Political economist | International money & finance | Global Climate Forum, Berlin | Global Development Policy Center, Boston University | BIS, Basel

How to get URL link on X (Twitter) App

In the next six years, we will use the monetary architecture framework to investigate the role of off-balance-sheet fiscal agencies (OBFAs) in war finance, reconstruction finance, and the Green Transition

In the next six years, we will use the monetary architecture framework to investigate the role of off-balance-sheet fiscal agencies (OBFAs) in war finance, reconstruction finance, and the Green Transition

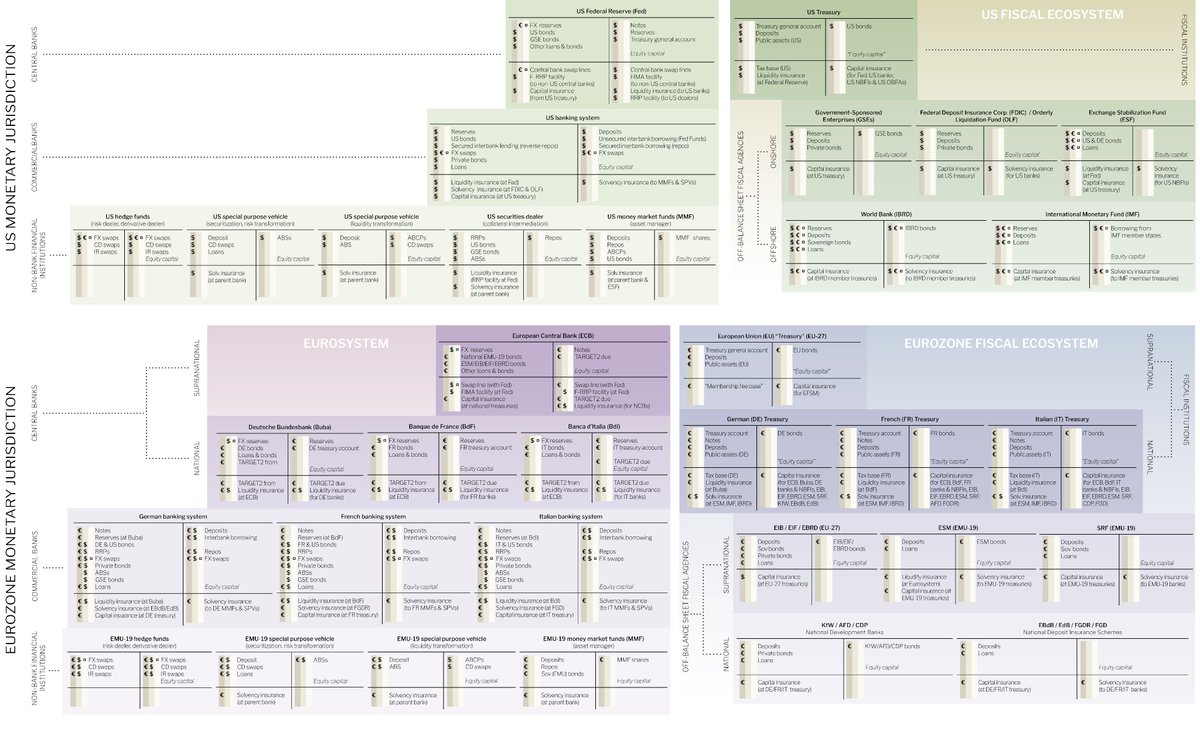

We built a macro-financial model of interlocking balance sheets

We built a macro-financial model of interlocking balance sheets

Core of GEGI Study (@GDPC_BU) is a macro-financial model of interlocking balance sheets. It depicts the interconnections of the US and the Eurozone 'monetary jurisdictions'

Core of GEGI Study (@GDPC_BU) is a macro-financial model of interlocking balance sheets. It depicts the interconnections of the US and the Eurozone 'monetary jurisdictions'

Today’s IMS is “Offshore US-Dollar System”, composed of “monetary areas”. It is global & hierarchical. The USD monetary area is in apex. Monetary areas with unlimited USD swap lines are 1st layer periphery. More layers to follow below, here BRICS

Today’s IMS is “Offshore US-Dollar System”, composed of “monetary areas”. It is global & hierarchical. The USD monetary area is in apex. Monetary areas with unlimited USD swap lines are 1st layer periphery. More layers to follow below, here BRICS