Hello world!

This week marks the kick-off for the #OBFA_TRANSFORM project, a new @dfg_public Emmy Noether research group to investigate the political economy of financing politically desired large-scale transformations

obfa-transform.eu

1/

This week marks the kick-off for the #OBFA_TRANSFORM project, a new @dfg_public Emmy Noether research group to investigate the political economy of financing politically desired large-scale transformations

obfa-transform.eu

1/

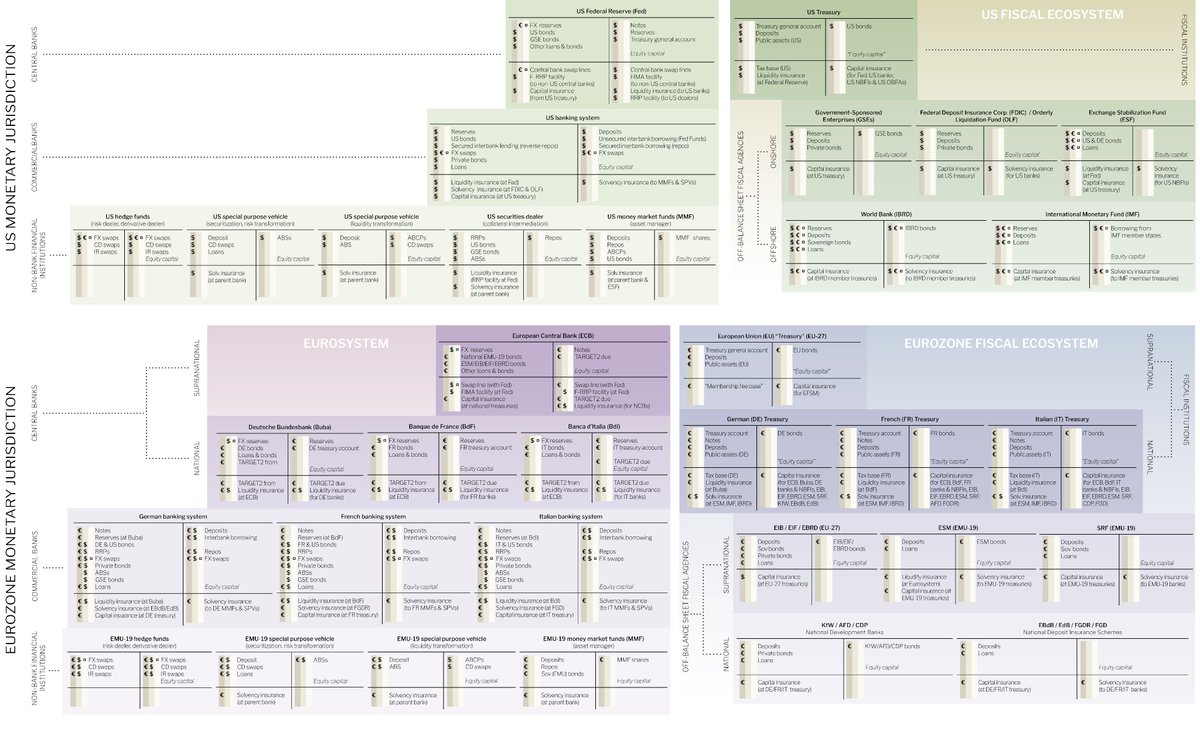

In the next six years, we will use the monetary architecture framework to investigate the role of off-balance-sheet fiscal agencies (OBFAs) in war finance, reconstruction finance, and the Green Transition

bit.ly/30acOdw

2/

bit.ly/30acOdw

2/

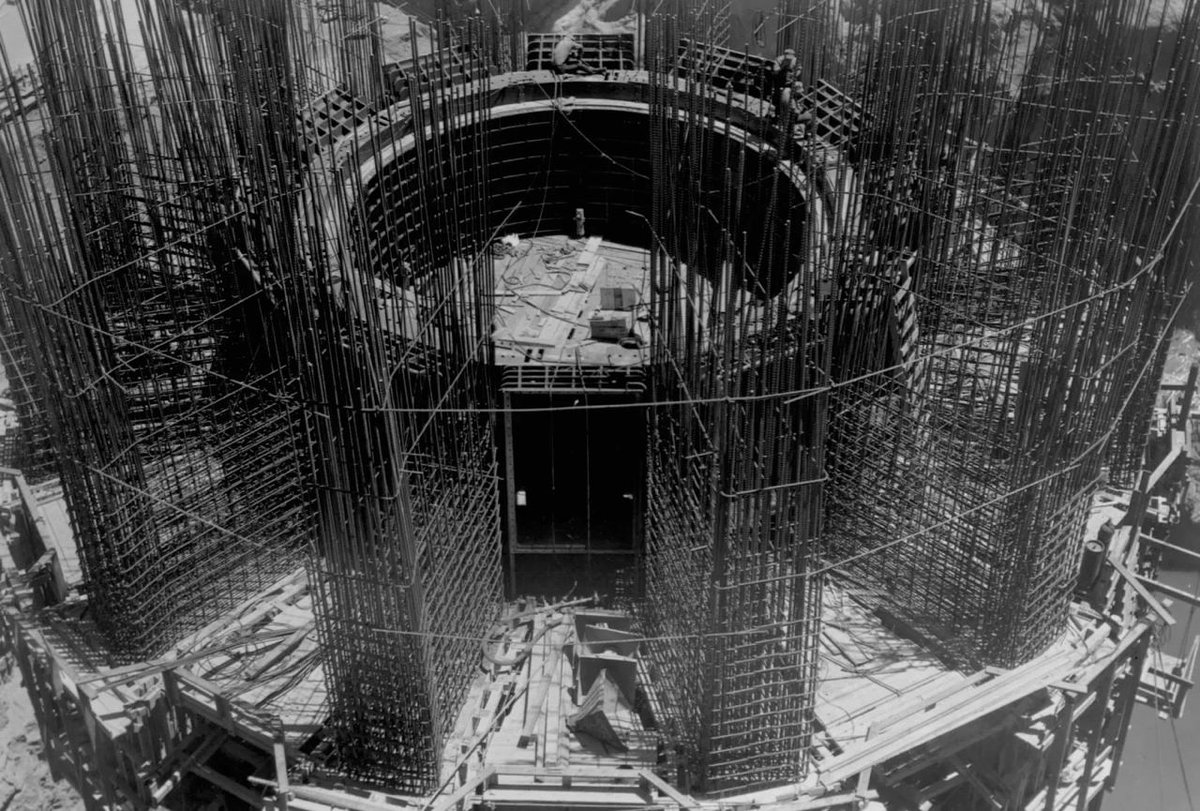

We will start with historical case studies of war finance & reconstruction finance in the 20th century

🔎 How was it possible to steer the monetary architectures at the time towards a politically desired purpose? 🔍

👉 We expect that OBFAs were crucial in this respect

3/

🔎 How was it possible to steer the monetary architectures at the time towards a politically desired purpose? 🔍

👉 We expect that OBFAs were crucial in this respect

3/

OBFAs played a pivotal role in financing military expenditure in North America & Europe throughout the 20th century

Setting up OBFAs not only enhanced credit money creation at an unprecedented scale but also transformed countries' monetary architectures for good

4/

Setting up OBFAs not only enhanced credit money creation at an unprecedented scale but also transformed countries' monetary architectures for good

4/

OBFAs were commonly used to finance economic reconstruction after wars and major crises. We will look at the Great Depression period and the post-WWII era.

Some OBFAs were phased out, others remain part of countries' monetary architectures until today

5/

Some OBFAs were phased out, others remain part of countries' monetary architectures until today

5/

Then we apply our historical insights to the Green Transition—today’s politically desired large-scale transformation of capital stock to reach net-zero

🚨 How to steer our privatized & globalized monetary architecture towards this goal is presently an open question

6/

🚨 How to steer our privatized & globalized monetary architecture towards this goal is presently an open question

6/

The Emmy Noether group will theorize on how OBFAs help govern monetary architectures beyond conventional understandings of monetary and fiscal policy

We also investigate if & how this technique is compatible with legitimate democratic governance

tandfonline.com/doi/full/10.10…

7/

We also investigate if & how this technique is compatible with legitimate democratic governance

tandfonline.com/doi/full/10.10…

7/

In the policy-oriented part, we will develop concrete proposals for how OBFAs can be used to support the financing of the Green Transition

We will communicate our framework & findings with an interactive online tool for visualizing interlocking balance sheets

8/

We will communicate our framework & findings with an interactive online tool for visualizing interlocking balance sheets

8/

The project will be conducted at Global Climate Forum, Berlin with me as principal investigator, Armin Haas as senior researcher & @agutersandu as senior associate researcher

We'll open positions for PhDs & student assistants, and can bring in project affiliates

Stay tuned!

🔚

We'll open positions for PhDs & student assistants, and can bring in project affiliates

Stay tuned!

🔚

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter