The liquidity situation in crypto is worsening after the banking fears this month 📉

I dived into several liquidity metrics to give an update on all things crypto liquidity🧵

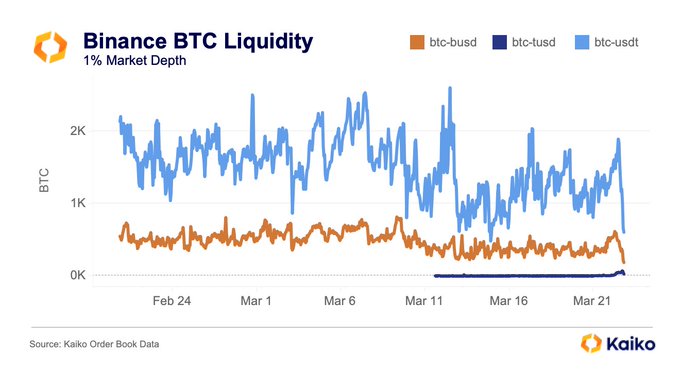

First, $BTC liquidity has dropped to 10 month lows as market makers lose access to USD payment rails👇

I dived into several liquidity metrics to give an update on all things crypto liquidity🧵

First, $BTC liquidity has dropped to 10 month lows as market makers lose access to USD payment rails👇

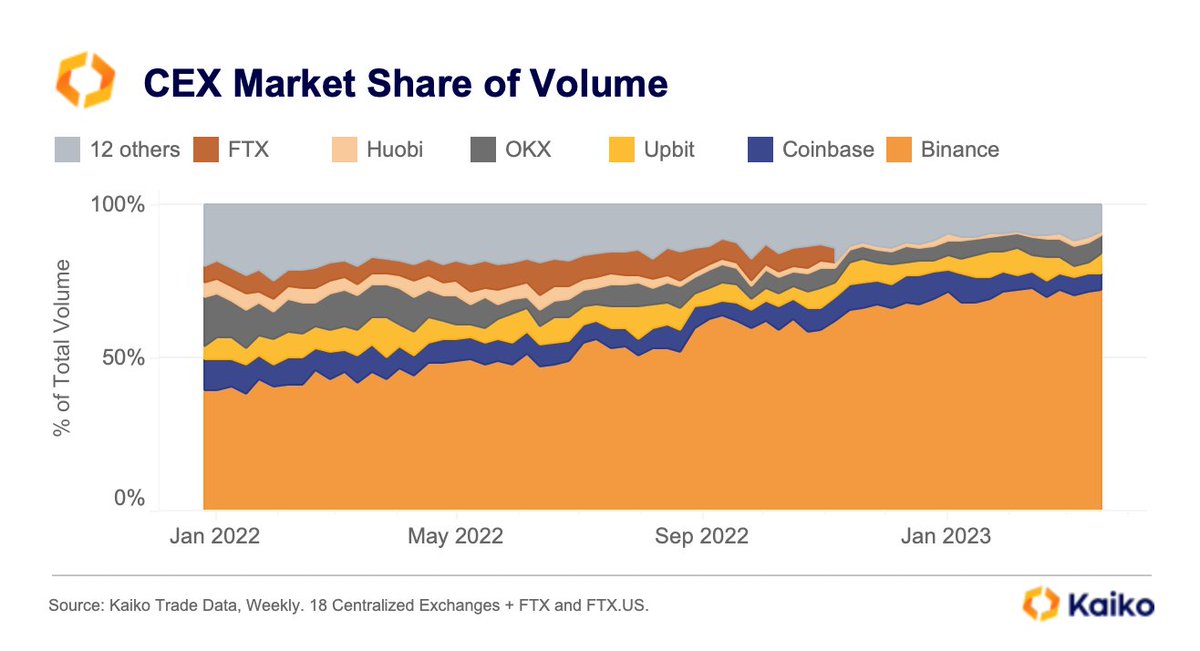

2/ US exchanges have been hardest hit due to the closure of USD payment rails and crypto banks

Market makers in the region facing unprecedented challenges to their operations

Market makers in the region facing unprecedented challenges to their operations

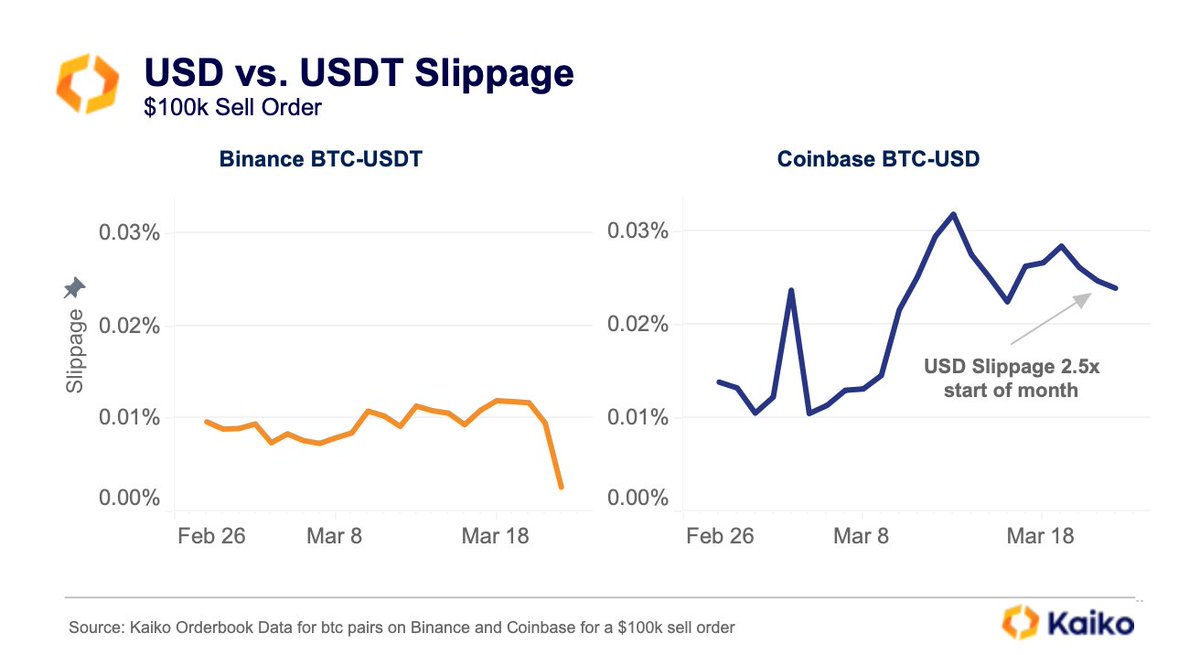

3/ Spreads for USD pairs have displayed a similar trend, suffering more volatility as a result of the uncertainty in the US

4/ Same story for slippage

On a $100k sell order, Coinbase's btc-usd pair has increased by 2.5x the slippage it started the month at

Binance's btc-usdt pair's slippage meanwhile barely moved

On a $100k sell order, Coinbase's btc-usd pair has increased by 2.5x the slippage it started the month at

Binance's btc-usdt pair's slippage meanwhile barely moved

5/ Coinbase have struggled from a volumes standpoint too despite the launch of its Layer 2 Base and fear around USD pairs

Binance have gained 20% marketshare since July thanks largely to their zero fee pairs

Binance have gained 20% marketshare since July thanks largely to their zero fee pairs

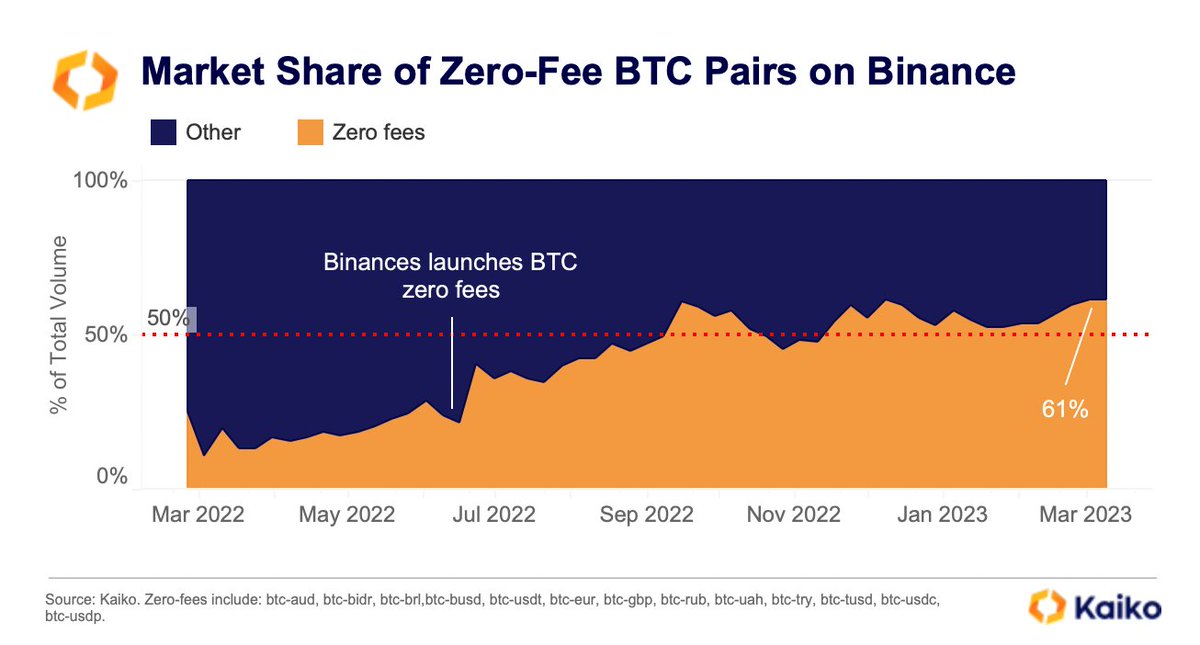

6/ Zero fee pairs have made up 61% of Binance's volumes but they have now officially removed zero fees for all pairs except btc-tusd

The importance of this is not to be understated — Binance is the most liquid exchange and the btc-usdt pair is the most liquid pair in crypto.

The importance of this is not to be understated — Binance is the most liquid exchange and the btc-usdt pair is the most liquid pair in crypto.

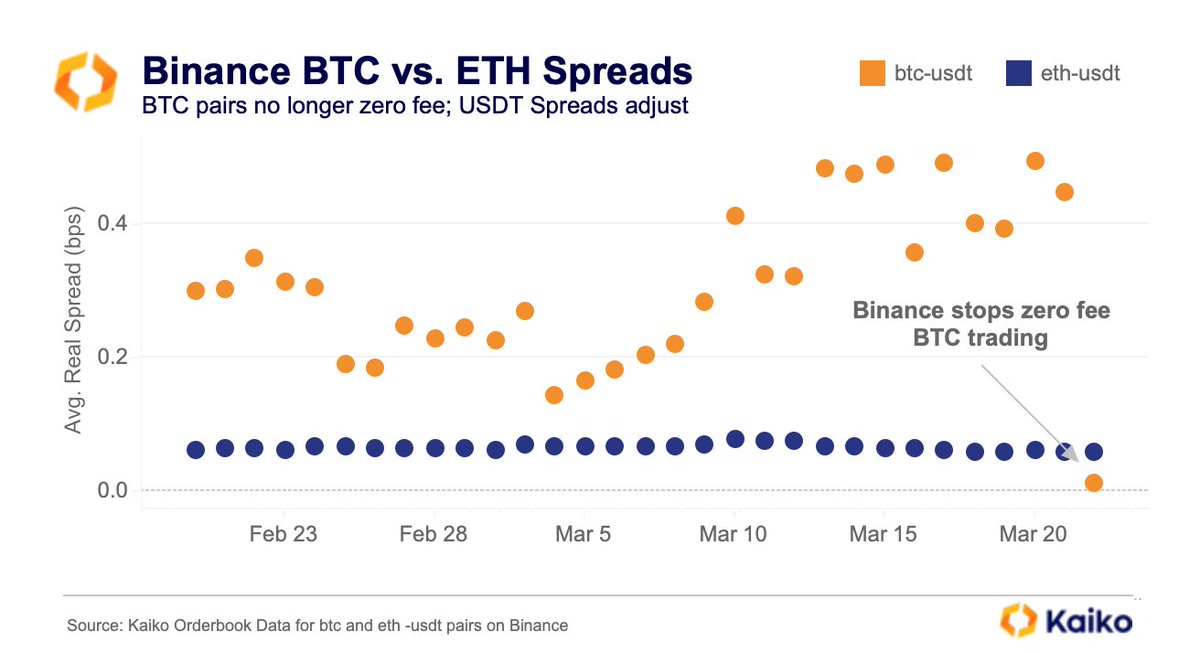

7/ The removal of zero fees means market makers on those pairs have to reduce their wide spreads, as investors won't pay for a taker fee and higher spreads

$BTC spreads corrected yesterday to the new norm on #Binance with fees

$BTC spreads corrected yesterday to the new norm on #Binance with fees

8/ Having to offer tighter spreads means market makers profitably is hurt

This results in them offering less liquidity on Binance, moving to more profitable exchanges/pairs

As the only zero fee pair, btc-tusd may see a huge influx of liquidity

BTC-USDT pair depth down 70%

This results in them offering less liquidity on Binance, moving to more profitable exchanges/pairs

As the only zero fee pair, btc-tusd may see a huge influx of liquidity

BTC-USDT pair depth down 70%

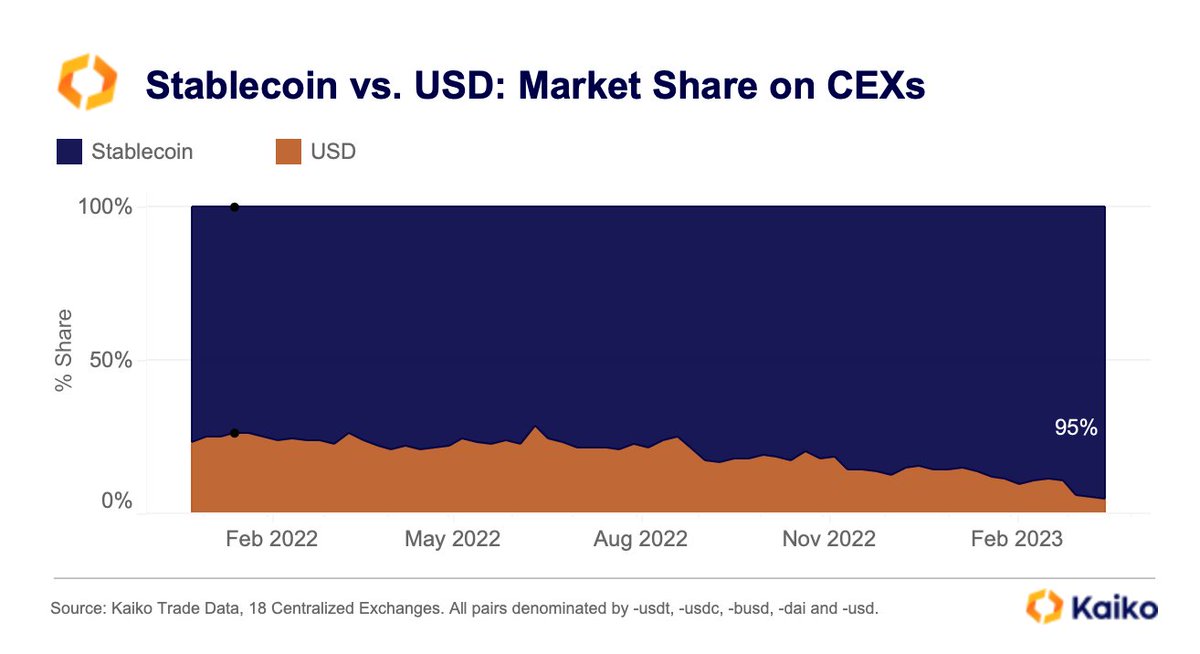

9/ Volumes wise, USD pairs are being phased out in favor of stablecoins

This dulls the impact of US banking issues, but as we've seen is impacting liquidity in the US which will indirectly hurt investors there

Stablecoins now have 95% share of volumes vs USD

This dulls the impact of US banking issues, but as we've seen is impacting liquidity in the US which will indirectly hurt investors there

Stablecoins now have 95% share of volumes vs USD

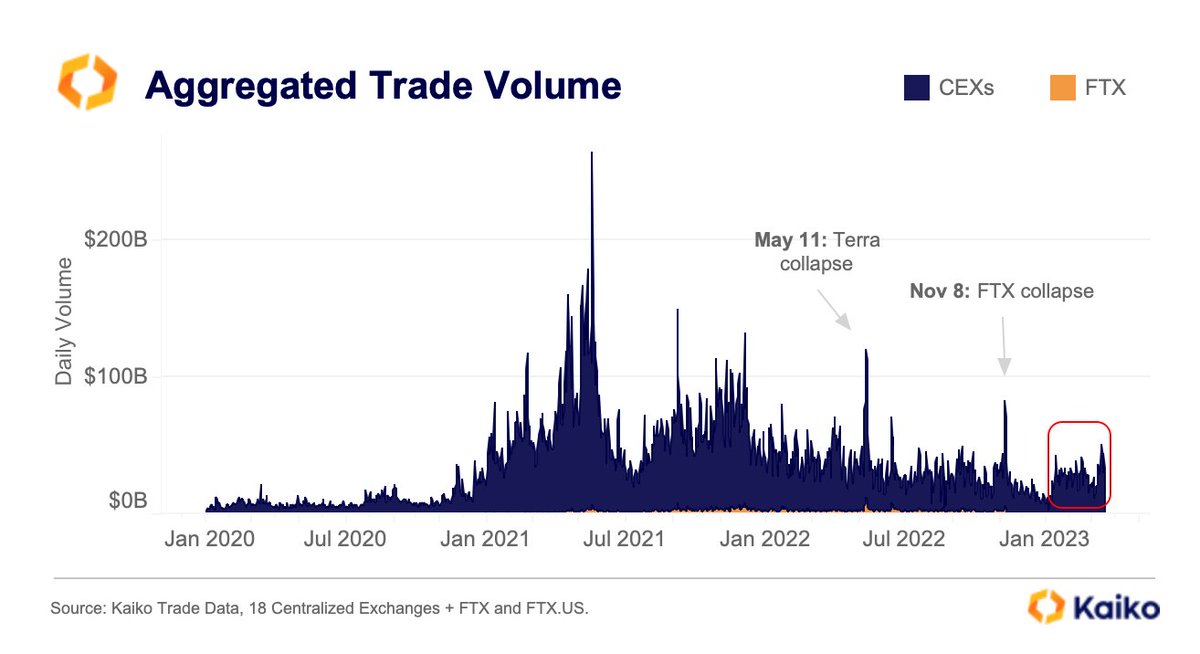

10/ To tie a bow on this thread, and to end on a more optimistic note:

Volumes have at least picked up off the multi-year lows at end of 2022

With volumes picking up, just waiting on liquidity to improve for a sustained uptrend in crypto

Otherwise be prepared for volatility ⚡️

Volumes have at least picked up off the multi-year lows at end of 2022

With volumes picking up, just waiting on liquidity to improve for a sustained uptrend in crypto

Otherwise be prepared for volatility ⚡️

12/ And subscribe to our free weekly newsletters to get more articles like this from the Kaiko team

kaiko.com/pages/kaiko-re…

kaiko.com/pages/kaiko-re…

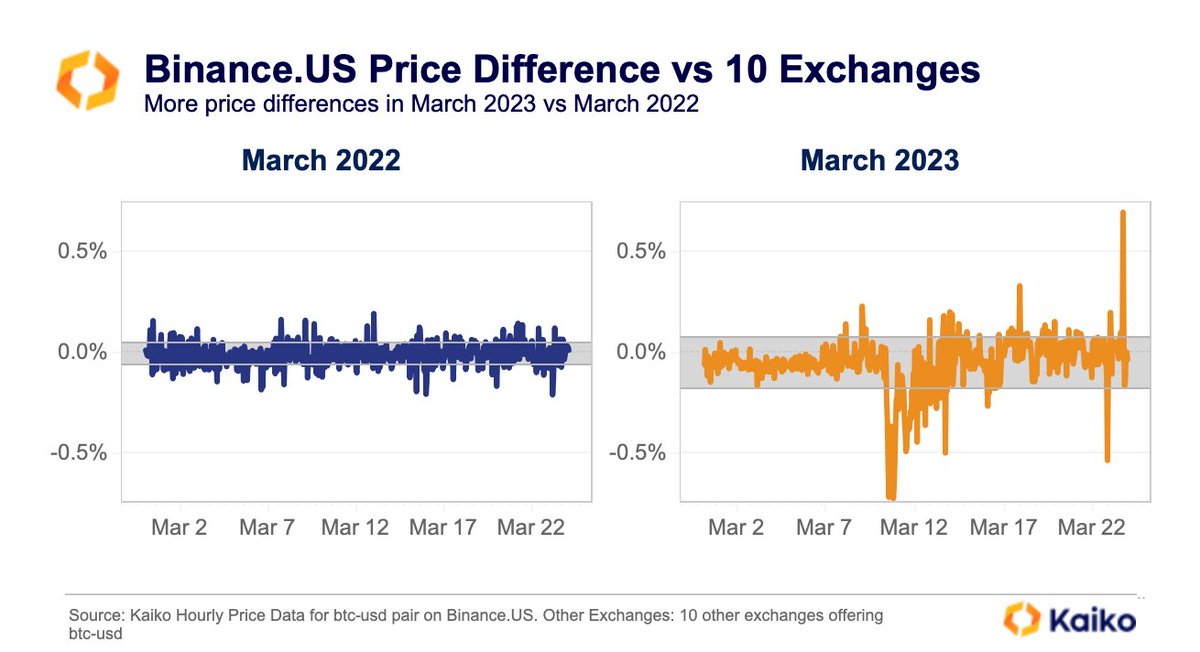

13/ As liquidity worsens, opportunities arise💵

US banking fears have resulted in greater disparity in price of BTC-USD pairs

Compared to the avg on 10 exchanges, Binance.US pricing more volatile than this time last year

USD pairs becoming easier to arbitrage ✍️

US banking fears have resulted in greater disparity in price of BTC-USD pairs

Compared to the avg on 10 exchanges, Binance.US pricing more volatile than this time last year

USD pairs becoming easier to arbitrage ✍️

• • •

Missing some Tweet in this thread? You can try to

force a refresh