalpha.com/news/3948314-e…

seekingalpha.com/news/3948319-u…

• • •

Missing some Tweet in this thread? You can try to

force a refresh