@dampedspring It may be a bit more than $3B Andy.

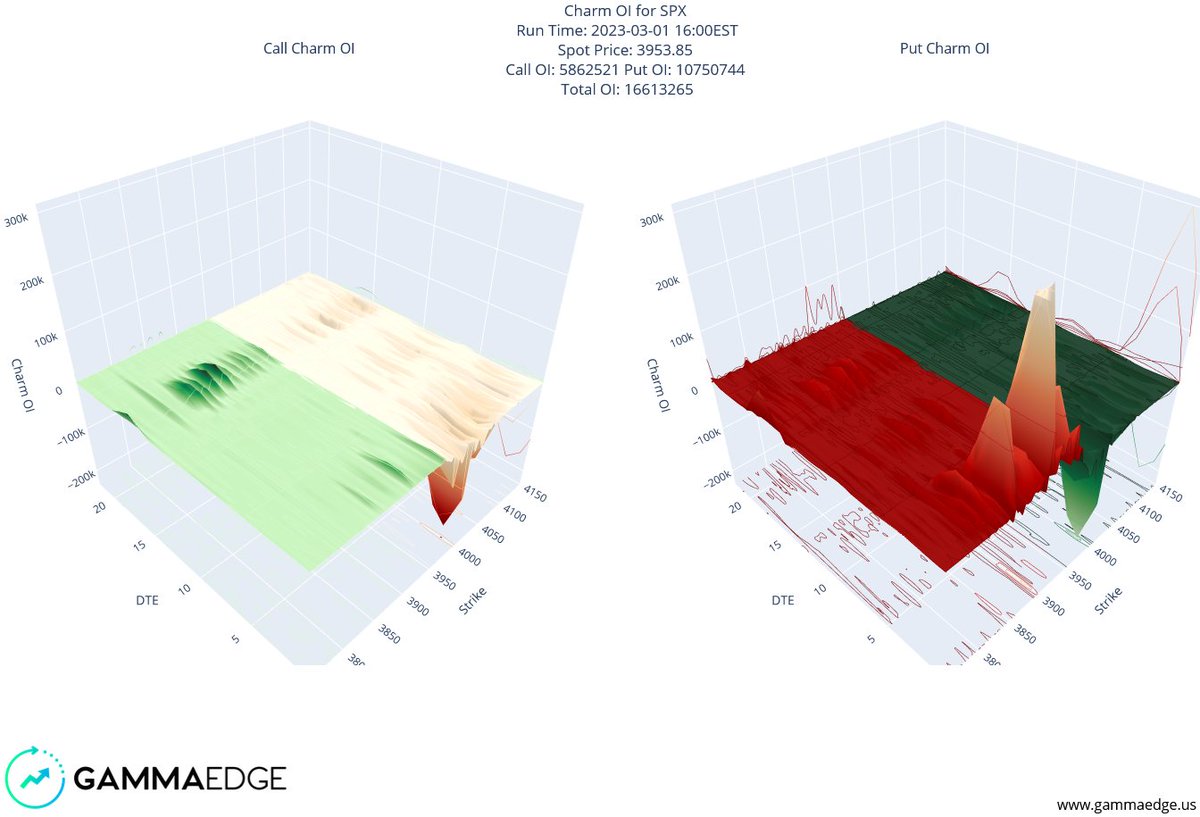

We're showing the following structure into the end-of week:

charts.gammaedge.us/charm_oi_3d_SP…

What we think matters on Friday is that ITM call component, as it will continue to push flows upward.

We're showing the following structure into the end-of week:

charts.gammaedge.us/charm_oi_3d_SP…

What we think matters on Friday is that ITM call component, as it will continue to push flows upward.

@dampedspring ... but into Friday, there is a significant net positive flow that could capture more ITM puts, forcing them to OTM and positive flow, as well as capturing more ITM calls.

charts.gammaedge.us/net_charm_oi_3…

charts.gammaedge.us/net_charm_oi_3…

@dampedspring What is most striking to us is the simple collapse of charm AFTER Friday.

The landscape for April is flat, relative to the charm surface of this week.

The contrast is quite evident.

✍️

The landscape for April is flat, relative to the charm surface of this week.

The contrast is quite evident.

✍️

@dampedspring Those views isolate the #spx PM-settled complex from the total AM+PM complex; we believe that there is value in performing that isolation.

For those of you who are pondering: the total complex:

charts.gammaedge.us/charm_oi_3d_SP…

Monthly ripples are present, but the EOQ expiry dominates.

For those of you who are pondering: the total complex:

charts.gammaedge.us/charm_oi_3d_SP…

Monthly ripples are present, but the EOQ expiry dominates.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter