Goldman: We boosted our Q1 GDP tracking estimate to +2.6% (qoq ar),

reflecting better-than-expected consumption and construction data

reflecting better-than-expected consumption and construction data

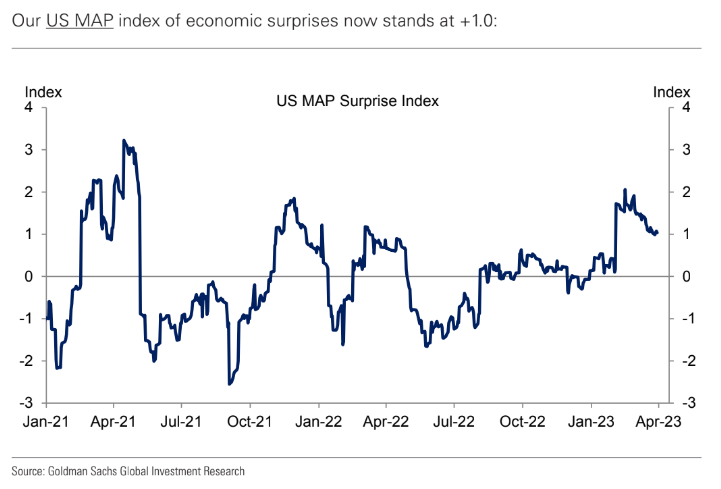

Economic Surprises continue to be decent. This will change on Good Friday! #NFP

US real GDP seen at +1% this year. Ho Hum.

Goldman sees +6% in China.. is that enough to help $SLX steel stocks? I say so.

seekingalpha.com/article/459215…

Goldman sees +6% in China.. is that enough to help $SLX steel stocks? I say so.

seekingalpha.com/article/459215…

internet searches for withdrawal related words have declined, suggesting bank deposit outflows have diminished

Crisis averted?

Crisis averted?

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter