You're not alone. DeFi's been plagued by high slippage and low liquidity.

That's why you need to know about @mavprotocol. It's a game-changing decentralized finance infrastructure that solves these problems.

Here’s how... 👇🍿

0xilluminati.com/p/maverick-amm…

That's why you need to know about @mavprotocol. It's a game-changing decentralized finance infrastructure that solves these problems.

Here’s how... 👇🍿

0xilluminati.com/p/maverick-amm…

@mavprotocol 1/ The DeFi industry craves solution-based mechanisms that provide greater access to liquidity assets, and the Maverick Protocol delivers exactly that.

@mavprotocol 2/ Maverick Protocol is a new decentralized finance infrastructure that facilitates the most liquid markets for traders, liquidity providers, DAO treasuries, and developers.

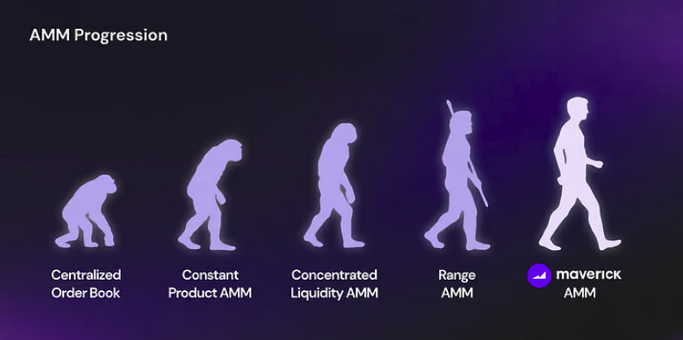

@mavprotocol 3/ AMMs are fully automated on-chain mechanisms that act as always-available counterparties for people who want to trade one type of token for another.

@mavprotocol 4/ Maverick's Automated Liquidity Placement mechanism natively automates the dynamic rebalancing of concentrated liquidity, achieving the best of both worlds: lower slippage and better liquidity.

@mavprotocol 5/ Maverick's AMM helps users maximize capital efficiency by automating liquidity concentration as prices move.

This results in more liquid markets, better prices for traders, and higher fees for liquidity providers.

This results in more liquid markets, better prices for traders, and higher fees for liquidity providers.

@mavprotocol 6/ The Maverick development team is made up of innovative cryptocurrency experts who have created unique cryptocurrency infrastructures.

@mavprotocol 7/ Maverick introduces LPing to a whole new class of market participants by allowing them to choose a direction and earn excess returns if they do so correctly.

@mavprotocol 8/ Pros of AMMs in DeFi include more efficient trading, low fees, and more liquidity.

Cons include price slippage and impermanent loss, limited trading options, the potential for exploitation, and complexity.

Cons include price slippage and impermanent loss, limited trading options, the potential for exploitation, and complexity.

@mavprotocol 9/ Maverick's Dynamic Distribution AMM is capable of automating liquidity strategies that required daily maintenance in the past.

Additionally, its LP modes provide LPs with more control over their capital.

Additionally, its LP modes provide LPs with more control over their capital.

@mavprotocol 10/ Maverick Protocol is poised to revolutionize DeFi liquidity management and make highly liquid markets accessible to traders, LPs, treasuries, and developers.

@mavprotocol If you enjoyed this thread:

1. Retweet & like the first Tweet

2. Subscribe to our newsletter: 0xilluminati.com/subscribe

3. Follow us @0x_illuminati

1. Retweet & like the first Tweet

2. Subscribe to our newsletter: 0xilluminati.com/subscribe

3. Follow us @0x_illuminati

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter