Wanna do some drugs? 💊

Amongst all the noise and hype around the #Arb airdrop, one protocol has not only caught my eye, but my attention.

Truthfully, I feel underexposed to this project & I'm going to tell you why.

Let's drop a tab on @0xAcidDAO

A thread 🧵👇

1/28

Amongst all the noise and hype around the #Arb airdrop, one protocol has not only caught my eye, but my attention.

Truthfully, I feel underexposed to this project & I'm going to tell you why.

Let's drop a tab on @0xAcidDAO

A thread 🧵👇

1/28

@0xAcidDAO So first things first, the #ETH Shapella upgrade is set to go ahead on April 12th.

@LouisCooper_ covers the basics!🍄

But, TL;DR 🍬

A shit tonne of staked #ETH ($27bn) will be unlocked, meaning the fight to offer the highest APR's by LSDs is on.

buff.ly/3TsckJO

2/28

@LouisCooper_ covers the basics!🍄

But, TL;DR 🍬

A shit tonne of staked #ETH ($27bn) will be unlocked, meaning the fight to offer the highest APR's by LSDs is on.

buff.ly/3TsckJO

2/28

@0xAcidDAO @LouisCooper_ So, having read the above, you should understand that:

💊 You need 32E to be validator on the #ETH network

💊 Non-validators use LSD's protocols to stake

💊 LSD's compete to pay out the highest APR's

LSD means "Liquid Staking Derivatives".

Stay with me!

3/28

💊 You need 32E to be validator on the #ETH network

💊 Non-validators use LSD's protocols to stake

💊 LSD's compete to pay out the highest APR's

LSD means "Liquid Staking Derivatives".

Stay with me!

3/28

@0xAcidDAO @LouisCooper_ So, we've set the scene with the upcoming #ETH upgrade and why there is a need for LSD Protocols.

Now, there are a lot of LSD Projects out there, so what makes $ACID special?

Well, how about this?

All of the protocol's revenue is distributed back to $ACID stakers.

4/28

Now, there are a lot of LSD Projects out there, so what makes $ACID special?

Well, how about this?

All of the protocol's revenue is distributed back to $ACID stakers.

4/28

@0xAcidDAO @LouisCooper_ As with any deep dive, let's start with the basics.

WTF is @0xAcidDAO? ☠️

$ACID is an LSD Protocol aiming to deliver maximum yield profits to token holders with innovative revenue models. $ACID incorporates bonds, real-yield, esToken and lending to increase yields.

5/28

WTF is @0xAcidDAO? ☠️

$ACID is an LSD Protocol aiming to deliver maximum yield profits to token holders with innovative revenue models. $ACID incorporates bonds, real-yield, esToken and lending to increase yields.

5/28

@0xAcidDAO @LouisCooper_ First up, let's look at Bonding 💰

In short, by locking up a certain amount of tokens, the protocol will provide you with additional rewards or benefits.

The issuance of bonds means $ACID can acquire its own liquidity ($) and hold more LSD (ETH related) assets.

But why?

6/28

In short, by locking up a certain amount of tokens, the protocol will provide you with additional rewards or benefits.

The issuance of bonds means $ACID can acquire its own liquidity ($) and hold more LSD (ETH related) assets.

But why?

6/28

@0xAcidDAO @LouisCooper_ Well, issuing bonds is used to raise capital, helping the issuer pursue more opportunities and drive growth.

By purchasing these bonds, the bond holder is given a higher value backing to his/her $ACID token.

But what does it mean to the person "bonding" their LSD assets?

7/28

By purchasing these bonds, the bond holder is given a higher value backing to his/her $ACID token.

But what does it mean to the person "bonding" their LSD assets?

7/28

@0xAcidDAO @LouisCooper_ In the example below, the issuer is giving the bonder a nearly ~10% discount on $ACID by bonding $ETH

The payout asset $ACID, is subject to vesting ~1/2 days.

#0xAcid will try to scoop up as much #ETH as possible, enhancing ETH security through staking!

8/28

The payout asset $ACID, is subject to vesting ~1/2 days.

#0xAcid will try to scoop up as much #ETH as possible, enhancing ETH security through staking!

8/28

@0xAcidDAO @LouisCooper_ There are risks and bonding is typically seen as a short-term strategy, which requires constant monitoring to be profitable.

Fluctuations in the price of $ACID could make bonding unprofitable, but when working efficiently, the potential rewards can be significant.

9/28

Fluctuations in the price of $ACID could make bonding unprofitable, but when working efficiently, the potential rewards can be significant.

9/28

@0xAcidDAO @LouisCooper_ Let's talk about Vesting with $esACID ☀️

Staking $ACID generates $esACID, in addition to the income from ETH.

$esACID can either be exchanged back to $ACID or used for the protocol governance rights.

Through vesting, this can reduce selling pressure on $ACID.

10/28

Staking $ACID generates $esACID, in addition to the income from ETH.

$esACID can either be exchanged back to $ACID or used for the protocol governance rights.

Through vesting, this can reduce selling pressure on $ACID.

10/28

@0xAcidDAO @LouisCooper_ Right now the APR for $esACID is ~3,000%+ making it highly lucrative to stake your $ACID.

To vest $esACID, 200% of ACID must first be staked. When fulfilled, vesting (30 days) commences, reducing sell pressure.

So, if you want to vest 100 $esACID you stake 200 $ACID.

11/28

To vest $esACID, 200% of ACID must first be staked. When fulfilled, vesting (30 days) commences, reducing sell pressure.

So, if you want to vest 100 $esACID you stake 200 $ACID.

11/28

@0xAcidDAO @LouisCooper_ Now, there's another way to earn $esACID and that is through Staking & Lock-Ups.

🔒 Lock-Ups = ETH/stETH and $esACID rewards.

🥩 Staking = $esACID rewards.

The longer you lock up your $ACID, the higher the rewards through Yield Boosts/Bonuses!

Here's how that looks:

12/28

🔒 Lock-Ups = ETH/stETH and $esACID rewards.

🥩 Staking = $esACID rewards.

The longer you lock up your $ACID, the higher the rewards through Yield Boosts/Bonuses!

Here's how that looks:

12/28

@0xAcidDAO @LouisCooper_ 🔐Locking Durations:

⏰ 1 Month = 15%

⏰ 3 Months = 30%

⏰ 6 Months = 50%

⏰ 12 Months = 100%

You can claim AND lock the rewards again, with no impact on the bonus rewards earned through staking.

There's also another little secret, I'll tell you at the end.

13/28

⏰ 1 Month = 15%

⏰ 3 Months = 30%

⏰ 6 Months = 50%

⏰ 12 Months = 100%

You can claim AND lock the rewards again, with no impact on the bonus rewards earned through staking.

There's also another little secret, I'll tell you at the end.

13/28

@0xAcidDAO @LouisCooper_ Staking 🥩

By staking, you support the network and earn rewards.

Simple, easy, you know this, you've done it before.

All profits (100%) generated are distributed to those who have staked and locked-up $ACID, which is paid in ETH (or stETH).

It's perfect game theory.

14/28

By staking, you support the network and earn rewards.

Simple, easy, you know this, you've done it before.

All profits (100%) generated are distributed to those who have staked and locked-up $ACID, which is paid in ETH (or stETH).

It's perfect game theory.

14/28

@0xAcidDAO @LouisCooper_ Another really cool feature to $ACID is the Lending aspect (coming soon)!

In order to free up $ACID, holders can use their $ACID at collateral to borrow wstETH.

The interest charged by the lending function will then in turn generate profits for the 0xACID.

🧠

15/28

In order to free up $ACID, holders can use their $ACID at collateral to borrow wstETH.

The interest charged by the lending function will then in turn generate profits for the 0xACID.

🧠

15/28

@0xAcidDAO @LouisCooper_ The max amount of wstETH you can borrow is 40% of the backing price of $ACID, with a liquidation threshold of 50%.

When a position is liquidated, $ACID is burnt, destroyed, forever 🔥

So, get liquidated, lower $ACID supply.

What a sick and twisted mechanism, I love it.

16/28

When a position is liquidated, $ACID is burnt, destroyed, forever 🔥

So, get liquidated, lower $ACID supply.

What a sick and twisted mechanism, I love it.

16/28

@0xAcidDAO @LouisCooper_ $ACID protocol is really complex, but also the most simple thing I've ever had the pleasure of using.

Why settle for ordinary LSD assets (stETH, cbETH) yields of 4% APY, when you can go full degen and earn 10-30% APY, paid out in LSD-assets, stETH, ETH and esACID.

17/28

Why settle for ordinary LSD assets (stETH, cbETH) yields of 4% APY, when you can go full degen and earn 10-30% APY, paid out in LSD-assets, stETH, ETH and esACID.

17/28

@0xAcidDAO @LouisCooper_ Now, let's have a chat about Real Yield 🍃

As you expect, $ACID only survives if it can provide long-term sustainable returns on LSD assets.

The strategy is fairly simple. Expand ETH denominated holdings as much as possible.

But how?

18/28

As you expect, $ACID only survives if it can provide long-term sustainable returns on LSD assets.

The strategy is fairly simple. Expand ETH denominated holdings as much as possible.

But how?

18/28

@0xAcidDAO @LouisCooper_ Partnerships will be key, each varying in risk 🤝

For e.g. leveraging @pendle_fi and supplying liquidity to their #LSD pools for rewards up to 109%.

Certainly deemed riskier than safe plays on @AuraFinance and @fraxfinance, but fruitful.

buff.ly/3Z43G5t

19/28

For e.g. leveraging @pendle_fi and supplying liquidity to their #LSD pools for rewards up to 109%.

Certainly deemed riskier than safe plays on @AuraFinance and @fraxfinance, but fruitful.

buff.ly/3Z43G5t

19/28

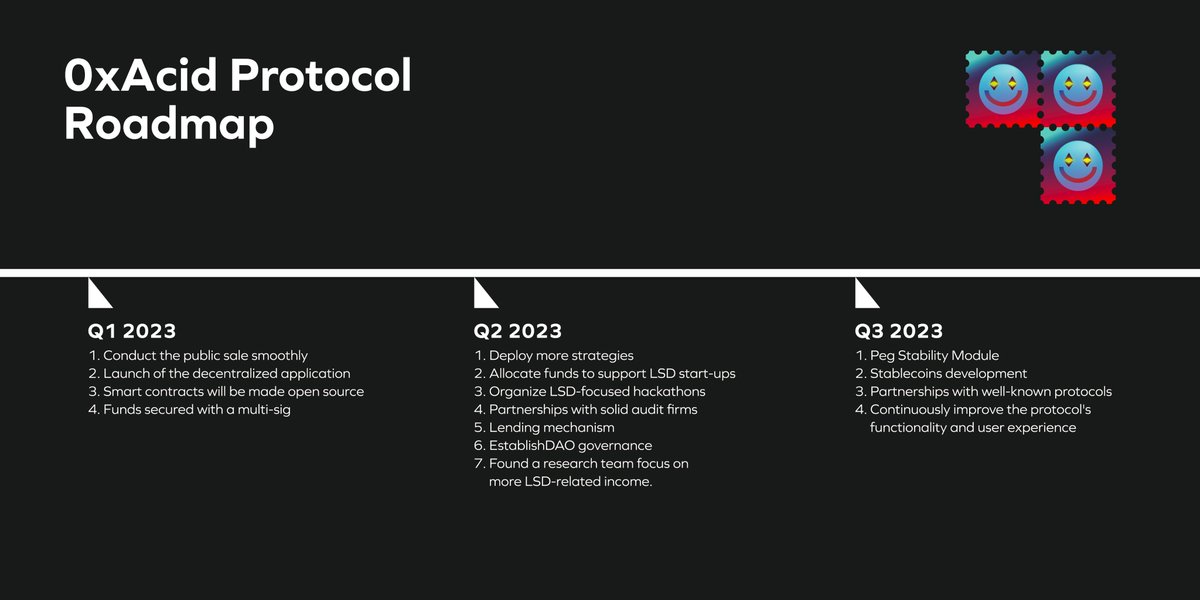

@0xAcidDAO @LouisCooper_ @pendle_fi @AuraFinance @fraxfinance So, what about the future? The focus will be on:

☑️ Deploying funds to support LSD start-ups

☑️ Increase Real Yield Strategies

☑️ DAO Governance

The team seems nimble, agile and they move FAST, as shown with the activity with @pendle_fi and @CamelotDEX

20/28

☑️ Deploying funds to support LSD start-ups

☑️ Increase Real Yield Strategies

☑️ DAO Governance

The team seems nimble, agile and they move FAST, as shown with the activity with @pendle_fi and @CamelotDEX

20/28

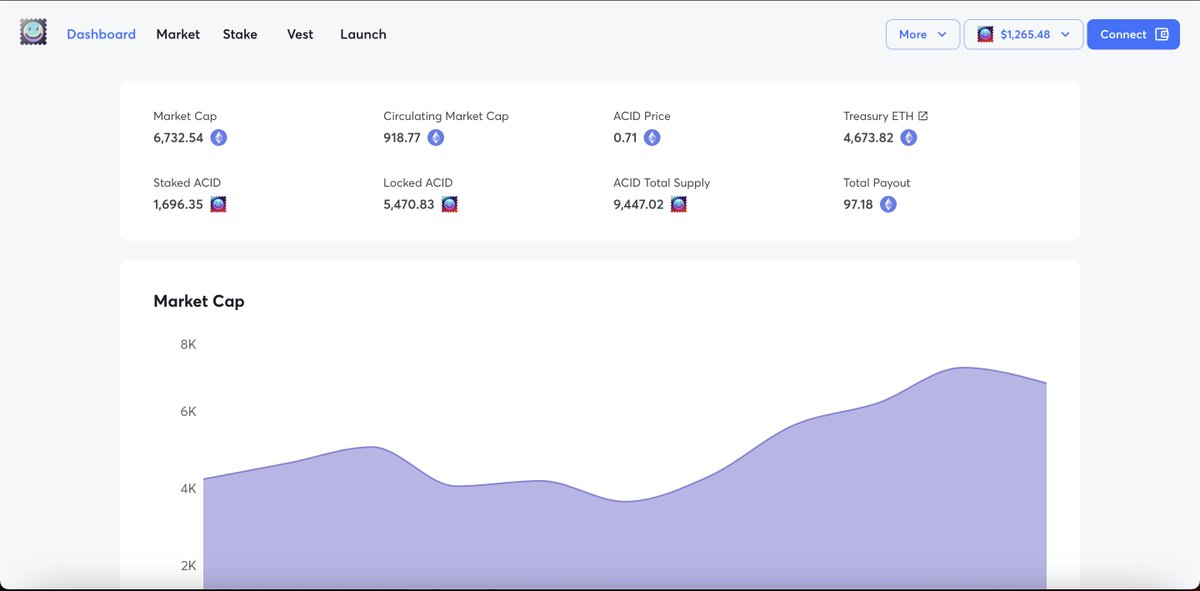

@0xAcidDAO @LouisCooper_ @pendle_fi @AuraFinance @fraxfinance @CamelotDEX Tokenomics time! 🪙

- Total Supply: Unlimited

- Initial Supply: 7,370 $ACID

- Token Sale: 5,000 $ACID

- Price: $1,238

- FDV Market Cap: ~$12M

- Circulating MC: ~$1.7M

Considering the yields, $ACID feels grossly undervalued.

21/28

- Total Supply: Unlimited

- Initial Supply: 7,370 $ACID

- Token Sale: 5,000 $ACID

- Price: $1,238

- FDV Market Cap: ~$12M

- Circulating MC: ~$1.7M

Considering the yields, $ACID feels grossly undervalued.

21/28

@0xAcidDAO @LouisCooper_ @pendle_fi @AuraFinance @fraxfinance @CamelotDEX It's worth us talking about the team too.

The Toxin Lab team are in charge of $ACID, their previous success being CongruentFi, which in the last run hit a Market Cap of $150M+ with a treasury of over $40M.

The team are smart, and IMO have branded this protocol perfectly.

22/28

The Toxin Lab team are in charge of $ACID, their previous success being CongruentFi, which in the last run hit a Market Cap of $150M+ with a treasury of over $40M.

The team are smart, and IMO have branded this protocol perfectly.

22/28

@0xAcidDAO @LouisCooper_ @pendle_fi @AuraFinance @fraxfinance @CamelotDEX $ACID launched on #Arb in March 2023, after hitting a hard cap of 4,000 ETH in 15 hours, selling out the token allocation offered. Hype.

ACID is the “LSD of LSDs” and after a the #Shapella upgrade, I can see a big chunk of #ETH finding it's way to this protocol.

23/28

ACID is the “LSD of LSDs” and after a the #Shapella upgrade, I can see a big chunk of #ETH finding it's way to this protocol.

23/28

@0xAcidDAO @LouisCooper_ @pendle_fi @AuraFinance @fraxfinance @CamelotDEX Here's the chart 📊

If you told me that $ACID will be trading for five figures this time next year, I wouldn't be surprised.

Be sure to dive into the analytics on @DuneAnalytics:

buff.ly/3FDvWVC

A lot of ETH might soon by finding a new home with @0xAcidDAO.

24/28

If you told me that $ACID will be trading for five figures this time next year, I wouldn't be surprised.

Be sure to dive into the analytics on @DuneAnalytics:

buff.ly/3FDvWVC

A lot of ETH might soon by finding a new home with @0xAcidDAO.

24/28

@0xAcidDAO @LouisCooper_ @pendle_fi @AuraFinance @fraxfinance @CamelotDEX @DuneAnalytics So, what else have @0xAcidDAO and their community have been up to?

Well...

1. Dune Dashboard, created by @0xplok

2. Community Thread Competition (Ironic)

3. Offering a Nitro Pool on @CamelotDEX

4. Partnering with @pendle_fi

$ACID only launched in March

25/28

Well...

1. Dune Dashboard, created by @0xplok

2. Community Thread Competition (Ironic)

3. Offering a Nitro Pool on @CamelotDEX

4. Partnering with @pendle_fi

$ACID only launched in March

25/28

@0xAcidDAO @LouisCooper_ @pendle_fi @AuraFinance @fraxfinance @CamelotDEX @DuneAnalytics @0xplok Saving the best til last...

@0xAcidDAO just announced the Bond Dividend Mechanism, where 10% of all Bond sales will be added to the dividend pool in the form of wstETH and distributed to $ACID lockers.

The APR of wstETH will be increased from 10% to between 20% to 100%!

26/28

@0xAcidDAO just announced the Bond Dividend Mechanism, where 10% of all Bond sales will be added to the dividend pool in the form of wstETH and distributed to $ACID lockers.

The APR of wstETH will be increased from 10% to between 20% to 100%!

26/28

@0xAcidDAO @LouisCooper_ @pendle_fi @AuraFinance @fraxfinance @CamelotDEX @DuneAnalytics @0xplok Thank you for reading and I hope you enjoyed this thread.

Please Like, RT and tell me what you think about @0xAcidDAO?

Quick Links ⛓️

🖥️ buff.ly/3loLJRo

🐦 @0xAcidDAO

💻 buff.ly/3JVvHYH

📊 buff.ly/3ZTooGl

Buy on @SushiSwap

27/28

Please Like, RT and tell me what you think about @0xAcidDAO?

Quick Links ⛓️

🖥️ buff.ly/3loLJRo

🐦 @0xAcidDAO

💻 buff.ly/3JVvHYH

📊 buff.ly/3ZTooGl

Buy on @SushiSwap

27/28

@0xAcidDAO @LouisCooper_ @pendle_fi @AuraFinance @fraxfinance @CamelotDEX @DuneAnalytics @0xplok @SushiSwap Tagging some frens, who I think might like this thread.

@DefiIgnas

@xpnp404

@WinterSoldierxz

@ViktorDefi

@thedailydegenhq

@Tanaka_L2

@Slappjakke

@SherifDefi

@RiddlerDeFi

@monosarin

@hc_trades

@giba_machado

@EricCryptoman

@eli5_defi

@DegenCamp

@DeFiMinty

@rush_hour51

28/28

@DefiIgnas

@xpnp404

@WinterSoldierxz

@ViktorDefi

@thedailydegenhq

@Tanaka_L2

@Slappjakke

@SherifDefi

@RiddlerDeFi

@monosarin

@hc_trades

@giba_machado

@EricCryptoman

@eli5_defi

@DegenCamp

@DeFiMinty

@rush_hour51

28/28

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter