Only a few generations ago, investing was mostly limited to wealthy individuals. No longer! Today, digitalization and democratization are reshaping how capital markets operate.

Here are 15 FREE investing tools every investor needs to start using today.

Here are 15 FREE investing tools every investor needs to start using today.

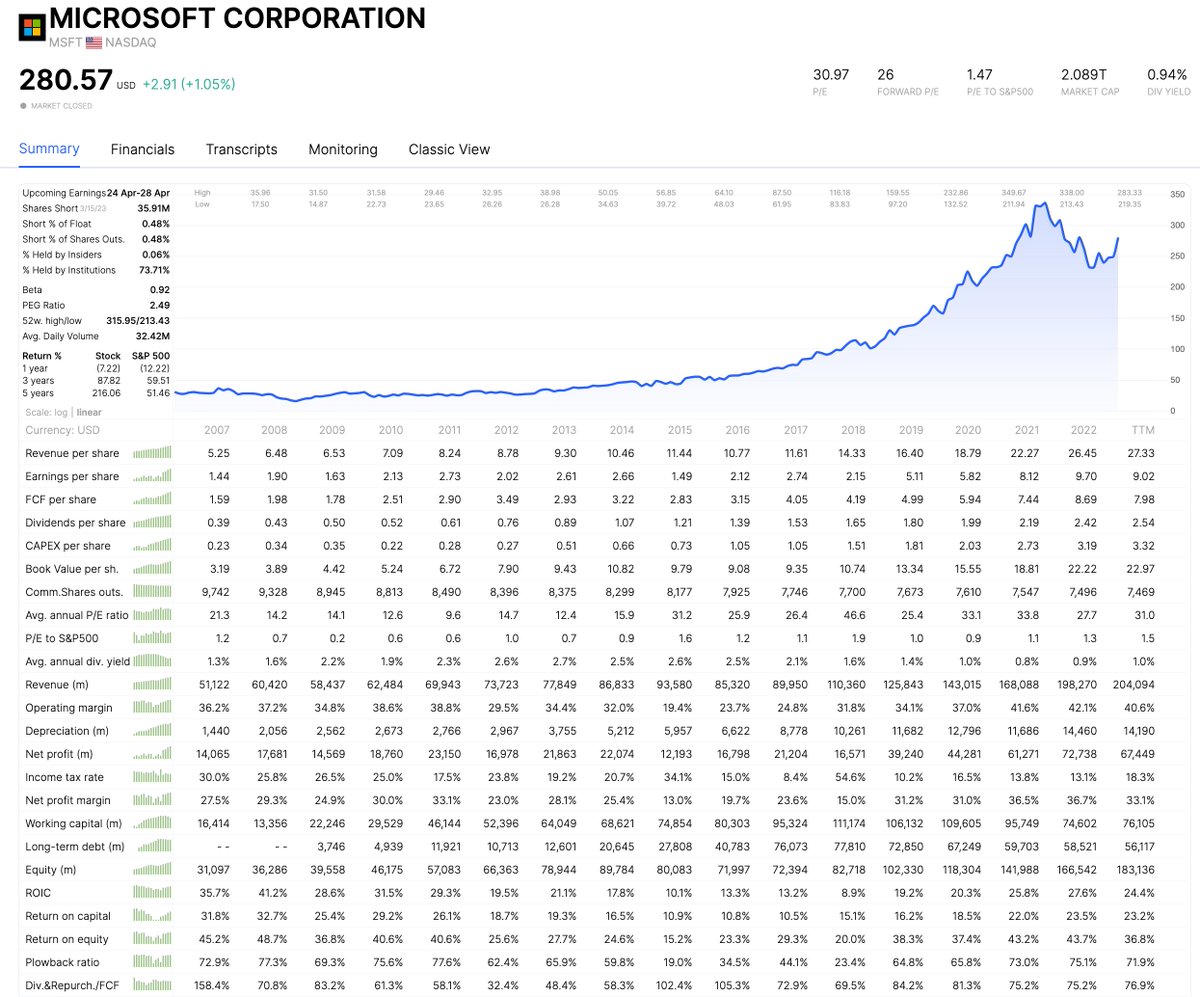

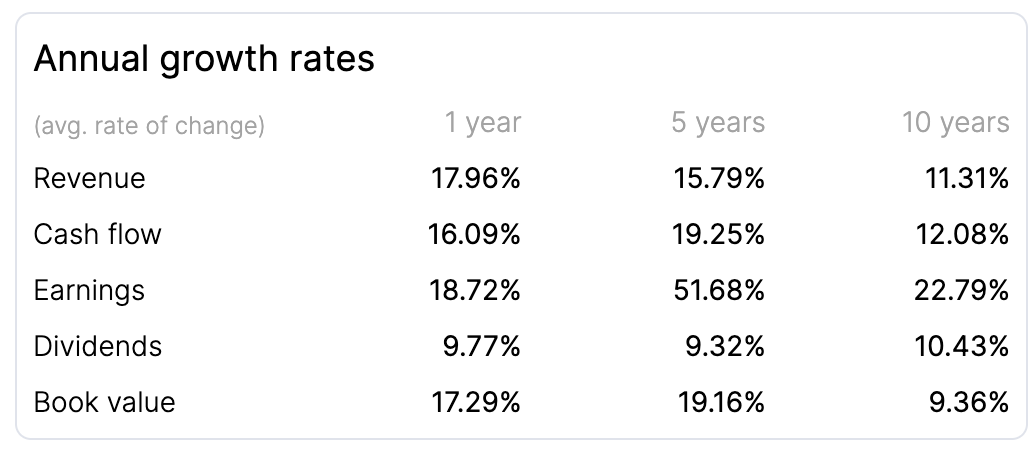

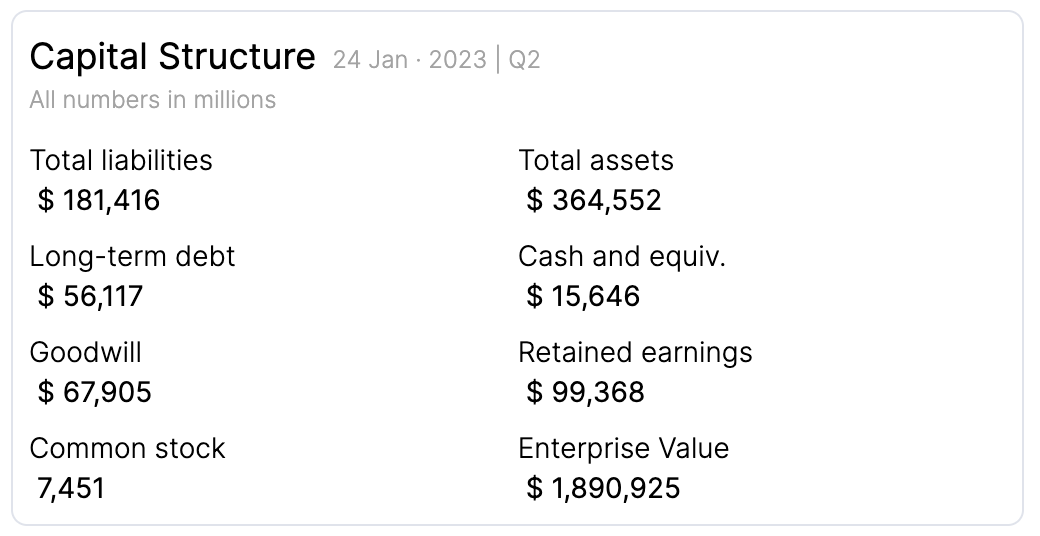

#1: ROIC.AI

This website offers you access to 30 years of financial data from 37,000 companies all around the world.

You don’t even need to register to get access to this big library of financial statements.

This website offers you access to 30 years of financial data from 37,000 companies all around the world.

You don’t even need to register to get access to this big library of financial statements.

Just type in the ticker symbol or company name and the website will immediately bring you to a summary page on which you find important metrics like FCF per share, margin metrics, ROIC, multi-year growth averages, the capital structure of the business, or insider trading…

…activities.

Still not convinced? Then check out the classic view mode. This truly allows you to feel like Warren Buffett when he was turning pages in the Moody’s Manuals.

Still not convinced? Then check out the classic view mode. This truly allows you to feel like Warren Buffett when he was turning pages in the Moody’s Manuals.

#2: The Business Breakdowns podcast

Show host @patrick_oshag & his guests examine the success stories and failures of some of the world's most prominent businesses around the world and deconstruct the strategies used and capital allocation decisions made by management.

Show host @patrick_oshag & his guests examine the success stories and failures of some of the world's most prominent businesses around the world and deconstruct the strategies used and capital allocation decisions made by management.

Each episode of the podcast is dedicated to a specific company, and the host takes a deep dive into the company's history, culture, business model, and financial performance by interviewing current and former employees, industry experts, investors, or business analysts.

They have now covered more than 100 companies and some of the companies that have been featured on the podcast include L’Oreal, Amazon, the Formula 1, and Netflix.

#3: TIKR.com

Every investor needs access to a powerful stock screener. And the screener offered by TIKR is exactly what you are looking for.

Every investor needs access to a powerful stock screener. And the screener offered by TIKR is exactly what you are looking for.

It is simple to use, covers US stocks in its free plan, and you can screen for stocks based on a wide range of criteria, such as market capitalization, dividend yield, growth rates, valuation metrics, or return metrics.

#4: Buffett letters

The fourth free investing resource is the work Warren Buffett himself shared publicly. On the Berkshire Hathaway website, you will find an archive of all the annual letters Warren Buffett shared with his shareholders.

berkshirehathaway.com/letters/letter…

The fourth free investing resource is the work Warren Buffett himself shared publicly. On the Berkshire Hathaway website, you will find an archive of all the annual letters Warren Buffett shared with his shareholders.

berkshirehathaway.com/letters/letter…

Buffett has been writing public letters since 1957, and they have become a valuable resource for investors and businesspeople around the world and consider them to be essential reading for anyone interested in investing, entrepreneurship, or business strategy.

In these letters, Buffett shares his insights and perspectives on the performance of Berkshire Hathaway, the state of the economy, the financial markets, and investing in general.

You may wonder why you should read 30- or 40-year-old letters?

You may wonder why you should read 30- or 40-year-old letters?

Let me assure you that many of the principles shared by Buffett are in fact timeless investing principles and Buffett has this unique ability to explain complex financial concepts in a clear and concise way thus even the older letters are widely regarded as an excellent source…

…of knowledge and wisdom.

Now I just said that Buffett has been writing these letters since 1957. However, on the Berkshire website, you will only find the letters from Buffett going back to 1977.

Now I just said that Buffett has been writing these letters since 1957. However, on the Berkshire website, you will only find the letters from Buffett going back to 1977.

Well, in the 1950s & ’60s, before Berkshire Hathaway, Buffett was sharing his wisdom in his so-called partnership letters. You can find those letters here:

ivey.uwo.ca/media/2975913/…

Now reading all of these letters is quite a task! But if you want even more of Buffett ...

ivey.uwo.ca/media/2975913/…

Now reading all of these letters is quite a task! But if you want even more of Buffett ...

... I’ve got one more bonus tip:

Ever since 1994, recordings of the annual Berkshire Hathaway meetings were allowed. And CNBC has curated these recordings in its own Berkshire Hathaway annual meetings archive.

buffett.cnbc.com/annual-meeting…

Ever since 1994, recordings of the annual Berkshire Hathaway meetings were allowed. And CNBC has curated these recordings in its own Berkshire Hathaway annual meetings archive.

buffett.cnbc.com/annual-meeting…

#5: Koyfin

Tool number 5 allows you to get a customized overview of your portfolio. The website is called Koyfin and they refer to this feature as dashboards.

koyfin.com

Tool number 5 allows you to get a customized overview of your portfolio. The website is called Koyfin and they refer to this feature as dashboards.

koyfin.com

Here's the dashboard I have set up for my portfolio.

What I particularly like about the suite of tools is that you can choose specific metrics that you want to be displayed for your companies. For example, I have chosen various growth metrics, margin, and valuation metrics.

What I particularly like about the suite of tools is that you can choose specific metrics that you want to be displayed for your companies. For example, I have chosen various growth metrics, margin, and valuation metrics.

And you can then even ask Koyfin to display the weight-adjusted average of these metrics – you basically get a look-through overview of your entire portfolio that takes into account how small or big each position in your portfolio is.

As the free plan allows you to set up two dashboards, you could create another dashboard in which you put companies that are on your watchlist.

#6: Substack

The sixth free investing resource that I think you absolutely should use is Substack.com which is basically a blog-publishing platform.

The sixth free investing resource that I think you absolutely should use is Substack.com which is basically a blog-publishing platform.

Obviously, there are many great investing substacks that you should follow to gain valuable insights into the thinking of other investors.

But the way I suggest you start using Substack is that whenever you start researching a company, just google something along the lines of “company name + stock + analysis + substack”.

Most blog posts are a very good starting point to develop a first basic understanding of a company.

#7: SEC filings

To develop a better and deeper understanding, it obviously makes sense to study the official public filings of the company.

To develop a better and deeper understanding, it obviously makes sense to study the official public filings of the company.

So the seventh free resource that you should have in your arsenal is the website of the Securities and Exchange Commission and in particular its Edgar database.

sec.gov/edgar/searched…

sec.gov/edgar/searched…

For US-listed companies, this is the ultimate resource for all sorts of company filings, so annual reports, quarterly reports, or proxy statements.

The user interface is a bit difficult to use and not very intuitive at first, but once you get the hang of it, it is super powerful and a must for every investor that is serious about his or her investing ambitions.

#8: Dataroma

A website that is easier to navigate, but also quite powerful is dataroma.com

Dataroma allows investors to track the portfolio activity of some of the most successful and prominent investors, including Warren Buffett, Seth Klarman, and Bill Ackman.

A website that is easier to navigate, but also quite powerful is dataroma.com

Dataroma allows investors to track the portfolio activity of some of the most successful and prominent investors, including Warren Buffett, Seth Klarman, and Bill Ackman.

This can be a valuable resource for investors who are looking for ideas or guidance on how to construct their own portfolios and it can help them gain a better understanding of how successful investors think and operate.

#9: Mohnish Pabrai's Youtube channel

The concept of looking at the portfolios of the best investors in the world and replicating their stock picks with the goal of achieving similar results is called cloning.

The concept of looking at the portfolios of the best investors in the world and replicating their stock picks with the goal of achieving similar results is called cloning.

And when it comes to the concept of cloning, you inevitably will come across Mohnish Pabrai who may be considered the father of the cloning concept.

So the next free investing resource is the Youtube channel of @MohnishPabrai:

youtube.com/@mohnishpabrai

So the next free investing resource is the Youtube channel of @MohnishPabrai:

youtube.com/@mohnishpabrai

On it, you will find literally hundreds of recordings of Pabrai talking to students of various institutions in which he explains his investment philosophy.

#10: IPOScoop

Tool number 10 is focused on IPOs which can be another hunting ground for active investors.

The very simple website IPOScoop.com includes a variety of features such as

Tool number 10 is focused on IPOs which can be another hunting ground for active investors.

The very simple website IPOScoop.com includes a variety of features such as

... an IPO calendar that should help investors stay informed about upcoming IPOs & information on recent IPOs which you can sort by industry or when the businesses went public.

#11: Quartr App

The eleventh resource that I want to bring to your attention is the app @quartr.

The main purpose of the app is to make it easy to listen to quarterly conference calls held by publicly traded companies.

The eleventh resource that I want to bring to your attention is the app @quartr.

The main purpose of the app is to make it easy to listen to quarterly conference calls held by publicly traded companies.

The app allows you to listen to these quarterly updates on the go and offers handy features like fast-forward and rewind buttons.

Investor Relations has long lacked the convenience of easily accessing company information, I’ll challenge you and try to find a recording of a past conference call of a company you own on the company website itself.

What Quartr has more recently been working on is actually allowing investors to listen to these calls live.

#12: Earnings call transcripts by TIKR & ROIC.AI

Speaking of earnings calls, the next free resources I’d recommend are the conference call transcripts provided by TIKR.com & ROIC

Speaking of earnings calls, the next free resources I’d recommend are the conference call transcripts provided by TIKR.com & ROIC

What I love about their service is that they do not just provide transcripts of earnings calls, but also of business conferences.

There is one caveat though, only the paid plans give you access to all of these transcripts.

The free plan only gives you access to the last 90 days of transcript history. So I wanted to include one alternative:

The free plan only gives you access to the last 90 days of transcript history. So I wanted to include one alternative:

And this brings us back to ROIC.AI. Here you get access to the full transcript history.

#13: Commonstock

Resource #13 is the social network and community-driven platform @JoinCommonstock which aims to make investing more accessible and engaging for everyone.

Resource #13 is the social network and community-driven platform @JoinCommonstock which aims to make investing more accessible and engaging for everyone.

The Commonstockm platform allows users to share insights, discuss investments, and learn from others in a collaborative environment.

One benefit of Commonstock that none of the other tools on this list can provide is that it fosters a sense of community and belonging among investors.

You can connect with other investors, join groups, and exchange investment ideas with others who share your interests.

You can connect with other investors, join groups, and exchange investment ideas with others who share your interests.

Obviously, the #fintwit space on Twitter serves a very similar purpose.

I know that most of my followers are investing actively, but I think even active investors could hedge the risk they take by investing in individual stocks by investing a certain percentage of their portfolio in passive ETFs.

ETF.com is a great resource when it comes to finding and comparing different ETFs as the website essentially offers a massive database of ETFs and provides a wealth of information and resources for investors who are interested in these types of investments.

ETF.com provides up-to-date news and analysis on the ETF market, including trends, performance, and regulatory changes and it even includes a screener that lets you search for ETFs based on criteria of your liking.

#15: Investopedia

And then finally, the best platform when it comes to educational content and investing jargon is Investopedia.com.

And then finally, the best platform when it comes to educational content and investing jargon is Investopedia.com.

Investopedia has a comprehensive financial dictionary that provides definitions and explanations of pretty much every financial term and concept you can think of.

Summary:

#1: ROIC.ai

#2: The Business Breakdowns podcast

#3: TIKR

#4: Buffett letters

#5: Koyfin

#6: Substack

#7: SEC filings

#8: Dataroma

#9: Mohnish Pabrai's Youtube channel

#10: IPOScoop

#11: Quartr

#1: ROIC.ai

#2: The Business Breakdowns podcast

#3: TIKR

#4: Buffett letters

#5: Koyfin

#6: Substack

#7: SEC filings

#8: Dataroma

#9: Mohnish Pabrai's Youtube channel

#10: IPOScoop

#11: Quartr

PS: These threads take time to write.

So if you learned something from this thread, please retweet the first tweet and spread the message.

So if you learned something from this thread, please retweet the first tweet and spread the message.

https://twitter.com/ReneSellmann/status/1639615475171598337?s=20

PSS: If you're looking for a video version of this, head to my Youtube channel:

• • •

Missing some Tweet in this thread? You can try to

force a refresh