1/ After the collapse of #FTX, many crypto holders are rethinking their storage methods.

So, where are people storing their #crypto now? Let's take a look 🧵

Read the full study: gcko.io/n78841r

So, where are people storing their #crypto now? Let's take a look 🧵

Read the full study: gcko.io/n78841r

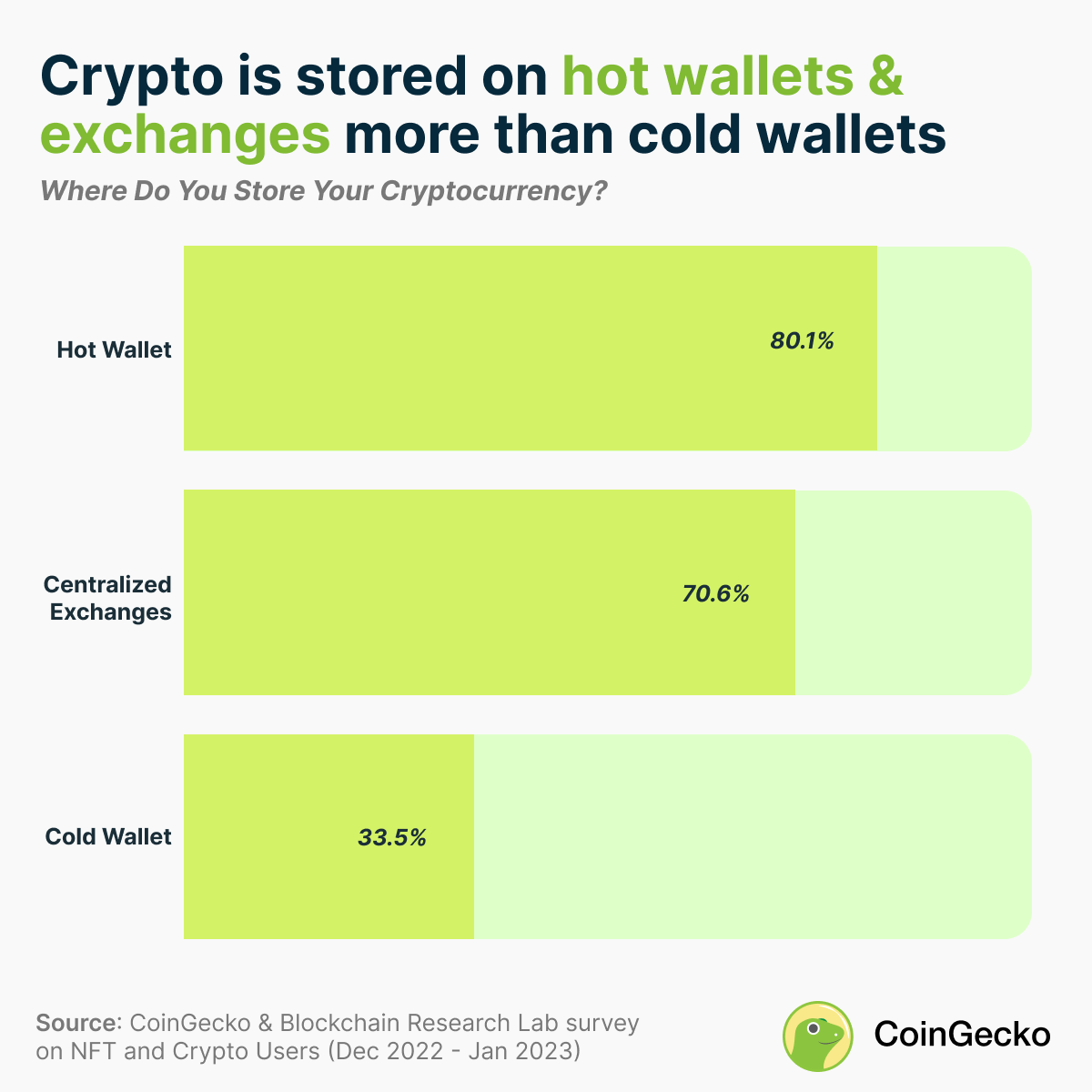

2/ Hot wallets are the most popular way for #crypto holders to store their funds.

8 out of 10 people use hot wallets, according to a recent survey of crypto holders. This points to a meaningful level of crypto holders practicing self-custody.

8 out of 10 people use hot wallets, according to a recent survey of crypto holders. This points to a meaningful level of crypto holders practicing self-custody.

3/ The widespread usage of hot wallets might also be driven by the popularity of NFTs among crypto holders.

Participants usually need hot wallets like @MetaMask, in order to mint, transfer, or buy and sell NFTs.

Participants usually need hot wallets like @MetaMask, in order to mint, transfer, or buy and sell NFTs.

4/ However, 7 out of 10 continue to store their #crypto on centralized exchanges.

Most crypto holders remain reliant on centralized exchanges for on- and off-ramping as well as for buying and selling crypto, such that holders prioritize convenience over security.

Most crypto holders remain reliant on centralized exchanges for on- and off-ramping as well as for buying and selling crypto, such that holders prioritize convenience over security.

5/ Only 3 out of 10 do not use centralized exchanges for crypto storage.

The number represents crypto holders who are wary of leaving their funds in third-party custody or perhaps no longer use the services of centralized exchanges.

The number represents crypto holders who are wary of leaving their funds in third-party custody or perhaps no longer use the services of centralized exchanges.

6/ Cold wallets are not commonly used, despite being one of the safest ways for cryptocurrency storage.

Just 3 out of 10 people use cold wallets to store their crypto, pointing to poor crypto cybersecurity practices.

Just 3 out of 10 people use cold wallets to store their crypto, pointing to poor crypto cybersecurity practices.

7/ The low usage of cold wallets also indicates that crypto adoption is still at an early stage, with most participants only engaging in easier-to-understand activities that have a lower barrier of entry or significant incentives.

8/ Methodology: The study examined 421 responses from the NFT and Crypto Users Survey, jointly conducted by CoinGecko and Blockchain Research Lab (@lab_blockchain) from December 2022 to January 2023.

9/ Read the full study: gcko.io/n78841r

Where do you store your #crypto? Let us know in the comments below!

Where do you store your #crypto? Let us know in the comments below!

• • •

Missing some Tweet in this thread? You can try to

force a refresh