1/ The $ROOK DAO is discussing dissolving the DAO.

Concerns have been raised about project stagnation and lack of transparency.

The idea is to distribute the DAO treasury assets to the ROOK holders, potentially resulting in a 250% return.

Here's what the drama is all about! 🍿

Concerns have been raised about project stagnation and lack of transparency.

The idea is to distribute the DAO treasury assets to the ROOK holders, potentially resulting in a 250% return.

Here's what the drama is all about! 🍿

2/ The proposal by @0xWismerhill cites misalignment of interests between the management team & $ROOK token holders, poor growth, and a flawed gatekeeping mechanism.

For example, the current team is vetoing & controlling community-led proposals that don't fit their objectives.

For example, the current team is vetoing & controlling community-led proposals that don't fit their objectives.

3/ Reminder: @Rook protocol helps protect users & decentralized apps from negative effects of MEV by managing it at the app layer.

It's community-owned and governed by a DAO, aiming to benefit protocols, apps, and users rather than becoming a harmful profit-maximizing entity.

It's community-owned and governed by a DAO, aiming to benefit protocols, apps, and users rather than becoming a harmful profit-maximizing entity.

4/ The proposal intends to dissolve the DAO and distribute the ROOK-governed treasury (~$51 per token) to $ROOK governance token holders pro-rata.

The rationale?

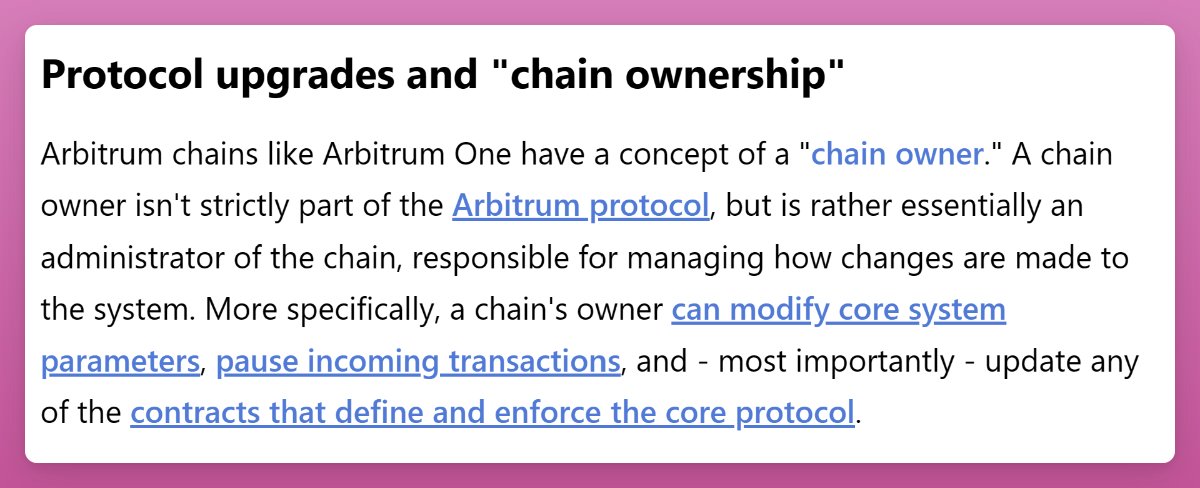

First, the governance mechanism excludes token holders from the process, securing the management team's power.

The rationale?

First, the governance mechanism excludes token holders from the process, securing the management team's power.

5/ Secondly, leadership is failing to grow the protocol, with volume declining ~78% in 6 months.

The burn rate of 22 DAO contributors is $6.1M per year ($300k per contributor).

With only 10% compensation in ROOK tokens, the justification is that the price was going down.

The burn rate of 22 DAO contributors is $6.1M per year ($300k per contributor).

With only 10% compensation in ROOK tokens, the justification is that the price was going down.

6/ Third, there's no publicly available roadmap or objectives from the management team.

The project is currently valued at <$17M - a 61% discount to the $44M governance token-controlled reserves of the DAO.

$ROOK is up by 27% since the proposal submission.

The project is currently valued at <$17M - a 61% discount to the $44M governance token-controlled reserves of the DAO.

$ROOK is up by 27% since the proposal submission.

7/ It is causing value destruction for $ROOK governance token holders, who have no way to stop the transfer of wealth from their treasury to the management team.

8/ In a governance call, the CEO @0x81B (Hazard) explained that they're "bound by the will of the order flow providers" who prefer to stay quiet about the roadmap due to their "conservative" lawyers.

P.s. Thanks to @coindesk for the governance call coverage 🙏

P.s. Thanks to @coindesk for the governance call coverage 🙏

9/ Hazard also acknowledged the lack of DAO's say in operational activities.

He blamed it on "large projects" interested in using ROOK:

"Their constraints are what's causing us to be a little bit more gagged about what we can talk about."

He blamed it on "large projects" interested in using ROOK:

"Their constraints are what's causing us to be a little bit more gagged about what we can talk about."

10/ Hazard suggested that the balance between public governance & private information may need to swing back towards public transparency:

"It's difficult to have public governance with private information."

"It's difficult to have public governance with private information."

11/ Interestingly, Hazard downplayed the token's importance, cautioning speculators not to expect its performance to be based on ROOK's output.

This reminds me of A. Cronje's "Building in DeFi sucks" discussion from 2 years ago.

This reminds me of A. Cronje's "Building in DeFi sucks" discussion from 2 years ago.

12/ I don't want to spread FUD, but this proposal could have significant implications not just for the ROOK holders, but #DeFi in general.

It highlights the challenges of balancing transparency & private preferences in a DAO-governed project

Or is it just bear market things?

It highlights the challenges of balancing transparency & private preferences in a DAO-governed project

Or is it just bear market things?

13/ It wouldn't be the first time that a DAO is dissolved.

Last year, $FEI Protocol DAO voted to shut down because of:

• "challenging macro environment"

• "mounting technical, financial, and future regulatory risks"

Last year, $FEI Protocol DAO voted to shut down because of:

• "challenging macro environment"

• "mounting technical, financial, and future regulatory risks"

https://twitter.com/DefiIgnas/status/1560794521977626624

14/ There's a lot of early alpha in the DAOs, so for more content like this follow me @DefiIgnas

Like/retweet the first tweet if you can:

Like/retweet the first tweet if you can:

https://twitter.com/DefiIgnas/status/1640253490651078656?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter