Wild how everyone becomes a #Bitcoin maximalist when the crypto VCs and shitcoin casinos blow up.

Crypto influencers will shill anything if you pay them enough.

But stop sponsoring their podcast and suddenly the truth comes out.

Crypto influencers will shill anything if you pay them enough.

But stop sponsoring their podcast and suddenly the truth comes out.

Gains in alts are driven by speculative VC money / FTX style ponzis.

Some retail folks *might* catch a pump and get out in time - but they're mostly exit liquidity. Scare off the VC's and what's left?

Just Bitcoiners relentlessly stacking Sats come hell or high water.

Some retail folks *might* catch a pump and get out in time - but they're mostly exit liquidity. Scare off the VC's and what's left?

Just Bitcoiners relentlessly stacking Sats come hell or high water.

That also means Bitcoin focused businesses are the most sustainable, and the most likely to be able to sponsor media in a bear market.

Hence the narrative shift from people with an audience that suddenly need to court Bitcoin businesses.

Hence the narrative shift from people with an audience that suddenly need to court Bitcoin businesses.

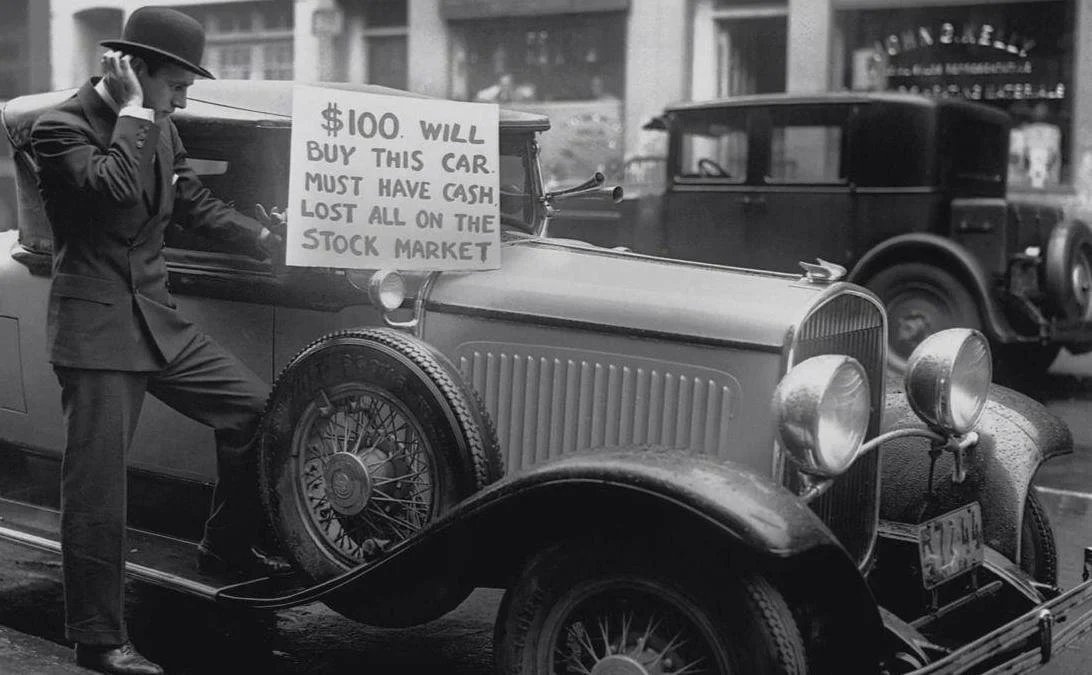

This is why it's so important to have sound money.

When a whole society is trying to outpace inflation, principles and morals go right out the window.

Financial independence makes it easy to remain principled and say no to obvious scams, however lucrative they may be.

When a whole society is trying to outpace inflation, principles and morals go right out the window.

Financial independence makes it easy to remain principled and say no to obvious scams, however lucrative they may be.

• • •

Missing some Tweet in this thread? You can try to

force a refresh