$MMTLP 🧵In response to @FINRA 's March 16th, 2023 FAQ: MMTLP Corporate Action and Trading Halt: finra.org/investors/insi…

FINRA's response is disingenuous and intentionally deceptive. It is also a magnification of the simple fact that the U3 Halt of MMTLP exclusively benefited… twitter.com/i/web/status/1…

FINRA's response is disingenuous and intentionally deceptive. It is also a magnification of the simple fact that the U3 Halt of MMTLP exclusively benefited… twitter.com/i/web/status/1…

It was clearly stated in the SEC approved proxy statement that the Series A Preferred shares were not to be listed or traded on any exchange. Additionally on June 21, 2021, the Options Clearing Corporation (OCC) released a memo stating the settlement of the Series A Pref shares… twitter.com/i/web/status/1…

1) The prospectus was finalized on November 25th, 2022, giving FINRA a two week window of opportunity to avoid "an extraordinary event", a subjective phrase with no specific criteria disclosed by FINRA. If FINRA truly had investors' best interests in mind, any concerns regarding… twitter.com/i/web/status/1…

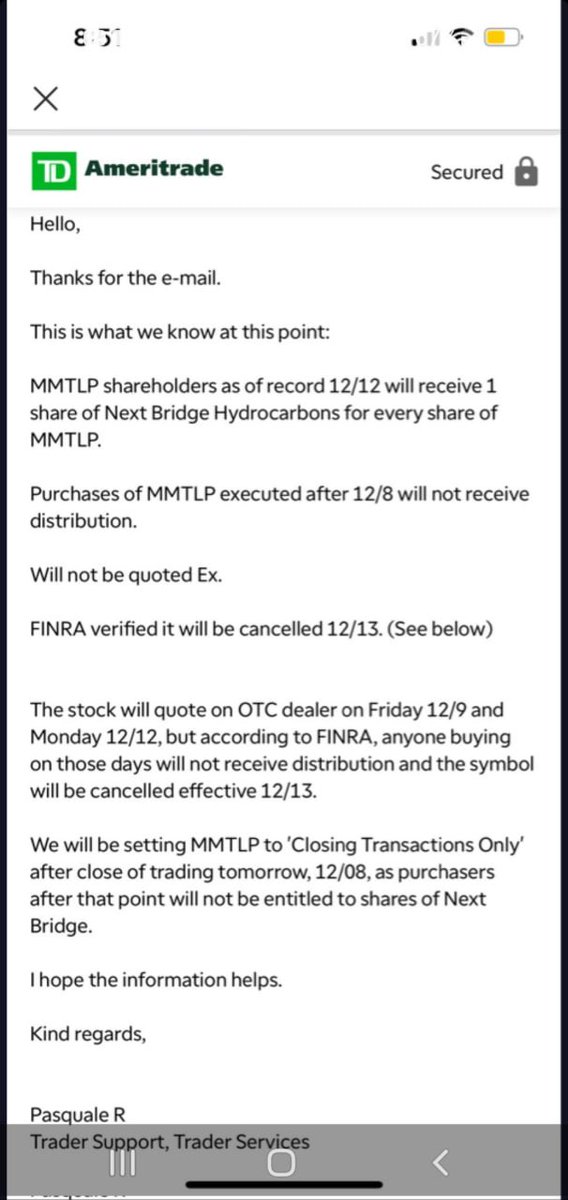

1 continued) Position Close Only (Buy to Close, Sell to Close) is common practice for circumstances such as MMTLP. Several broker dealers communicated with their clients that they would not be accepting "buy to open" orders on the December 9th and 12th, but rather only “buy to… twitter.com/i/web/status/1…

2)If DTC eligibility was truly an issue, FINRA could have addressed it by asking the company to maintain eligibility through the 14th at the meeting on the 8th that was summoned by the DTCC. However, FINRA failed to attend that meeting. Again, some very simple solutions were at… twitter.com/i/web/status/1…

4) This answer is another blatant attempt by FINRA to intentionally deceive the investing public. TRCH filed a shelf S3 for all types of offerings, but not specific to Series A Preferred or MMTLP. In order for this S3 registration to apply, the company would have to specifically… twitter.com/i/web/status/1…

7) This is false and intentionally misleading. Broker dealers can and will eliminate the buy button to avoid this problem (position close only). “Buy to close” should have been permitted and could have been settled in time. In addition, Broker to Broker clearing can happen in… twitter.com/i/web/status/1…

8) Assume for a moment that we accept this bit of fantasy, then the investing public relied on this erroneous information provided by FINRA when making buying or selling decisions based upon an admitted FINRA "systems coding issue" mistake. The magnitude of losses to investors'… twitter.com/i/web/status/1…

9) Why did the corporate action not compel broker dealers to close out short positions as they have done in other tickers? Why did DTCC not forward the corporate action issued by FINRA in order to compel action by broker dealers? Did FINRA have any communication with any broker… twitter.com/i/web/status/1…

10) FINRA and broker dealers have engaged in a finger-pointing exercise in which no party has taken accountability for their respective responsibilities to investors. Countless investor complaints and escalations have been made to @FINRA, @SECGov, @TheJusticeDept, @FBI, and… twitter.com/i/web/status/1…

11) FINRA conveniently forgot the "non-trading" aspect of the independent public reporting company description in the S-1. FINRA's response is suggesting an activity that goes against the expressed wishes of Next Bridge Hydrocarbons. It appears that FINRA wants NBH to trade on an… twitter.com/i/web/status/1…

FINRA added the Dec 9th verbiage despite the objections of Meta Materials and Next Bridge Hydrocarbons counsel. FINRA then advised Meta to simply restate the verbiage in any public statements and DO NOT attempt to clarify. The FINRA explanation on December 6th regarding the need… twitter.com/i/web/status/1…

FINRA's purpose for the mandated verbiage was portrayed one way to the company, only to later use the FINRA mandated verbiage to justify the U3 halt. Either this was intentional deception by FINRA to plant a "dead man switch" to be used later, or subsequently they discovered they… twitter.com/i/web/status/1…

A letter was sent from a member of the Congressional Oversight Committee asking the President and CEO of FINRA, Robert W. Cook, why his constituents were complaining about the long delays in issuing the Corporate Action. The letter, sent December 5th, likely resulted in immediate… twitter.com/i/web/status/1…

Counsel for NBH and Meta then had a call on December 6th protesting the added language. FINRA provided an explanation counsel accepted. FINRA instructed all parties not to attempt to interpret the meaning of the language. FINRA directed that if questions arose, the company should… twitter.com/i/web/status/1…

AST disclosed that FINRA requested for immediate access to the MMTLP share count, which AST produced. By this point FINRA knew they had a huge problem, but the Meta Materials S-1 was airtight and the only switch they could pull to stop the impending train wreck was their own… twitter.com/i/web/status/1…

The DTCC refused to issue a corporate notice because they did not agree with the FINRA wording. FINRA was a no-show for the December 8th meeting with DTCC and company counsel to agree upon an acceptable solution where DTCC could send out notices. By the morning of December 8th,… twitter.com/i/web/status/1…

This FINRA FAQ statement has factual inaccuracies and is obviously disingenuous. FINRA's failed to address the shorting and naked shorting that occurred in the predecessor company, Torchlight Energy Resources, Inc., which was the clear motive of facilitating MMTLP trading in the… twitter.com/i/web/status/1…

Based upon this FAQ and FINRA’s actions (and lack thereof), FINRA is, at minimum, complicit in the egregious and rampant epidemic of Naked Shorting. This is just one example out of many highlighting the massive scale of FINRA's failure to provide proper oversight, which is… twitter.com/i/web/status/1…

For more information on MMTLP, please visit the following:

fairmarketsnow.org/mmtlp/

mmtlpresources.com

mmtlpstudios.com

@kshaughnessy2 @KL_Copeland @cvpayne @adenatfriedman @ArvindKrishna @SecYellen @abhabhattarai @JasonFyk @JasonRaznick @MarioNawfal @Robrobjugoslav… twitter.com/i/web/status/1…

fairmarketsnow.org/mmtlp/

mmtlpresources.com

mmtlpstudios.com

@kshaughnessy2 @KL_Copeland @cvpayne @adenatfriedman @ArvindKrishna @SecYellen @abhabhattarai @JasonFyk @JasonRaznick @MarioNawfal @Robrobjugoslav… twitter.com/i/web/status/1…

@threadreaderapp unroll the thread please 🤓

$MMTLP Please share this link! threadreaderapp.com/thread/1639354…

• • •

Missing some Tweet in this thread? You can try to

force a refresh