Divis has been a compounding machine for the past 10 years. But the stock has corrected almost 50% from its all-time high.

In today’s thread, let us understand what are the reasons for this massive fall.

Like and retweet for maximum reach.

#Divis #DivisLabs #Pharma

In today’s thread, let us understand what are the reasons for this massive fall.

Like and retweet for maximum reach.

#Divis #DivisLabs #Pharma

This is the third time the stock has corrected by 50%, the last two times were during the 2008 financial crisis and in 2017 when they had received an import alert at their manufacturing facility. Divis went on to create massive wealth from there.

The first reason is the decline in sales for Molnupiravir. Molnupiravir is a Covid drug by Merck that can be administered orally. The company had given voluntary licenses to a lot of formulation companies that wanted to manufacture the drug.

Divi’s was the largest manufacturer of Molnupiravir API and benefited tremendously over the last year due to this. They were supplying the API not just to Merck, but also the formulation companies in India and other emerging countries.

Molnupiravir was a high margin drug for which they had done around ₹400 Cr of capex. So with the demand for Molnupiravir gone, they saw a reduction in the high margin business and some idle capacity which they are in the process of reorienting towards manufacturing other drugs.

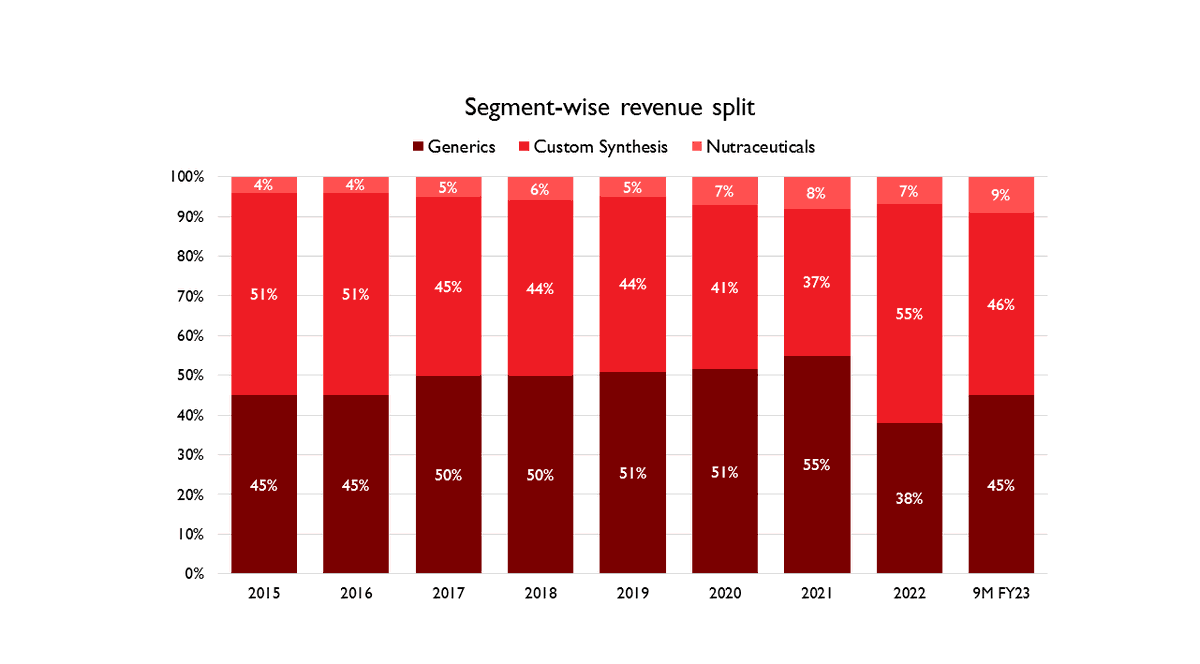

These costs reduced their margins and the decline in Molnupiravir resulted in a decline in the higher margin CSM business and skewed the revenue mix towards their lower margin Generic API business. So the revenue mix became unfavorable for the company.

The lower margin Generic business faced its own set of problems. There was a lot of pricing pressure in their key molecules due to excess inventory in the channel. They also faced increased costs of key raw materials like lithium and iodine.

This resulted in further margin compression as they had a higher revenue contribution from the generic segment which faced a much higher margin compression due to a fall in prices and increase in costs.

Apart from these reasons, there is also a slowdown in the growth for the company. Divis has grown its topline at 20% CAGR for the past 10 years. But this year, they have faced a 9.7% decline in their top line.

The valuations for the company soared post the pandemic. The valuations were pricing in much higher growth rates and margins. The company has said that they are not expecting the growth and margins that they enjoyed during the pandemic to continue over the next few years.

This has resulted in a de-rating of the stock. (insert image 7)

Watch the detailed analysis:

Watch the detailed analysis:

Micro Cap Club:

bit.ly/3zYY8OS

bit.ly/3zYY8OS

• • •

Missing some Tweet in this thread? You can try to

force a refresh