1/5

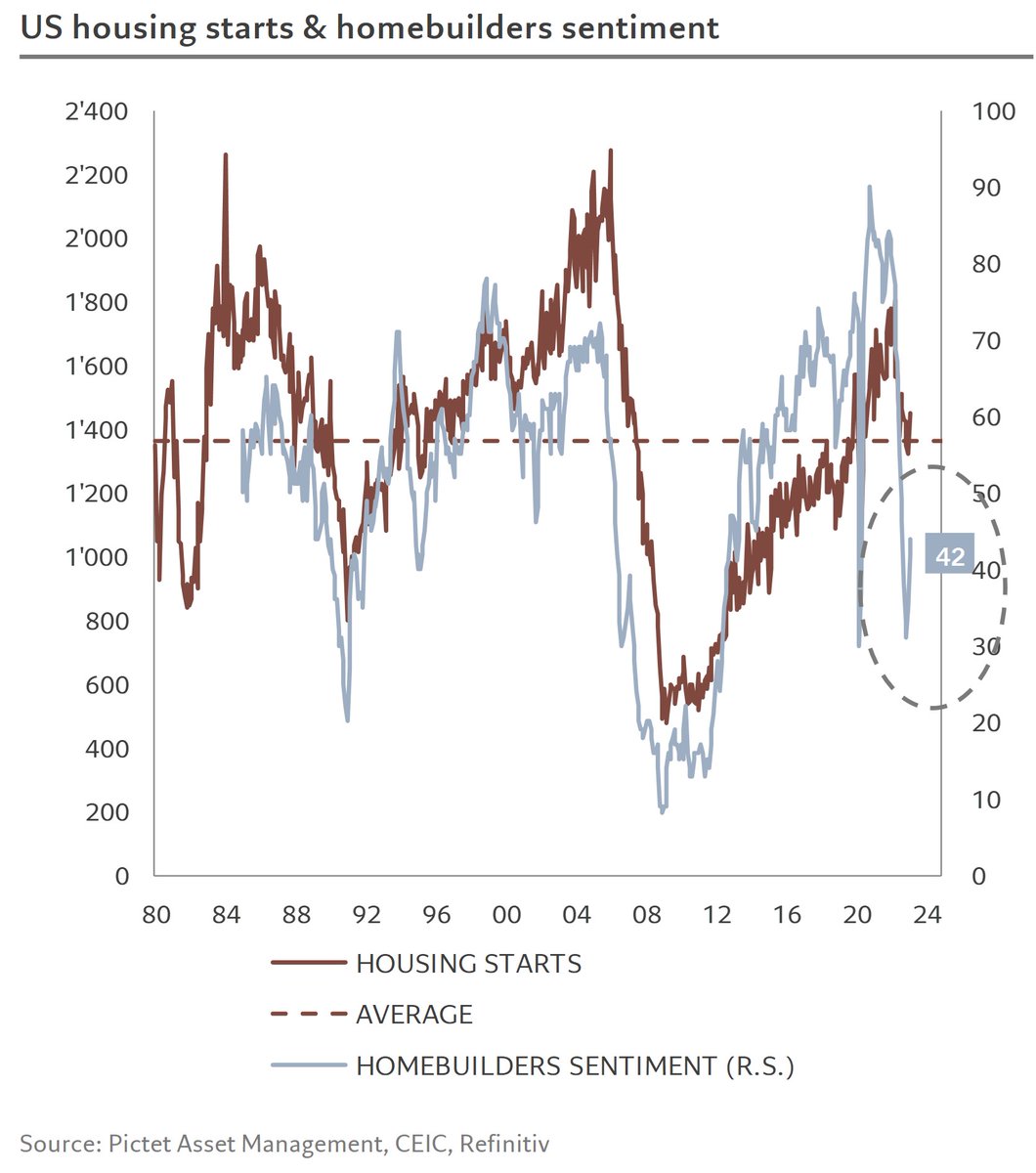

After 10 months of decline and for the 3rd month in a row, our #US housing activity indicator has stopped deteriorating with 11 out of 15 indicators up, among which building permits

After 10 months of decline and for the 3rd month in a row, our #US housing activity indicator has stopped deteriorating with 11 out of 15 indicators up, among which building permits

2/5

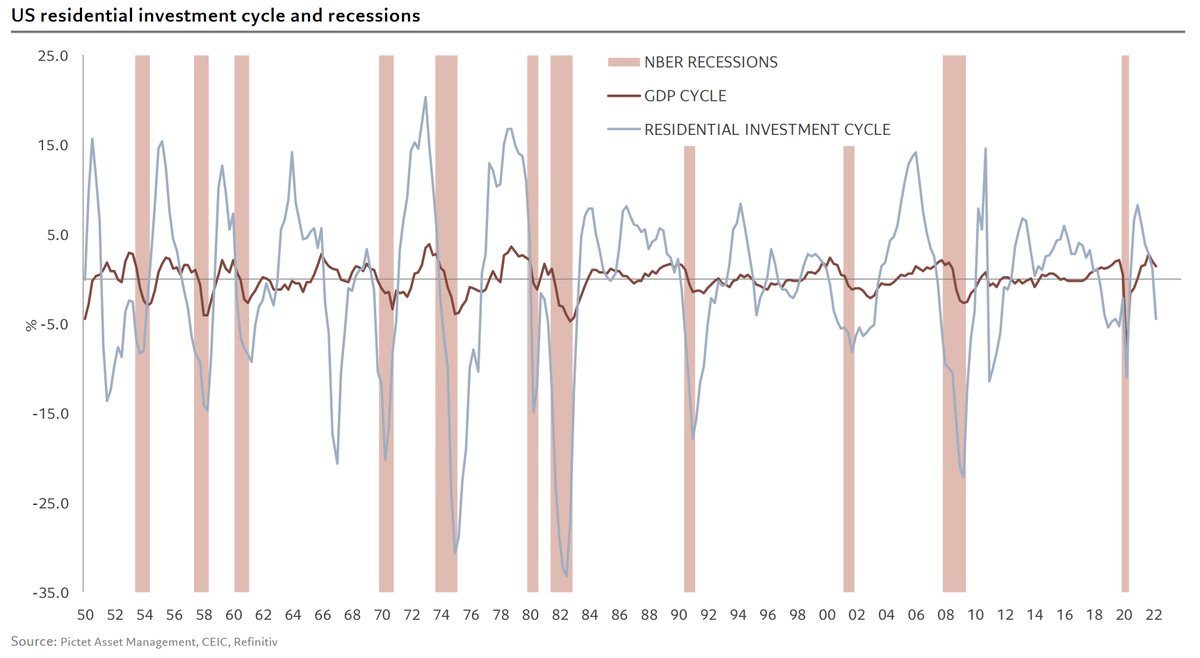

Housing was the 1st demand component to turn around in March 2021 and should, as in past cycles, be the first to recover

There are three main reasons for the first signs of recovery in the housing market:

Housing was the 1st demand component to turn around in March 2021 and should, as in past cycles, be the first to recover

There are three main reasons for the first signs of recovery in the housing market:

3/5

1) The decline in house prices, which is expected to continue given the historical lag of prices on housing activity. This correction makes homes more affordable as is evident in the decline in the ratio of house prices to disposable income by over 10%

1) The decline in house prices, which is expected to continue given the historical lag of prices on housing activity. This correction makes homes more affordable as is evident in the decline in the ratio of house prices to disposable income by over 10%

4/5

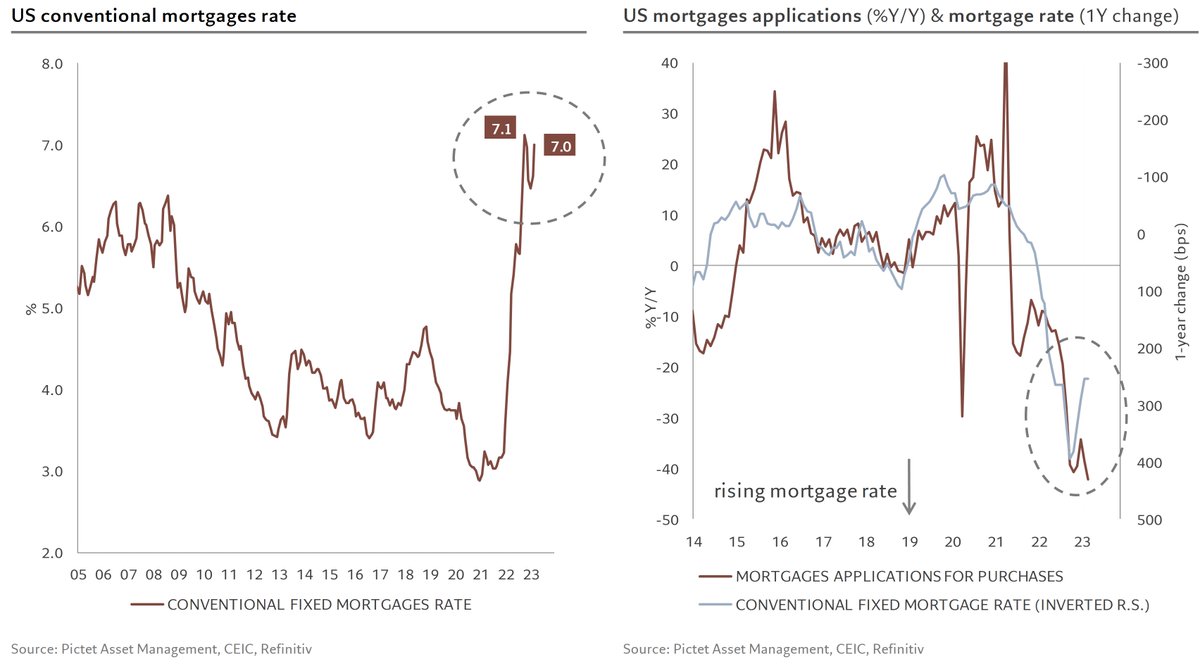

2) A stabilization of mortgage rates at their record levels of last October. While still high, this stabilization does put a floor under mortgage applications

2) A stabilization of mortgage rates at their record levels of last October. While still high, this stabilization does put a floor under mortgage applications

• • •

Missing some Tweet in this thread? You can try to

force a refresh