Most people think learning swing trading takes 10,000 hours,but it's not true. Here's what you'll get out of this🧵

✅Understand what swing trading is

✅Know the benefits and risks

✅Learn how to develop a strategy

✅Understand importance of discipline and emotional control

✅Understand what swing trading is

✅Know the benefits and risks

✅Learn how to develop a strategy

✅Understand importance of discipline and emotional control

👉 #1: Understand what swing trading is.

Swing trading involves buying and holding a stock or other financial instrument for a short period of time, typically a few days to a few weeks. The goal is to profit from the price movements that occur during this time.

Swing trading involves buying and holding a stock or other financial instrument for a short period of time, typically a few days to a few weeks. The goal is to profit from the price movements that occur during this time.

👉#2: Know the benefits and risks of swing trading.

The benefits of swing trading include the potential for high returns in a short period of time, the ability to profit from both upward and downward price movements...

The benefits of swing trading include the potential for high returns in a short period of time, the ability to profit from both upward and downward price movements...

... and the ability to use technical analysis to identify trading opportunities. However, the risks include the potential for significant losses, the need for disciplined risk management, and the need to be able to make quick decisions.

👉 #3: Learn how to develop a swing trading strategy.

A swing trading strategy should include a plan for identifying trading opportunities, a plan for entering and exiting trades, and a plan for managing risk. You should use technical analysis.

A swing trading strategy should include a plan for identifying trading opportunities, a plan for entering and exiting trades, and a plan for managing risk. You should use technical analysis.

Another tip is to use a trailing stop. This is a type of stop-loss order that follows the stock's price movements, allowing you to lock in profits as the stock rises.

One of the key aspects of swing trading is managing risk. You should only risk a small percentage of their trading account on any one trade, typically no more than 2% to 3%. You should also use stop-loss orders to limit losses and protect profits. Less is more.

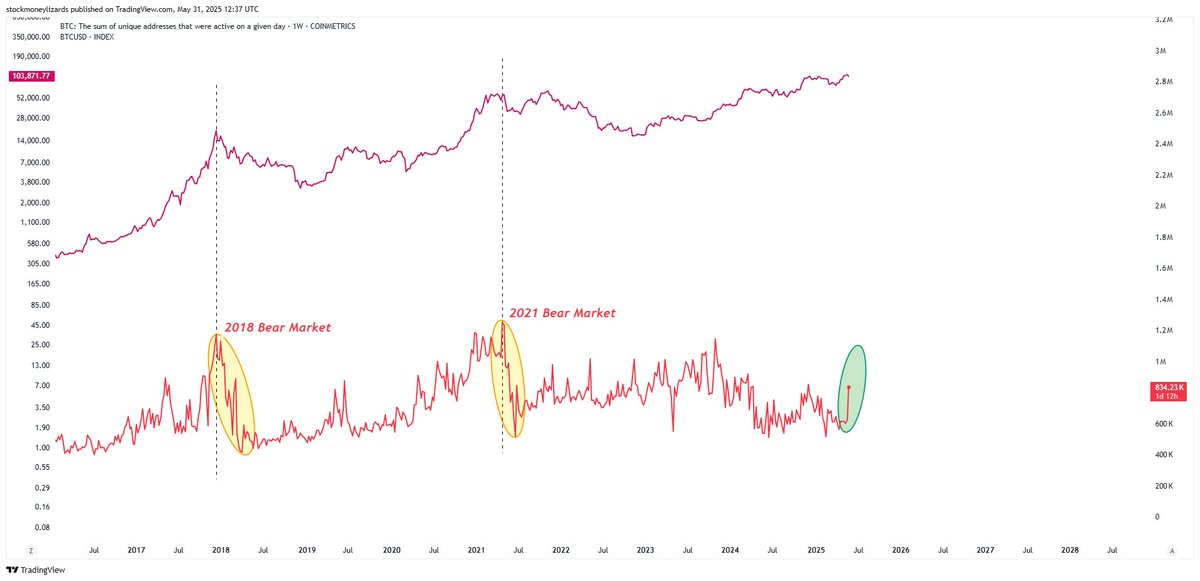

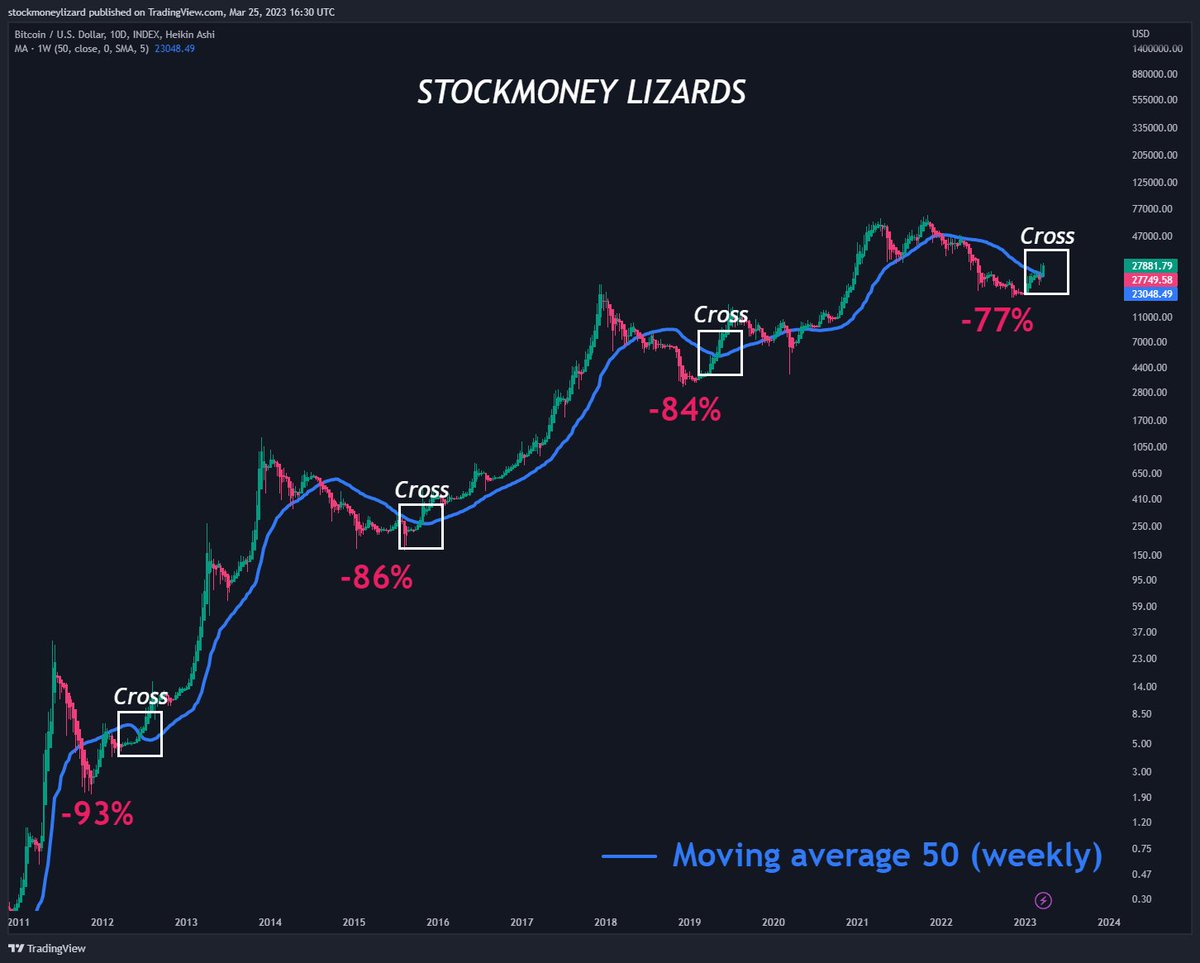

Technical analysis is an important tool for swing traders. This involves analyzing charts and using technical indicators to identify trading opportunities. Some popular technical indicators include moving averages, relative strength index (RSI), and Bollinger Bands.

Fundamental analysis is also important for swing trading. This involves analyzing a company's financial statements, management team, and competitive landscape to identify potential trading opportunities. This is even more important, when selection screening possible sh*itcoins😘

To be successful at swing trading, traders need to be disciplined and have a solid understanding of technical and fundamental analysis. They should also stay up to date on market news and events that could impact their trades.

Keeping a trading journal is also important for swing traders. This can help them track their trades and learn from their successes and failures, which can help refine their trading strategy over time.

Remember that swing trading is not a get-rich-quick scheme. It requires patience, discipline, and a willingness to learn. Start small and gradually increase your trades as you gain experience.

Don't forget to also pay attention to market news and events that could impact the crypto or stocks you're trading. Stay up-to-date.

In conclusion, swing trading can be a profitable trading strategy, but its needs time and effort to learn. Use technical analysis, risk management techniques, and stay informed to make informed trading decisions.

Join our tradingchannel on discord discord.com/invite/6JP9HeN…

Join our tradingchannel on discord discord.com/invite/6JP9HeN…

And join our crypto newsletter, to stay up-to-date for #Bitcoin and Co. You will get background information on current market situation and we will present you on a weekly basis the "coin of the week".

stockmoney-lizards.ghost.io

stockmoney-lizards.ghost.io

• • •

Missing some Tweet in this thread? You can try to

force a refresh