Here are the 7 most important pieces to understand the seismic shift happening now in global money.

#1 - The US Dollar is losing its status as the world's reserve currency.

China wants the crown - but another challenger has already won. And nobody realizes it yet. #Bitcoin

#1 - The US Dollar is losing its status as the world's reserve currency.

China wants the crown - but another challenger has already won. And nobody realizes it yet. #Bitcoin

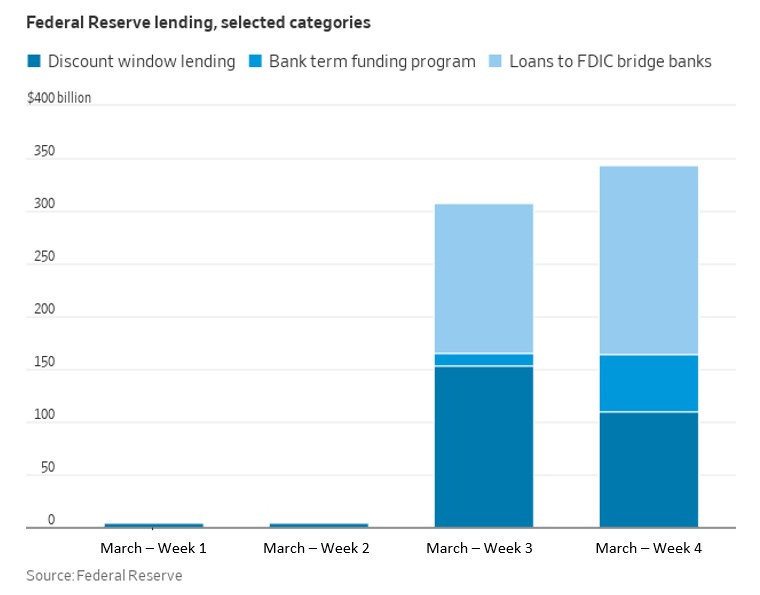

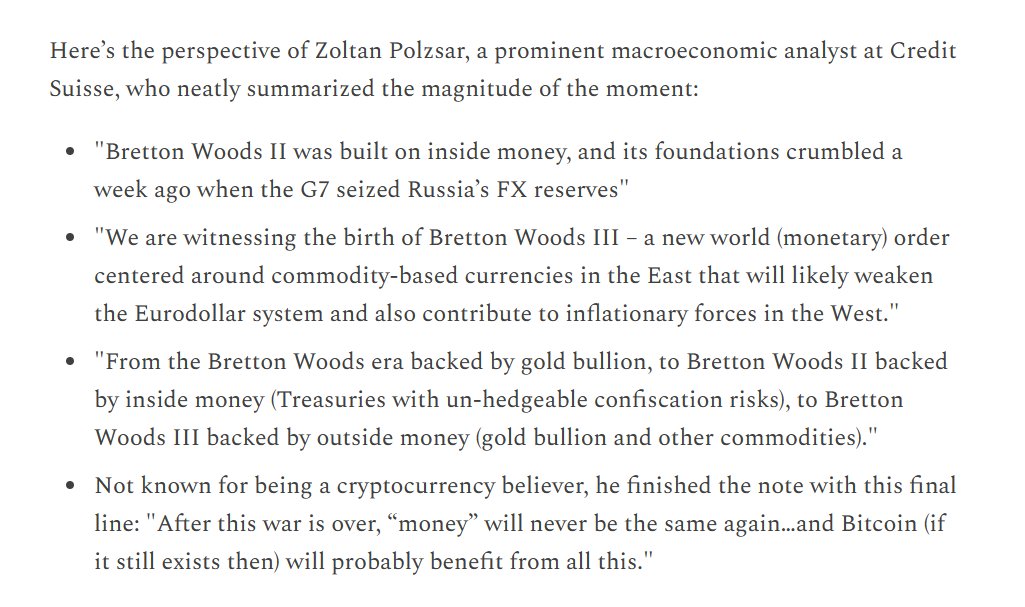

#2 - In early 2022, the US froze Russia's foreign currency reserves & cut them off from the SWIFT banking system.

This was like dropping a nuke on the monetary world order.

The world as it has been since 1971 is over. Have you noticed everything getting weird?

This was like dropping a nuke on the monetary world order.

The world as it has been since 1971 is over. Have you noticed everything getting weird?

#3 - The rise of the BRICS nations.

Originally an informal acronym of emerging economies (Brazil, Russia, India, China, South Africa)...

...the group has become a formal coalition of countries sick of taking directions from the post-WW2 world order dominated by the USA.

Originally an informal acronym of emerging economies (Brazil, Russia, India, China, South Africa)...

...the group has become a formal coalition of countries sick of taking directions from the post-WW2 world order dominated by the USA.

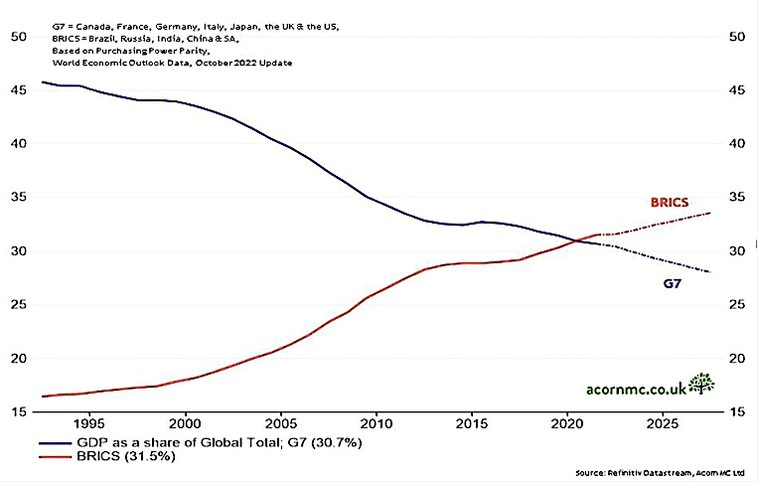

#4 - For years, the economic strength of BRICS has grown relative to the G7.

Recently, the BRICS nations surpassed the G7 nations in GDP.

...But the BRICS nations still needed a reason to break free from the status quo.

The G7 freezing Russia's FX reserves was it.

Recently, the BRICS nations surpassed the G7 nations in GDP.

...But the BRICS nations still needed a reason to break free from the status quo.

The G7 freezing Russia's FX reserves was it.

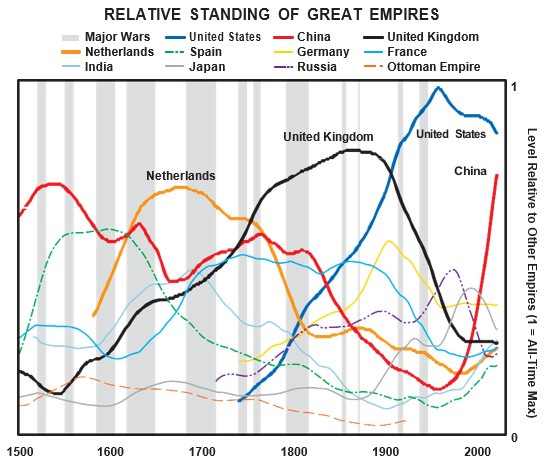

#5 - In 2020, Ray Dalio released "The Changing World Order"

In it, he argues that superpowers always succumb to death by too much cheap, easy debt. And a new superpower emerges.

The implication is we are living in the decline of American power and the rise of China.

In it, he argues that superpowers always succumb to death by too much cheap, easy debt. And a new superpower emerges.

The implication is we are living in the decline of American power and the rise of China.

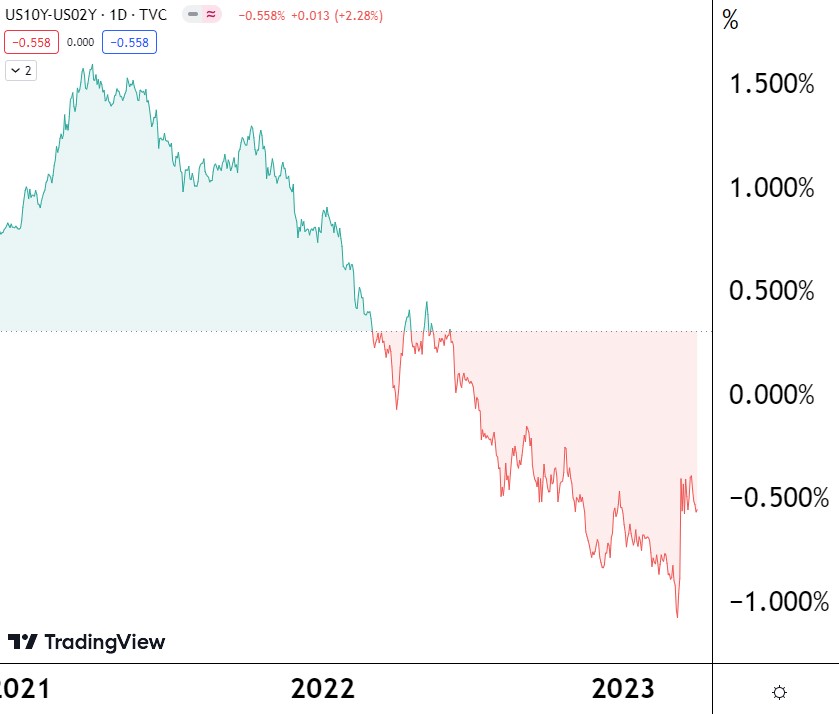

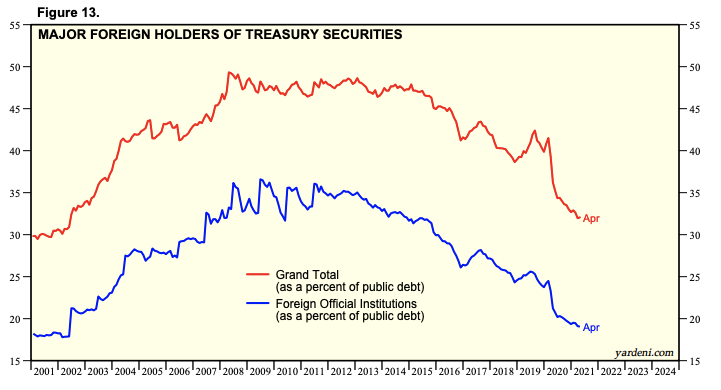

#6 - For the last 40 years, commodities have underperformed financial assets (stocks, RE).

This was caused by interest rates compressing, fueled by huge international demand for the stability and low-risk returns of US Treasuries.

That era is over. Nobody is buying Treasuries.

This was caused by interest rates compressing, fueled by huge international demand for the stability and low-risk returns of US Treasuries.

That era is over. Nobody is buying Treasuries.

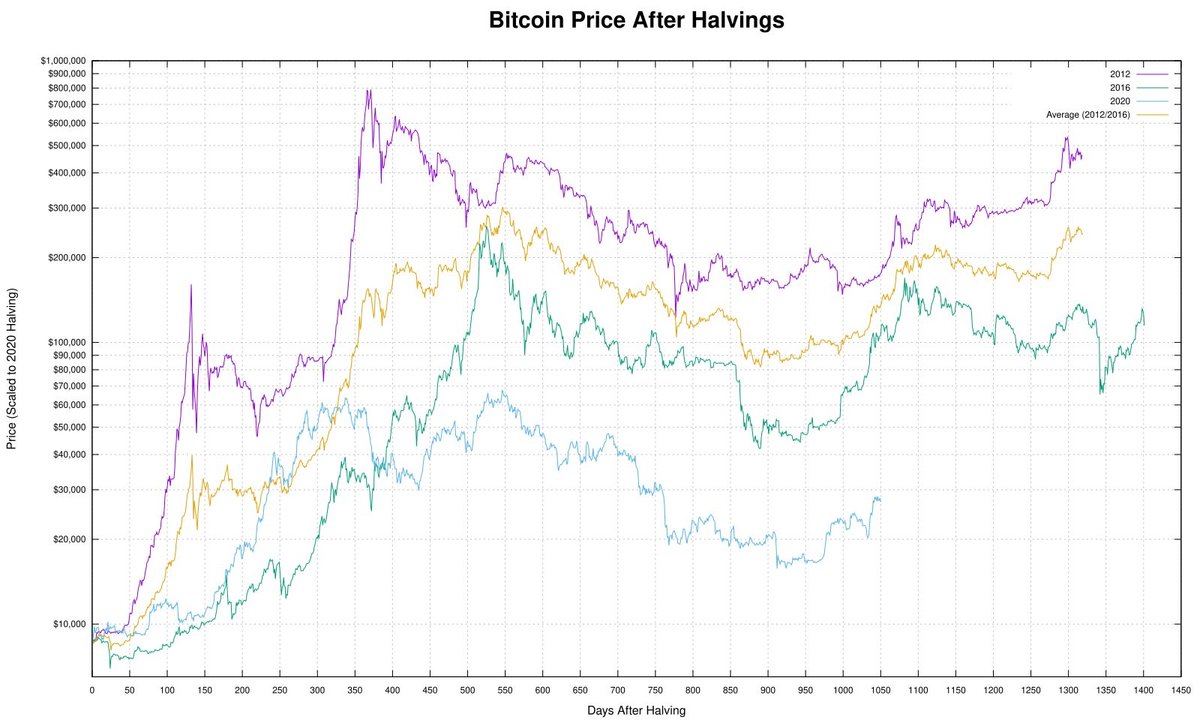

#7 - Commodities are back. In a multipolar world (USA/G7 + China/BRICS), "hard money" is king.

This used to mean gold, now it means gold + #Bitcoin

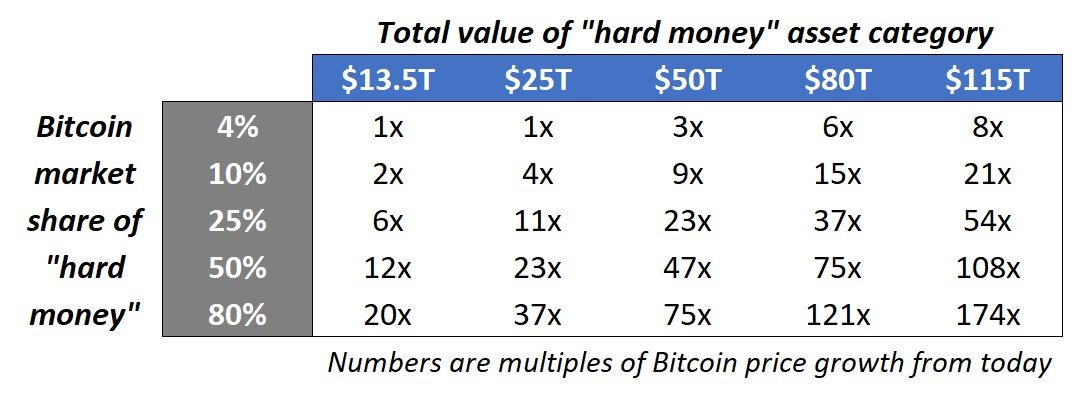

Depending on Bitcoin's share of growth in the "hard money" category, it could be the major winner this decade.

This used to mean gold, now it means gold + #Bitcoin

Depending on Bitcoin's share of growth in the "hard money" category, it could be the major winner this decade.

And #Bitcoin is the key to understanding why Ray Dalio is wrong.

China's currency will not be the world's reserve currency.

Find out why in this month's Bitcoin & Macro update: jessemyers.substack.com/p/64-april-202…

China's currency will not be the world's reserve currency.

Find out why in this month's Bitcoin & Macro update: jessemyers.substack.com/p/64-april-202…

Thread and article informed by the excellent analysis of: @LukeGromen @LynAldenContact @FossGregfoss @LawrenceLepard @BitcoinIsSaving @MartyBent @ODELL @stephanlivera @VailshireCap

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter