1/ Liquidity Vaults and Asset Management solutions bring billions of dollars in liquidity to Ethereum.

@QuasarFi is bringing this to the Cosmos Ecosystem.

Unlocking the next wave of liquidity with the launch of a new appchain. 🧵👇

@QuasarFi is bringing this to the Cosmos Ecosystem.

Unlocking the next wave of liquidity with the launch of a new appchain. 🧵👇

2/ What is @QuasarFi

Quasar is a pioneering sovereign appchain that manages Digital Assets through the use of Interchain Vaults.

The goal is to make investing and earning passive yield simple for users anywhere across the interchain.

Quasar is a pioneering sovereign appchain that manages Digital Assets through the use of Interchain Vaults.

The goal is to make investing and earning passive yield simple for users anywhere across the interchain.

3/ Web3 has given us the power to be our own custodian and asset manager.

But let's face it, not everyone is cut out to be their own money mastermind. Maybe you don't have the know-how or just can't spare the time.

Along comes Decentralized Asset Management (DAM) 🎉

But let's face it, not everyone is cut out to be their own money mastermind. Maybe you don't have the know-how or just can't spare the time.

Along comes Decentralized Asset Management (DAM) 🎉

4/ DAMs leverage the permissionless and transparent nature of DeFi to create innovative investment solutions.

In crypto today, you have a myriad of digital assets - tokens, liquidity pools, NFTs - all of which can be difficult to track and invest in.

Vaults aim to solve this.

In crypto today, you have a myriad of digital assets - tokens, liquidity pools, NFTs - all of which can be difficult to track and invest in.

Vaults aim to solve this.

https://twitter.com/QuasarFi/status/1630982227386302481

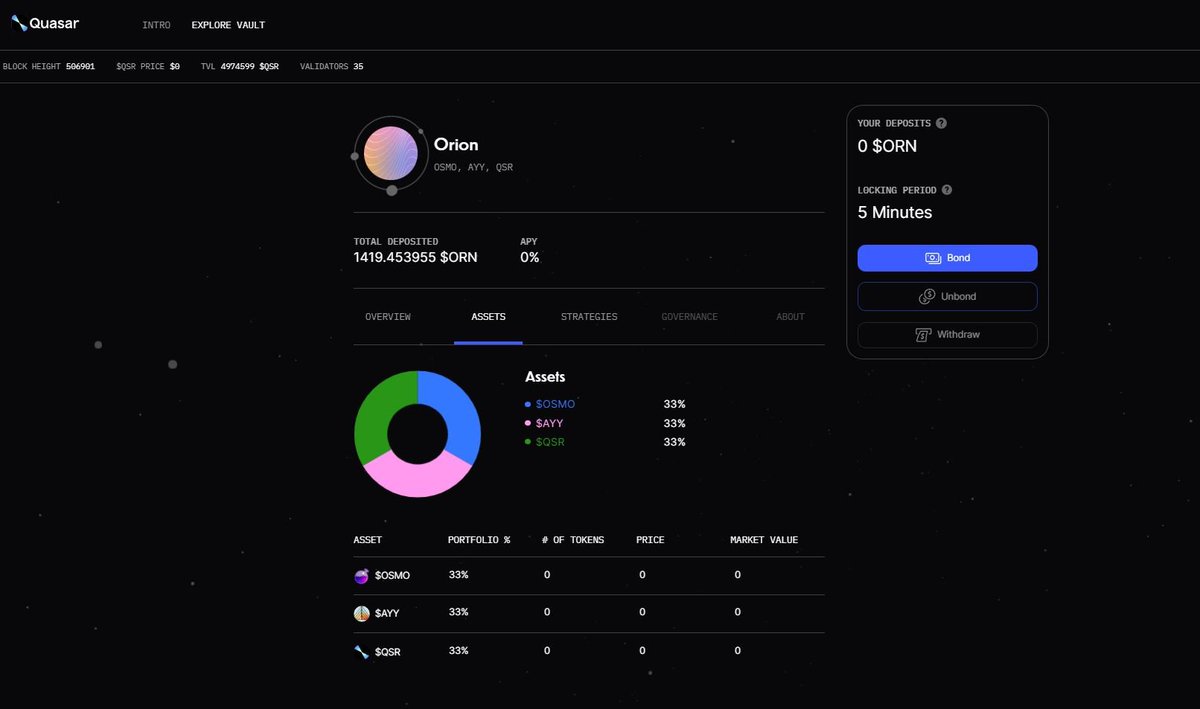

5/ What are Vaults?

Vaults are essentially containers that hold crypto assets and are an essential part of @QuasarFi strategy.

Here, you can create and manage strategies, deposit liquidity, and rotate funds.

Vaults are essentially containers that hold crypto assets and are an essential part of @QuasarFi strategy.

Here, you can create and manage strategies, deposit liquidity, and rotate funds.

6/ @QuasarFi Vaults will have 3 roles.

1️⃣ Vault Administrators: Control Vault management, can be a person or a multisig contingent on governance.

2️⃣ Strategist: Create the pool strategy (exposure).

3️⃣ Liquidity Providers: Provide liquidity to vaults LPs.

1️⃣ Vault Administrators: Control Vault management, can be a person or a multisig contingent on governance.

2️⃣ Strategist: Create the pool strategy (exposure).

3️⃣ Liquidity Providers: Provide liquidity to vaults LPs.

7/ Vaults are already big on Ethereum with @iearnfinance.

But Quasar is taking things up a notch by offering:

- Yield across the Interchain

- Self-custody of assets

- Full control over strategy parameters

But Quasar is taking things up a notch by offering:

- Yield across the Interchain

- Self-custody of assets

- Full control over strategy parameters

8/ How does it work?

In a similar way to how @osmosiszone pools operate. Through the magic of @CosmWasm, Quasar users will be able to deposit liquidity into specific strategies.

Each vault will have a different yield aggregation strategy customized by the vault's creators.

In a similar way to how @osmosiszone pools operate. Through the magic of @CosmWasm, Quasar users will be able to deposit liquidity into specific strategies.

Each vault will have a different yield aggregation strategy customized by the vault's creators.

9/ @QuasarFi Vaults are great, they allow for an easy onramp solution while injecting a social aspect to the customization.

Launching as an appchain provides even more customization and sovereignty to develop more optimal strategies.

As such, it will have its own token $QSR

Launching as an appchain provides even more customization and sovereignty to develop more optimal strategies.

As such, it will have its own token $QSR

https://twitter.com/QuasarFi/status/1630982239629475878

10/ The $QSR token will serve 4 purposes.

- Security

- Governance

- Fees paid to stakers

- Vault Creation

- Security

- Governance

- Fees paid to stakers

- Vault Creation

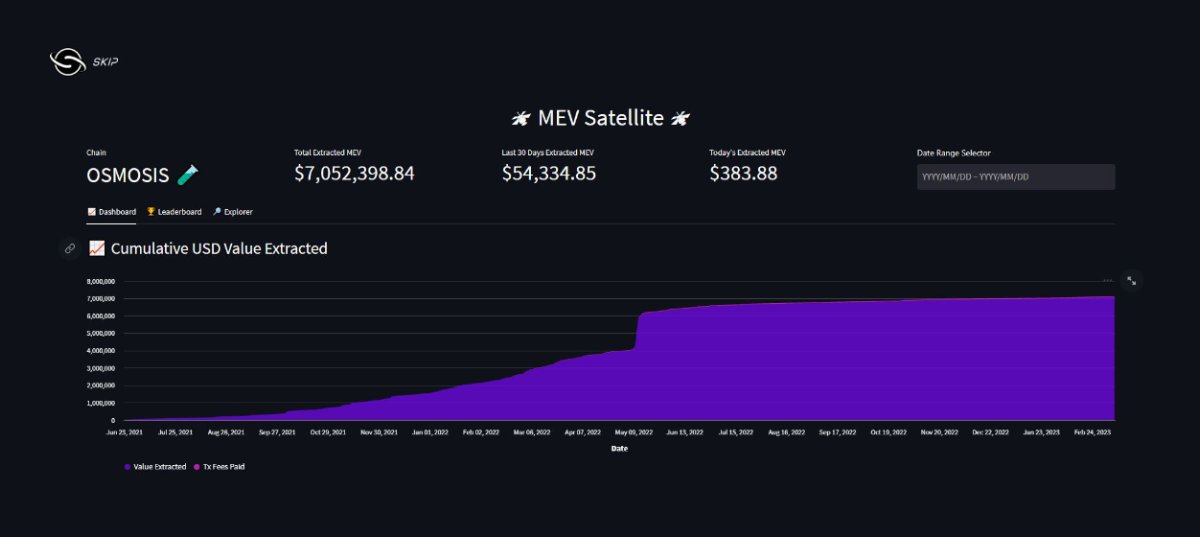

11/ @QuasarFi will initially integrate with @osmosiszone

Allowing users to create strategies with the $OSMO token.

💡Some potential use cases

- Re-staking/re-delegation of rewards

- Automated staking into various LPs

- Auto-compounding of LP rewards

- Automated LP rebalancing

Allowing users to create strategies with the $OSMO token.

💡Some potential use cases

- Re-staking/re-delegation of rewards

- Automated staking into various LPs

- Auto-compounding of LP rewards

- Automated LP rebalancing

12/ Ultimately, @QuasarFi Interchain Vaults will be the go-to DeFi interface for both individual users and institutional investors seeking to maximize their capital.

#Cosmos DeFi will grow exponentially, as more strategies, more "outposts" and more tokens are available.

#Cosmos DeFi will grow exponentially, as more strategies, more "outposts" and more tokens are available.

13/ Quasar will be going live on March 23rd and feature @osmosiszone as the first asset in its vaults.

Can't wait to see what creative and innovative strategies you degens create! 😎

Can't wait to see what creative and innovative strategies you degens create! 😎

https://twitter.com/quasarfi/status/1634208412320792578

14/ Tagging DeFi chads!

@defi_mochi

@TheDeFinvestor

@crypto_linn

@DeFiMinty

@DeFi_Taha

@Chinchillah_

@0xTindorr

@0xsurferboy

@Louround_

@IamZeroIka

@Deebs_DeFi

@MercyDeGreat

@0xSalazar

@thelearningpill

@schizoxbt

@WinterSoldierxz

@crypto_linn

@Curious__J

@rektdiomedes

@defi_mochi

@TheDeFinvestor

@crypto_linn

@DeFiMinty

@DeFi_Taha

@Chinchillah_

@0xTindorr

@0xsurferboy

@Louround_

@IamZeroIka

@Deebs_DeFi

@MercyDeGreat

@0xSalazar

@thelearningpill

@schizoxbt

@WinterSoldierxz

@crypto_linn

@Curious__J

@rektdiomedes

15/ Thank you for reading!

I hope you've found this thread helpful.

Follow me @Flowslikeosmo for more.

Show your support by Liking and Retweeting the first tweet below if you can 👇

I hope you've found this thread helpful.

Follow me @Flowslikeosmo for more.

Show your support by Liking and Retweeting the first tweet below if you can 👇

https://twitter.com/Flowslikeosmo/status/1638888402656591876

• • •

Missing some Tweet in this thread? You can try to

force a refresh