1/ As we wait for the congestion to clear around today's @arbitrum airdrop...

@chasedevens gets us up to speed with everything happening in the #Arbitrum ecosystem and within #Ethereum's competitive Layer 2 landscape. 👇🧵

@chasedevens gets us up to speed with everything happening in the #Arbitrum ecosystem and within #Ethereum's competitive Layer 2 landscape. 👇🧵

2/ @arbitrum is an #Ethereum Layer 2 scaling solution with two general-purpose optimistic rollups, Arbitrum One (flagship) & Abitrum Nova (high throughput).

Arbitrum One is the leading rollup by most user metrics, w/ its bridge becoming the 7th largest $ETH holder by contract.

Arbitrum One is the leading rollup by most user metrics, w/ its bridge becoming the 7th largest $ETH holder by contract.

3/ @arbitrum's growth is best displayed by its relative share of Total Value Locked (TVL) against its competitors, increasing 131% over the last 180 days and growing its TVL market share from 3.6% to 8.4%.

4x greater than the next fastest-growing competitor, @optimismFND.

4x greater than the next fastest-growing competitor, @optimismFND.

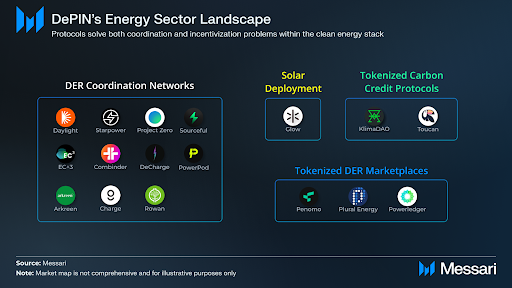

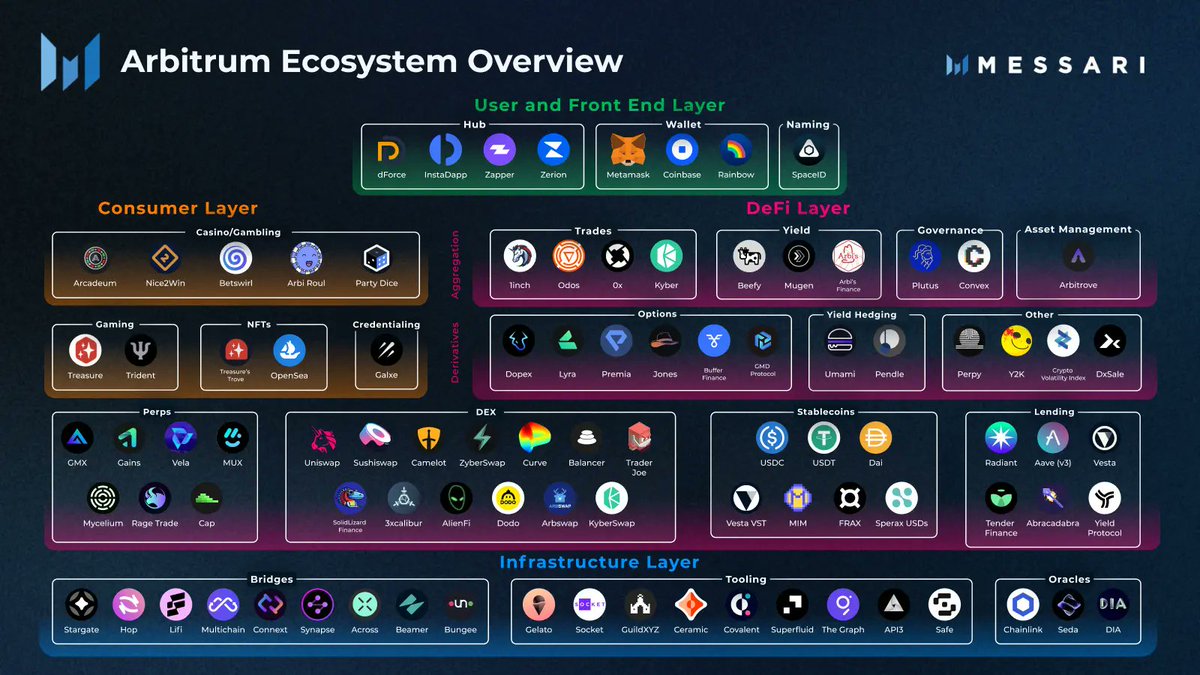

4/ Post airdrop, the focus now shifts to @arbitrum's application ecosystem which can be broken out into two primary categories:

+DeFi

+Consumer applications

+DeFi

+Consumer applications

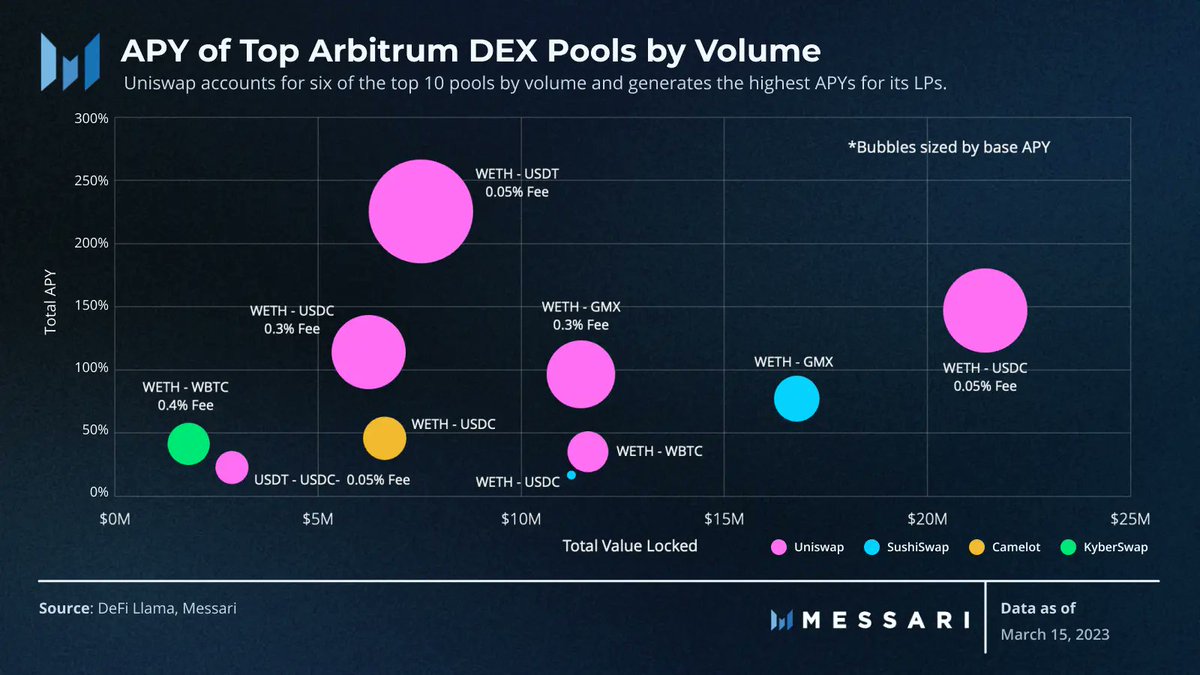

5/ Native protocols like @CamelotDEX have put pressure on familiar DEX protocols, yet @Uniswap still owns 6 of the top 10 DEX pools by volume.

As the DEX sector matures and more stablecoins enter, DEXs that offer concentrated liquidity pools will be positioned for success.

As the DEX sector matures and more stablecoins enter, DEXs that offer concentrated liquidity pools will be positioned for success.

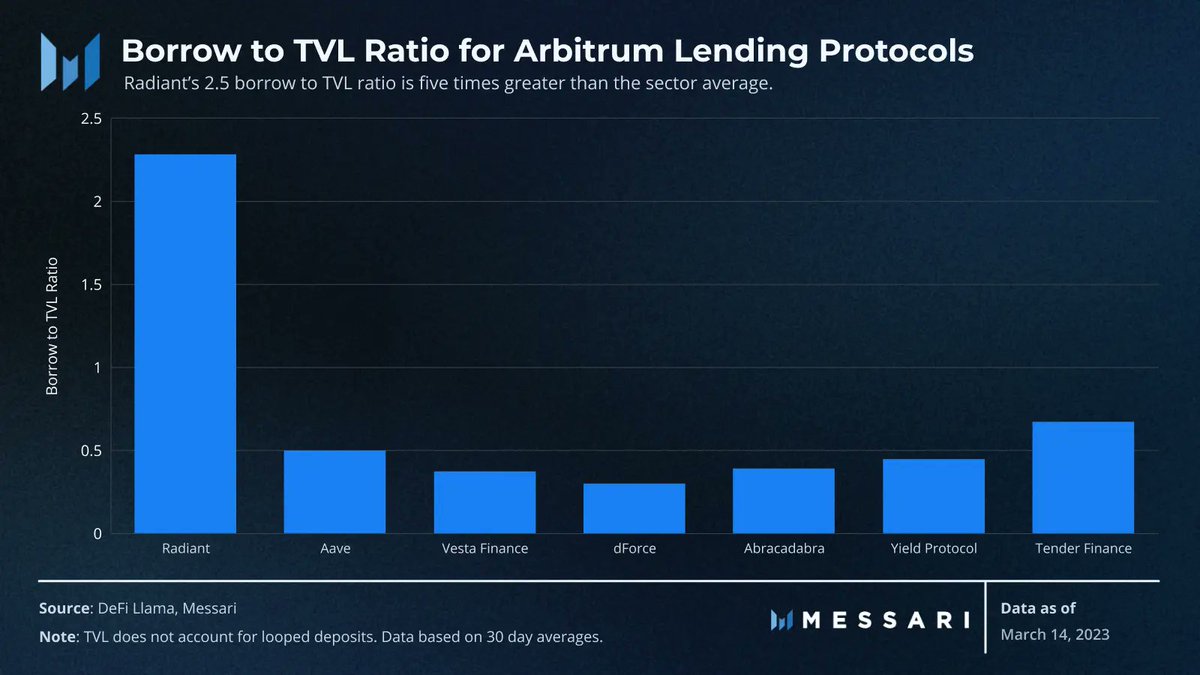

6/ @RDNTCapital currently accounts for 56% of @arbitrum’s lending TVL with the next closest competitor, @AaveAave V3.

A deeper look into the protocol reveals that this growth is due to heavy $RDNT incentives.

A deeper look into the protocol reveals that this growth is due to heavy $RDNT incentives.

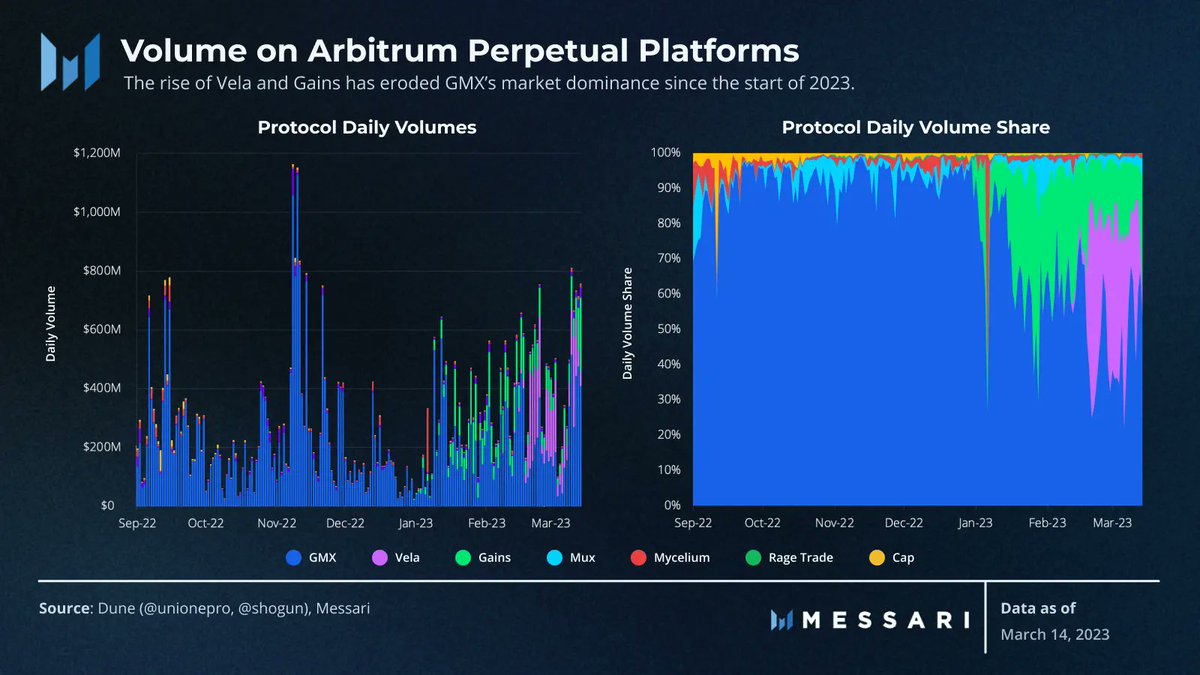

7/ Potentially the most important factor contributing to the network’s early adoption is the growth of hybrid perpetual platforms.

@GMX_IO has positioned itself as a leader in Arbitrum's DeFi space accounting for over 80% of all TVL.

@GMX_IO has positioned itself as a leader in Arbitrum's DeFi space accounting for over 80% of all TVL.

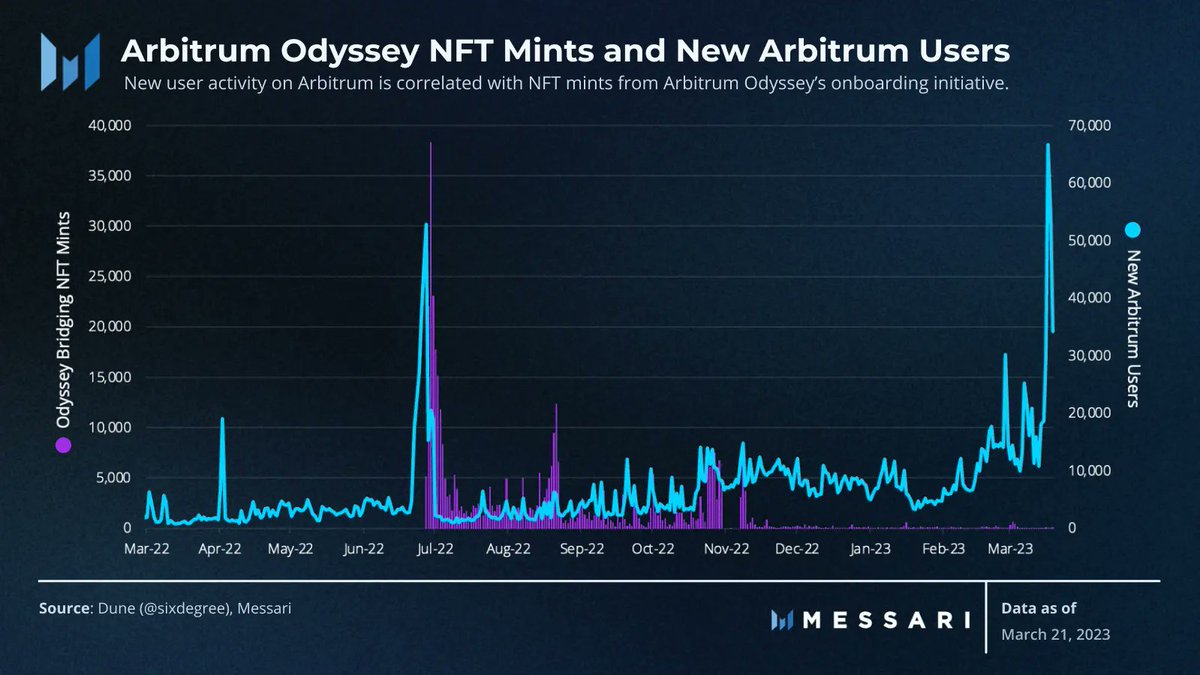

8/ @arbitrum is also home to a number of consumer-based applications.

@Galxe issued #NFT credentials during the Odyssey.

@Treasure_DAO is bootstrapping Arbitrum's gaming and NFT sectors.

And a new crop of projects are building Arbitrum’s decentralized casino space.

@Galxe issued #NFT credentials during the Odyssey.

@Treasure_DAO is bootstrapping Arbitrum's gaming and NFT sectors.

And a new crop of projects are building Arbitrum’s decentralized casino space.

9/ For an in-depth look at the @arbitrum ecosystem, including an application-level ecosystem overview, and a dive into the upcoming token launch and the roadmap ahead, check out the full Enterprise report from @chasedevens.

messari.io/article/inside…

messari.io/article/inside…

Subscribe to the Unqualified Opinions newsletter for world-class research from the Messari analysts, straight to your inbox!

messari.io/newsletter?utm…

messari.io/newsletter?utm…

• • •

Missing some Tweet in this thread? You can try to

force a refresh