10 Questions to ask before investing in any stock.

All you should learn and follow.

A THREAD 🧵

(1/20)

#StockMarketindia #trading #stockmarket

@sunilgurjar01 @kuttrapali26 #investing @caniravkaria

All you should learn and follow.

A THREAD 🧵

(1/20)

#StockMarketindia #trading #stockmarket

@sunilgurjar01 @kuttrapali26 #investing @caniravkaria

✅Is the company profitable?

Businesses with higher net profits enjoy a much better risk-reward profile and hence the the net-profit ranking suits investors the best. (2/20)

Businesses with higher net profits enjoy a much better risk-reward profile and hence the the net-profit ranking suits investors the best. (2/20)

Profit is "money in the bank." It goes directly to the owners of a company or shareholders, or it is reinvested in the company. (3/20)

✅How strong is the company’s balance sheet?

Balance sheet depicts a company's financial health. It records all your business' assets and debts; therefore, it shows the 'net worth' of your business at any given time. (4/20)

Balance sheet depicts a company's financial health. It records all your business' assets and debts; therefore, it shows the 'net worth' of your business at any given time. (4/20)

Company with a strong balance sheet are more likely to survive economic downturns than a company with a poor balance sheet.(5/20)

✅What does company do?

Buying stocks of the company means one is buying proportional ownership in the company.

Hence understanding a company before buying its stocks is essential. (6/20)

Buying stocks of the company means one is buying proportional ownership in the company.

Hence understanding a company before buying its stocks is essential. (6/20)

Ownership in a company comes with its share of risk and reward. Hence we as an investor need to tune our expectations (from stocks) accordingly. (7/20)

✅How was the past performance of the company?

While you need to value the assets of a business, past profits are often the best indicator of the business' overall value, says Wise. (8/20)

While you need to value the assets of a business, past profits are often the best indicator of the business' overall value, says Wise. (8/20)

You can use past profits to predict future earnings, by looking at the current and past financial statements.(9/20)

✅How is the stock valued?

The importance of valuing stocks evolves from the fact that the intrinsic value of a stock may be different from its current price. (10/20)

The importance of valuing stocks evolves from the fact that the intrinsic value of a stock may be different from its current price. (10/20)

By knowing a stock's intrinsic value, an investor may determine whether the stock is over- or undervalued at its current market price.(11/20)

✅Any involvement of the management in any past fraud/scams?

Management’s responsibilities include creating an environment where fraud is not tolerated, identifying risks of fraud, & taking appropriate actions to ensure that controls are in place to prevent & detect fraud.(12)

Management’s responsibilities include creating an environment where fraud is not tolerated, identifying risks of fraud, & taking appropriate actions to ensure that controls are in place to prevent & detect fraud.(12)

But if management itself is involved in any kind of fraud then it will make the roots of company weak and your investment may suffer losses.(13/20)

✅Who are the key competitors?

The purpose of a competitor analysis is to understand your competitors' strengths and weaknesses in comparison to your own and to find a gap in the market. (14/20)

The purpose of a competitor analysis is to understand your competitors' strengths and weaknesses in comparison to your own and to find a gap in the market. (14/20)

Knowing who your competitors are, and what they are offering, can helps company to make their products, services and marketing stand out. (15/20)

✅How much debt the company has?

A company can have more debt than its assets.

A debt attracts interest. Hence, higher debt and/or longer tenure implies more money lost towards interest payment.

This affects the profitability and growth of the company.

(16/20)

A company can have more debt than its assets.

A debt attracts interest. Hence, higher debt and/or longer tenure implies more money lost towards interest payment.

This affects the profitability and growth of the company.

(16/20)

✅Does the company have a sustainable competitive advantage?

Sustainable competitive advantage occurs when a company consistently outperforms its competitors in the same industry or field. (17/20)

Sustainable competitive advantage occurs when a company consistently outperforms its competitors in the same industry or field. (17/20)

Most often, companies with this type of advantage create a value for their customers that's superior when compared to other businesses.

Sustainable competitive advantages are difficult to duplicate or replicate.(18/20)

Sustainable competitive advantages are difficult to duplicate or replicate.(18/20)

✅Promoter check?

Always read about the people who are running the company.

Find out their background and how long they have spent with the company.

Frequent changes in the top management, inexperienced top managers may be poor indicators while picking the right stock. (19/20)

Always read about the people who are running the company.

Find out their background and how long they have spent with the company.

Frequent changes in the top management, inexperienced top managers may be poor indicators while picking the right stock. (19/20)

♥If you found this thread useful, please RT the first tweet & follow @itsprekshaBaid for more useful threads.🔁(20/20)

A Thread to learn : Fibonacci Retracement and how I use this tool in with Supply & Demand levels? 👇

https://twitter.com/itsprekshaBaid/status/1624345560827445249

A Thread to knowthe difference : Mutual Fund vs. ETFs👇

https://twitter.com/itsprekshaBaid/status/1629364217185980418

A Thread to: learn About a Bull Flag Pattern.👇

https://twitter.com/itsprekshaBaid/status/1626827071182995457

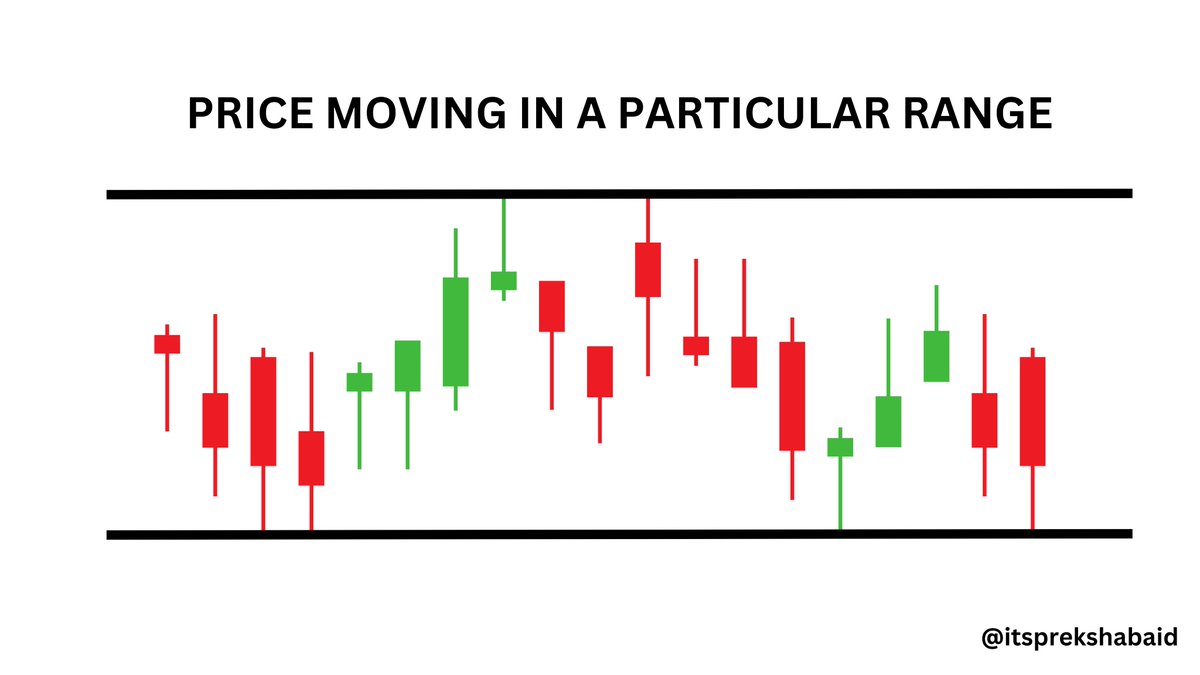

A Thread to learn : Simple range breakout strategy 👇

https://twitter.com/itsprekshaBaid/status/1618246899760533504

A Thread to learn : Stock Market Manipulation. 👇

https://twitter.com/itsprekshaBaid/status/1631887401294630912

• • •

Missing some Tweet in this thread? You can try to

force a refresh